Dear Valued Clients and Friends –

I think this is a special Dividend Cafe, with a whole list of Public Policy/geopolitical events you won’t want to miss and quite a trip around the horn.

Dividend Cafe on Friday looked at the top-heaviness of the market and the ahistorical realities around it and did an interesting dive into the top of that pack (Nvidia). There was a lot about China, about bond yields, about sector allocation in the market, about where the economy is and what it means for the market, and so much more. The written version (my favorite) is here, the video is here, and the podcast is here.

Off we go…

|

Subscribe on |

Market Action

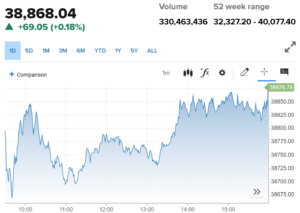

- The market opened down a bit and then came right back to flat, and then zigged and zagged for a while before leveling out up a tad and saying there the final two hours of trading.

- The Dow closed up +69 points (+0.18%), with the S&P 500 up +0.26% and the Nasdaq up +0.35%.

*CNBC, DJIA, June 10, 2024

- There has been so much obsession lately (especially from yours truly) about the top-heaviness of the market that it can be confusing when we are talking about the percentage of the S&P that the top 5 represent, or the top 3, or just one company, or the Mag-7, as I think I did all of the above just in Friday’s Dividend Cafe alone. Let’s add to the data dump by pointing out that the top ten stocks in the S&P 500 are now 35% of the index, far and away the highest we have seen in human history (it was 27% in 1999). To succinctly say it, 2% of the index is now 35% of its value. What could go wrong?

- Speaking of which, only half of the S&P 500 is even above its own 50-day moving average.

- The ten-year bond yield closed today at 4.46%, up four basis points on the day.

- While the 10-year yield rose today, the huge move from 4.70% in late April to 4.28% last week was the bond rally of the year, with a pretty sizable reversal on Friday (+15bps) after the unemployment report came out (with yields back up above 4.4%). France and Italy each saw their bond market sell off a great deal today in the aftermath of their elections, with their respective 10-years up to over ten basis points. The range of 4.25%-4.75% is not exactly thin, but that has been the range for quite a while now.

- Top-performing sector for the day: Utilities (+1.28%) and Energy (+0.71%).

- Bottom-performing sector for the day: Financials (-0.39%).

Top News Stories

- A heroic weekend for Israel with a daring rescue of four hostages previously held by Hamas (since the Oct. 7 atrocity).

- The other big news this weekend came from the European election results. The party of French President Emmanuel Macron was decimated, as were the Social Democrats of Germany’s Chancellor, Olaf Scholz. The conservative party in Spain beat the socialist party by over four percentage points. Overall, the European Union saw a big move to various right-wing parties in its major countries Sunday, a major move away from its far-left parties, and the more centrist party remains in the largest position of power. Immigration and Inflation were the primary issues for voters, according to exit polls.

Public Policy

- There have been a lot of questions about this “Texas Stock Exchange” chatter, and it does warrant a few comments. For those unfamiliar, a group called the TXSE announced last week plans to launch a national stock exchange in Dallas, with $120 million of backing from such companies as Blackrock and Citadel. Texas has a [deserved] reputation for being business-friendly; many companies have expressed dismay at some of the mandates and direction the Nasdaq has gone (with concerns the NYSE may follow), and the court system in Texas is considered more friendly. Other exchanges have surfaced over the years but failed to make much of a dent in the duopoly of the NYSE and Nasdaq. The SEC still has to give its approvals, and the upstart TXSE exchange is targeting 2026 to begin listing companies. I suspect it will be hard to recruit current companies to change, but dual listings are a real possibility, as is competition for new IPO listings. That, of course, assumes companies have even re-engaged the whole idea of going public by then (i.e., IPOs are dormant right now). It’s not a barnburner story, but it is worth watching, and we will watch it.

My dear friend, Rene Aninao of Corbu Research, provided this helpful little calendar of pending geopolitical and electoral events (some macro/news driven as well) that all sit just in the next 50 days or so.

- 12th June: USA, FOMC forecasts | CPI print.

- 12th June: Russia, Putin state visit to Hanoi and Pyongyang.

- 13th June: G7 Apulia Summit in Italy.

- 15th June: Ukraine Peace Conference in Switzerland.

- 27th June: USA, first Biden vs Trump debate.

- 28th June: Iran, presidential “elections.”

- 3rd July: SCO [Shanghai Cooperation Organisation] Astana Summit in Kazakhstan | [Xi Jinping] XJP-Putin bilateral meeting.

- 9th July: NATO Washington Summit [75th anniversary].

- 11th July: USA, sentencing in Trump NY criminal case | CPI print.

- 12th July: G20 Rio Summit in Brazil.

- 15th July: USA, Republican National Convention [RNC] in Milwaukee, WI.

- 15th July: Venezuela, CITGO bankruptcy auction in Houston, TX.

- 26th July: France, Paris Olympics opening ceremony

- 28th July: Venezuela, presidential “elections” [to be soon canceled scheduled].

- 31st July: USA, FOMC presser | ECI print.

Economic Front

- The job numbers for May were quite interesting, with the headline numbers showing 272,000 new jobs created, almost 100k over expectations, yet the unemployment rate ticked up to 4%.

- The labor participation rate ticked down to 62.5% (from 62.7% previously).

- Average hourly earnings were up 0.4% on the month.

- Private sector gains were the lion’s share of the 272k jobs created (229k).

- TSA checkpoint headcount (a pretty good way to know real travel data since the headcount of commercial travelers really cannot be any less or any more than those who have the great pleasure of going through TSA security) is meaningfully above pre-COVID 2019 levels now. Seeing the charts showing where things were in 2020 depresses me. Seeing the still low figures of 2021 and even 2022 angers me (I assure you I did my part in all three of those years). But seeing where travel is now in 2024 amuses me because I remember all the people who said in 2020 and 2021, “People are not going to travel the way they used to,” – and “Air travel is never going to be the same.” And much like air travel post-9/11, these predictions deserve to be in the same place as those who said, “New York City is dead” and “a robo-advisor will replace the need for financial advice.” Some predictions are better comedic fodder than they are commentaries on the reality of human nature.

Housing & Mortgage

- We have $900 billion of commercial real estate loans set to mature in the remainder of 2024, though a better way to say that is “to be re-financed.” The number is over $500 billion next year and the year after, as well. Multi-family is about 28% of that amount this year and 36% of it next year. The office is the second biggest component. The amount in industrial, retail, and hospitality is all reasonably small. I expect a lot of “amend and extend” in office and some tighter cash flows coming from multiple families.

Federal Reserve

- There was no chance the Fed was going to cut rates at the July FOMC meeting before the jobs number on Friday, so when media outlets say, “Strong jobs report closes door on July rate cut,” they are sort of saying, “the Lakers will not play for an NBA championship in 2024.” I mean, yes, it is true. But it isn’t new news. It is repeating old news and making it sound like it is new news.

