It was on Easter, 5 years ago, when I got that dreaded phone call – a friend reaching out to me to let me know that my brother had been in a horrible motorcycle accident. These are the type of memories you never forget. You remember the date, what you were doing, who you were with, and you absolutely remember the stomach-wrenching feeling that you had when you first heard the news.

Less than 30 minutes later, my wife and I found ourselves, along with our pastor, in the hospital waiting room anxiously waiting to speak with the doctor. In this moment, nothing else mattered to me, I just wanted to know if my brother was going to be ok. I had one simple question for the doctor – will he make it?

The doctor did not provide us any odds or probabilities just that he would be going into surgery and had suffered a lot of damage to both his body and his brain. I stayed the night on an undersized couch in his ICU room, hoping and praying that my brother would pull through. Over the next 30 days, that same scene played out over and over again.

In just under a month, my prayers were answered as he came out of his coma which soon led to a full recovery. That was a long and grueling month and it’s impossible to retell this story without reliving all those emotions.

Losses Loom Larger Than Gains

It’s unforgettable experiences like these that shape who we are and how we see the world. Human beings have an interesting feature hardwired into them, in which these types of painful memories tend to surface and reveal underlying angst to relive another such occasion.

The world of investing is no different. Many of us can recall the trauma of Black Monday in 1987, the Dot Com Crash of the 2000s, the Great Financial Crisis of ’08, and I am sure the Coronavirus of 2020 will be added to this list. Yet, what if I was to asked you about the markets in 2013? Do you remember the S&P returning 32% that year? We really don’t even need to go back that far, how about 2019? Do you recall the market being up 31% last year?

It’s wild how those painful market moments are branded into our memory, yet the euphoria of the “good years” tends to fade quickly and be forgotten easily.

Daniel Kahneman was awarded the Nobel Prize in 2002 for his work in the field of behavioral economics. One of Kahneman’s primary studies, along with Professor Amos Tversky, was on loss aversion. Kahneman and Tversky summarized that, “losses loom larger than gains.” Even further quantifying this fact, concluding that the psychological impact of a loss is twice as painful as the relative delight one would experience from an equivalent gain.

Like I said, painful moments/memories shape who we are as a person and as an investor. For an advisor like myself, there is a tremendous responsibility to be a good steward of client capital. This means that one must deeply understand each investor’s tolerance and the potential risks that are present in each investment. This is why I am such an advocate for dividend growth investing, as it solves two key objectives for investors (1) providing sustainable and growing income and (2) long term growth and preservation of capital. Much like my question to the doctor, many investors have one thing on their mind – will I make it? Will my nest egg be sufficient to last my lifetime?

Providing Sustainable & Growing Income

During our working years, we become very accustomed to the concept that if I work “X” number of hours that I will get a certain sized paycheck every week or two. We build a lifestyle and expectations around that paycheck showing up in our checking account every payday. The certainty of it provides comfort that the mortgage, utilities, and the summer vacations are all going to be covered.

Could you imagine how difficult it would be to transition from 40 years of this regular routine to then not really having a clear idea of where your next paycheck will come from? This is the dilemma that many retirees are faced with.

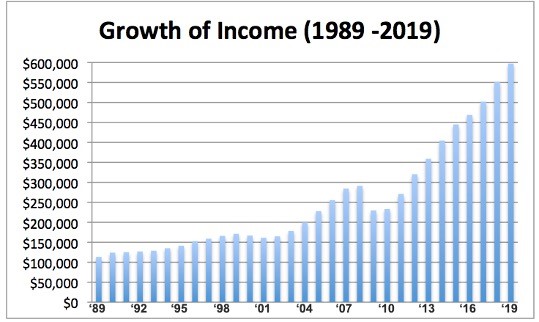

Amidst the recent market bottom of this COVID crisis, I shared this chart below to remind investors that through the best of times and the worst of times, dividends have not only always shown up (like a paycheck), but they’ve grown. I will share it again, here is what $100,000 in dividends (S&P 500) in 1988 looks like today and year over year:

Source: S&P

A few minor dips along the way, but a consistent, positive, payday for decades. Not to mention that the total income is now about six-times larger!

