Thin Mints & Venmo

It’s that time of the year.

The season when you get those unexpected knocks on the door and you are greeted by little girls in green vests selling cookies. That’s right, ’tis the season for Thin Mints and Caramel deLites; it’s Girl Scout cookie season.

Our most recent cookie-sales-presentation was actually quite comedic. Those persuasive little salespeople wouldn’t take no for an answer when my wife said she had no cash. “We take Venmo,” said little Miss Sales lady. So, my wife caved and picked out three boxes. About 5 minutes post-transaction, we got another knock on the door. Turns out they gave us the wrong Venmo account and asked us to send another payment, which means we paid twice.

Three boxes of cookies and $36 later. The opposite of BOGO, we actually bought six and got three. At least it made for a good laugh, a memorable story, and some content for Thoughts On Money.

The Price is Right?

We have this saying in English – “you get what you pay for.” This is typically meant to say that when you are overly frugal, you shouldn’t be surprised by the lack of quality of the product or service. Yet, sometimes – like these Girl Scout cookies – you actually don’t get what you pay for.

The great thing about cookies is that they are a simple commodity to price. You and I both know that paying $36 for three boxes of cookies was not a good deal. Yet, if we tried to price out the value of a cookie company, it’d take a bit more work. if we were going to buy a cookie company, we’d want to know our return on investment – we would want to know the profits of said cookie company. Why? Because we invest money to make money and profits (the revenue above and beyond expenses) is how we make money.

