Missed Expectations

One of the highlights of the internet era is that nothing gets missed. Every story, every photo, every highlight, and every disappointment is available for the world to see.

A few stories over the last few years come to mind. Both of the accounts I will share have a whole lot to do with expectations – fair and reasonable expectations, I might add – and highlight exactly what disappointment looks like.

In 2014, the Winter Olympics were hosted in Sochi, Russia. This was the first time the country was hosting the games since Moscow in 1980. What soon came to light was how unprepared the host city was for the upcoming games. The infrastructure and accommodations were more than lacking. So, athletes and coaches alike took to social media. Photos of yellow water, unfinished construction, plumbing not equipped for flushing toilet paper, exposed electrical, and the list goes on. The internet had a good laugh; the meme-mania was exploding, but as you can imagine, those participating were quite disappointed.

A now popular Netflix documentary, FYRE: The Greatest Party That Never Happened, highlights the infamous Fyre Festival of 2017. Promoted to be THE musical festival of the year, it became documentary-worthy for all the wrong reasons. A once nearly forgotten rapper, Ja Rule, all of a sudden became quite relevant again as he was the familiar face behind the event. Millennials from around the world flooded into this small island in the Bahamas for the disappointment of their lifetime. What they thought to be first-class turned out to be tents and ham sandwiches.

THE Lost Decade

This concept of missed expectations and disappointment is not foreign to investors. Sure, maybe you didn’t attend the 2014 Winter Olympics or the Fyre Festival, but perhaps you were an investor during the aughts. A time period we now refer to as the “Lost Decade” where the market (S&P 500) delivered a negative return over a 10-year time period (2000-2009). Investors had heard tales of markets averaging 7% – 10% per year throughout history, and those same investors ended this decade seeing their portfolio value shrink when they assumed those values would double. Again, missed expectations and disappointment galore.

It is a destructive era for new retirees and a reminder of the importance of stress-testing a financial plan.

First Stocks, Now Bonds

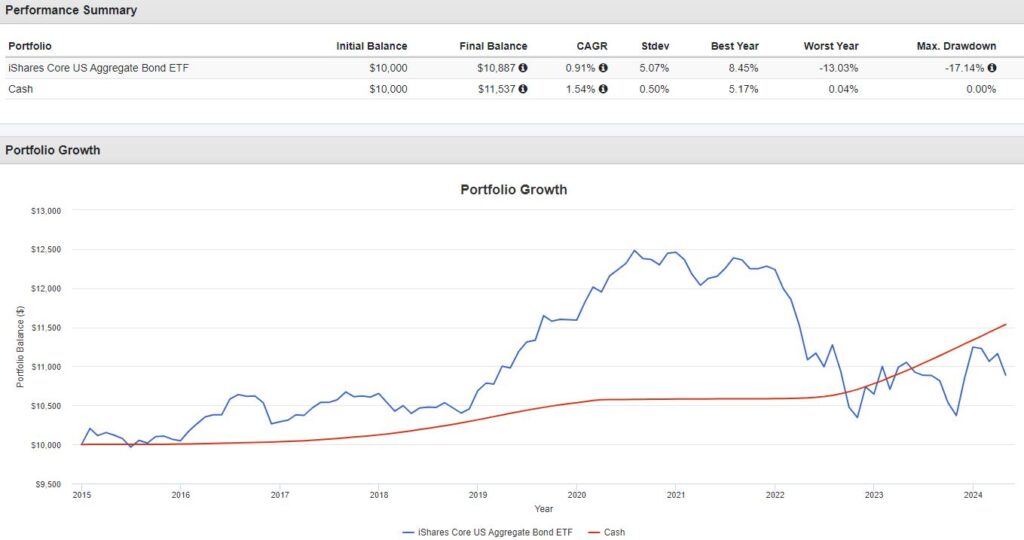

Now, the Lost Decade is a thing of the past, but very few are talking about the New Lost Decade that we are actually living in right now. The U.S. Aggregate Bond index is nearly the same price today that it was almost 10 years ago.

Source: Portfolio Visualizer

For most investors, especially retirees or soon-to-be retirees, stocks and bonds have traditionally represented a majority of their allocations. Bonds have been synonymous with “safety,” yet we are now living in a decade where—in real terms (accounting for inflation)—bonds have actually not been safe at all.

For clarity, the chart above reflects cash (money market) providing a return greater than the aggregate bond index for almost the last 10 years.

A Little History…

We need some background to give further context to why this matters. I don’t want to spend too many words on the history here, so I’ll try to give you the readers’ digest version.

