One of the most rewarding aspects of our work is guiding clients as they transition into retirement. Each person brings a unique vision for this next chapter, and no two financial journeys are exactly alike.

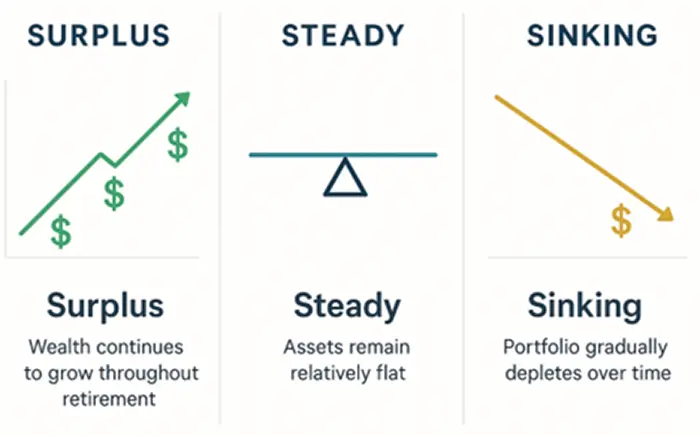

While every retirement story is different, most portfolios tend to follow one of three general paths. Some experience a Surplus, where wealth continues to grow throughout retirement. Others maintain a Steady course, with assets remaining relatively stable. And some follow a Sinking trajectory, where the portfolio gradually declines over time.

Just because a Surplus retirement might sound more appealing than a Sinking one doesn’t mean it’s automatically better. What matters is understanding which path your retirement is likely to follow—or which one you hope it will—and making thoughtful plans to support that vision.

Let’s dive in…

Surplus: Growing Through Retirement

In our backyard, we have a loquat tree. If you’ve never heard of it, you’re not alone. Also called “Japanese plums”, this time of year the tree is littered with hundreds of small loquats.

My kids pick the fruit close to the ground, my wife and I pick the fruit a bit higher up, and my neighbor’s kids (who are older than our kids) climb the tree and pick the fruit at the very top. Because of the abundance of loquats, in the Spring / early Summer, we can’t possibly pick the tree bare.

For some retirees, this is the likely scenario playing out before them. No matter how much “fruit” they harvest, the tree keeps producing more. When high income, disciplined saving, and prudent investing come together, the result can be a portfolio that continues to grow and compound, even while supporting regular withdrawals.

In a Surplus retirement, the question shifts from “Will I have enough?” to “How much is enough?” While the answer varies from person to person, simply asking it encourages more intentional and meaningful financial decisions during one’s lifetime.

Retirees in this category often have the capacity to leave a lasting legacy—whether to family, charitable organizations, or causes close to their hearts. While many would love to have this opportunity, if not equipped properly, this can sometimes feel like more of a burden than a gift.

Steady: Sustaining Without Growth

The Steady retiree is like the kid at the skate park who goes up and down the ramps quite conservatively. They know what they’re capable of doing, and they know what they’re not capable of doing. An outsider knows they’re not going to crash and burn, but they’re also not expecting them to perform a backflip anytime soon.

A Steady retirement is one where the portfolio remains relatively flat over time, neither growing significantly nor depleting. In my experience, this is the most commonly desired outcome among retirees. A Surplus retirement can feel like underutilizing hard-earned savings, while a Sinking trajectory may bring anxiety. In contrast, a Steady path often feels like a win, and rightly so.

Picture a retiree who lives off the dividends and interest their portfolio generates, occasionally drawing a bit more for a special trip or a home repair. While the portfolio may fluctuate with the markets, it tends to hover around the same value it had at the start of retirement. With the right mix of investment discipline and spending control, this approach can be both sustainable and satisfying, supporting a desired lifestyle without leaving behind a larger-than-anticipated inheritance.

Sinking: Spending Down

The statistics are clear – most Americans fall into the Sinking bucket. The National Council on Aging reports that 80% of households with older adults are either financially struggling or at risk of falling into economic insecurity. https://finance.yahoo.com/news/guess-percent-people-retire-no-203017726.html

A Sinking retirement isn’t inherently the “wrong” path—it’s simply one of several valid approaches. Some retirees may never have had the opportunity to build a portfolio that supports a Surplus or Steady retirement, and that’s okay. Choosing to draw down assets over time can still lead to a fulfilling retirement, especially for those who approach it with patience and discipline.

For many, there’s a deep sense of satisfaction in fully utilizing the wealth they’ve worked so hard to accumulate—truly “squeezing all the juice out of the lime.” However, this path can also be the most emotionally challenging. Because there’s less margin for error, a significant market downturn can quickly shift from discomfort to panic, prompting decisions like selling out of the market entirely. Unfortunately, acting on that fear can severely damage the longevity of a portfolio.

Which Retirement Are You Planning For?

There’s no single “right” way to retire. Each of us is wired differently, with our own values, priorities, and dreams. For some, the goal may be to grow their wealth and leave a lasting legacy. For others, it might be to enjoy every dollar they’ve saved, spending it fully and intentionally during their lifetime.

What’s important is…

- That you identify which trajectory you might be on,

- Understand the pitfalls, the questions to ask, and the opportunities given your trajectory, and

- Intentionally develop a plan.

If my back hurts, my doctor will give me an X-ray. When I receive my X-ray results, I can then collaborate on the next steps. It might be rest, physical therapy, or surgery, but the sooner I get the X-ray report, the better positioned I am to heal my back.

A detailed, well-constructed financial plan, built around your unique circumstances and goals, can turn uncertainty into clarity and confidence.

If you haven’t revisited your retirement strategy recently, now is the time.

Trevor Cummings

PWA Group Director, Partner