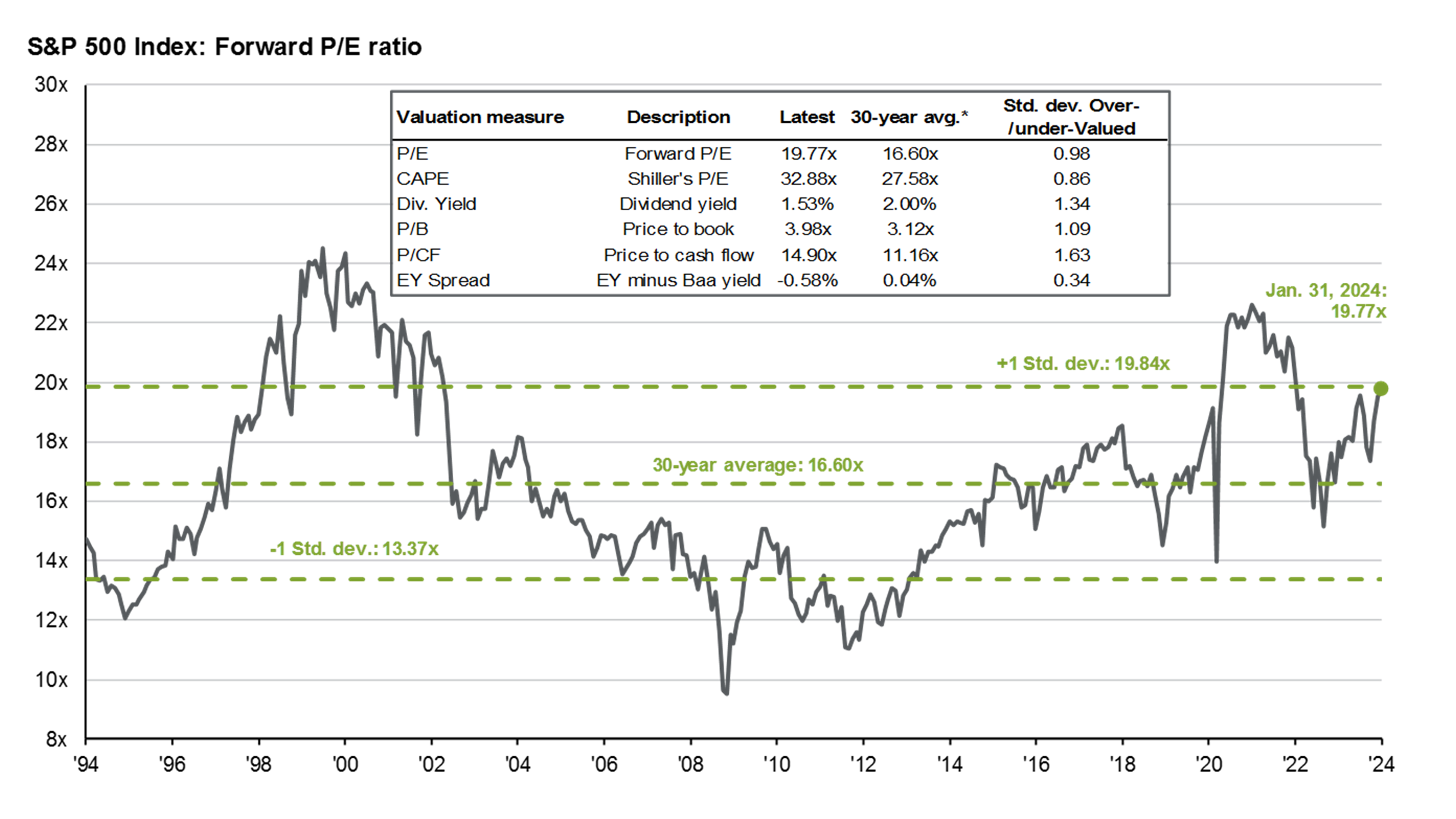

So… a very simple measurement for valuing a company is to measure the price you have to pay for that company relative to the profits it produces. We call this ratio the price-to-earnings ratio or a P/E Ratio for short. The nice thing about a ratio like this is that we can use this metric as a reference point to see how prices today compare to prices historically. This is another way of saying, “Are stock prices cheap or expensive right now?”

Here is a look at that ratio dating back 30 years: Source: JPM – February 26, 2024

Source: JPM – February 26, 2024

The conclusion here is simple – P/E ratios are currently above average, or, said another way, prices are relatively high right now. Maybe not like $36 Girl Scout cookies, but definitely on the high side of the 30-year average.

The Prognostication of Valuations

Now, what can or should we do with this information? Like with any financial data point we want to know, is this actionable? Can we initiate some strategy or tactic from this information alone?

Here is what history has taught us. Valuations, P/E ratios being a type of valuation metric, are not a reliable tool for timing the market. Sometimes high prices lead to high prices or said another way, sometimes expensive things get more expensive. Just knowing the market is expensive (overpriced) doesn’t give you insight into whether you should or shouldn’t own stocks today.

