Dear Valued Clients and Friends,

The month of April saw the S&P 500 drop, ummmmm, 0.8% … Wait, what? The market feels down way more than that, right? Well, the index is down over 5% on the year (through the end of April), but most of that happened in March. Wasn’t April a debacle? It was, but then it wasn’t, and here we are. How “debacl-ish” was it? Well, the already-down 4.5% market dropped 11% in three days in the first few trading days after the Liberation Day announcement of April 2, and at its intra-day low of April 9 was down over 20% from its February high. So yes, markets were in a freefall.

And then, the big reversal happened. A “90-day pause” told markets a lot, and the April low was in place. There were plenty of moves up and down since then, days where iPhones were exempted from tariffs, other days where agitation with China was intensified, days where the President tried to fire Jerome Powell at the Fed, other days where he said that was fake news, but after all of that roller coaster, the S&P 500 was down -0.8%.

And people think they can time the market. Good luck with that.

Are markets out of the woods? Not at all. But as I wrote last week, markets feel reasonably comfortable that the “Trump market put” is not dead, even with substantial uncertainty lingering in China. But the wild month of April did not mean this particular chapter was over. Substantial economic questions linger, intensified by U.S. GDP reports that came out this week, not to mention reports out of China. This is about as “current events” oriented as I am capable of doing in the Dividend Cafe, but current events we shall do. Let’s jump into the Dividend Cafe …

|

Subscribe on |

Recession Come Early, or not Really?

The buzz this week on the Q1 GDP report is so unbelievably frustrating to me, because it forces me to tell the truth, to unpack some nuance and complexity, and to do it in a way that goes against all narratives from all sides – even though I don’t want to. But I have to call balls and strikes … So here’s the thing: I believe we are very likely headed into a recession, and that the Q2 data is going to be very rough. So I am not saying what I am about to say to sugar coat the Q1 GDP numbers – I am in a recessionary camp (though hopeful it proves shallow and short, which is definitely within the prerogative of the administration) – but I do not believe the Q1 GDP numbers actually foreshadow this. Rather, the -0.3% contraction in Q1 GDP (vs. expectations of +0.3% expansion) more speaks to the math of the methodology in concert with some idiosyncratic events.

Reminder: GDP growth = C + I + G + (X-M). Consumption + Business Investment + Government spending + Net Exports …. In other words, a decline in government spending contracts GDP growth, and an increase in imports contracts GDP growth.

Business equipment investment was substantially higher (+22%), but that clearly speaks to businesses “pulling forward” capital expenditures in Q1 out of fear of pending tariffs going into Q2. Consumption was up +1.8% (what people usually obsess over). The major detractor from GDP growth in Q1 was imports, as importers heavily front-loaded purchases out of fear of pending tariffs (imports were literally up +41.3%).

That much of the decline was related to a decline in federal government spending also speaks to the report being a little less indicative of economic distress than the headlines suggest.

Alternative Facts

I have never bought the argument that “Gross Domestic Product” (GDP) is a bad measurement for the economy, or that how it is measured is structurally flawed. Now, I do believe there are some challenges in the way it is measured, and I do not believe it paints a comprehensive or infallible picture. But that has never been my expectation. I believe GDP is a valuable tool as a relative barometer of economic growth. In other words, if you believe it is structurally flawed, at least it is consistently structurally flawed (measuring the same flawed things the same way today that it did last year, the year before, and for a gazillion years before that). The methodology consistently measures the same thing as it always has and therefore serves a valuable purpose in telling us what economic growth looks like, defined in the same way we have always measured such a thing.

Now, I also believe “gross output” matters a great deal, and its measurement of total sales (to final consumers and in the supply chain along the way) is a very elegant, simple, thorough way of combining intermediate inputs with final sales to capture the entire value of production processes all the way through (my old friend, Mark Skousen, has long advocated this measurement for analyzing economic growth). It best measures the health of the business economy, which some may say (I am one of them) is sort of the same thing as the “real economy” (unless you know of a way to generate wages, jobs, and profits outside of “business”).

Those genuinely interested in economic data (cool kids like me) are not limited to the GDP data in our analysis. Much like the BLS monthly jobs data, it does not exist in a vacuum. And as I have long advocated, combining the BLS monthly data with the weekly jobless claims, the ADP private payrolls number, the Labor Participation Rate, and the Household Survey gives multiple inputs that all tell a story about the health of the labor market. If there is contradictory information, it can be scrutinized for explanation, but there often are different nuances that tell a complete story.

