I typically devote some part of my weekend to researching on what I plan to discuss each week on Thoughts on Money [TOM]. I had no idea that my decision to write on topics of risk, drawdowns, and recovery periods, as I believe these are important topics for investors to understand, would also be so timely based on how the markets kicked off this week!

If you didn’t get a chance to listen yet, I’d encourage you to check out the TBG Investment Committee Corona Virus Update – Week of February 24, 2020. David Bahnsen and team provide some insightful dialogue into what’s going on in the markets and how a prudent investor should react.

The Difficulty of Defining Risk

One of the most difficult concepts to understand in finance is risk. More specifically, the ability to understand how to manage risk and an awareness of how much risk one is taking.

The common risk nomenclature in personal finance are these three traditional categories of investors – conservative, moderate, and aggressive.

Why is it that I absolutely despise these three monikers? It’s because they are rather inefficient measurements as they mean entirely different things to different people. Think about it in terms of politics, when someone calls themselves a moderate, is that easy to know exactly where they stand?

Those who choose to side-step these risk labels (conservative, moderate, and aggressive) prefer to quantify risk by focusing in on an investment’s standard deviation; a mathematical measurement for volatility. What? Still confused? While finance people understand this math, it is far from being palatable for the common investor.

Therein lies the tension, when risk definitions are too broad and ambiguous, they are meaningless and when they are mathematically defined, they are not easily comprehensible.

In reality, investors love risk when it means they are making more money and despise it when it’s amplifying their losses.

Under Promise & Over-Deliver

“I have written for nearly twenty years of the pivotally important truism that “risk” and “volatility” are not the same thing – that risk is the possibility of a failure to achieve a financial goal, whereas volatility is the up and down movements of value in asset prices inevitable in the life of any investor.” David Bahnsen, Dividend Café – April 13th, 2018

There’s an old adage in the service industry to always “under promise and over deliver.” The premise is that customers have a tendency to set expectations and their experience will be defined by if those expectations were met or not. If you set the bar low and go above and beyond, it’s very likely that you will help to create a favorable experience.

We can translate this same truth to investing. Investors have expectations and it’s important to align those expectations with reality.

From David’s quote above we understand that the real definition of risk is the possible failure to achieve one’s financial goals (retirement, college funding, new home purchase, etc.). This means a portfolio should be designed using details such as one’s time horizon for retirement, savings rate, expected returns, AND one’s risk tolerance (as well as other factors). You can have the perfectly designed portfolio, but if you can’t stay the course then it all goes out the window. This “downside” is often referred to as a “drawdown.”

Peaks and Valleys

Our tolerance for drawdowns typically have a breaking point. In finance we call this capitulation, it’s the straw-that-broke-the-camels-back moment or the I-can’t-take-this-anymore moment. When we build an investment portfolio, we first must set expectations around how much the portfolio could potentially change in value to the downside (drawdowns) and how long it might take to recover from that change (recovery periods). We need to look to history and get a general understanding of what worst-case scenario looks like, so that we can tether our expectations to this potential reality and define our own personal tolerance for volatility.

A Graphical Explanation of Drawdowns & Recovery Periods

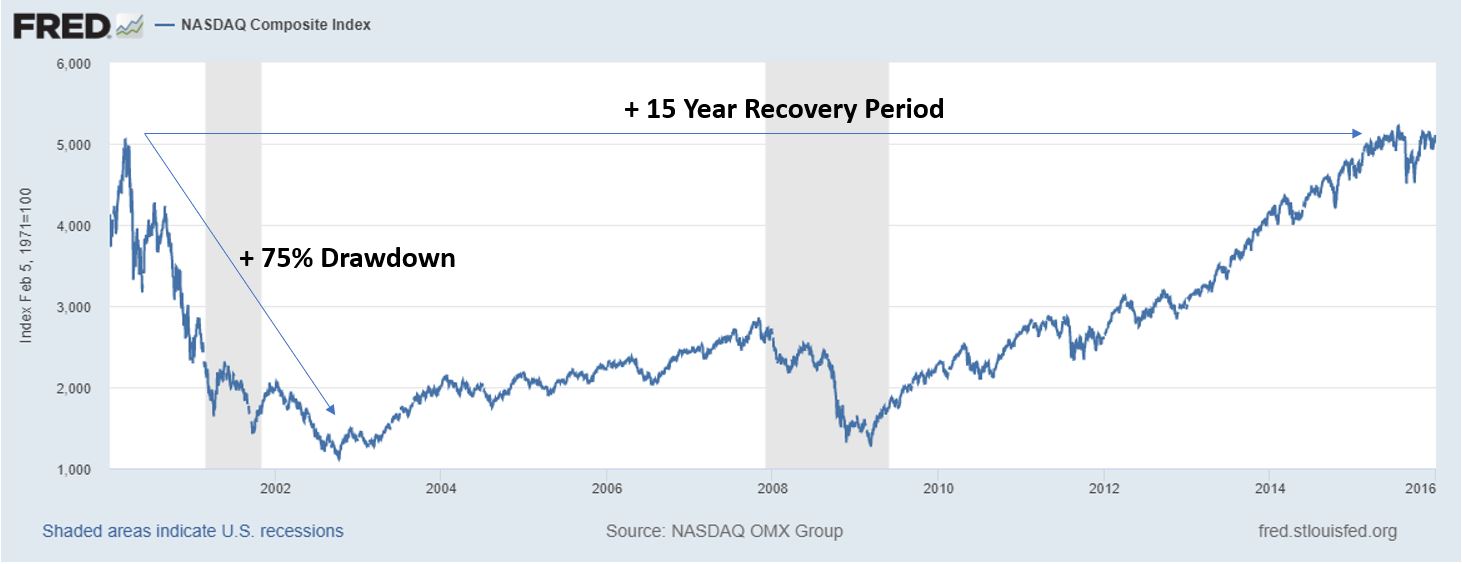

Like I mentioned earlier – investors love risk when it means they are making more money and despise it when it’s amplifying their losses. The early 2000’s perhaps explained this truth best. In the late 90’s investors piled into risk assets, became apathetic about valuations, and this happened:

The Nasdaq Composite Index experienced a +75% drawdown and it took over 15 years for an investor to recover from this drawdown.

In the late 80’s we saw an even more exaggerated bubble in Japan:

You can see the numerous drawdowns (peak to trough) over the 30 years and the craziest part is that the price still hasn’t recovered from the highs of 1989.

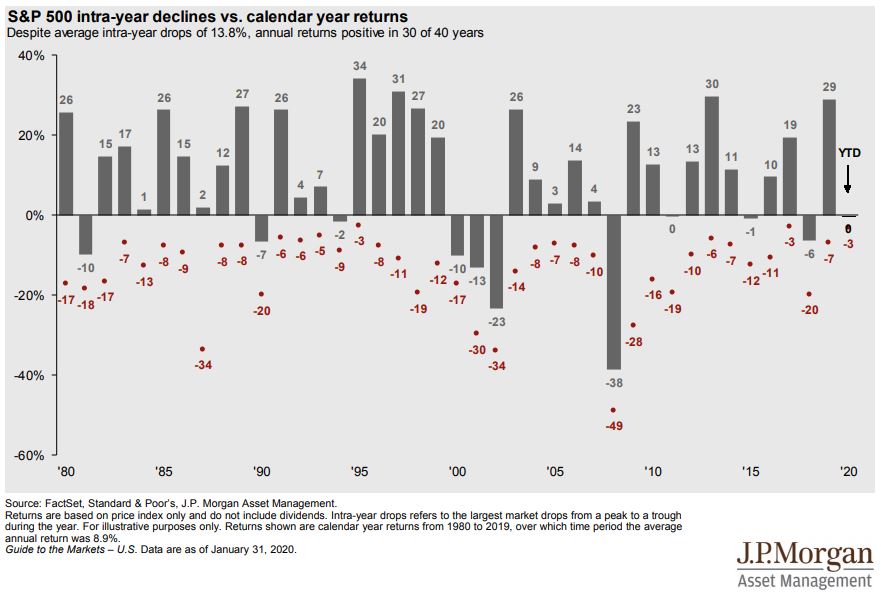

These are extreme cases of drawdowns and long recovery periods, but just like we’ve experienced this week, markets do dip, zig, zag, and recover on a daily, monthly, and yearly basis.

That’s an average of 13.8% peak to trough drawdown each year, with a majority of years recovering from that loss intra year. Fluctuating values are par for the course.

Have the Right Expectations

This is about the time in our weekly conversation where I make a baton pass and encourage you to start a conversation with your advisor on this topic. As I said from the get-go, risk is a tricky topic to understand and misinterpretations of risk are often the impetus to bad financial decisions.

Priority number one is for you to achieve all the financial goals you have laid out for yourself and your family. Those goals are most likely not targeted to be achieved tomorrow, some are a few years out and some are many years out. This means that we are setting out on a journey and the road to achievement will be laden with surprises both to the upside and the downside.

You need to have a clear understanding of the downside exposure (potential drawdown) of your portfolio and how long the expected recovery might be if you experience one of these outsized drawdowns. I encourage you to go beyond the conservative, moderate, and aggressive labels and actually define what percentage drawdown you can personally tolerate. Then, work with your advisor to affirm that your tolerance aligns well with the portfolio you are invested in.

Again, this will allow you to set the right expectations because there is nothing worse than an over-promise-under-deliver experience.