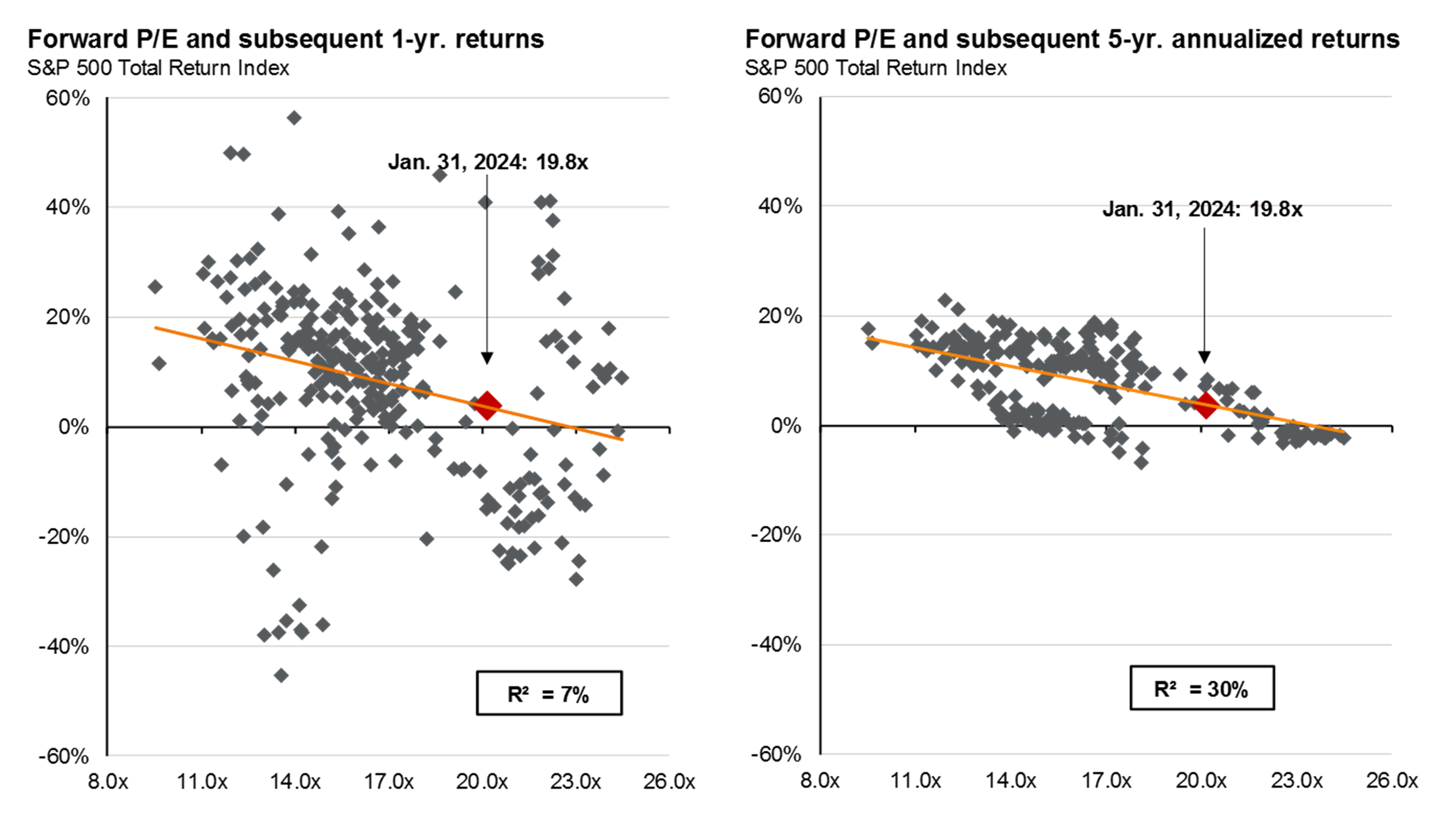

What valuations do help provide is what type of returns to expect over the next 5 to 10 years. Again, a high or low ratio tells you very little about the next 12 months but a lot about the next 60 months. The chart below helps to express this point. The graph on the left looks like chaos – no correlation, rhyme, or reason, just randomness. While the graph on the right shows a clear trend – when prices are high future returns (over the proceeding five years) are low and vice versa.

Source: JPM – February 26, 2024

Here’s the problem. Human beings are very shortsighted creatures. They tend to care a lot more about the here and now than the future. Also, humans despise the thought of missing out. We want what we think our neighbors have. So, the reliability and consistency of the chart on the right fade into irrelevance as our gambler DNA takes over.

Profits & Sentiment

It’s important to remember where exactly stock market returns come from. Let’s keep it simple and say that returns come from one of two sources. The price of a stock goes up because (1) the profits relative to that company have increased or (2) the sentiment surrounding that particular company has improved. Imagine our cookie company had the exact same profits this year as it did last year, but recently, Taylor Swift announced that she thinks our cookies are the best cookies she’s ever tasted. The value of our cookie company could increase even if profits don’t. Why? Because there would be a general buzz, excitement, and expectation that profits should improve based on this high-profile testimonial. This is sentiment, and this is how prices increase even while earnings (profits) stay the same. Taken to an extreme, this is how you get above-average P/E ratios.

As David Bahnsen cleverly states in a recent commentary, “Sentiment is the worst investment advisor ever created.”

Made from Concentrate

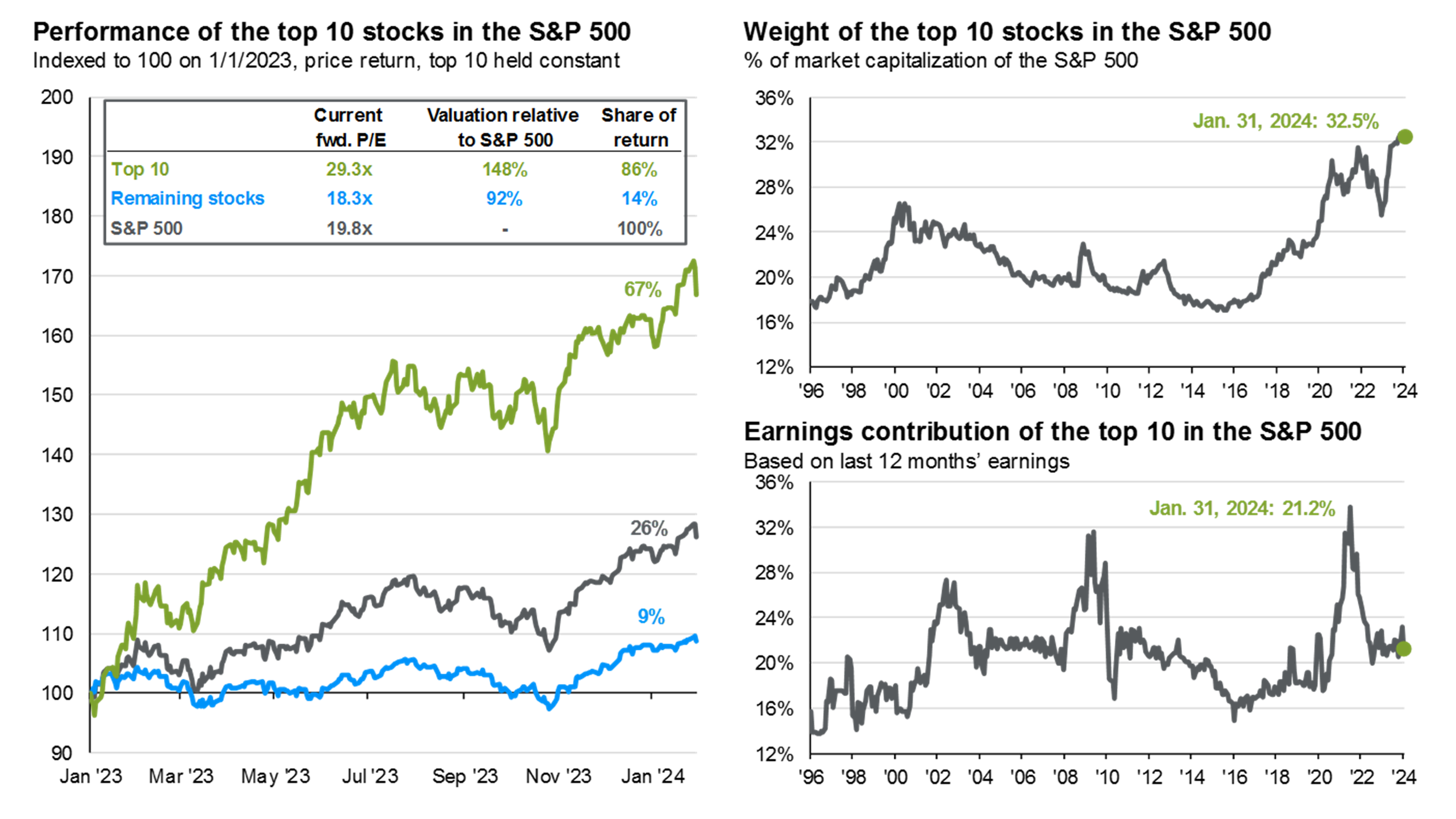

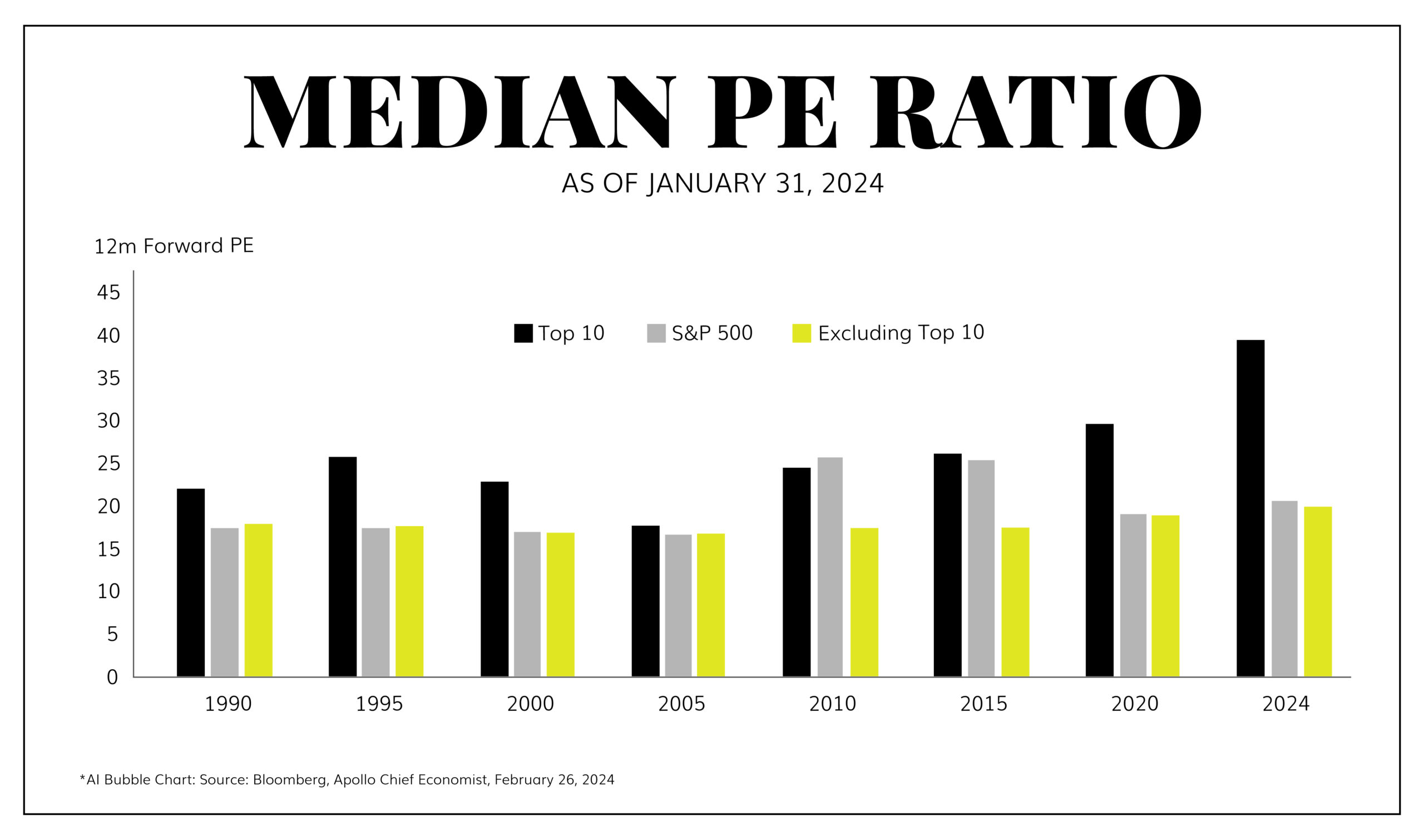

Now, let’s add a bit more to the story. Sometimes it doesn’t help to talk about a single cookie company. What’s happening to that company may be unique to their business or industry, so it’s not always representative of the “average” company. For this reason, we often talk about “the market” which means we are intending to talk about the average company amongst publicly traded stocks. Yet, recently “the average” has been much less representative of the average. The market (S&P 500) has become more concentrated and a small group of companies are now an overwhelming representation of the whole.

Source: JPM – February 26, 2024

Furthermore, these overrepresented companies are also more expensive than they’ve ever been. This is a scary reality, as expensive current prices are the enemy of future returns.

So, when you see headlines like “Buffett’s Berkshire Posts Record Cash Piles” (Bloomberg), and you come across quotes from the Oracle of Omaha like this one:

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced.”

Translation, the pond that Buffett has to fish in based on the size of his company is a pond made up of very large fish (companies). Right now, those “large fish” companies are expensive, and expensive prices lead to poor future returns. So, he [Buffett] is content to wait for better prices, hence the pile of cash.

What’s Your Strategy?

The real question is this – does your strategy depend on profits or sentiment? Sentiment can only take you so far, at some point gravity kicks in. Here at The Bahnsen Group we believe valuations matter, we believe they matter a lot. So, a strategy based on the diligent and prudent shopping of companies at a fair price with attractive future prospects is where we choose to live.

Perhaps Bitcoin will hit a new all-time high this week. Maybe the top ten companies in the market will continue to outpace the field. Who knows? What I do know is that people invest to make money, to create a return on investment. This depends on profits and paying a fair price for those profits. This will always be the foundation of my approach to investing. So, we overpaid for a few boxes of cookies; not much regret there, but I don’t plan to make the same mistake with my nest egg.

Because… sometimes you just don’t get what you pay for.