An Exercise in Patience

Raising kids is one of life’s greatest joys – a blessing wrapped in chaos, laughter, and endless lessons in patience.

With four little ones, my evenings are filled with repeated instructions, spilled snacks, and toddler negotiations.

Progress is often three steps forward and two steps back. One week, we are celebrating victories, the next week, we are simply trying to make it to bedtime.

But growth is happening, even when it’s hard to see. My toddler will learn to communicate. My kindergartener will learn to read. It is not a straight line of progress, but the progress is inevitable. Patience truly is a virtue.

Just as parenting teaches patience, so too does investing. Entering the stock market requires accepting that frustration is part of the journey.

Imagine an investor who contributed funds to a portfolio tracking the Dow Jones Industrial Average on December 2nd, 2024 (see chart below).

*Source: koyfin, August 7, 2025

This investor’s journey may have felt like an emotional rollercoaster -initial frustration (down over 6% in just over a month), followed by relief (rebounded 7% the next month), and then panic as the index fell more than 16% in seven short weeks. Since hitting bottom on April 8th, this index has climbed back over 16%. However, this reality remains: eight months after investing, they have less money than they started with, and have endured a wave of emotions along the way.

Expectations

We all bring expectations into our investment journey. Some might be too high and some might be too low, so inevitably this leads to pleasant surprise (the investment outperforms expectations) or disappointment (the investment underperforms expectations).

The stock market offers a risk premium – an additional return an investor expects or requires from a volatile asset compared to a risk-free asset, like cash. Without this premium, no one would accept the uncertainty that comes with investing.

The challenge for investors is that the timeline for this additional return is unknown. The additional return (premium) may arrive in a month, a year, or even a decade. The reward is real, but the timeline is unpredictable.

Is the stock market a casino?

When markets underperform expectations, even the most resilient investors can have their confidence shaken. You might hear from others, “the stock market is like a casino”.

It’s tempting to agree because in the short run, the stock market may feel like a casino. Consider the following:

Since 1926, the U.S. stock market has experienced positive returns:

-

- 56% of the time on a daily basis

-

- 63% of the time on a monthly basis

-

- 75% of the time on a yearly basis

-

- 88% of the time on a 5-year basis

-

- 95% of the time on a 10-year basis

-

- 100% of the time on a 20-year basis

Holding stocks for a single day is much like Vegas. It is essentially a coin flip whether you come out ahead or behind.

However, the longer you’re in a casino, the greater the chances of the house winning. The opposite is true for stock market investors.

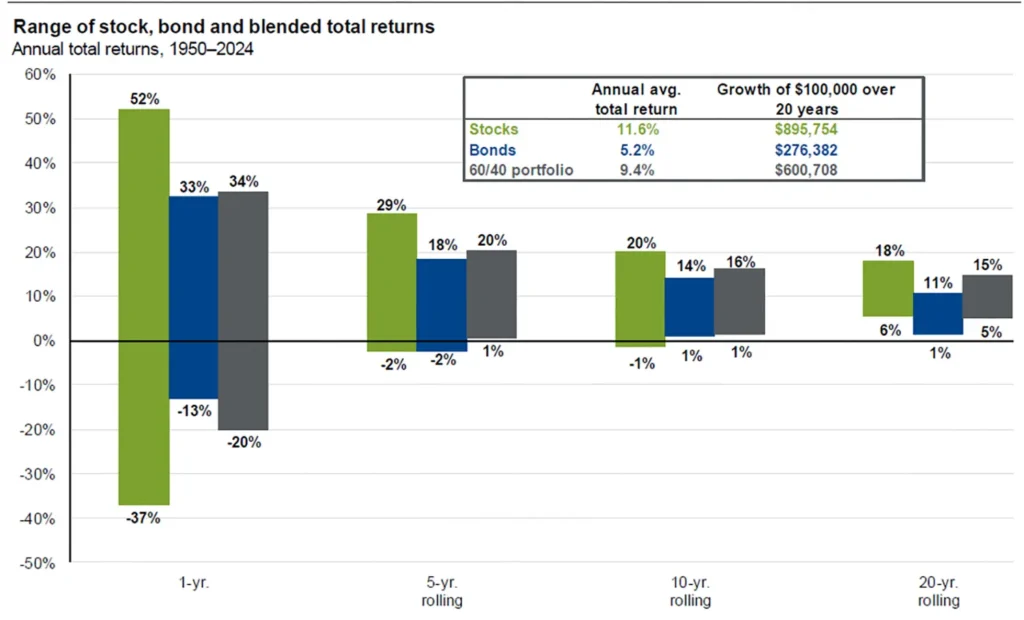

Take a look at the green bars in the chart below – they represent the stock market’s range of annual returns over various time periods.

*Source: Bloomberg, FactSet, June 30, 2025

Shrinking Range of Outcomes

The data above is incredibly clear – the longer you are invested, the narrower the range of outcomes. This is a good thing!

If you are only invested for a year, your timing matters a great deal. Through dumb luck, one investor might have experienced a 52% gain. Another investor may have contributed at the beginning of 2008 and experienced a 37% loss in a single year.

However, notice the “20-yr rolling” chart on the right side. For those invested for at least 20 years, the worst return was 6% annually, and the best return was 18% annually.

Thanksgiving Day

“Turkey Day” is one of my favorite holidays of the year, with family, food, and football. The spread on the table is always delicious, and it is an all-day labor of love.

Now imagine prepping for a 5 pm feast but putting the turkey in at 4 pm. The stuffing, sweet potatoes, fresh bread, and green bean casserole are all waiting to be devoured. You pull out the turkey… and it’s still pink.

Disappointing, right? Because turkeys need time.

But here’s the key… the only way that turkey doesn’t cook is if you take it out too soon. Eventually, the turkey will get to a point where it is cooked through.

Financial Myopia

Our culture has had a dramatic shift since the rise of the Internet. We’ve traded 3-hour movies for 30-minute episodes, and traded books for 40-character tweets.

The culture shift has spilled into investing as well. In the 1950s, a typical investor held onto their stock for eight years. Today, the average investor holds shares for just 5.5 months.

Patience is Rewarded

Despite our culture’s “I want it now” mentality, investors have historically been rewarded handsomely over the long term.

Consider this: The Los Angeles Lakers were purchased by Jerry Buss for $67.5 million in 1979. The Buss Family just sold the Lakers for $10 billion this year, amounting to a 149x increase in those 46 years.

Yet a $67 million investment in the stock market in January 1979 (as measured by the S&P 500 with dividends reinvested) would have been worth more than the $13 billion today!

If $67 million is unrealistic for you, simply remove three digits. $67,000 would have turned into $13 million. This is simply the math of compound interest, or what Albert Einstein called “the eighth wonder of the world.”

Practical

As we wrap up, here are two foundational principles every successful investor should embrace:

- Set proper expectations – the stock market is volatile, will frustrate you, and will test your resilience. Expect this so you’re not surprised.

- Be an optimist – Despite the inevitable frustration, believe in a future in which great companies continue to innovate, solve problems, and create goods and services that meet the needs of humanity. History tells us it is foolish to do otherwise.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett