Dear Valued Clients and Friends,

I want to start this weekend’s Dividend Cafe by wishing all of you dads a very Happy Father’s Day. I am, of course, a dad myself, with three kids between the ages of 10 and 15 at home. But I also had a father who impacted my life tremendously. He passed away 25 years ago at the age of 47 (heart condition), but in the 20 years I had with him on planet earth he left me a legacy that has impacted every aspect of my being to this day – influencing my views of the world, my approach to my work, and my personal faith and values system. I am sad that the U.S. Open golf tournament is not on this weekend. And I am sad that the NBA Finals are not underway. And I am sad that there remains a portion of the economy that has not yet returned to normal (it’s all happening incrementally). But all of those things are coming back – I promise you that – and it will be spectacular when they do. And while my dad is not coming back, I am grateful for the memories I have, and most importantly, the legacy he left. He was an incredibly proficient man, productive, studious, brilliant, with a work ethic you would not believe. I pray my kids can one day think of me the way I think of my father, and I pray I will live out the gratitude I have for his legacy, by honoring him and his memory.

Whether it is honoring your own father, or being honored by your own kids as their dad, Happy Father’s Day … We have so much to be grateful for – as dads, and as kids.

This week’s Dividend Cafe is a special read – covering all these topics:

- There is a solution of the problem of always having a reason to sell, and always having a reason to buy: It is – always having a plan …

- The nation’s debt is talked about as much any topic in the political/economic sphere but rarely talked about with any real practical sense of what the eventual possible outcomes actually look like. Today we provide five crystalized options for what eventually comes of America’s national debt. This is crucially important for people who care about their kids and grandkids, and people who don’t.

- The “financialization” of the American economy is happening right before our eyes, and it is a major consequence of the monetary regime in which we live. It needs to be understood – the good, bad, and ugly.

- Why inflationary efforts are creating more deflation – an economic primer you will love, and your college professors never gave (or got themselves)

- Proof that dividend growth requires active management, and that passively trying to get it will ensure you lose it

- Small-cap investing is very promising coming out of recessions, and if you think dividend growth needs active management, you should see the data in small-cap!

- The economy is picking back up – but wow does it have a lot of work to do. Check out the updated data from air travel, restaurant reservations, retail shopping, and more. And then, check out what really, really matters – business investment. Some investors are focusing on mall traffic in Q2 of 2020. We are focusing on industrial production in Q1 of 2021.

- The Chart of the Week tells you why the market keeps embarrassing not just bears, but those who don’t understand how markets work

- And in Politics & Money, look at worst news imaginable for President Trump, and the best news imaginable … all at once.

It’s an action-packed Dividend Cafe, so jump on in … There is no U.S. Open to watch, so you really have no excuse.

A refresher on one of the most basic of basics

There is always a reason to be selling, and there is always a reason to be buying. For some, when stocks drop it means things are bad and they want out! For others, when stocks drop it means things are cheap and they want more! And of course, for some, when stocks go up it means they are rich and it is time to take profits and sell. And for others, stocks going up means momentum and more gains ahead. One’s view of what to do when asset prices appreciate or depreciate is almost always a reflection of their personality, their mood, their psychological make-up and profile – and not what stock prices will do next.

How to account for these various behavioral options when stocks go up or down? Well, a pretty good place to start is to have a plan in place, already. A strategic asset allocation that allows for an appropriate blend of asset classes, and a comfortable and suitable allocation to risk assets like stocks, ought to capture the various scenarios for “it could go down further” or “it could go up further” within it. Now, a shock to the market (like the one we had in March) may very well cause you to re-think your real tolerance for equity volatility versus your perceived tolerance (it always reveals a lot to me about the delta between what clients believed their tolerance to be and what it proved to be). But asset allocation is the process of absorbing into your weightings the behavioral defenses against trying to chase falling markets, or panic, or risk-up at the wrong time, etc. In all thy getting, get this.

Debt counseling for a nation

There are few lines more unhelpful than, “our long-term debt trajectory is unsustainable.” It being an unhelpful line certainly doesn’t make it untrue, but I am focused on the former right now. Various expressions of dismay over U.S. indebtedness generally lack specificity – even if they don’t lack verity.

“Our debt is going to blow up in our face”

“The U.S. debt level will sink the U.S. economy”

“One day the rubber will meet the road on all this borrowing”

“We are leaving our kids a mess they won’t be able to afford”

You get the idea. And none of those expressions are wrong, and all of them come from a place of normalcy – of just pure exasperation at the idea of owing ~$25 trillion while adding $1-2 trillion per year to that debt (more in this COVID year). It feels unsustainable because it is unsustainable. And yet, how it feels does not tell us what exactly it means. The insanity of present debt levels has to mean something for the future, and the lack of understanding of what that means is the real problem. Some description of the tangible problems (or various options of tangible problems) is necessary – otherwise, the gravity of the issue is lost in sheer nebulousness.

Breaking down the debt options

The most important thing to understand is what my friend, John Mauldin, has been saying for years: There has to be some pain. The present accumulation of debt will not end with no one feeling any pain at all. There are only bad options. But from there, we have to consider the fact that there are a whole host of ways this can go. I will play the role of cheerful messenger in breaking out what some possible outcomes are (definitely not in any kind of order):

(1) We grow our way out of it – productivity, profits, higher revenues – creating a more benign ending. This has been my hope for many years. We have mostly gone away from growth-oriented solutions, at the same time the debt levels have risen to a point that makes this all the less feasible.

(2) We cut our way out of it – austerity; entitlement reform; budget discipline; etc. This option is probably the most laughable of all of them, given not just the impossibility of politician cooperation, but the total lack of appetite for it from the people themselves.

(3) We pursue debt forgiveness/cancellation. One of the worst options. Pretty much not possible if we want to ever borrow money on the world stage again, and have our currency be the world’s reserve.

(4) We go full-blown Japan, with our Fed essentially buying the debt. There are varying degrees of what this could look like, basically creating sub-options under the Japanification option … Suffice it to say, this is where I believe we are headed. But enabling ongoing borrowing is different than monetizing legacy debt. They could do one, or both, but I do not believe they will do neither.

(5) We go to a complete Modern Monetary Theory, essentially giving the monetary powers to the fiscal authorities to simply create the money in their spending itself (no debt to pay for spending; they just spent with new money created by the spending itself). Various central bank machinations (Japanification, option #3) are far more politically and economically feasible in our country than the radicalism of MMT, but many would argue that these are differences of degree, not kind.

The “bad” comes not from some alleged moment where all of a sudden our ATM cards don’t work and there are wastelands of space filled with alienated people like in a science-fiction movie because of a debt event. Rather, the “bad” comes either from inflation (they haven’t been successful in using this tool), or deflation (the suppression of growth that comes from Japanification). A lack of access to debt capital would lead to a decline in government services, which is why options 4 and 5 are more likely than option 3. As for options 1 and 2, there simply is no appetite from the people for what it would take to see that happen.

A new word to learn

I am pretty sure I stole the word “Japanification” from my friend, John Mauldin, but I know I did not steal the term “financialization” from him, even though he also uses it a lot. “Financialization” is a pretty broad term to describe the dynamic that a heavy Fed brings to the economy. Activity is done not in the spirit of productive economic behavior, but in the spirit of financial deck-chair movement. With cheap money and heavy liquidity (ZIRP and QE), the true engines of markets are not themselves. Companies that maybe shouldn’t survive, do. Companies that maybe should get started, don’t. Decisions for survival and thriving become more around financial management than operational performance. That is financialization.

But this has a “bad” in it for all of us, just like the suppressed growth I describe above of “Japanification.” In a world of Fed assistance, companies can buy their competition rather than beat their competition (excess liquidity, low cost of capital, etc.). It is futile to try and identify this with one company or one acquisition. And not all M&A is bad, and in fact, much of the M&A universe is synergistic and productive. But what I mean is very simple in a macro sense: The mentality of financialization is in something different than productive, operative performance.