The same is true of how we measure economic growth. The GDP number is important. So is gross output. So is, by the way, the only reason we actually care about GDP growth, looking at real-life impact on wages, jobs, and profits. There is also “core real GDP” that merely includes consumer spending, business expenditures, and home building, leaving the lumpiness of government spending, international trade, and inventories out of the equation. Now, do government spending, international trade, and business inventories sound like small things that should be left on the cutting room floor? Not at all. But when that “core” number tells a very different story, you do get a chance at a contrarian narrative (and inversely, as is more often the case, when they tell the same story, you get affirmation and validation).

Q1 2025’s core real GDP? Up 3%, compared to a 0.3% drop in “real GDP” … A massively different story!

So, the good news for those wanting Q1 to tell a good economic story: It objectively does not tell the bad story many are trying to extract from the data. It just doesn’t.

What is the bad news for those wanting Q1 to tell a good economic story? I don’t think Q2 is going to please a lot of people (unless the exports minus imports story is so severe that it reverses the data of Q1, but it isn’t like exports are flying even if imports are dried up). Oh, what a tangled web we weave when first we practice to centrally plan global trade …

State of the Economy

Unfortunately, my submission deadline for this Dividend Cafe was before the BLS report came on Friday morning, so as of press time, we did not have an April jobs number. But earlier in the week, we got the ADP private payroll number, and it was brutal (62,000 jobs created versus well more than double that expected). There have been many, many times over the years when the ADP number on a Wednesday and the BLS number a couple of days later told two different stories. By the time you read this, we will know what the BLS number in April was (even though I did not know as of the time I was writing this). However, we also saw an increase in the weekly jobless claims this week (241,000 versus 223,000 expected). Continuing claims and Initial claims saw a jump. I know the lumpiness of this data requires a few more weeks to really assess it, but some early anecdotal evidence is suggesting a softening of the labor market.

ISM Manufacturing contracted in April, as well. Production fell from 48.3 to a very low 44. This overall trend has not been great for a couple of years, but added tariff uncertainty is obviously not going to help. The survey shows substantial indications of delayed orders and slower delivery times. In short, this does not appear to be a positive lagging or leading indicator.

What Next?

Supply chains are complicated things, and any attempt by a portfolio manager with a macroeconomic focus to unpack the particulars of supply chains as if they were monolithic would be highly unsatisfying. That said, we know general high-level timing things, filled with caveats as they are, and we can safely say the following:

- Containers in transit have already begun to experience delays and cancellations

- Deliveries to ports are likely to see substantial declines by mid and late May

- Trucking demand then ceases/collapses from there

- Store shelves begin to seem emptier by early June

- Layoffs likely follow the second, third, and fourth of the above steps

- Then a recession call gets easier to make (if it hasn’t been made already)

Resuming trade is the first domino that softens or reverses all the others. Capex and New Orders probably do not turn back on light a like switch, but the lights cannot even begin to fade up until the switch is hit, which cannot happen while trade is so diminished.

This is the domain most worth watching. Shopping (consumer confidence) is not the low-hanging fruit of economic health for all the reasons I constantly repeat (at risk of sounding condescending to the American people, they simply love to shop whether they say they feel good about it or not; it is immaterial to me how “confident” one feels when they run their credit card at the mall – a purchase is a purchase; what is a substantive issue is if production of those goods and services has declined – that is the heart of the economy).

China’s Got Problems of Its Own

I have been skeptical that the U.S. has the upper hand in leverage over China, not so much out of belief that the trade stalemate hurts the U.S more than it does China, but more based on the cultural and political reality that there is much less tolerance for economic pain in American society. I stand by the general take there, but would like to point out some of the economic data we got this week from China, all of which could very well be even worse than reported.

- The Purchasing Managers Index for Manufacturing went negative. Activity at factories is in serious decline.

- New Export Orders plunged to 44.7, the lowest level in three years

- Though direct exports to the U.S. are only 15% of total Chinese exports, the amount of goods rerouted through other countries is estimated to make up another 6% of total exports. Total exports are 13% of China’s GDP, with U.S. purchases being about 3% of the total. Exports will likely be down 10% this year (almost entirely due to this U.S. tension), which essentially brings 1.3% out of GDP growth. Based on early-year assumptions of 4% GDP growth in 2025, this means that economic growth would be down 33% from what was expected (from 4% to 2.7%, if all else held).

And I am quite sure I am in good company to say that I believe all of these numbers get worse before they get better.

Not That Beautiful After All

Perhaps the two biggest events of the week regarding the tariffs were:

- The White House’s announcement of significant carve-outs on walk-backs on automotive tariffs, and

- The White House’s aggressive pushback against Amazon’s quasi-announcement of displaying the cost of tariffs on the products being sold.

These are two big developments in what they imply more than what they actually are. In both cases, it is a rather explicit, direct, unequivocal acknowledgment from the White House that “the cost of these tariffs is large, and paid by Americans, and not likely to be popular.” I would have different expectations for where some of these policies could or will go if I believed that there was still an assumption of general public support, and particularly approval from that base. It is increasingly apparent that the White House realizes (at least to some degree) the impact these costs represent, the public response to that impact, and the need to soften it.

Now, markets just need to see more of these walk-backs in action …

Conclusion

We enter the month of May with a roller coaster in markets from April that has left many woozy, but no one knocked out. In fact, the recovery in markets has meant that the one interesting thing from the decline (the beginnings of some possible re-valuations) is put on hold. If the intense violence of April’s tariff debacle is done, the next phase appears to be the “consequence” phase – that is, what has happened to the economy thus far, and what will be happening as the uncertainty in our trade relationship with China persists. The Q1 GDP reality points more to “preparation” for tariff issues than anything else, but Q2 is more likely to be about reality.

Where things go from here is an unknown, though what is not unknown is how much both the U.S. and China need a deal. Both. And so we wait.

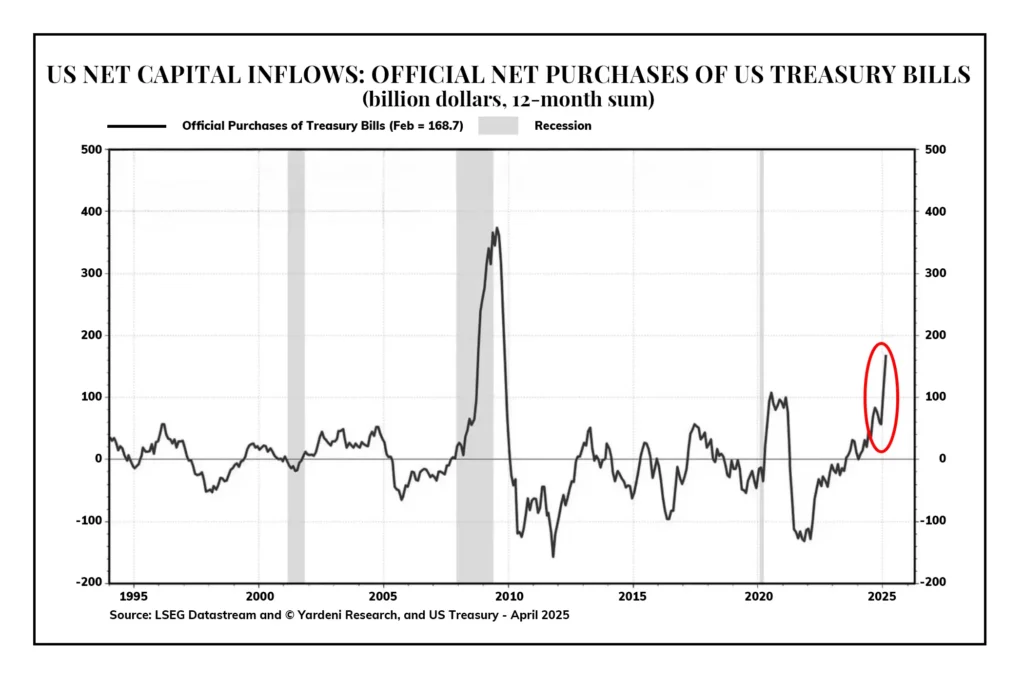

Chart of the Week

Remember when foreign appetite for U.S. Treasuries had dried up, and we would not be able to sell our debt anymore? That talk was, well, three weeks ago. Hasn’t aged well.

h/t Weekly ChartStorm, Callum Thomas, April 26, 2025

Quote of the Week

“Self-delusion helps sustain most people.”

~ Daniel Kahneman

* * *

I am off to Boston Friday morning to speak at Harvard University on Friday afternoon and will be back in New York City Friday night. I am sure many of you are hoping May will be less exciting than April. You are not alone. But whether there is high drama or not, there is a very serious need for a low response to whatever drama there is. People continue to learn the hard way how unproductive their response to drama can be.

So, being anti-drama and anti-bad behavior continues to be our job. In fact, you could say that to those ends, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet