Dear Valued Clients and Friends –

We had a reasonably boring week in the markets (as of press time, which is after the market open on Friday, the Dow is modestly down on the week but no up or down day this week was particularly significant), but it was somewhat less boring in economic news.

What I want to do today is look at the variety of economic news circulating and apply a market perspective to it. My view is very simple as to the dangers around most conventional methods of receiving that news and most conventional methods of applying that news to investment practices: The news itself is prone to sensationalism, and the application of the news is prone to over-reactionism.

Put differently, the incentive structure behind how most people receive their news is flawed (and in this case, I am talking about economic news, but my statements here are true in all forms of news). And the incentive structure in how investment applications are delivered is substantially flawed, not to mention divorced from personal financial reality.

I unpack all of that this week, and do a look at the current news, and provide wise investment applications for you – within our framework – where the incentives are right, the temperature is moderate, the perspective is sober, and the culture is fiduciary.

The business model flaw

Many people receive their news from their preferred political outlet. The business models of any entity delivering political news are rather simple: Please those listening, and outrage those listening. Those are not contradictory things – please people by saying what they want to hear, and recognize when what they want to hear is something outrageous. It is remarkably easy to do. Delivering economic news in this context is particularly dangerous. There is complexity and nuance in economic news that simply cannot exist within a convenient political framework, other than coincidentally. But complexity and nuance are antithetical to the business model I have described. Therefore, a consumer of economic news from a political (and commercial) voice should assume there is some limitation and distortion at play.

Cases in point

I get why many on the right want to bang the drums of inflation right now. Sticking inflationary price pressures on President Biden is useful to them politically. Most of you reading this commentary know that I am on the political right. So I am not speaking to “them” but “us.” However, I believe that the actual economic reality right now transcends the political aspiration of the moment. The points I will make on inflation in a moment are not to defend President Biden – and only one way too caught up in political tribalization could possibly think such an absurd thing. Rather, my comments are driven by a desire to get this right, to do economic analysis without a political agenda, and most importantly, to be a truth-teller who applies economic wisdom well to investment portfolios.

I also get why many on the political left would want to defend the government unemployment subsidy right now. The policy appears to have blown up in policymaker’s faces, and created the last narrative any of them wanted right now – namely, that what they did not only failed to aid an economic difficulty, it created one far, far worse. If one were making this accusation only out of partisanship, it would be illegitimate and unhelpful. But if one is defending the policy only out of partisanship, such defense is equally illegitimate and unhelpful.

The fact of the matter is that disliking President Biden does not mean we have a long-term inflation problem ahead, and liking President Biden does not absolve this government unemployment subsidy of its disastrous consequences. Objective economic analysis devoid of conflicting agendas can get us to the right place.

You said business model

I understand that it sounds like I am referring to the oft-bemoaned tribalism of today’s news outlets, and growing polarization between what is called the “right” and “left” in the country. But I am not merely concerned about that when it comes to the lenses through which we view economic news. It is not the political agenda of a news outlet that concerns me, because I don’t believe there is a news outlet that has a political agenda that trumps its business model. The problem is that the business model requires delivering outrage and division to keep those who are themselves politically tribalized. A nuanced analysis of inflation or of the jobs policy is not outrageous; it is frankly, boring (as many of you who read my boring ___ can attest). So the business model is served when the respective bases who have identified an outlet with their point of view can be fed economic news in a way that stimulates their outrage, or at least their pre-conceived biases. It is bad, but it is hardly shocking. It is simply human nature.

But it is absurd to think that I am only talking about cable news outlets when I speak to the business models driving poor delivery of economic perspective.

Financial firms that have a product to sell. Doom & gloom newsletters that have subscribers to scare. Don’t get me started on the real estate industry (in fairness, they do the least to even pretend they are trying to give objective or cerebral analysis; they are almost downright transparent in the commercial that is couched as analysis they deliver).

The business model of who is delivering you economic news matters.

But there’s more!

Beyond, the business model, though, is the competence, and then the application. I would suggest that me even bringing up the competence factor is almost unhelpful because it surely will beg the question. For most people, competence refers to “people with whom I agree.” How do we define competence or ascertain and identify it? Well, at the end of the day, competence must surely mean more than agreement. I know plenty of utterly incompetent ninnies who probably agree with a lot of what I have to say. And I most certainly know many highly competent folks who still manage to get a lot of things wrong.

What I mean by competence is merely the ability to conduct a serious and sober study with objectivity and skill, and to move from their premises to conclusions with logic and cogency. They can have poor premises, and end up at poor conclusions, and still be competent. Subject-matter expertise matters. Piety is no substitute for technique.

But there’s still more!

Then we get to investment application. This is a killer for many in my business. I have seen so many people over the years say “X is going to happen” (it does), “and when it does, it will cause this reaction to Y” (it does), “and therefore a really good way to be invested for this is Z” (it was not).

Very few deliverers of economic news are even remotely positioned to be presenting investment application from the news, and even fewer are good at it. Of course, for many, the issue is not even just being good at it but being conflicted. If I ran a taco stand and I said, “I see GDP growth increasing this quarter by 2.4% and the long-term interest rate staying flat, therefore I really recommend the carnitas taco platter” – you may see the non-sequitur of my conflicted advice pretty easily. But for some reason in the world of investment products and services, it gets trickier.

Investment application takes skill and competence and experience and humility. And it most certainly requires an objective, open-architecture, conflict-free landscape.

Inflation nuance

Consumer prices were up 0.6% in May, and are up 3.8% from a year ago. This would seem to be in line with at least the belief in some cyclical inflation (a totally separate category from the secular inflation/deflation debate I participate in frequently). But let’s do that nuance thing …

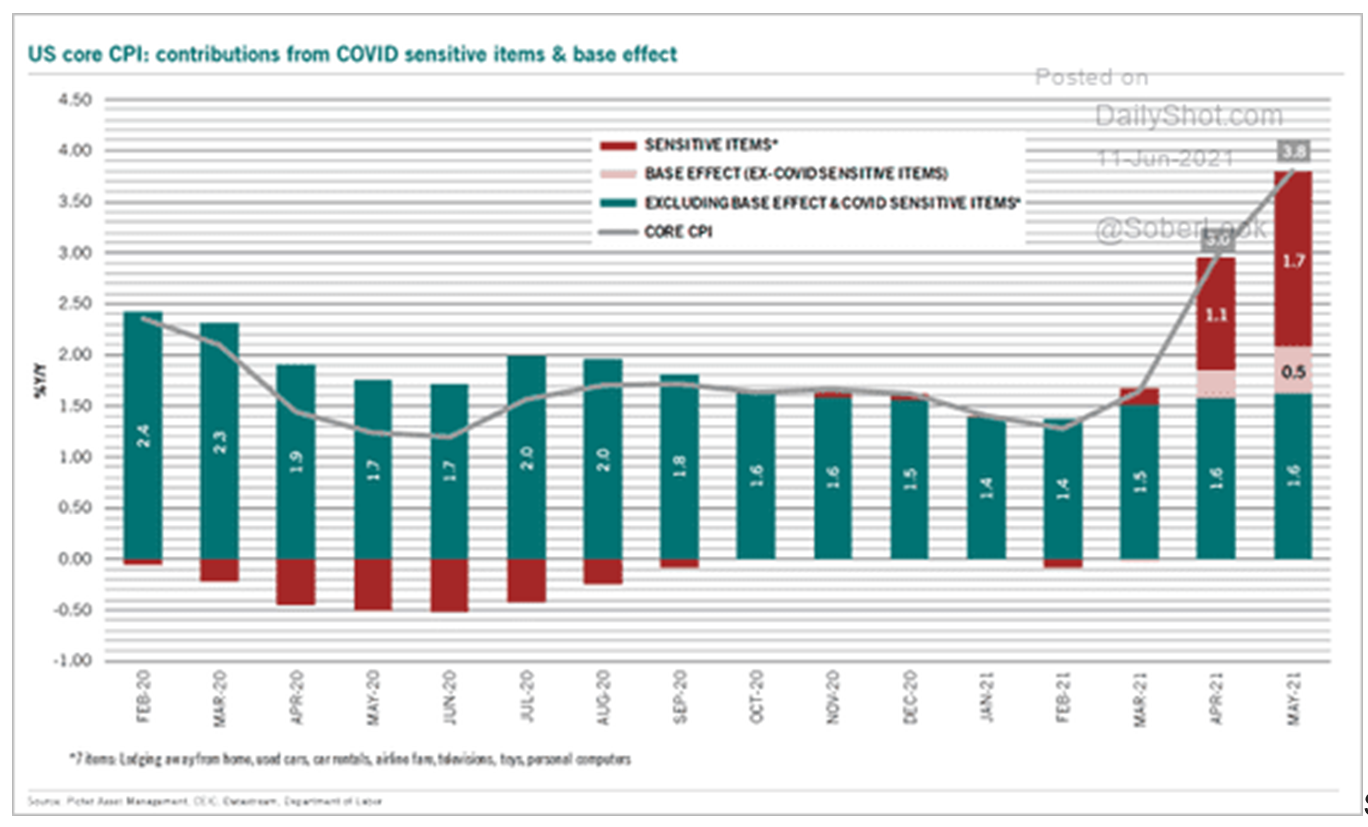

Separated from “base effect” and particularly COVID-sensitive items, the core inflation rate is relatively stable. I mean even in this cycle.

*DailyShot, June 11, 2021 h/t Michael Poulos, Marsh Advisory

What are COVID-sensitive items? Vehicle rental prices were up 12% as travel is re-opening to great success. Airfare was up 7%. The most relevant aspect to this month’s CPI data – used cars and trucks (beyond massive supply shortages) were up 7.3%.

But food and shelter prices are up 2.2% since last May. Airfare is 12% cheaper than it was two years ago. Gas prices are way up versus last year but flat since 2018. I have spoken a lot about the massive amount of commodity prices that are higher now than a year ago, but lower than they were five, seven, and ten years ago.

The bottom line is that anyone looking for a monthly data blip to get a “see, I told you so” moment out of it is not acting like a serious person. Inflation affects different people who buy different things at different times in different ways.

How can we think about inflation as investors?