Many moons ago, investors resourced a commission broker to facilitate the buying and selling of stocks and bonds. Soon, brokers would become a thing of the past as the relationship proved to be more transactional and conflicted than advice-centered.

Next, mutual funds were the latest innovation and all the craze. The ability to execute a single transaction and get broad exposure (diversification) was revolutionary. At its inception, it was still orchestrated through a broker, but soon enough, access became broader, cost-friendly, and seamless. Eventually, mutual funds became familiar, the industry was flooded with fund options, and the relative cost/benefit came under the microscope of criticism.

The next leg in the financial advice industry evolution was the financial planner. An advice giver operating in the client’s best interest and looking beyond just investments to how the whole financial puzzle fit together.

With all this change, one thing remained constant: Investor outcomes depended on good investor behavior. This was true when Jesus walked the earth and is just as true today. You are most often your own worst enemy when it comes to investing—fear, greed, panic, overconfidence, and the like.

Another reality was/is that we live in a very litigious society. In the era of brokers, people often said things like, “Nobody ever got fired for buying IBM.” It was the safe play, it was vanilla ice cream, it was following the herd. In the era of planning, one might translate this as “Nobody ever got sued for recommending the 60/40 portfolio.” So, an entire industry sits on this common advice of allocating 60% to stocks and 40% to bonds.

And, if that was going to be the standard advice, who needs an advisor anyway, right? Enter the robo-advisor and target-date funds. The standard solution would simply place you in the 60/40 portfolio, just like your litigation-timid neighborhood financial planner.

Then… bonds broke, and that’s where we find ourselves today, the New Lost Decade.

EBP

Roughly three years ago I introduced this concept on Thoughts On Money that I call Expense Based Planning (EBP). This approach took a look at the common strategy for allocating investor capital and challenged the standard.

Again, the common cover-your-rear approach in the industry was to basically ask the investor, “Are you conservative, moderate, or aggressive?” and use that single answer to design a recommended allocation. The way humans are wired, we simply want to fit in, so most of us just choose the middle ground: moderate. And pressing that moderate button spit out that 60/40 portfolio I referenced earlier.

I argued that the role of the advisor was more like a Safari guide than a drive-thru window attendant. The Safari guide, with his or her expertise and experience, would guide the tourist (investor) into areas that would normally be deemed dangerous if visited solo. This is as opposed to the drive-thru attendant who simply states, “Would you like fries with that?” Again, a guide, not an order taker. There is a big difference there, one that should be both recognized and pondered.

So, in the EBP framework, allocations are built around expenses and spending habits. Bonds are allocated on a pro-rata basis relative to one’s annual expenses. Those expenses and spending plans are defined by the income produced by the portfolio. In layman’s terms, the portfolio income (dividends and interest) is meant to be enough to cover one’s withdrawal needs for living expenses. Then, an additional safety net is initiated by allocating 2, 3, or 4 more years (investor preference) to cash and high-quality duration bonds.

Bond Expectations

The right expectations for bonds are a mechanism for reserves, not returns.

If you go through this exercise, you will most likely not end up in a 60/40 portfolio. And, as described above, you will be thankful for it.

Imagine an investor plans to take out 4% per year, and their dividends and interest more than satiate their withdrawal rate. Perfect! Now, the investor prefers to set aside 4 years of those withdrawals in cash and high-quality duration bonds. Based on the math, that’s 16% allocated versus that 40% norm we referenced earlier.

Challenging Tradition

For this to work, the advisor and the investor have to agree that the investing jungle is indeed both dangerous and scary. The advisor can’t change that reality, but they can help guide, direct, comfort, and protect the investor—often from themselves. This all hinges on trust.

Don’t get me wrong. I’m all for traditions and leaning on the wisdom of those who have come before us. Yet, I think my history lesson above helps us to see how we got here and why that traditional approach is worth challenging.

Perhaps you don’t agree with or like this EBP approach. That’s ok. I simply want to encourage you to do things on purpose and with purpose. Build your strategy around sound logic and reasonable expectations.

I’ll end here and draw a bit more attention to that point of expectations. Our Olympians in 2014 were shell-shocked by the accommodations, or lack thereof, in Sochi. Those Fyre attendees all have a story for the ages, and hopefully, they can look back at it and laugh now. You know what’s not funny, though? How many retirees 10 years ago loaded up on bonds, frazzled by the lost decade, and depended on some financial planning assumptions that modeled out bond returns in the 5% range? In hindsight, we can now see how incredibly short the actual results were compared to those lofty assumptions.

What we expect, what we assume, and what’s actually delivered will either lead to satisfaction or disappointment.

Build (allocate) wisely, my friends.