Batter Up… Up, and Away!

Whether you are watching an episode of Sesame Street or you’re Sir Isaac Newton sitting under an apple tree, you understand this concept of what goes up must come down.

A basic law of gravity, right?

Yet there are these rare moments in life where things just seem to be suspended in air. We see that certain something go up and we we find ourselves just waiting for gravity to do its thing.

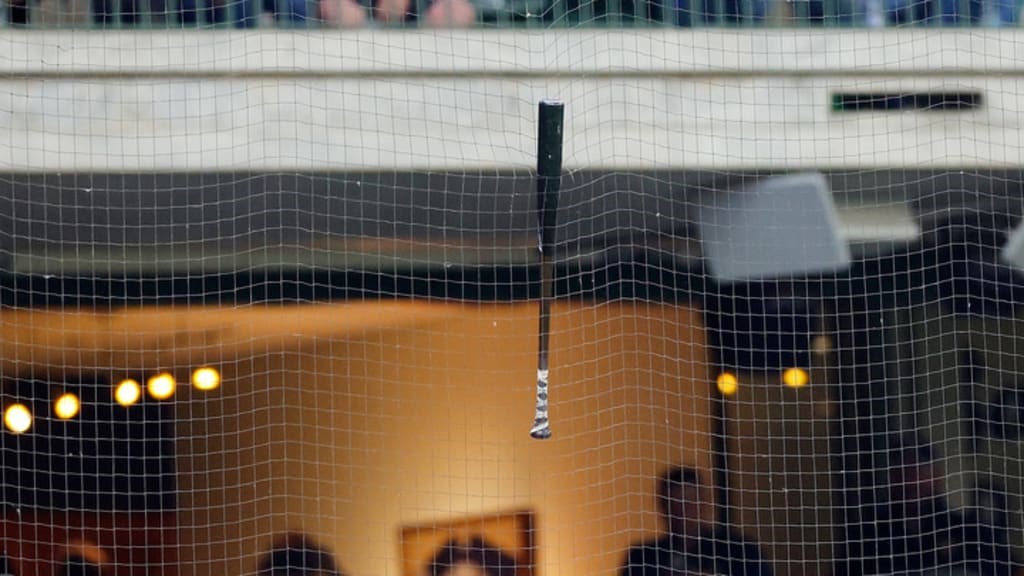

Here is a fun example. In a fairly inconsequential game on Monday night between the Toronto Blue Jays and the Milwaukee Brewers, something both rare and comical happened. Well-known slugger Vladimir Guerrero Jr. lost his grip on the bat, sending his lumber high into the air. The bat never came down. Not quite suspended in midair, but rather stuck in the netting above.

Source: ESPN, June 13, 2024

Teammate Justin Turner attempted to knock the bat down by throwing some baseballs at it. The staff tried to hook the bat down with a long pole. All attempts showed little progress or success. Some two innings later, they rigged a tool to get the bat down.

For those two innings, what went up did not come down.

You can enjoy the full video here.

Real Estate… Up, Up, and Away!

Between 2019 and 2022, home prices across the nation rose by roughly 43%.

Why? The catalysts are many – demographics, lack of supply, COVID, etc. Regardless of the cause, home prices have increased significantly.

From 2022 to the present, home prices have increased another 10% – 12%. And, important to today’s conversation, over that same time period, mortgage rates have also more than doubled.

Ratios

It’s important when talking finance that we never reference a single figure / data point in isolation. Saying that homes prices are high, or that stock prices are high, without any reference point isn’t very helpful. This is where ratios come into play, you anchor a price back to another reference point for context – this is a ratio.

So, when we talk about stock prices, we may reference them relative to corporate earnings, this is a P/E Ratio (price divided by earnings). You could ratio stock prices to sales or cash flow or many other figures. The point is to see how prices have related to that denominator throughout history.

Affordability

Here is a mind-bender for you: Can home prices be higher but not more expensive? Perhaps semantics, but I would say the answer to that question is, “Yes, and the inverse can be true as well.” I would argue that “more expensive” means that a particular cost cuts deeper into your monthly budget (percentage-wise) than it has historically. This is where ratios come in handy.

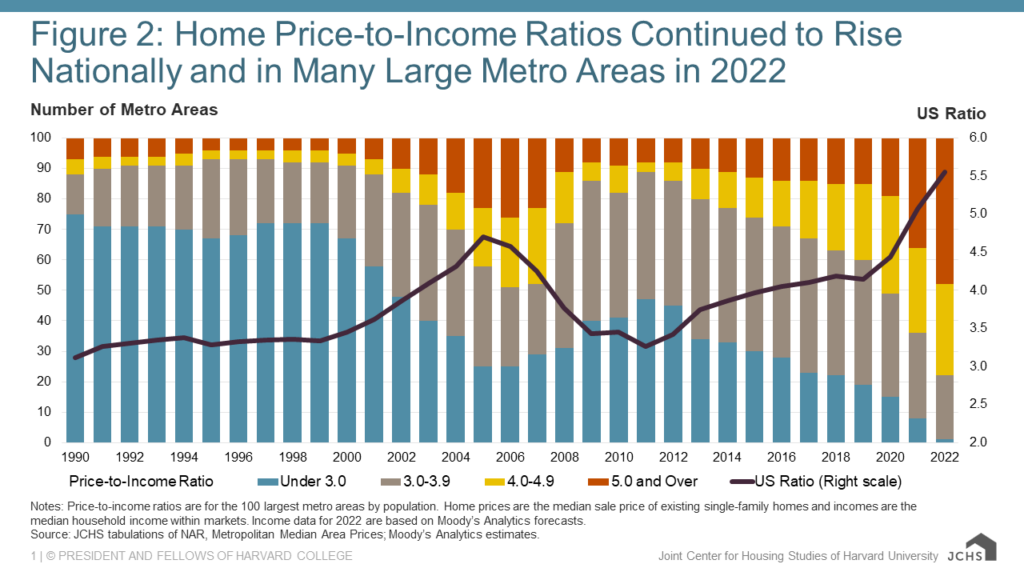

Let’s ratio home prices to median household income. By dividing home prices (national average) by the median household income, we can start to get an idea of what sort of price one needs to pay (compared to their income) to buy a home. Then, we can relate that multiple over history. The chart below helps to express this.

Source: Harvard, June 13, 2024

The multiple of one’s income needed to purchase a home today is the highest we’ve seen in the +30-years referenced above. This is an “affordability” metric. So, I believe we can confidently conclude that homes are more expensive today than they have been historically.

Rates

What the above measurement doesn’t factor in is the relative mortgage rate over that stated time period. This chart simply compares prices and income, but most homes in America are not purchased outright; they are financed with debt (a mortgage).

Today, rates hover around a 20-year all-time high. Perhaps obvious, but higher rates amplify this “more expensive” argument even further.

Let’s unpack a basic example. Where I live (San Clemente, CA), an entry-level single-family home will cost approximately $1.5mm. Let’s assume one was to put a down payment of 20% and finance the remainder, a very common practice. A $1.2mm mortgage at 7% is going to be in the range of $8,000 per month. If impounded (including property taxes and insurance), we are talking more like $10,000 a month.

Another common finance ratio is the debt-to-income (DTI) ratio. Let’s assume your lender doesn’t want your monthly housing expense (mortgage, property tax, and insurance) to be more than 1/3 of your income. This means you need a household income of some $360,000 per year to purchase this starter home. According to US Census data, the median household income in San Clemente is roughly $135,000. I hope the affordability disconnect there is obvious.

What Goes Up

As stated, the numbers would lead us to conclude that homes today are relatively more expensive than they have been historically. It’s almost as if prices are suspended in midair or stuck in the netting.

It’s important for me to be very clear here. I am not making a prediction of where home prices are headed tomorrow. I simply don’t know that. This is not a forecast of the future but rather a description of the present. Homes are not as affordable today as they have been for much of history.

One would rightfully assume that a baseball bat hurled into the air would soon come crashing back to earth. But sometimes it doesn’t. Sometimes, other variables are at play. One would assume that the aggressive rise in mortgage rates over the last handful of years would’ve put downward pressure on home prices. Yet, it hasn’t.

Social Pressure

Perhaps the most important thing I will say today is this: You (or your children) should not feel pressured or rushed to buy a home.

There seems to be this social stigma with renting, and this social pressure to own a home ASAP. The pressure is palpable; you can feel it in the air.

I see the stress this causes for friends and family, and I want them to know it’s not only ok to rent, but in many cases, it is financially prudent.

Financial Acrobatics

This pressure, I am referencing, often leads people to “outside-the-box” thinking or what I like to call financial acrobatics.

People will do whatever they can to become homeowners. They will stretch and contort themselves financially to “make the numbers work.” The sort of behavior that real estate agents often encourage. (I’ll have to write another article on incentive-polluted advice.)

I’ve seen people move an hour or more away from work to get into a zip code they could afford. I’ve seen young families move back in with Mom and Dad to build up a down payment. I’ve seen Mom and Dad chip in for the down payment or help subsidize the mortgage. I’ve seen people pack up and move their families across the country to a more affordable state. I’ve seen new homeowners renting a room or multiple rooms out to help afford the mortgage.

None of this is inherently bad. Outside-the-box thinking has its place and should be an important part of a white-board-brainstorm session. BUT all these decisions have repercussions and consequences that go beyond finances. A commute, living with your in-laws, living with roommates, moving away from family, borrowing from family, all these things have the potential to create unintended stress.

Again, my advice, don’t succumb to that pressure. Financial prudence is about making the wise choice, and sometimes that choice is to rent.

Some More Advice

I’d like to conclude with some additional itemized advice.

First, let’s keep it simple: don’t buy what you can’t afford. As a wise savior once said, “For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?” A mortgage payment is just the start of a calculation. The taxes and maintenance need to be factored in, too. Water heaters and air conditioning units might not be at the top of your mind now, but they will be all that’s on your mind when they break.

Second, impatience is rarely rewarded in personal finance. If you feel rushed, if you feel pressured, then STOP. As much as it is possible and within your control, defer the decision and lean into patience. Urgent decisions should be rare. Yes, they come up and you hope for poise and a clear mind, but most decisions can and should be made with patience. Don’t rush the process.

Third, parents, don’t remove obstacles that are there to help your children grow and mature. Take heed to the signage at Yosemite that reads, “Don’t feed the wildlife.” Sometimes, helping is hurting when it hinders someone’s ability to survive and sustain themselves. There is a place to assist and support, but there is a fine line there. Sometimes, your kid’s impatience and pressure can lead to imprudent parenting. Be thoughtful about how you help your children financially.

Lastly, I am not an economist or a prognosticator. I don’t know where home prices go from here or wages – both factor into affordability. The financial industry loves to analogize economic cycles with baseball. In that vein, it took two innings to get Vlad’s bat down. I’m not sure what inning we are in for the real estate cycle, and I don’t know when those prices will normalize. This might surprise you, but I also don’t think it matters. If you act in financial prudence, buying in high markets, low markets, or normal markets will not make or break your financial success. If you are not operating in financial prudence, then all bets are off, and financial ruin may be lurking around the corner.

So, as home prices remain stuck in the net above home plate, we will simply revert back to controlling what we can control. We will focus on the decisions that are within our grasp. We won’t get distracted by trying to time markets or outsmart the proven techniques of prudent financial planning. We won’t spend all of our thought life “outside the box” but rather remain aligned with the goals and aspirations we’ve set forth.

And to that end, we work…