More Fed intervention = more financialization.

Therefore, less Fed intervention = more productive, operative performance.

We all win with the latter. Only shareholders win with the former.

Deflation/Inflation touch of the week

We know that money supply growth is in a period of acceleration. Unless money is used to pay off loans (hint: it won’t be), that money supply is not eliminated. So why is that not inflationary in and of itself? Because unless demand for money increases – a demand that organically comes from greater demand for goods and services – that money may as well have been used to pay down loans, because it sits on bank shelves all the same. Credit cannot get extended just because there is more money stock; there must be a demand that joins the supply for that velocity to kick in, and for inflationary forces to become present. Instead, what has happened (and we believe will continue to happen) – is that asset prices are inflated, but credit growth is constricted lacking organic demand, stuck in a cycle of deflationary forces.

I lack the arrogance to say “the Fed cannot put money into the real economy with the tools at its disposal – it simply cannot be done.” I certainly can say they have not been able to do it in the precedents we have. Other countries have not proven me wrong – Japan, Europe, UK, etc. So maybe this time it’s different – maybe this time the Main Street Lending Facility creates a “real economy” dynamic, not just a financialization effect. But the burden of proof is high.

You don’t say??

I read a report this week (The GIC Weekly, Morgan Stanley Investment Committee) that questioned if the Fed has “abandoned its focus on financial market stability and embraced a willingness to tolerate asset bubbles in the service of full employment goals?” I really don’t even know how to respond to this. It is not my understanding that the Fed even denies their willingness to tolerate asset bubbles, but regardless, the answer is so clearly yes to this question, that I am shocked a major Wall Street firm economist felt the need to ponder it. There is certainly room for disagreement as to whether or not the Fed is right or wrong about this. But that the Fed operationally views the potential of an asset bubble as a small price to pay in their quest for employment and economic improvement, is clearly verified by the testimony of history and the witness of policy actions.

Actively managing for dividend sustainability

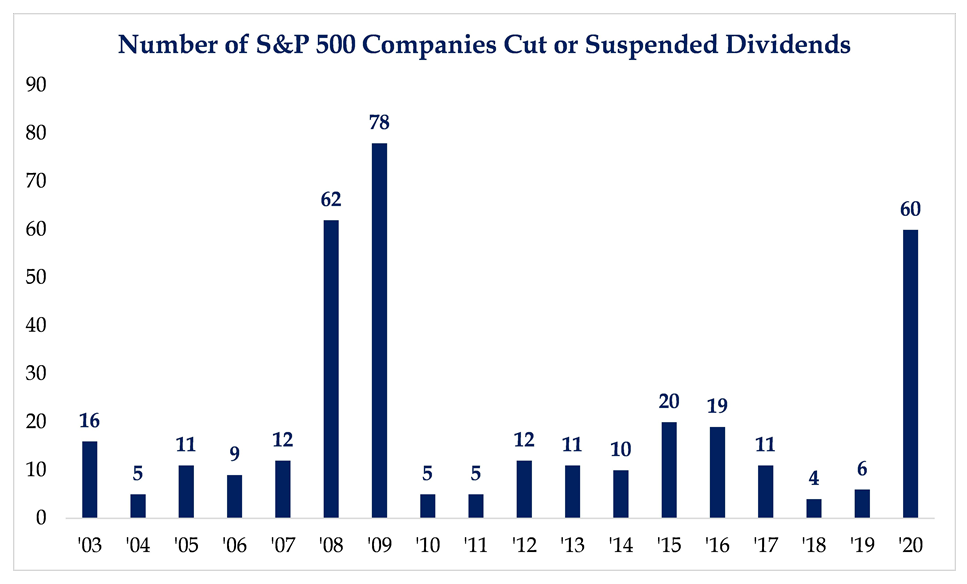

The imperative for those who believe in the investment merits of dividend growth to manage for dividend sustainability, to be proactive and active, to have a process for avoidance of potential dividend cutters, is well-illustrated by this chart. Companies cutting or suspending their dividend in the COVID era have now reached sixty (from the S&P 500). Finding the dividend growers and avoiding the dividend cutters takes research, analysis, and effort.

* Strategas Research, Daily Macro Brief, June 16, 2020

Something to think about for small-cap positioning

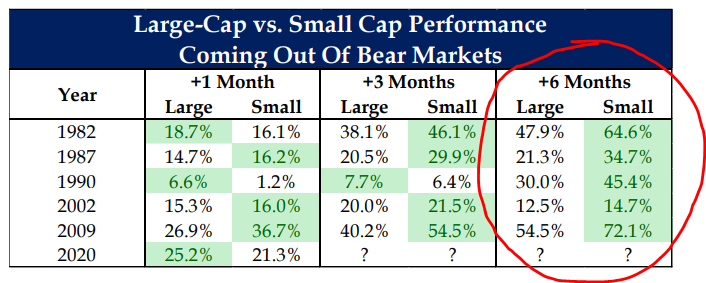

Part of the challenge with statements like this is the hindsight dilemma – one can know that small-cap has historically far out-performed large-cap six months after a market low, but one doesn’t know what the low was at the time they are making their decision. That said, the historical consistency with which small-cap has out-performed large-cap coming out of recessions is a fascinating tactical consideration. We are looking to modestly re-weight small-cap in the weeks and months ahead.

* Strategas Research, Investment Strategy Report, June 15, 2020, p. 1

That said …

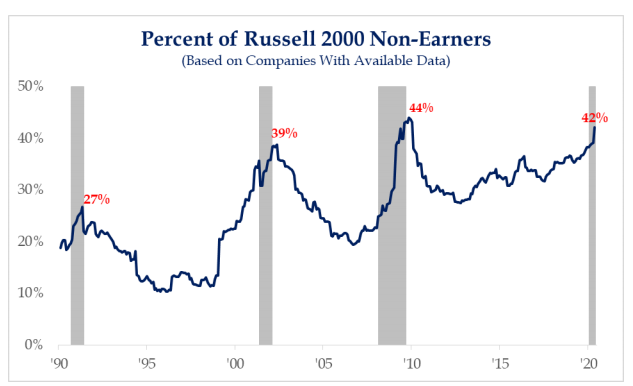

It bears reminding, there are few asset classes where active management vs. passive exposure seems more advisable than small-cap U.S. equity … The mere existence of an index where almost half of the constituents lose money is stunning to me. Some discernment and qualitative judgments seem like a good idea in this space, both defensively and opportunistically.