Long Term Growth

I am sure that you’d agree that most of us are short-sited. We tend to get caught up in current events and what’s happening in the here and now, that we aren’t always the best long-term planners. But, beyond solving the short-term problem of needing a paycheck to keep the lights on, we (investors) also have other aspirations. We like the idea of a growing balance in our investment account and what that means to the legacy we will pass down to our heirs or the impact it will have on the charities that are near and dear to our hearts or again, the peace of mind it provides as an emergency resource.

Some investors will prioritize the first objective – income – and forget about the importance of growing the base of their nest egg. A solution like an annuity or a CD may be deemed “conservative” and will scratch that “income” itch, but often sacrifices the opportunity for growth and sometimes even relinquishes the access to your capital.

Preservation of Capital

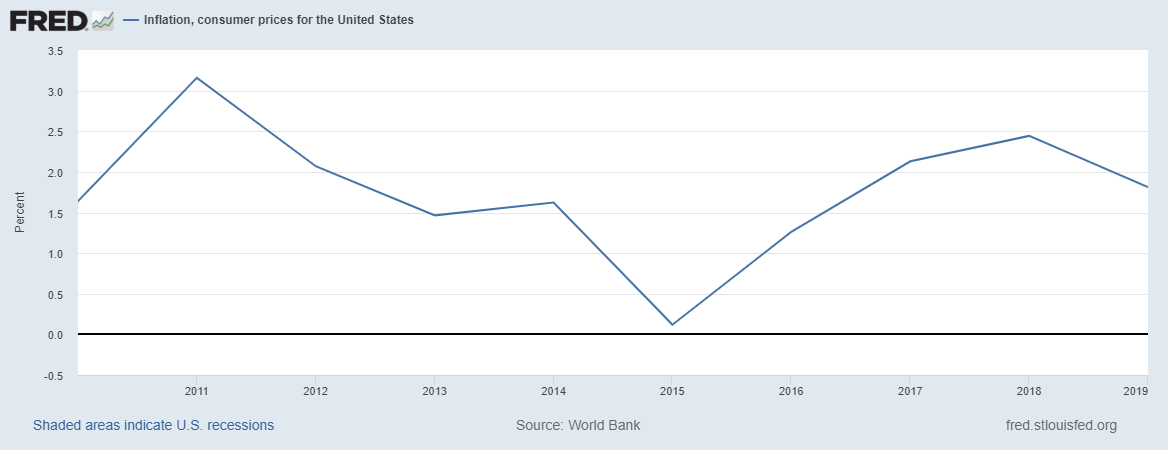

Here’s the reality, regardless of whether inflation makes the headlines or even if it is below its historical average, it still exists. Just to stay at par, your investment portfolio needs to outpace inflation. Here’s what inflation looks like over the last 10 years:

Source: FRED

Inflation has been bouncing around between 0% – 3% per year over the last decade. So, if the plan is to create a portfolio that produces 4% in income via dividends and interest, you’ll also want to target that the base minimally grows at inflation. Preserving capital isn’t about eliminating volatility and retaining the baseline number, it’s about growing that baseline number to preserve buying power.

Will I Make It?

I opened up today’s conversation with a memory that still carries a sting. I am sure you have a long list of these as well. Kahneman’s and Tversky’s research should not be too shocking, as we’ve lived the reality that losses do tend to hurt much more than gains feel good; it’s part of our nature. Have you suffered serious losses from COVID-19? Or did your planning insulate you from disastrous losses?

Yes, You Can Make It

For me, and the clients The Bahnsen Group cares for, a dividend growth strategy provides a great solution. Dividend growth solves for the cash flow and income needed to live the life we desire. It’s a strategy not built around “swinging for the fences” or “betting the farm,” but rather about making sure we make it. The focus is that our investments do what they were built to do – provide financial freedom through planning and prudence.

I hope you enjoyed our discussion today and as always, please feel free to email me at with any questions or comments.

Until next week… this is TOM signing off…