Dear Valued Clients and Friends,

We are in a moment of “volatile Sundays” in the financial services industry. This is when market actors, policymakers, movers, and shakers have big news to announce on a Sunday in an effort to “beat markets opening”, or as Ben Bernanke once joked that his memoir would be called, “before Asia opens.”

I lived through it in spades in 2008 – Fannie and Freddie’s conservatorship, Lehman’s bankruptcy, Wachovia into the arms of Wells Fargo, Morgan Stanley’s deal with Mitsubishi, and the government’s extended backstop of Citi – all on different Sunday afternoon/evenings in either September, October, or November of 2008. I can tell you where I was, what I was doing, the exact date, the exact time, and all the things. Good times.

The last couple of Sundays have been a little adventurous, but for different reasons and with different catalysts. In a different environment, the news that UBS had done a “rescue acquisition” of Credit Suisse would have been the biggest news story of the entire year. I want to unpack it this week and share some thoughts on where it may be relevant for you, regular U.S. investors presumably with no direct exposure to either UBS or Credit Suisse, who normally just prefer to use your Sundays for church, family, rest, and sports.

Let’s jump into the Dividend Cafe!

|

Subscribe on |

Sunday Part 1

Two Sundays ago, March 12, I sat down at a coffee shop very early to work for four or five hours on a new book I am writing. I didn’t get a single word typed. Three days earlier, a run had begun on the deposits of Silicon Valley Bank, and 24 hours after that, the second biggest (by deposit level) bank failure in U.S. history was complete. News alert after news alert after tweeting after op-ed after rumor after text after DM after email after headline bleeped, blopped, alerted, and surfaced, and over the next 5-6 hours, I was immersed in the happenings of this bank failure. By 3:00 pm that day, just in time for Asian markets to open, U.S. futures to open, and for me to head to the Lakers/Knicks game with my son, the FDIC made an earth-shattering announcement: The FDIC/Fed/Treasury triumvirate would be backstopping depositors even above the $250,000 level of insurance. Pre-market futures rallied (it wouldn’t hold the next day), outrage ensued, and questions popped up everywhere about what it all meant and what the causes of it might be.

Oh, and the Lakers lost to the Knicks …

Sunday Part 2

I left my house on Sunday, March 19, at 6:30 am, having just returned from a couple of days out of the office to watch college basketball with friends in Las Vegas. One day means a thousand emails for me, and though I had stayed on top of the inbox, I had over 100 emails to deal with still, plus ample reading and writing to get done. But I had a volleyball tournament to take my daughter to in Irvine, and since she would only be playing 2-3x over a nine-hour stretch, I figured I had ample time to sit off to the side reading, writing, and working. Ipad, laptop, phone – like a portable office at a table in a massive gym – with 1,000 volleyball players coming and going on the 28-court megaplex. Ay yi yi.

The beeps, tweets, alerts, pop-ups, and all the things began shortly thereafter, and I do not mean because of my daughter’s vicious serve. Rumors began a day or two earlier that UBS was offering to take over Credit Suisse for roughly $2 per share (a $1 billion valuation). It had been $9/share one day earlier, and in 2007 it had achieved an $88 billion valuation. We’re going to unpack all of this in a moment, but my point is: a UBS takeover of one of the most famous and prominent banks in the world (Credit Suisse) would be a massive story in financial markets.

As this up-and-down drama was playing out, more speculation was hitting the wire on a potential deal for First Republic Bank here in the states (as of press time, nothing has been forthcoming, but reports continue to say high-level efforts are underway). Additionally, it was announced that one of the failed banks of the week earlier, Signature Bank, was landing in the loving arms of New York Community Bank. And reports were hitting at a ferocious pace about potential action with some of the assets of Silicon Valley Bank (private equity deals, etc.). As of press time, nothing has been forthcoming there, either.

Anyways, there was a lot of drama and a lot of noise (that had more to do with the 28 matches of volleyball taking place around me), and I feel pretty confident saying that I was the only one in this sports complex working on three electronic devices at once about the inner-workings of the global financial system.

Sunday Bloody Sunday

For all the things that happened and all the things that didn’t happen last Sunday but generated buzz and chatter nonetheless, nothing will stick out more for me than hearing the voice of Colm Kelleher in my AirPods listening to Bloomberg on my iPad as the now chairman of UBS announced the acquisition of Credit Suisse for $3.2 billion. Kelleher was the CFO of Morgan Stanley in the fall of 2008 and was widely regarded as the orchestrator of the Mitsubishi deal that saved the firm, and he is one of the most compelling people you will ever be around. Now, chairman of one of the most prominent banks in the world (UBS, where I also used to work), it added to the deja vu for me (for obvious reasons).

(Incidentally, I first fell in love with San Pietro at 54th & Madison because it was the place Kelleher was dining on the Sunday night when Mitsubishi called his cell phone to say they were interested in taking an equity stake in Morgan Stanley).

But I digress.

This UBS deal to acquire Credit Suisse is a big, big deal, not merely because the equity holders are receiving a value 96% or so less than the all-time high of the stock. Let the unpacking ensue.

Credit Suisse isn’t rescued, its counterparties and creditors are

The great PR fiasco of TARP fifteen years ago was and is that it was always presented as a “Wall Street bailout” with no real ability to push back or nuance that narrative. And in fairness, even though Citi’s stock price remains down over -90% to this day, the equity wasn’t “wiped away” entirely (as it was for Lehman Brothers), and there were different protocols followed than standard bankruptcy and creditor provisions that produce irreparable optics.

But, I assure you, no one gave a rat’s [you-know-what] about the stockholders of these firms. The purpose of standing up those financial firms with holes the size of Nevada in their capital position was purely and entirely about their creditors and, to some degree, their depositors. This was true then, and it was true for Credit Suisse last week. Is that because those bondholders, in particular, warranted some sympathetic approach? Not really. It is because our world’s financial system revolves around credit, and if they blew up the financial system over credit impairment, not only would the systemic risk and contagion have been apocalyptic, but the ability to maintain functional credit markets into the future would have been irreparably broken. Put differently, if they could make creditors face existential pain without taking away the ability to borrow and lend money in the future, I suspect they would. But they can’t. At least not really. And so, to maintain the ongoing functionality of credit in the global financial ecosystem, a creditor-friendly system has been the unspoken law of the jungle for a long time.

It gets called a “bailout,” and that is fine – it was all awful, and it was all riddled with poor decisions and poor execution – but the nuances and details and actual reality of it have never been really expressed well, and the public relations of it were necessarily atrocious.

But the PR and the politics do not change the substance. Credit Suisse’s $531 billion balance sheet (roughly twice the size of Lehman Brothers) with $486 billion of liabilities is the story of this deal. $245 billion of their liabilities were customer deposits. $160 billion is long-term debt. This is what the Swiss would call “too big to fail.”

And if that was too big to fail, how do you think the new UBS is positioned, with their $1 trillion balance sheet and $486 billion of customer deposits, and $193 billion of debt (all of that is PRE-acquisition)????

The $100 billion credit line from the Swiss National bank is to ensure proper liquidity as UBS navigates through was is undoubtedly a huge issue of liquidity and severe write-downs still to come. Will they end up needing to extend more? Perhaps not. I hope not. They hope not. We should all hope not. But would they if it was deemed necessary? The answer is – ummmm – yes.

Some negatives

So capital markets responded favorably this week as a reasonably private-sector solution surfaced, albeit one with lots of central bank winks and regulatory nods. Hundreds of billions of dollars of capital became the responsibility of a more solvent institution with greater liquidity and, of course, a central bank backstop to boot.

But should we be entirely sanguine about this? A couple of observations are in order.

My friend, Louie Gave of Gavekal Research, a stellar economist and truly original thinker (I assure you, there are few of those on Wall Street), has been fond of pointing out over the years that the west is increasingly turning against its most special and unique and valuable contributions to global economics – private property, and the rule of law.

Should this transaction have happened? I am sure it should have. Should they have suspended a shareholder vote to get it done? Well, I won’t answer that here – but I will emphatically say this: There’s no free lunch. If the upside was a closed transaction that needed to close, the downside is some erosion of the rule of law, and that comes with a cost.

Should the “AT1 Capital” – convertible contingent bonds (alternative tier one) – have been wiped out when the common equity was not? Again, that is a little complicated, and it is a pretty small impact in the grand scheme of things systemically (the largest holder, Pimco, only had $750 million of exposure), but it was a pretty aggressive and subjective and controversial circumvention of the basic laws of capital structure. Was it for the systemic greater good? I imagine it was. Does it come at a cost? I have absolutely no doubt.

The Saudis put in $1.5 billion of equity capital a few months ago for a 10% position. It is now worth $0. They took a risk in pursuit of a reward, and it backfired badly. There is no other outcome that could be considered here than their loss of invested capital. But will this have repercussions in geopolitics as the west and its relationship with Saudi Arabia continues to be tested? Sure. Will other sovereign funds think twice next time a behemoth is looking to sell equity on the cheap (that it may not be as cheap as appears)? I have absolutely no doubt. (Anecdotally, some countries that put equity in various Wall Street firms in 2007 and 2008 are still underwater).

The ramifications of the deal are short-term good, it would seem, but carry other mid-term consequences and certainly some long-term effects that need to be better considered by investors.

Stop picking on the Fed

I will take a break from my regular scheduled programming of pointing out concerns I have with U.S. Fed policy and broaden the critique to the whole world. Central banks around the world have facilitated a boom-bust cycle that has led to greater financial system instability, and greater financial system instability has led to marginal erosion of the rule of law and regard for private property.

Again, I am not saying only the Fed is doing this. I would point to the Bank of Japan, the European Central Bank, and the Bank of England, as well. This is a global monetary reality – boom/bust forever – and we have no political or democratic tolerance for what it means, so we have to – have to! – pick away at our own legal and capital norms in the process.

Conclusion

Is it necessary when the house is on fire? Maybe it is.

But maybe, just maybe, someday, someone will start talking about what causes these houses to light up, to begin with.

And then maybe, just maybe, we won’t face any more pop-ups on our weekly day of rest.

Chart of the Week

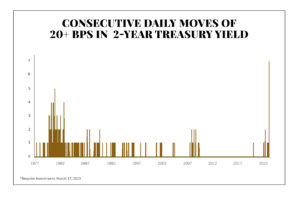

People complain about equity market volatility, where returns have averaged 9-11% for a hundred years. Look at the recent bond market volatility. What are people taking on this volatility for? 4-5% currently and 2-3% for most of the last 25 years.

Quote of the Week

“No matter how much money you have, if you’re still worried, you aren’t wealthy.”

~ Nick Murray

* * *

I do not know what this Sunday holds in the financial news cycle. I am prepared for all comers. So is your portfolio. To that end, we work, sometimes more than we should.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet

References

[1] First Republic Bank, First Citizens Bank, New York Community Bankcorp, Signature Bank, Credit Suisse, UBS