I absolutely cannot believe that we are already preparing for Thanksgiving. It feels like 2019 flew by, right? Well, I know from experience, that these last 6-weeks of the year seem to fly by at hyper-speed as well. This is indeed a great time of the year to spend time with family, rest, and reflect on the year. It’s also a great time to do some end of year tax planning.

I know, I know, tax planning is not so festive, and it isn’t as fun as a turkey dinner, but the holiday season is our final opportunity to help reduce our 2019 tax bill. Who doesn’t like to pay less in taxes, right? So, with that spirit in mind, today’s TOM will be dedicated to a quick list of three potential strategies to employ before the end of the year.

And off we go …

It Is Better To Give… And Receive a Tax Benefit

The Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction. This meant that a lot of folks that would have previously itemized their deductions would now just be taking the standard deduction.

Taxpayers who have mortgage interest, charitable giving, and other items that fall below this standard deduction would no longer glean a tax benefit from itemizing going forward. Yes, for many the standard deduction being raised does create extra tax savings, but is there a strategy where one might still glean benefits from itemizing?

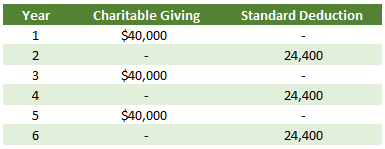

Here’s an idea that might apply to some of us and provide additional tax relief. Let’s look at an oversimplified example to see how this strategy might work. Let’s say a taxpayer is married, has a standard deduction of $24,400 and only has one item that they traditionally itemize – charitable giving. Let’s assume they give $20,000 per year.

What if, instead of giving $20,000 per year they gave $40,000 every other year so that they could itemize every other year and receive a tax benefit from their giving?

My first objection to this strategy would be that I personally like to give to the charities of my choice on a monthly basis and I would rather not give every other year. A Donor Advised Fund (DAF) solves for this concern. I can contribute to a DAF, receive the tax benefit in the year that the contribution is made, and then distribute to the charities of my choice according to whatever schedule I would like. While the money remains in the DAF, I can invest it in stocks, bonds, etc. so that I can also grow the money creating an even greater future gift. I can name the DAF whatever I’d like (e.g. Smith Family Foundation or Jones Family Charitable Account) and I can list successors of who I want to pass these granting responsibilities down to. I personally have really enjoyed funding and resourcing a DAF in my own tax planning.

A strategy like this could also apply to someone who has an extraordinary tax year and lumping contributions in the current year would create greater tax relief than it would in future years.

Giving strategies like this can be a bit nuanced, so you’ll want to consult with your advisor and tax professional before implementing it. Also, be sure to ask about giving highly appreciated investments (like stocks) into the DAF, this is another great way to supercharge your tax savings.

Time to Harvest

With a diversified portfolio, you’ll typically own a lot of different types of investments. Most investors will own an array of individual stocks, bonds, and alternative investments. As you are reviewing the investment performance of your portfolio you will probably find some studs and some duds; some investments that saw a significant appreciation in 2019 and some that are worth less than you paid for them.

When it comes to taxes, gains or losses that are unrealized (meaning that a position has not yet been sold) are not accounted for on a tax return. This is good in one sense because you don’t have a tax responsibility on those highly appreciated positions that you haven’t sold. What about those “duds” though? Perhaps you have a stock that you want to continue to own, but it also has some unrealized losses that could create a tax benefit for you this year (losses can be used to offset gains for tax purposes).

This is where tax-loss harvesting comes into play. This is a great end of the year tax strategy to help reduce the taxes that may have been created from any realized gains that you generated within your investment portfolio throughout the year.

Here’s how this strategy works. You start by selling the position(s) with the unrealized losses that you want to benefit from in this tax year. The sale triggers the realization of the loss and creates a tax benefit. Now, as I mentioned above, perhaps you wanted to continue to own this investment. The tax code does say that you have to not own the investment for 31 days in order to realize that loss (wash-sale rule), so you could buy a replacement that you are willing to own for the 31 days then swap back. Maybe you owned a soft drink company and you replace it with a similar company within the same industry as you await the repurchase.

I know this strategy might seem too simple to be impactful, but throughout the years I have helped to reduce a lot of taxes by implementing tax loss harvesting. Again, a great conversation to have with your advisor to see how this might benefit you in 2019.

Not too Late to Defer

We will wrap up today’s discussion with one last end of the year tax strategy. One of the easiest ways to reduce your taxable income is to defer it. To take portions of your income, set it aside for future use, and avoid paying taxes on it in the current year.

This is exactly how many retirement accounts work. Whether that be a 401(k), 403(b), Traditional IRA, or even a Health Savings Account (HSA). All of these accounts have their own contribution limits set by the IRS and they allow you to defer some portion of your income.

Many savers will have these accounts set up to systematically pull a set percentage from each paycheck. In one sense, this is all happening in the background and sort of out of sight out of mind. For those that are deferring amounts that are below the maximum limits they now have a chance, with a few paychecks left in the year, to increase their savings and reduce their tax bill.

For business owners, there are also other retirement deferral options available. Some that may be able to be initiated before the 2019 tax year is said and done. Again, I know I am beginning to sound like a broken record, but definitely worthwhile to set aside time with your advisor to discuss and see how a deferral strategy might benefit you.

Far from Exhaustive…

Today we reviewed three seemingly simple tax strategies that could create some tax benefits in 2019. My intention for today’s conversation was to remind us all how important it is to account for taxes when we are doing our financial planning. Taxes are one of our BIGGEST expenses throughout the year and if we can implement some strategies to help reduce that tax bill then that is money we keep in our pockets. A penny saved is a penny earned, right?

Today’s list is far from exhaustive and that is why I continued to harp on this idea of meeting with your advisor and tax professional to see if there are any strategies that might apply to your particular situation. Although tax planning is not the most invigorating subject, the savings could eventually equate to an extra vacation, helping another grandchild through college, or whatever other financial aspirations you have set for yourself.

As always, please feel free to reach out via email with questions or comments. I can be reached at .