Baseball Bats and Broken Golf Swings

Today’s topic is all about re-programming our minds from old ways of thinking to new ways.

Think of an activity you’ve done a specific way for a long time. You’ve developed habits and skills and programmed your mind and body a certain way for many years. But one day, circumstances change. What happens when your old way of doing things is no longer working?

In elementary school, one of the many sports I played was baseball. My Dad was a collegiate baseball player, and he taught me all the tricks of the trade. I understood how to place my feet, turn my hips, and swing through the ball. I also learned how to swing a baseball bat properly.

Years later, as an adult, I picked up golf. As I started playing more frequently, I noticed something was off. I wasn’t connecting properly with the ball. My drives were sailing into the woods or sometimes the wrong fairway. It was then that I had an epiphany… I had trained my body and mind to swing a baseball bat rather than a golf club…

If you read that last paragraph and thought, “This guy is delusional – he just has a broken swing,” you are absolutely right! I am humble enough to admit that my elementary school baseball training isn’t the real reason for the “FORE!’s” you hear on the golf course.

But to be fair, I have heard from high-level baseball players that swinging a baseball bat negatively affects your golf game. On the surface, both sports appear correlated, but the techniques, mechanics, and mental approaches are vastly different.

The Line

Like swinging a baseball bat versus a golf club, spending money in your working years is entirely different from spending money in retirement.

Most of us find determining our spending level easy during our working careers. We tend to view our cash flow per the graphic below. I’ll call this “The Line.”

*Illustrative Purposes Only

The rule is quite simple: spend less than you make, and you have a “margin.” A small purchase doesn’t cause too much stress as long as expenses are less than income. In addition, time is on the worker’s side. Even if he doesn’t have margin currently, perhaps there is time to “catch-up” in the years leading to retirement?

The Circle

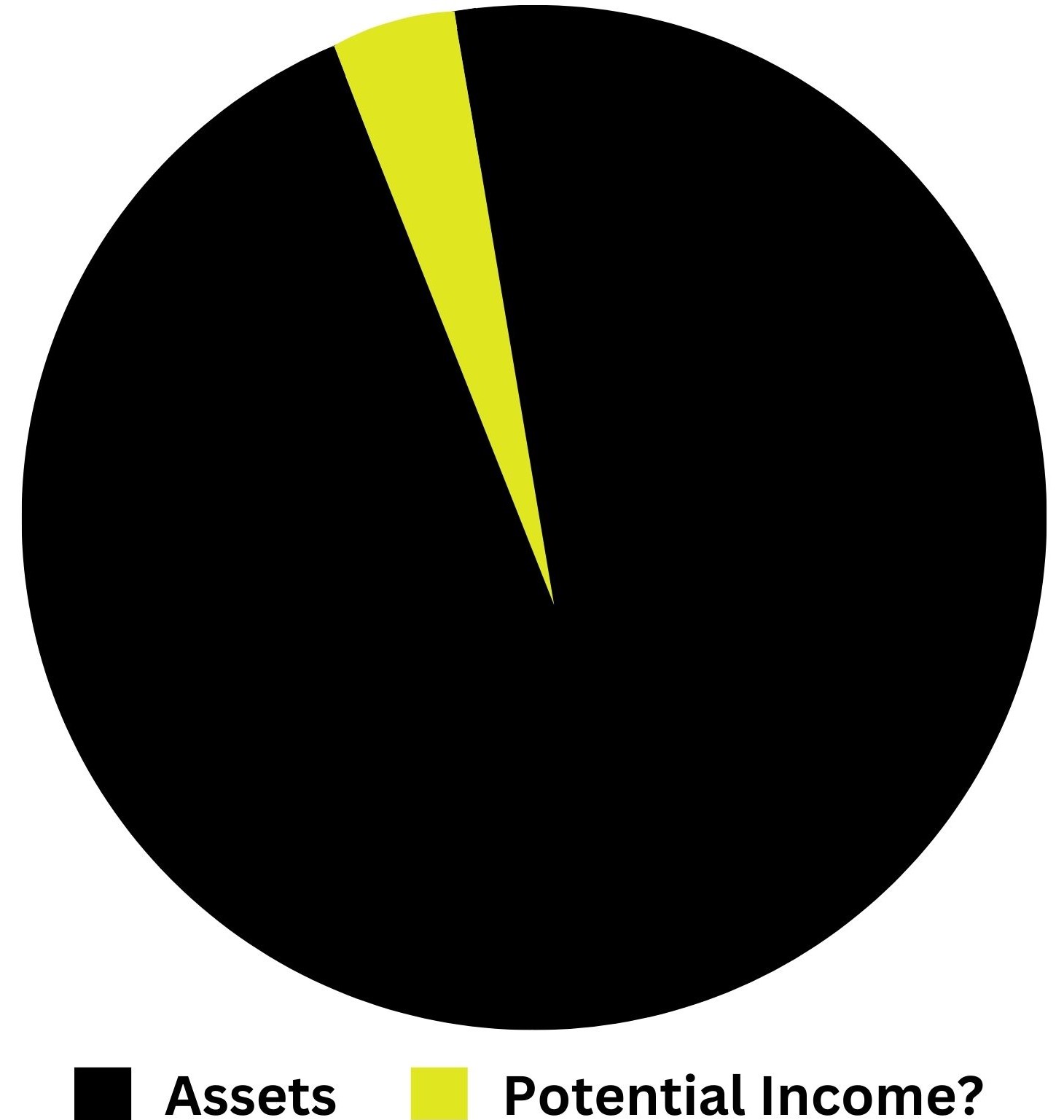

Spending money in retirement is a different ballgame. Instead of the simple rule “spend less than you make”, we often have a foggy view of what amount of spending is too little, what is too much, and what is, as Goldilocks would describe, “just right”.

Instead of our income (“The Line”) giving us a concrete measure of how much we can and should spend, we now have “The Circle.”

*Illustrative Purposes Only

Converting Circles into Lines

As you may have guessed, “The Circle” is your investment portfolio. You may have Social Security or a pension, but generally, those don’t cover your desired spending level. Figuring out the right amount to withdraw from an investment portfolio does not come naturally to most people.

When counseling clients as they approach retirement, the anxiety is often palpable. Regardless of income or net worth, quite often, there is a feeling of uncertainty or nervousness when approaching the fateful day upon which they no longer receive a paycheck.

Are these clients excited? Most definitely. However, much of the financial anxiety comes from investors not being sure how a circle (their portfolio) gets converted into a line (regular, recurring income).

The Biggest Problem

In my career, I have reviewed hundreds upon hundreds of financial plans and have experienced many success stories. However, one of the biggest issues I find is one you may not expect…most investors don’t spend enough money when they transition to retirement.

How could I say such a thing?

When you’ve been programmed for so long never to touch your assets and let them build and compound, it is difficult for folks to do a 180 and begin to withdraw from their portfolio. Most people understand the concept intellectually… but it’s undoubtedly difficult emotionally.

“What If…?”

The most common pitfall I see is retirees going down the “What-If” rabbit trail without running the numbers or consulting a professional. “What if I live until I’m 105?” “What if I go into Assisted Living?” “What if Social Security is cut?” “What if World War 3 breaks out?”

As a fiduciary whose primary responsibility is to ensure that money lasts throughout one’s lifetime, you can have confidence that our team is running these scenarios on behalf of clients. But our worries need to be nestled in the context of reality. We need to find a balance between preparing for legitimate concerns (stress-testing the plan) AND not letting fear and anxiety rule the rest of our days.

Practical Solutions

There are two practical ways we can combat this tension…

- Create a robust plan – If you are in, entering, or near retirement, you need a plan. One that accounts for your current assets, current and future income, taxes in retirement, Social Security, medical expenses, and lifestyle expenses. Using rules of thumb, like the “4% rule,” is not sufficient!

Only after this plan is built will you understand the appropriate amount to spend in retirement. The good news? You can spend with confidence knowing that your plan has been stress-tested.

“For which of you, intending to build a tower, does not first sit down and count the cost, whether he has enough to complete it?” Luke 14:28

- Convert Your Circle into a Line – When you were in the Accumulation phase, you might not have cared much about the income from your portfolio (perhaps you simply reinvested dividends). Now, you are in a different phase of life.

By utilizing investments that pay an income stream (ideally a sustainable, growing income), it becomes much easier to visualize “The Circle” as “The Line”. By only withdrawing dividends and interest from your portfolio, you can have confidence that you’ll never be a forced seller.

Are you wondering how your investment portfolio converts into regular, recurring income in retirement? Are you playing the “What If” game without talking to someone who has walked through hundreds of financial plans? If you’re still in the accumulation phase, how do you think you’ll approach spending when the regular paycheck is no longer coming in?

Until next time…

Blaine Carver

Private Wealth Advisor

Trevor Cummings

PWA Group Director, Partner