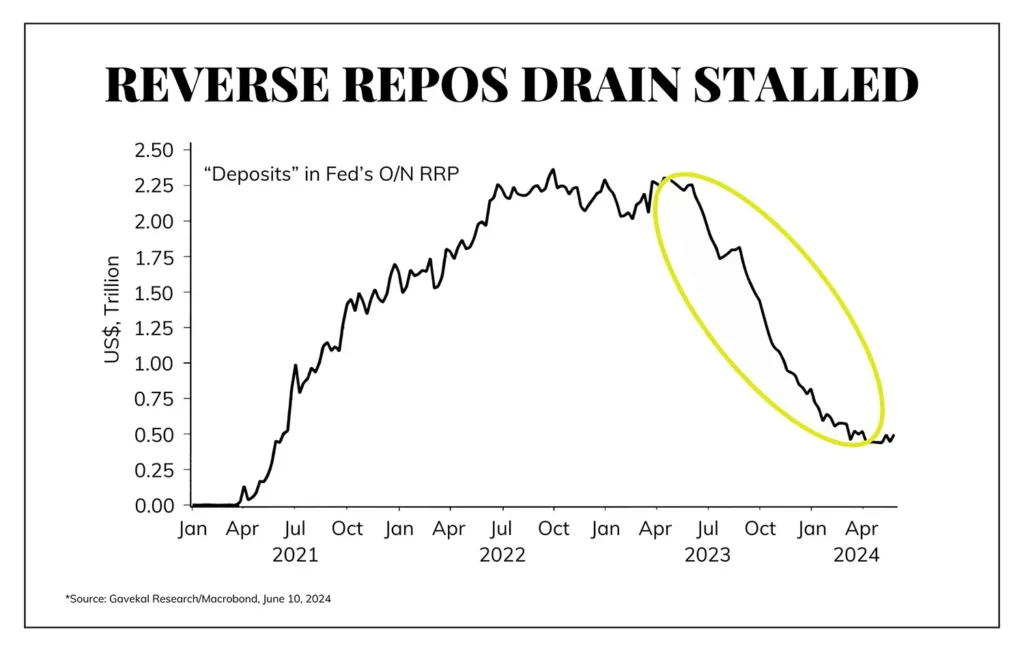

- The money flowing out of reverse repos has flown into assets. When we think about the quantity theory equation, velocity refers to money turning over for goods and services. But assets are now included in velocity measurement. The chart below explains both why (a) Velocity would have risen the last year, (b) It wouldn’t matter a lot (assets vs. goods/services), and (c) That party appears to be over. There is now less than $500 billion left in reverse repos.

Oil and Energy

- WTI Crude closed at $77.91, up over +3% today.

- Upstream energy stocks were hit last week and crude oil was down -2% but midstream was actually just fine, with MLP’s up nearly +1% on the week.

- One thing I picked up in this weekend’s research report from Howard Hinds – private midstream companies are trading at 7-9x in private equity deals, meaning that public midstream companies can do acquisitions that are immediately accretive. The key is a strong balance sheet and a debt ratio that has room.

Against Doomsdayism

- I am using the Against Doomsdayism section to walk through Maarten Boudry’s Seven Laws of Pessimism. We have thus far covered the immediate visibility of bad news versus the gradualism of good news (1) and then the velocity of bad news – how quickly it now spreads (2). But today, #3: The Law of Rubbernecking: The more gruesome the news, the more we lap it up. There is a sort of human nature to this, and it is not necessarily sadistic but sensationalistic, and it certainly speaks to our view of risk/reward. We are drawn to “dread risk” based on the large numbers involved with bad events and more bored with success based on the fact that it generally happens to individuals in individual cases (a whole lot of people can have a bad thing happen to them all at once; it is harder to identify really good things that happen with the same sensational flair to a large number at once).

Ask TBG

| “Decades ago, there were many more public corporations. I believe we are down to 4,000 now from as many as 8,000 at one time. I would welcome TBG’s thoughts on not only why but how we got here and what the ramifications of this are for investors?” ~ Fred H. |

| There really is no question or debate at all about how we got here – private markets have grown leaps and bounds over the years in their ability to provide monetization and access to capital without a need to tap public markets. And public markets are less attractive where capital and liquidity are not needed because they are expensive, they are regulated to the hilt, and in many cases, they are downright obnoxious.

The issue is far more relevant for those who believe there is free money to be had at IPOs, where time and time and time and time again over the last decade, the “biggest and best companies” were able to continue doing more and more private rounds of fundraising without needing public markets, leaving over-valued unattractive pricing for the suckers who bought the IPO. It means very little to investors in public markets but a lot more to those in private markets who have seen the rules of engagement change, the mechanisms of monetization, and the timeline. |

Have a wonderful night, and reach out with questions!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.