Deer In Headlights

Double dates, they are a funny thing, right? You learn a lot about another person when you interact with them alongside their significant other. You learn more about who’s the talker and who’s the listener, who’s the comedian and who asks great questions, who’s the pet lover and who takes care of the pets, who’s the instigator and who’s the diffuser, and so on.

If you spent any amount of time with my wife, Nicole, and I, you’d quickly learn how blessed I am. Her peaceful presence and attentive ears balance out my blabbermouth. My dad jokes complemented by her head shakes and smirks that she tries to hide, but I know are always there. We are two very different people, but puzzle pieces meant to be together – a perfect match. And, if you hang around us long enough, you’ll get to hear all our comical stories about how I got her number from a friend and went on a blind date with her later that same day or how petrified I was when asking her father for his blessing or how I forgot to pop the question when I was kneeling with the ring awaiting her reply – like a deer in the headlights.

Roses are Red, Violets are Blue, and I Got a Roth Just for you…

Perhaps the story that gets the most laughs, though, is how I funded Nicole’s Roth account when we were dating. A move that only a man wired to be a financial advisor would do. I remember the conversation vividly, and I still laugh about how much of a nerd I was and still am. Let me set the scene for you; we were at her parents’ house, watching TV when I started a conversation about saving. A real Romeo type topic, right? I explained how a Roth IRA worked and tried to captivate Nicole with all the amazing tax benefits associated. To appease me, Nicole agreed to open a Roth. This was music to my ears, and I explained that she could put up to $5,500 in the account, and I’d help her set it all up. She replied, “Great, I’ve got a couple of thousand dollars I can set aside in it” and then gave me a smile that probably should have cued me to shift to some more entertaining discourse. Of course, I didn’t, though. I responded, “Couple thousand dollars? I said you could put up to $5,500, though.” My brain couldn’t comprehend why any contribution would be short of the maximum, and I questioned whether I did a good enough job explaining what I saw as the beauty and wonders of the Roth IRA. We went back and forth from here, and the result was me contributing the difference to her account. Keep in mind she was my girlfriend at the time. We only dated for 6 months and were married one year after our first date. I guess when you know you know, and some guys show their affection with chocolates and roses, but I chose Roth contributions.

Interest That Earns Interest Had My Interest

As funny as this story is, there is a real lesson or truth to glean from all of this. My infatuation wasn’t really with the Roth account; although the tax benefits are quite appealing, the concept and power of compounding enthralled me. This is a finance truth that is profoundly relevant but often forgotten. The fact that you can earn a return on your investment and that your “returns” can earn a return is what creates long term wealth.

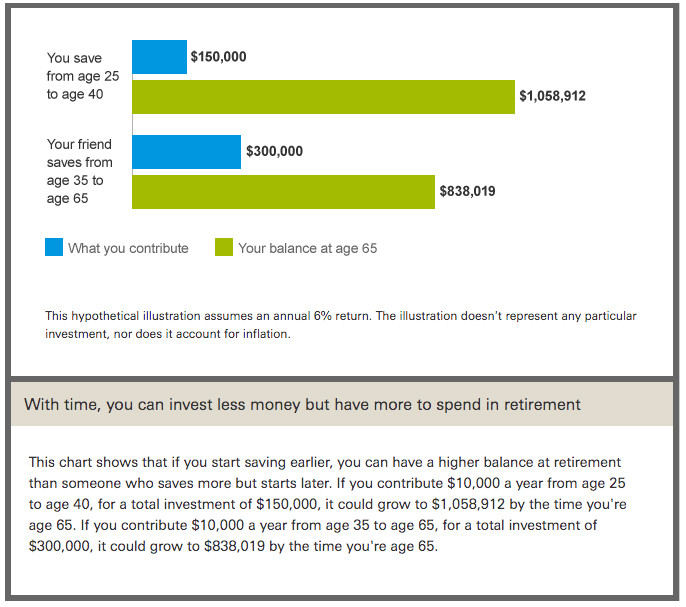

I remember when I first started to understand this concept of compounding. As a senior in high school, you must spend half the school year in a government class and the other half in economics. My econ teacher, also the basketball coach, provided us with a print out that looked something like this:

Source: Vanguard

At first, I was in disbelief, how could saving earlier for fewer years produce that result? It was the power of compounding. More importantly, I learned that compounding was made possible by two key variables returns and time. Time tends to have a larger impact.

A Wonder that is My World

Here’s a fun fact, did you know Warren Buffett didn’t hit billionaire status until he was 50 years old, and if you looked at his net worth today, you’d see that 99% of his wealth was accumulated after the age of 50. How can this be true? Well, with Mr. Buffett being 90 years old, this reflects the power of compounding over 40 years.

Supposedly, Einstein described it this way, “Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.” I say supposedly because it seems these days that every Einstein or Mark Twain quote has come into question on whether the attribution is credible. Maybe these two are remembered with more wit and wisdom than deserved, who knows? Nonetheless, the truth stands, compounding is an absolute wonder.

Despite its role as perhaps the most important investment truth, compounding still doesn’t get the coverage it deserves in financial media. Want to know why? Because it isn’t exciting to talking about being patient – we live in an instant gratification culture. We know that great food takes time to cook, plants take time to grow before we harvest, and the greatest benefits from investing also take time. Yet, when we watch a cooking show, we also know that we aren’t going to watch them prepare and cook the meal from start to finish. We wouldn’t sit through that. The ingredients are added and mixed, then a finished product prepared beforehand is shown. Investing isn’t too dissimilar. Just like cooking shows, in investing we want to talk about and focus on the ingredients – the individual stocks, hedge funds, etc. The reality is, great meals take hours of preparation, and significant wealth takes decades to build – time and patience is the common attribute.

As always, any and all questions/comments are welcome. You can reach me at .

Until next week… this is TOM signing off…