* Strategas Research, Investment Strategy Report, June 15, 2020, p. 6

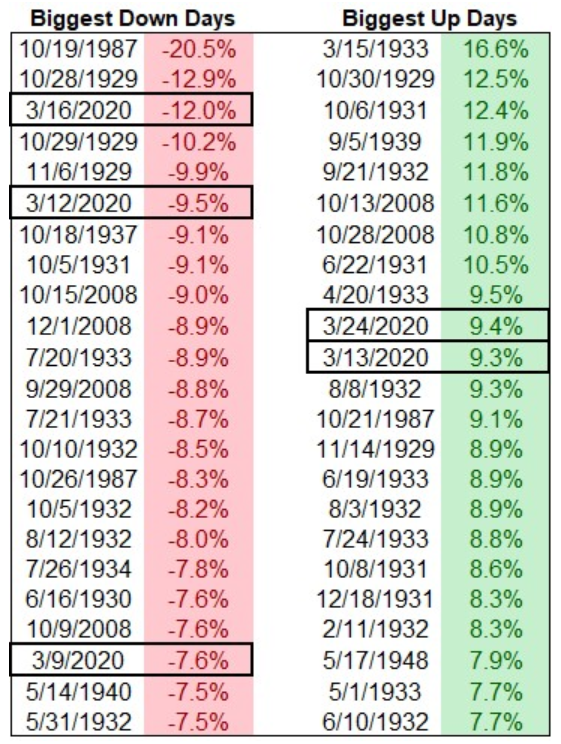

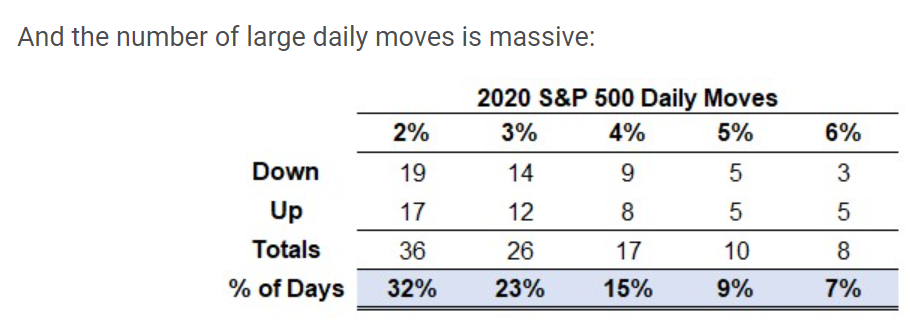

Market Volatility for the Ages

The fact that the two of the worst six days in market history took place in the same week this year, or that two of the best days in market history took place right in that same period is pretty amazing. And when one looks at the dates below and sees the biggest down days and biggest up days of all time, they will pretty quickly realize they are all connected to either (1) The Great Depression, (2) The financial crisis, (3) Black Monday 1987, or (4) COVID. This is the volatility company that the COVID crisis of March will forever occupy. Fully 1/3rd of all market days this year have seen up or down movements of 2% or more.

* A Wealth of Common Sense, Ben Carlson, June 12, 2020

In the long-term …

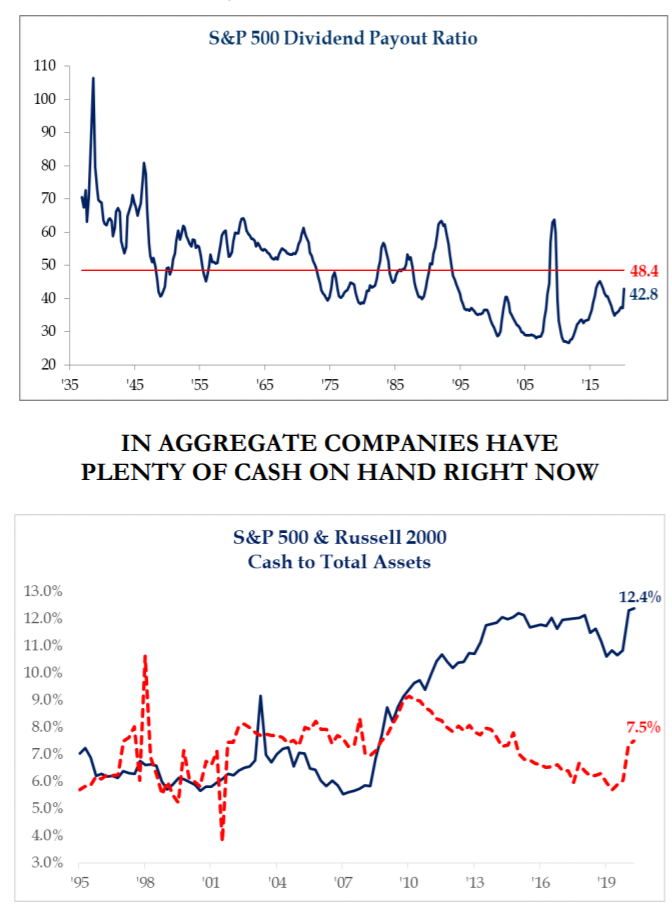

It is frequently said that “in the long-term” stocks have generated ~10% per year … Fair enough. The Dow and S&P have averaged something like 9-10% going back almost 100 years. But from 1927-1981, dividends were fully 60% of that return, and since then have accounted for just 25% of that market index return. Stock buybacks have made up for a big part of that difference, and yet stock buybacks are presently under tremendous assault by leaders of both political parties, and by various external groups not fully up-to-speed on what a stock buyback is. Dividend payouts have dropped from almost 90% generations ago (investors used to assume they would receive the profits of a company they owned), to just 40% now.

