My Confession

When I walk across a crosswalk, I pull out my phone. When I watch a football game, I check my fantasy scores. When I play with my newborn, I watch the news. Even writing this article is hard to do without being tempted with notifications!

The advent of modern technology has allowed our culture to practically eliminate boredom. Our minds are filled with constant stimulation. We might think this is a good thing. It feels productive, after all.

However, today, I’m telling you that you need to be bored.

Arthur Brooks

About ten years ago, I attended an industry conference in San Diego. One of the nights was capped off by a keynote speech by a gentleman named Arthur Brooks. Brooks is a renowned author, social scientist, and Harvard professor known for his work on happiness.

By the end of the keynote, my notepad was filled top to bottom, front to back. The speech was simply fantastic. Recently on YouTube, I came across a short clip of him titled “You Need to be Bored. Here’s Why”.

The Science of Boredom

Brooks discusses the actual science behind boredom, but what primarily stood out to me was his quote (about boredom) … it “makes us think about things that might be kind of uncomfortable. When you think about nothing, while your mind wanders and thinks about… big questions of meaning in your life. What does my life mean? You go to kind of uncomfortable existential questions when you’re bored.” He then links our lack of boredom to the explosion of depression and anxiety in society today.

Brooks’ brief talk made me realize just how much effort I put into avoiding boredom.

In the Zone

I’m always amazed by the creativity of children. My five-year-old creates a pretend clothes shop. My four-year-old has a dress-up party. My two-year-old lines up cars and races them against each other.

It’s so fun watching their mind wander and get into “the zone”.

Perhaps there is a reason so many of our best ideas and most meaningful thoughts come in the shower… we aren’t distracted!

The Four Big Questions

A pastor once said that every human being must confront four basic questions in their life:

- How did life come to be in the first place?

- To what purpose is my life?

- How may I choose between right and wrong?

- What happens to me when I die?

Are we avoiding the meaningful questions because we’re afraid to sit in silence?

The Connection to Finance

This all connects with finance because our tendency to seek constant stimulation is causing us great financial harm, whether we know it or not.

Our culture today has a very hard time waiting. Delayed gratification is no longer the virtue it once was. Our tendency to seek constant dopamine hits means we often find ourselves making decisions of little importance, sidestepping the topics and questions we ought to be confronting. In a way, our activity can be a way of procrastinating.

Urgency vs. Importance

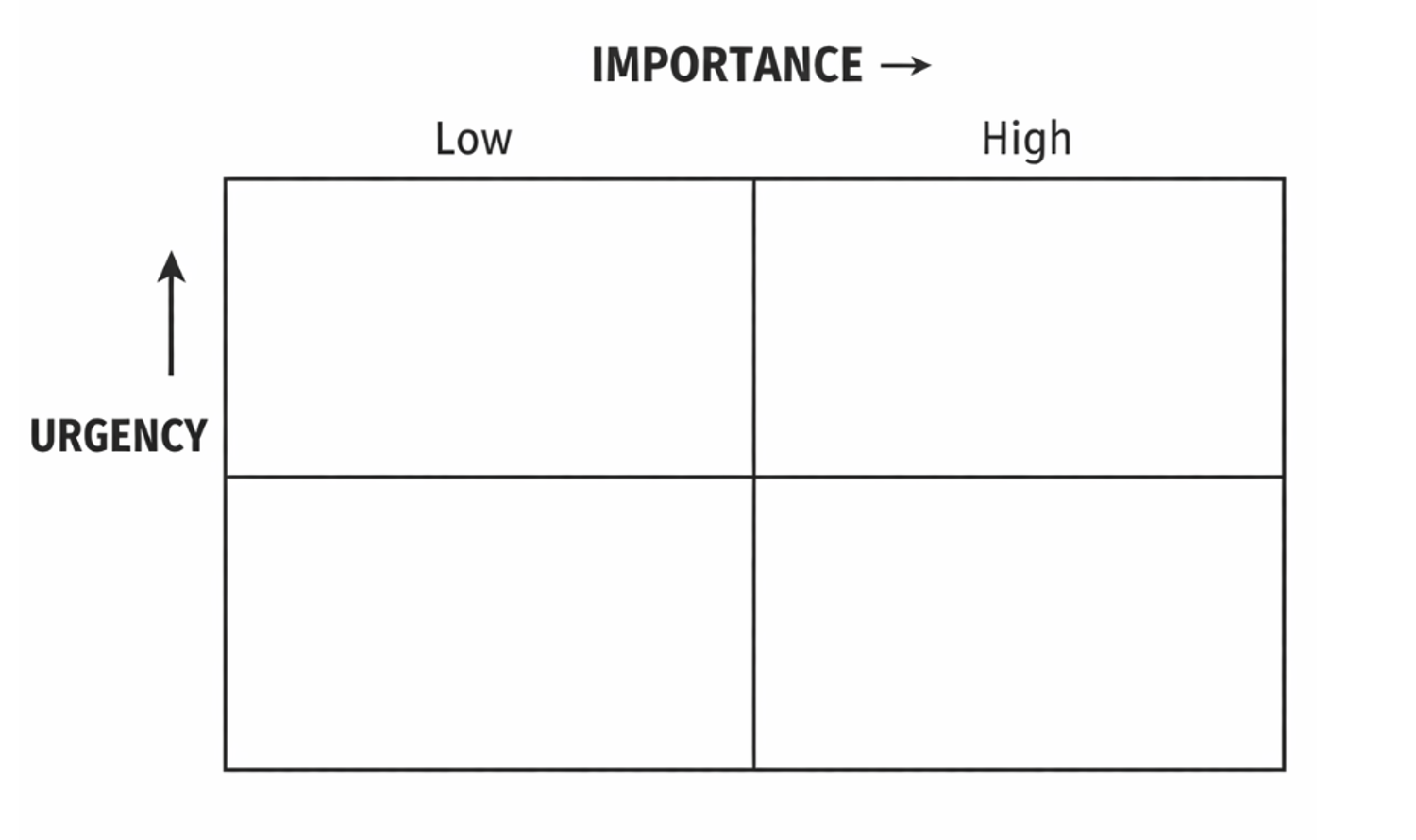

Look at the graphic below. Where do you spend most of your time?

Many of us spend much of our time in the High Urgency / Low Importance category.

Our Time Allocation

It is not uncommon for me to talk to folks who have zero background in finance who spend an hour day-trading every day. The allure tends to be the combination of quick riches and stimulation.

Let’s think about what our brain defaults to…

- We spend time reviewing our biggest gainers and losers for the day, but we fail to plan for transferring money to heirs.

- We agonize over which stock to buy, yet we fail to spend 30 minutes to obtain life insurance to protect our spouse and kids.

- We check our bank account every day, but we fail to think about the purpose of the money and why it’s important in the first place.

- We abandon our investment strategy because it is not “exciting” enough.

We solve micro problems that make us feel productive. We avoid macro decisions of real importance. We seek short-term pleasure while suppressing long-term meaning.

In the History Books

2020 was a year that shook culture, politics, and the financial markets. Market historians will forever study the lessons of 2020-2022, given the unprecedented health scare, followed by lockdowns, the sharpest market drop we have ever seen, followed by one of the quickest recoveries we have ever seen.

The excitement of “Work-From-Home” stocks (combined with subsidy checks) created a swath of investors who experienced huge gains in a very short period of time. Many of them obtained this by the constant stimulation and activity of day-trading. Steady compounding was no longer a valid investment philosophy, or so it was thought.

These “Work-From-Home” stocks were subsequently clobbered in 2021 and 2022. Even the S&P 500 was down more than 18% in 2022 alone.

In 2022, boring was beautiful.

The Math of “Excitement”

Our avoidance of the “boring” path often causes us to chase shiny objects. This can be alluring, but the math is eye-opening.

If I invest in hypothetical stock ABC and the stock loses 50%, followed by a subsequent gain of 50%, I am still down -25% from my initial investment… because of the way math works.

Warren Buffett’s quote is not just catchy, but true… “Time in the market beats timing the market.”

Pretend Progress?

I am not against phones, apps, or any other productivity-enhancing technology. I love that we can get Wi-Fi at 30,000 feet, and I love that I can stay connected to clients, family, and friends no matter where I’m at. I appreciate the fact that we’re able to get data and information in mere seconds to inform and educate.

I simply want to focus our time and attention on the things that deserve our attention. In the financial realm, this might be your long-overdue estate plan update. It might mean you need to discuss your legacy plans with your children. It may mean you need to take time to think about the purpose of your money, or put together a cohesive investment strategy.

So as we approach 2026, let’s spend more time focusing on the needle-moving issues. Constant stimulation is addicting and makes us feel like we’re moving the ball down the field, but the progress is often an illusion and leads to shallow thinking.

My goal at the next crosswalk is to stand. And wait. And be okay with boredom. My future self will thank me.