I have a problem.

I have a lot of trouble saying, “no.” I have a tendency to overcommit and, my wife will be the first to attest to this. I like to help, and I don’t want to let people down. So, whether it is dog sitting for a friend or volunteering at church, I have a tendency always to say “yes.”

Here’s the problem with commitments; they take time, and time is a finite resource. Personally, I need to learn not to overcommit.

Now, what does this have to do with personal finance? Well, I have a growing concern that our culture is pushing us to overcommit financially. This overcommitment presents the same problem – like time; money is a finite resource.

More and more, I see products promoting themselves with financing options. Everything from a mattress to a stationary bike is being marketed with long term financing options. Something with a $2,500 price tag might seem too rich, but a $60 monthly payment over 3 or 4 years becomes more palatable.

Our culture has begun to create “luxury” everything and these price tags for these “luxury” items are meaningful. If lump-sum purchases were the only option, the demand would shrink. What happens is that these seemingly “micro” commitments compound, and as one accumulates more commitments, they begin to place an even greater burden on their cash flow.

These commitments do not only come in the form of financing large purchases they also surface as subscriptions. Subscriptions to everything from streaming video services to theme park memberships. These subscription models make sense from a business perspective because businesses want predictable and sustainable income. For you, the consumer, this means that you have a defined amount of your income that has already been spoken for.

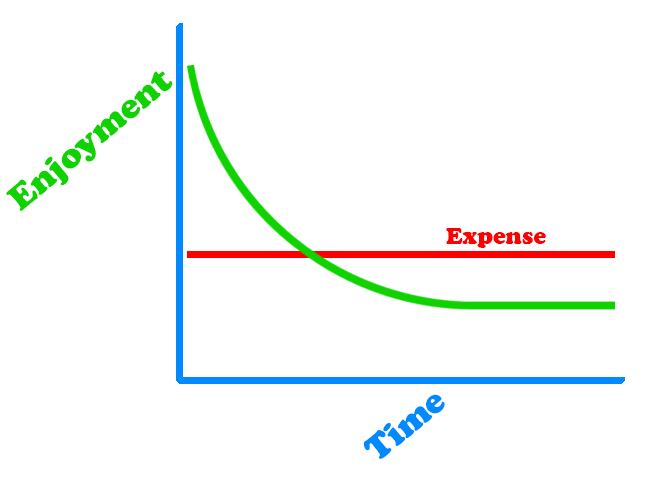

Here’s where I want to encourage you to shift the way you think about subscriptions and financing. When you choose to commit to something today and plan to pay for it later, you are choosing to allow your “current self” to enjoy the utility of your purchase, and you are committing your “future self” to pay for it. Naturally, we tend to derive the highest enjoyment from a new purchase at the beginning, yet the cost lives on.

It’s that old piece of fitness equipment you have the garage or the wine club membership that you joined and forgot to cancel. The “low monthly cost” lures us in, and then we are committed. As I said, overcommitment becomes a problem.

I will openly admit that a lot of these commitments are indeed small – $50 a month here or $100 a month there – but it is when you look at them as a whole that they can become more daunting. As our culture continues to push these commitments, it means that you need to be aware and prepared. I encourage you to do some homework and take inventory of what you are currently committed to. Ask yourself, am I still using this product or service? Is the cost fitting for the use and enjoyment I now derive from it? Taking inventory is a healthy exercise and one that helps you stay in the driver seat of your finances.

As I mentioned, businesses will continue to build out these subscription type models because it is in their best interest. They will assess metrics like customer acquisition cost and the customer lifetime value that will drive them to execute advertising plans to entice you to join. Some of these commitments are good, and they will be additive to your life, but sometimes you will have to ask yourself questions like, “Do I need to be a monthly subscriber for purchasing my pet food?”

Stay diligent, stay aware, and don’t overcommit – that’s my advice. As they say, a penny saved is a penny earned.

That is all I have for you today, and we will be back next week with more Thoughts On Money.