Our view is that (a) “Long-term” returns for the whole market reflect circumstances that are no longer true when it comes to market index dividends, (b) Companies have ample room to grow dividends, (c) Companies have ample cash on hand, and therefore, (d) An investor focus on companies who actually care about all of this will be rewarded, in the “long-term”

Be careful what you wish for – part 35

Another very noteworthy thing about the zero interest rate policy … not only does the return profile for bonds go down substantially, but the correlation with equities goes up dramatically. In other words, the diversification benefits disappear. Our longer-term objectives of substantially replacing much of fixed income with alternatives are not just return-driven, but diversification-driven as well.

How is the economy doing?

I wrote a lot throughout the week in Covid and Markets about the jobs data, mortgage data, housing data, and even a bit of retail spending that drove economic releases this week. On a more granular level, the data is interesting.

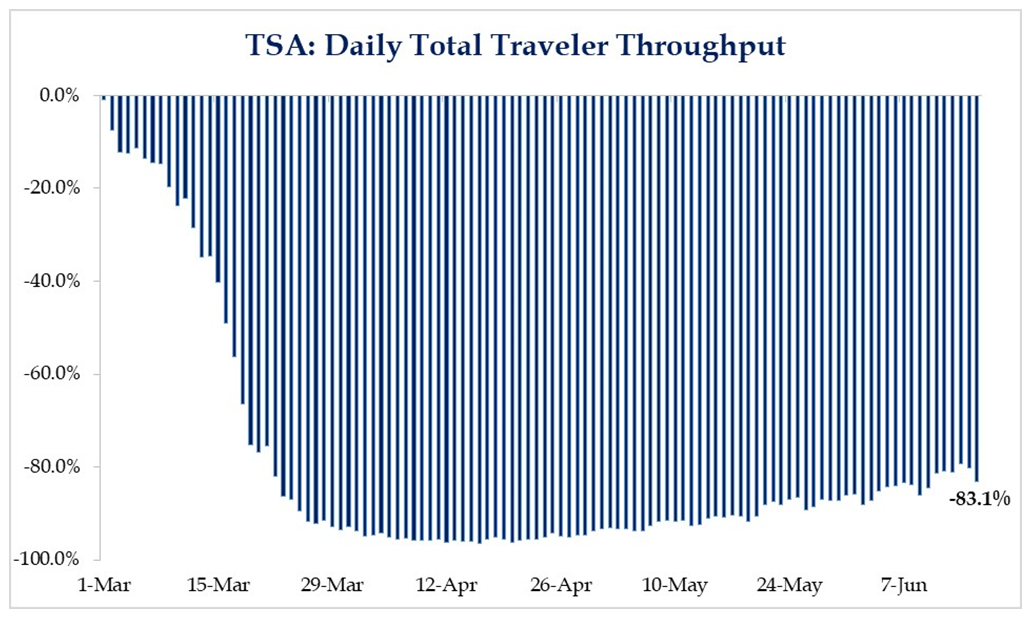

Air travel is obviously picking up with the partial economic re-opening, but still has a lot of work to do to even come close to approaching normalcy:

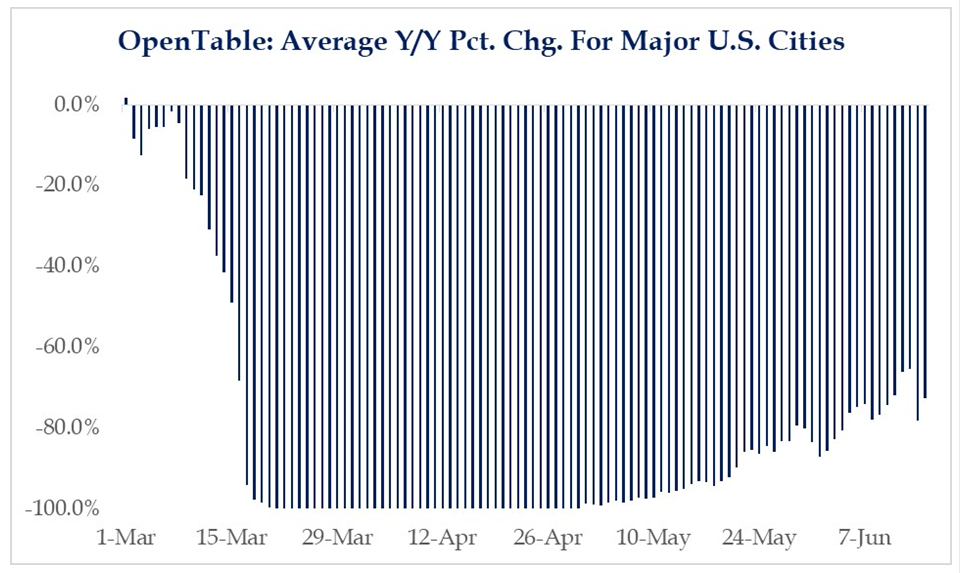

And restaurants are also seeing great improvement, but with plenty of work to do …

* Strategas Research, Daily Macro Brief, June 18, 2020 (includes TSA chart above)

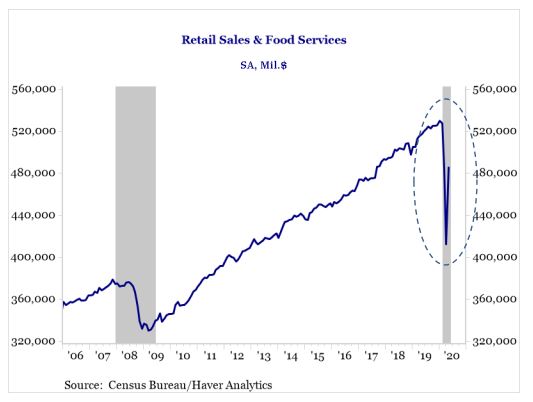

Retail sales and food services have skyrocketed higher but that comes off of an unspeakable plunge …

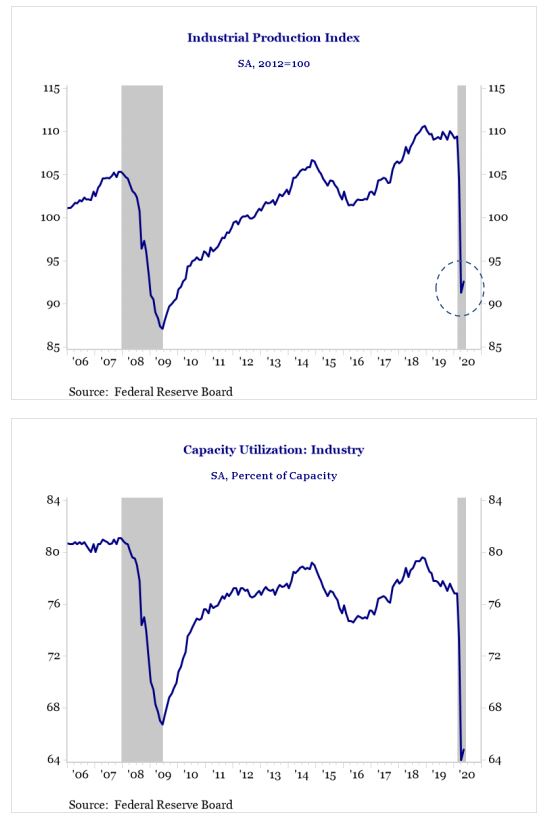

And yet – through the improvements in travel, restaurants, retail, etc., the area that will surely lag, yet is so crucial to long-term economic concerns – industrial production (business activity) – has barely scratched the surface yet. Mark my words – not Q2 and Q3 of 2020, but Q1 and Q2 of 2021 will depend much more on business activity than any consumer metric we can look to.

A final thought on a “plan”

The final piece of research I read this morning came from a macro-research provider I read daily (I’ll keep them nameless since I am about to be critical). They are thorough, diverse, often contrarian, and good at not committing the one sin I cannot suffer from a research provider I pay – group-think. They have been incredibly bearish throughout the COVID era, and the report I read this morning did all the things you would expect when someone who told you to sell at S&P 2,200 now has to tell you what to do with S&P at 3,200 … First, they blame the rally on various esoteric factors (“day traders,” “speculators,” “unexpected Fed interventions”) – but then they do one of the most difficult things one who commits the cardinal sin of panic selling ever has to do: Dare to explain what to do now that prices are where they are. Their line – paraphrased – fine, we were wrong about 2,200 to 3,200, but now that we’re at 3,200 it’s really, really true what we said at 2,200 … You get the idea.

None of this means their ideas are wrong now, or that prices should go higher, or lower, or anything to that effect. It simply means this – investment management must be done with humility, and humility means asset allocation, and the avoidance of panic selling, or panic buying.

Politics & Money: Beltway Bulls and Bears

- Many have asked why I wouldn’t assume the recession is enough to kill the re-election chances of President Trump. Re-elections have been virtually 100% correlated with a recession or lack thereof for a first-term Presidency for a hundred years. I think there are plenty of things that may impact President Trump’s re-election, but this particular economic circumstance is tricky for its political predictiveness in two ways … (1) The universal consensus that this was an outlier event around COVID; (2) The possibility of a GDP recovery surge as much as +20% in Q3 before votes are cast

- Did you know the only time an entire Presidential term had a negative stock market return going back 75+ years was the financial crisis (2008) and the partial second term of Nixon (stagflation), and even that was cut short by his Watergate resignation (Ford actually experienced positive returns in the second half of Nixon’s term). More history and perspective coming in two weeks in an exhaustive white paper I am working on analyzing the Presidential election and market.

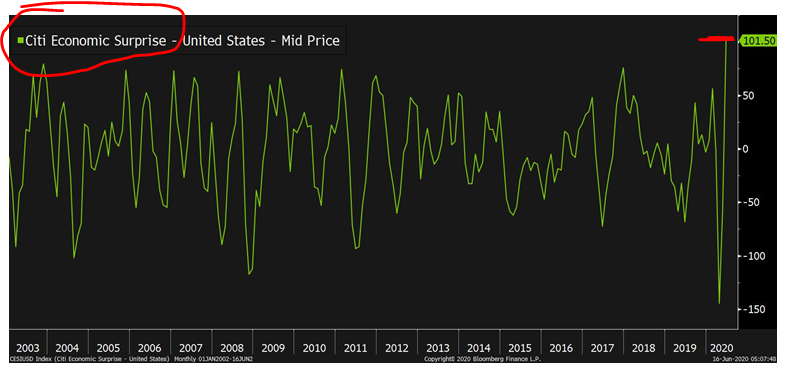

Chart of the Week

I think this is absolutely one of the most stunning things I saw all week. Citi has long maintained a highly regarded and closely watched index of “economic surprises.” The rebound of economic activity relative to what economists had been expecting put the index at the highest level in its 17-year history. It does not speak to economic conditions being good or bad, per se, it speaks to economic conditions relative to what had been forecasted or assumed. The “surprise” component is what is key, and should go a long way to informing our understanding of why markets have been out ahead of the economy.

* Citi Economic Surprise Index, Bloomberg, June 16, 2020

Quote of the Week

“Be sure you put your feet in the right place, then stand firm.”

~ Abraham Lincoln

* * *

I’ll leave the conclusion short because I was so long in the Dividend Cafe this week. Have a wonderful weekend, stay safe, and Happy Father’s Day … And reach out to us any time, about anything … To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet