Dear Valued Clients and Friends –

I get into where I am and what I am doing at the end of this Dividend Cafe, but for now (even from my spot out of the country), I do keep my weekly streak alive with the Dividend Cafe. Going back to the week of Lehman’s bankruptcy in September 2008 I have missed just one weekly commentary, and this weekly writing really is one of the things I love most about my job.

Today’s may be a little shorter than normal, and it is primarily Fed-oriented, but I am quite happy with some of the subject matter covered and hope you find it simple, readable, and useful.

If it turns out that this week’s Dividend Cafe speaks to you more than normal, perhaps I will have to open an office in the spot I have written it so that the magic can be repeated.

In the meantime, jump on in to the Dividend Cafe …

The Big Three

So I said last week that the three major issues I thought were front and center in macroeconomic concern right now as it pertains to investment application are:

(1) The inflation-deflation debate

(2) China’s ascendancy

(3) Central bank dependency

There are most certainly other areas and categories that warrant coverage, though even many of those will actually prove to be sub-categories to one of these three. But I do believe these three will be the most primary areas that warrant attention and application in the years to come.

Fed Ahead

So when it comes to #3 on that list, it really is difficult to write about with the precision I prefer because so much of what needs to be written about is in the realm of hypothetical, and our ability to form hypotheticals is limited by our own imaginations, and those imaginations are very likely inferior to the imaginations of central bankers. What I mean by this is very simple, and implies nothing sinister or evil in the actions of the Fed whatsoever. I simply mean:

(1) The Fed has taken on a far, far, far, far greater role in the administration of our economy and capital markets in the last twenty years, especially the last 13 years, and especially the last fifteen months than anyone could have ever imagined.

(2) There are problems in the country’s economy that will very likely create MORE, not less, Fed interventions or relevance.

(3) The Fed is currently a 20% holder of the total U.S. national debt. Their role in the future issuance of debt and cost of debt and settlement of debt is profoundly important.

(4) When it comes to #3 above, the sky is the limit as to what that could mean and entail.

(5) The Fed has credibility globally right now in the context that the word “credibility” is generally used. Many disagree with some or almost all of their actions. Many feel there are risks growing. Many have legitimate questions about the future. I do not say this to imply a benign atmosphere whatsoever. What I mean is that the Fed is not looked at as a banana republic third world central bank. How seriously the Fed is taken in global markets is a big, big deal.

Never let a crisis go to waste

Most Fed expansions have come out of some form of crisis. It seems like small-ball now, but from the Asian currency crisis to the Long Term Capital Management implosion to Y2K (LOL), and then to bigger things like 9/11 and the great financial crisis and COVID, we have a series of incremental changes in the Fed’s actions, postures, beliefs, and interventions that always flow out of “crisis.” To have a view of what further escalations in Fed activity may take place in the future, one would have to have a view of what further crises may take place in the future. And THAT is the height of hubris – to believe one knows what bad things are going to happen and how they are going to happen (not to mention when).

Preparation not Avoidance

But if believing one can predict crisis is the height of hubris, believing there is no need to prepare for crisis is the height of recklessness.

Our Federal Reserve knows another crisis will come. Will they have an interest rate buffer before one does? I strongly doubt it. That leaves them more reliant on creative policy tools than it does on conventional policy tools.

Brilliant monetary economist, Bill White, who I interviewed recently at the Mauldin SIC conference, believes that our bankruptcy proceedings for large debtors (i.e. COUNTRIES) remain wholly inadequate. We lack a framework for dealing with sovereign bond defaults. Is that going to be addressed before the next crisis?

Making ex-ante preparation for the next crisis is the key to limiting the interventions of the Fed when the next crisis comes. The more prep, the less interventions; the less prep, the more interventions.

Err on the side of the latter in how you think about this. It is becoming the American way.

Creative vs. Conventional

All I mean by “conventional” policy tools are things like the federal funds rate – that short-term interest rate the Fed uses to either loosen or tighten borrowing incentives in the economy. It is hard to further incentivize borrowing when the rate is at 0%.

Technically speaking, interest paid on excess reserves (or charged?) could be considered a “conventional” tool, as well, but basically the fed funds rate is the one we all know and understand.

So what are the “creative” tools? Well, 13 years ago the idea of the Fed buying government bonds (or mortgage bonds) with money that did not exist would have been considered creative. But “quantitative easing” (QE) is now child’s play.

The “creative” stuff post-crisis was TALF (buying asset-backed securities like mortgages, car loans, and other securitized debt instruments). You could also call Operation Twist pretty creative, where they altered the maturity profile of their debt holdings to effect an interest rate outcome in the economy.

The creative stuff post-COVID was buying junk bond ETFs, for starters, but also the whole idea of leveraging up a small piece of Congressionally-approved equity injections into a “special purpose vehicle” to intervene in a given financial market. This started post-GFC but was significantly expanded post-COVID with corporate bonds, muni bonds (short term), asset-backed securities (again), and even the mostly-whimpered-out “Main Street lending facility.”

What I want my clients to understand is that each creative innovation in monetary finance so far has emboldened further use of creative monetary instruments and plans. I believe there are plenty of additional things they can and will do.

But that darn Constitution!

One limiting factor is our law. The Bank of Japan has far broader powers in the law than our Fed does. Fair enough, and very, very true. However, two things must be said:

(1) The creative ability to stretch the plain meaning of the law has obviously been successfully executed both post-2008 (Maiden Lane out of Section 13.3, TALF, AIG, etc.) and post-COVID (junk bonds, etc.). It WAS legal, and it WAS creative, and it WAS clearly outside the intent and spirit of the law.

But then also …

(2) The law can change

Congress expanded Fed powers in TARP. And Congress really expanded Fed powers in the Cares Act. If you believe that most men and women in the United States Congress (House and Senate) have the foggiest idea what the Fed does, how they do it, and what the implications are in various legislative acts for the Fed, I promise you that you believe something totally outside of reality.

Will the Fed be able to buy stocks one day? I don’t know. The Bank of Japan is the largest equity holder in all of Japan. Our Fed cannot legally do it. I can only tell you that 15 months ago they couldn’t buy junk bonds either.

Will the Fed forgive U.S. treasury debt? I don’t know. The central banker I most admire in the last fifty years, Richard Fisher, swears they won’t. But will they quasi-forgive with rank shenanigans that work around it? It can’t be ruled out.

Some implications

Low-interest rates keep companies with a low return on invested capital from going bankrupt. This prevents or delays the destruction part of the creative destruction fundamental to successful free enterprise from happening. It limits creation. It limits production. It limits growth.

But …

Ultimately, the MACRO implications are more systemic. They speak to the fragility and risk of the whole system. I will not stop writing about this for years to come, and I most certainly will not stop thinking about it and formulating opportunistic applications to it in our portfolio management, ever.

Chart of the Week

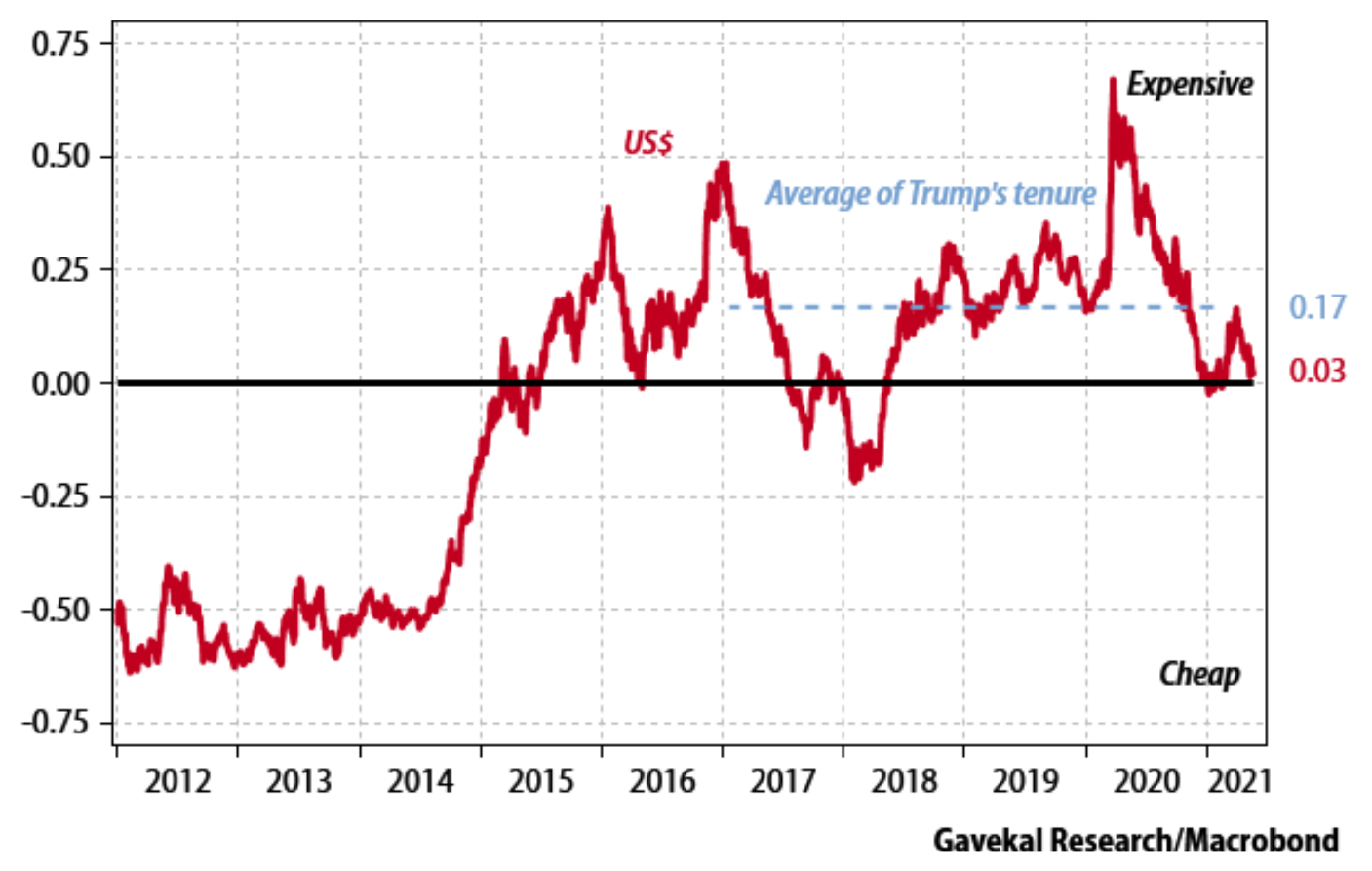

The U.S. dollar was excessively cheap for years post-crisis. As oil prices collapsed in late 2014 it became quite expensive and stayed there all the way until COVID. Here we are now. The next move is as much your guess as mine, except not really because it is going lower. Well, that is my fallible and humble prediction anyways.

Quote of the Week

“Success is not enough; what matters even more is adherence to high moral and aesthetic standards.”

~ Siegmund Warburg

* * *

I enjoyed writing this morning’s Dividend Cafe for a variety of reasons … And as I mentioned in the introduction, I am quite open to opening an office where I have written it.

This little annual weekend getaway for Joleen and myself comes at a good time. We have more work to do this year than normal (work-less getaways have never been particularly feasible), but we most certainly aren’t complaining. And it is tremendous to see the pent-up demand of vacation travel being addressed. I also have three books with me that I am very hopeful will be complete by our return. And more than anything, I get this time away with my very best friend.

I have a week ahead of me in the California office before returning to the New York office at the end of next week. Summer is upon us, school is ending, and it just feels so much different this year, doesn’t it? Thank God.

Back to my coffee and book …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet