In this week’s Thoughts on Money, we address the dangers of following the herd when it comes to your investment strategy. We’ve written before about being careful not to succumb to the news media as your gauge of what is worth investing in and that it is best to start with a plan and stick to it. If this truism is so easy to understand, why do so many investors blindly follow what others are doing? It’s because we have a human tendency to follow what appears to be the leader. Let’s get into this a little deeper in hopes we can recognize and avoid the pitfalls.

A Short Study of Human Nature

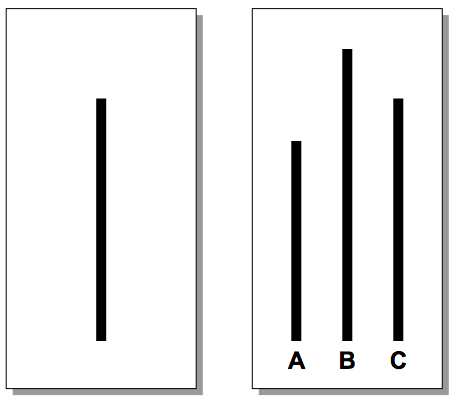

Which of these three lines (A, B, or C) is the same length as the line on the left?

The answer is obvious, right? So obvious, that it makes the question almost humorous.

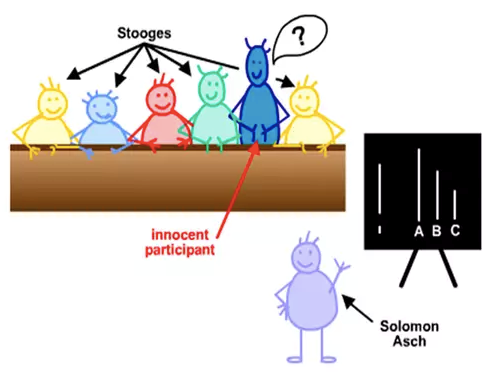

In 1951, Psychologist, Solomon Asch conducted an experiment using questions like the one above to test conformity. Asch stood at the front of a classroom, asking which line matched in length, and the 6 participants in the room would provide their answers out loud, one at a time. 5 of the 6 participants were told before the experiment to intentionally provide a false answer. Each of them would provide the same wrong answer, and the experiment was to see if the unknowing participant (the test subject) would conform their answer based on the other participant’s responses.

Source: www.simplypsychology.org

This experiment was run numerous times, and the results showed that greater than one third (37%) of the time the test subject would modify their answer to match that of the other participants.

You can watch the experiment here:

It is priceless to watch the facial expressions and the body language of the participant when he or she realizes that their answers to these seemingly easy questions are not the same as the majority.

This type of groupthink or herd mentality is exactly what we see in markets.

People don’t hold tightly enough to their beliefs and convictions about investing; they tend to waver and find themselves chasing after whatever everyone else is. This is what leads to bubbles and bubbles eventually burst, creating financial destruction in their aftermath.

Great Investors Don’t Conform

Famous value investor, Howard Marks, says, “To achieve superior investment results, you have to hold nonconsensus views regarding the value, and they have to be accurate.” These contrarian viewpoints are not birthed from a place of just simply disagreeing with the herd, but rather from a strong and unwavering perspective on how one believes things should be valued.

When you hold to these types of valuation beliefs, your patience will be tested. Your strategy and philosophy will not always be in favor. You will go through long droughts; you may even find yourself questioning your approach. As Bernard Baruch once said, “The main purpose of the stock market is to make fools of as many men as possible.”

The majority of people, or what I am referring to as the herd, will say things like, “It’s different this time…” or “I just don’t want to miss out on this once in a lifetime opportunity…” Their strategies and beliefs will oscillate around whatever is trending or whatever is in vogue. The herd will never have a strong foundational belief in their approach; there will be a constant second-guessing which will always lead them to dump their strategy and go shopping for a new idea. Yet this is not the case for great investors; they do quite the opposite.

Buffett vs. the Nasdaq

Let’s take our friend Warren Buffett as an example. Some consider Mr. Buffett as the greatest investor of all time. He carries a long track record of solid performance and consistent results. Within the investing community, he is known for his unmatched temperament and unshakable approach to valuing companies.

At the peak of the dot com craze, the herd was only interested in buying companies that had a “.com” in their name. Money piled in from everywhere, as the prices of these companies continued to get bid up. Just like Asch’s study, people began to change their beliefs as they saw these stock prices skyrocketing. Mr. Buffett did not. Why? Because throughout his entire career Buffett has had a system for valuing companies and part of that formula depended on a company being both profitable and sustainable, which most of these dot com companies were neither.

In 1999 the Nasdaq Composite was up an astonishing 85.59%, the index nearly doubled in value. Meanwhile, during the same year Mr. Buffett’s holding company, Berkshire Hathaway had a return of -19.86%. You can imagine the ridicule that he received. You can imagine how difficult it would be for most of us to defend our approach and continue with our strategy. For the 37% of the participants in Asch’s study, this would’ve meant it was time to make a change.

In hindsight though, we know that this ridicule was short lived. At the turn of the millennium, the dot com bubble burst. Over the next three years (2000 – 2002) the Nasdaq would decline by greater than 67%, while Buffett’s Berkshire Hathway would gain nearly 30%. Some might say this was vindication for his tried-and-true strategy that is value investing. I would agree.

Fighting FOMO

There will always be someone or some strategy that seems to be doing better than you. The key to success is your ability to stick to a strategy and stand by your beliefs about investing. Staying the course though will be a constant battle. The fear of missing out (FOMO) will always be creeping in the back of your mind. You’ll hear about a neighbor who got rich investing in cryptocurrency or a big win that they had on a high flying stock and you may begin to question your approach.

At the end of the day, I hope you can remember this Asch study and how silly it can be to change your beliefs based on the loudest opinions in the room. Over time, the patient and the grounded investor should always prevail.