The current shelter-in-place orders have kept most of us at home – some working and some waiting to get back to work. Our typical social calendars have been modified and now mainly consist of short video calls with friends and family. This has created some surplus in our schedule and a lot of this spare time has been dedicated to projects that we’ve been meaning to get to, but never had the time. For some, this has meant repairing old furniture or painting their spare bedroom, but for others, it’s meant catching up on their personal finances and taking inventory of their portfolio and financial plan.

Many personal finance blogs across the internet have seen more traffic in these last 30 days than maybe ever. I find myself in a unique position as (1) being a large consumer of this content and (2) a person who is in regular conversations with investors; this allows me to spot the trends and narrow down those common questions on investor’s minds.

Here’s one of those conundrums that many investors are faced with: With bond yields so low, should I own any bonds in my portfolio?

Great question and one that deserves to be dissected. Perhaps the perfect topic to tackle here on Thoughts On Money [TOM], so let’s dive right in…

The Nature of Bonds

To understand this question better, I believe you first need to understand some of the basics behind asset allocation and portfolio construction.

When an investor is constructing a portfolio, they typically have multiple objectives they are seeking to achieve. These objectives can range from current income to growth of principal to the preservation of capital to an array of other targets. Seeing that there are usually multiple objectives at play, one must weight or prioritize these against one another to decipher what type of portfolio would provide the best fit.

Another term for bonds is fixed income, which provides a good descriptor for the nature of bonds – they pay a fixed income. Like any investment, there is a give and a take. What you receive in the form of reliable fixed-income payments usually comes with the sacrifice of any expected appreciation beyond those fixed payments.

Let’s oversimplify it, if I lend out (to a person, a government, a company, etc.) $100 for 5 years at a rate of 1%, then I’d expect to receive $1 in income each year and a full return of my $100 at the end of the term (5 years). As this example illustrates, I received that fixed income payment of $1 and then was given back my original principal; there was no appreciation of my investment principal.

Traditionally, these fixed payments are a perfect solution when one is trying to match an asset to a liability. For an individual, this could mean a retiree needs to withdraw a certain percentage from their portfolio each year to cover their living expenses. For an institution, like an endowment or pension, this could mean they have a payment obligation (e.g. pension payments, scholarships, etc) that need to be met from the portfolio on an annual basis.

Historically, bonds have well served these two common objectives of providing current income and preserving principal.

Ok, So What’s the Problem?

One thing that this question presupposes is that most investors either own bonds in their portfolio or were considering an allocation to bonds. Well… the global bond market is a +$100 trillion dollar market – larger than the global stock market I will note – so someone out there definitely has a current allocation to bonds in their portfolio.

So, why in the world are we asking this question whether or not we want to still own bonds?

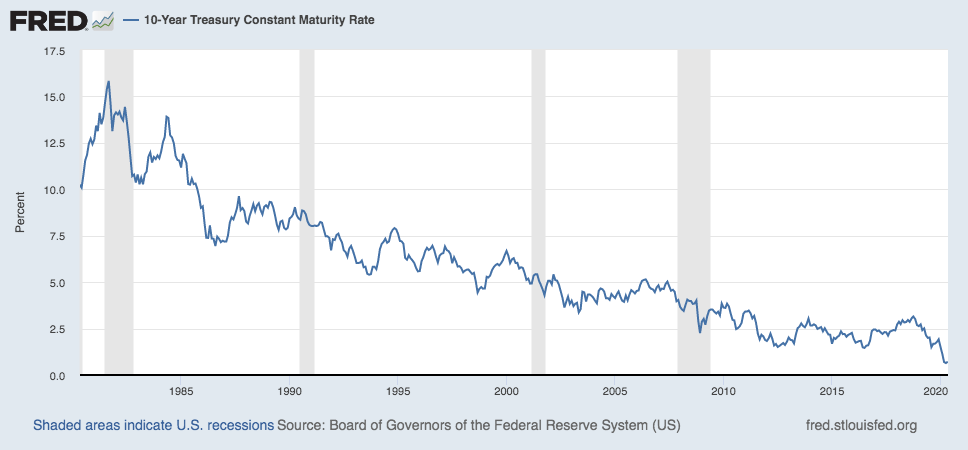

We ask this question because we’ve seen bond yields absolutely collapse in the last 12 months.

On May 1st, 2019 the yield on a 10-year government treasury was 2.39%. Not as good as it was on May 1st, 2018 at 2.98%, but a whole lot better than the rate now at .64% as of May 1st, 2020.

An investor that was formerly (1 year ago) getting $2,390 per $100,000 lent would now only have the opportunity to receive $640 a year for a 10-year loan to the US government. How’s that for a pay cut? If you’re curious, that’s a 73% decrease in income.

So you ask, what’s the problem? The problem is that for many investors this asset no longer matches the opposing liability. It is not meeting the current income objective.

And just for dramatic effect, here’s the chart of that 10-year treasury yields over the last 40 years:

Source: FRED

Not All Bonds Are Created Equally

Maybe at this point, you are ready to trash bonds from your portfolio altogether. Maybe you’re thinking “Who needs ’em!?” Maybe you’ve read one too many headlines highlighting the collapse of yields and you are convinced that you are done with bonds.

Here’s my advice – pump the breaks.

Much of the discussion thus far and the above references to yields have been regarding Government bonds (treasuries), but these are not the only type of fixed income instruments. Yes, you can lend to the government, but you can also lend to individuals or companies. Yes, you can lend for 10 years, but you can also lend for 2 years or 30 years. You can lend to public companies, you can lend to private companies; you can lend to companies with great credit quality, you can lend to companies with poor credit quality; you can lend domestic, you can lend internationally.

Here’s the point – there is a wide array of different bonds available in the marketplace and not all bonds are created equally.

A Diversified Bond Portfolio

In the past, when reviewing a portfolio with a client I would always segment the four asset classes and refer to the allocations as cash, stocks, bonds, and alternatives. Lately, I’ve been reprogramming my vernacular to be intentional about always referring to this allocation as a Diversified Bond Portfolio.

Let’s go back to what we referenced earlier, every investor has different objectives. These objectives are what drive the design of their portfolio. We also learned that some of the “traditional” bond allocations are no longer meeting those income objectives. This means that we must pivot and readjust the portfolio to assure that it produces sufficient income.

This can be tricky, so we must be prudent in how we adjust and have a clear understanding of all the risk exposures. The income (or yield) of a bond is determined based on the duration, how long we lend for, and the credit quality of the borrower. When constructing a portfolio, you can basically pull on those two levers – duration and credit quality – to ratchet up or down the income and risk.

The Takeaways

The moral of the story is this, an investor should be very careful about making a wholesale change in their portfolio to just sell all bond exposure and reallocate to another asset class like stocks. I do agree that an investor’s historical allocation to government treasuries may look a lot different today based on the environment we find ourselves. Remember though, the bond market is a GIGANTIC market made up of bonds in all different shapes and sizes.

A prudent investor will take the time to sit down with their advisors to reaffirm their personal risk tolerance and design and diversified bond portfolio that is fitting for their needs and comfortability.

Why own bonds? Because bonds add diversification to a portfolio and as the old adage goes, it’s not wise to put all your eggs in one basket.

That’s all I have for you today and I look forward to connecting with you next week for another issue of Thoughts On Money [TOM]. This is TOM signing off…