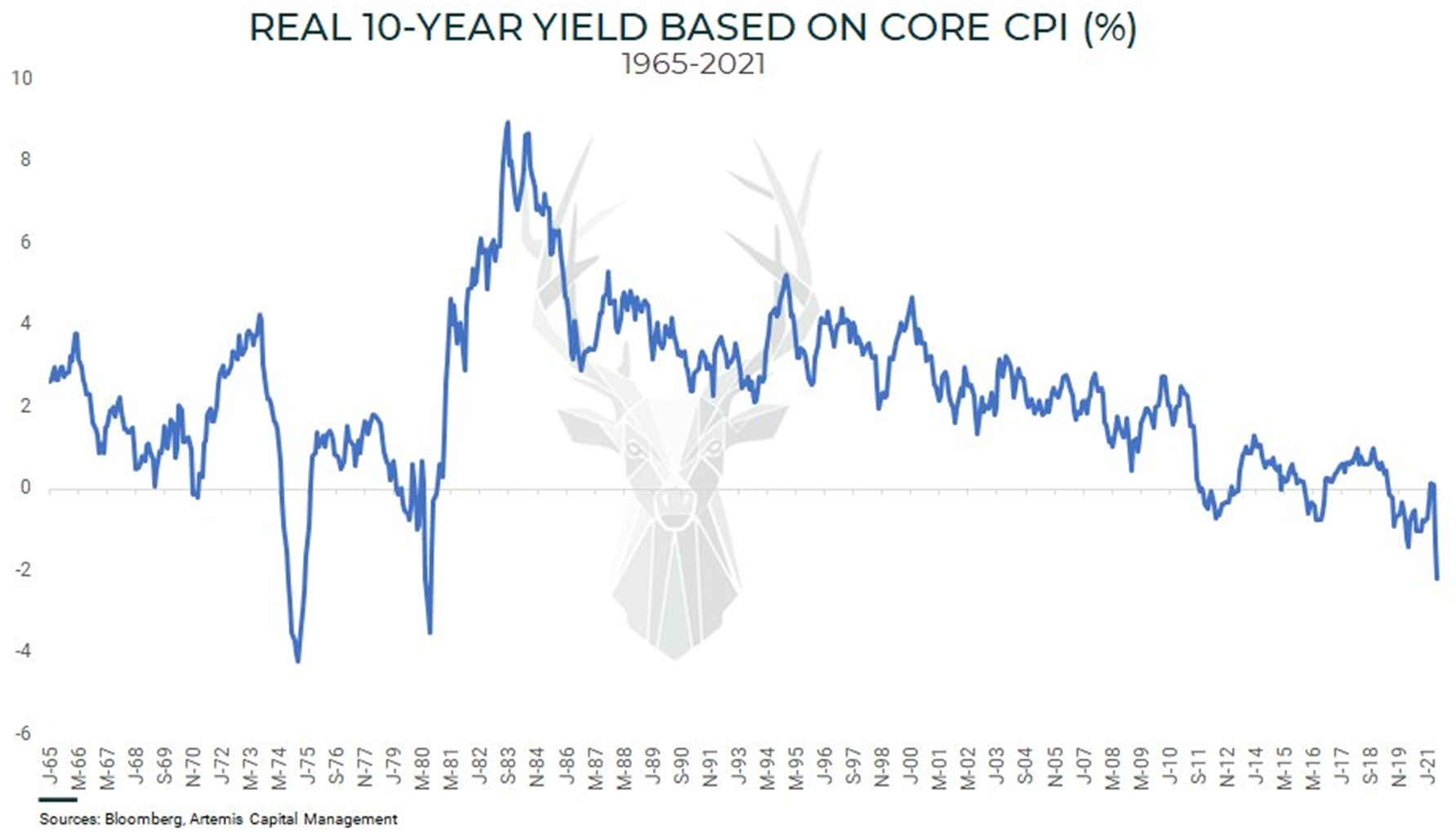

I would adopt a better way in a minute if someone came up with one, but all we have ever had is the bond market. When long-term bond rates reflect inflation, we will know it. Even in the ancient history of March 2021, when the 10-year hit a whopping 1.85%, it struck me that 1.85% was not quite the radical inflation fear some may have been predicting.

But then as the inflation thesis has taken on new volume the last few months, you notice what the ten-year bond yield has done? New lows since February, now at 1.44%. This is not the stuff extended inflation fears are made of.

Do I see continued reflation in certain commodity prices and various manifestations of cyclical price increases for at least a few more months? It certainly would not surprise me. Investing around reflation is generally a good idea out of deflationary punch (like a global pandemic, for example).

But would I be shorting the long-bond, or betting all the marbles on a new era of the Weimar republic?

Not with this staring me in the face:

What affects stock returns?

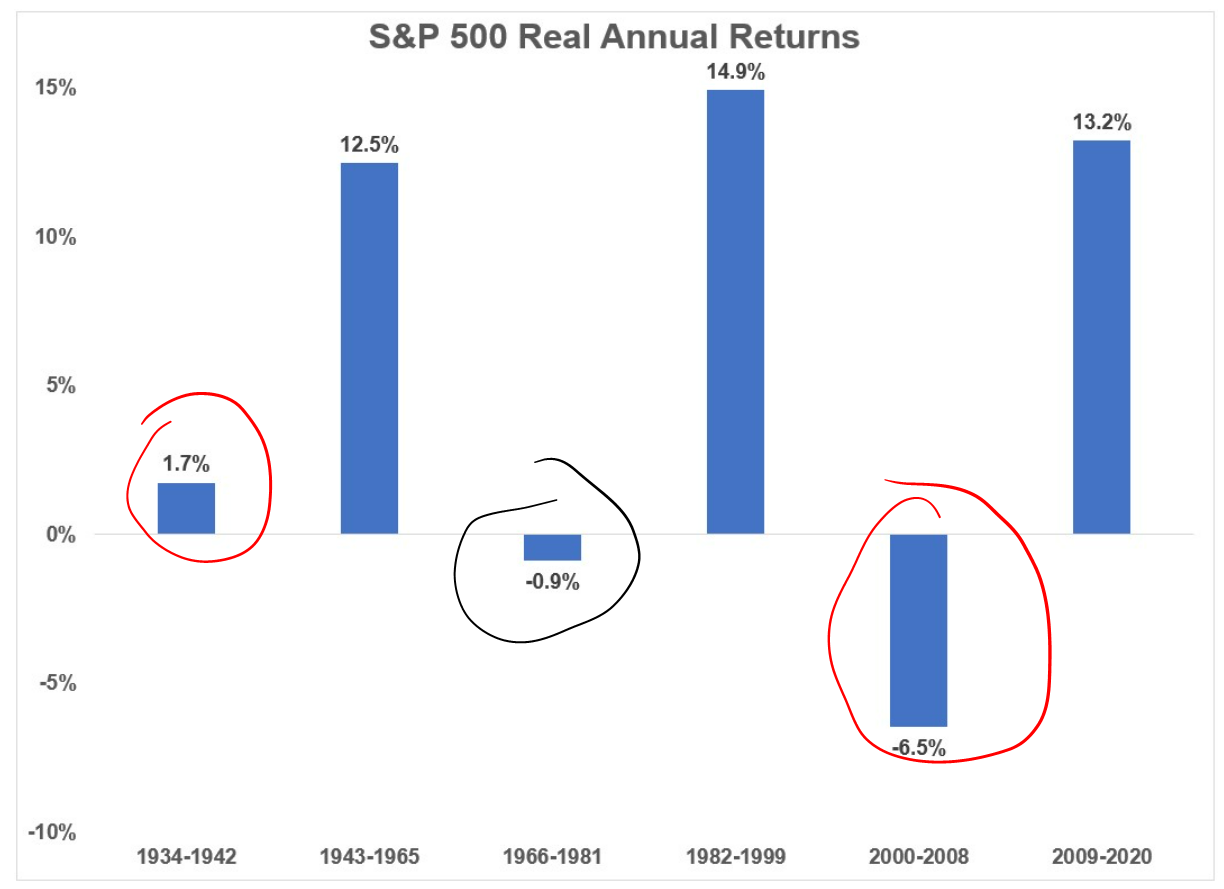

Multiple factors impact stock market returns in various periods of time, making attempts to assess the market in a binary framework (i.e. “if this then that, but if this then that”) futile. There are more macroeconomic environments than “inflationary” and “deflationary.” There are more speeds than “fast” or “slow.” There are more interest rates than “high” and “low.” And even there were no nuances to account for in these binary options within these categories, there are differences in direction. High rates that are headed lower command a different dynamic than low rates that are headed higher. But if all one looked at was “high or low” they would get confusing results.

We have had three extended periods of bad stock market returns (net of inflation) in the last one hundred years. Two of them (circled in red below) were mostly known as deflationary periods, and one of them (circled in black) was mostly known as inflationary. But one could argue that 4% inflation which is headed lower is better for stock prices than 2% inflation headed higher, and so forth. 15% interest rates headed lower proved much better for markets than 4% rates that didn’t move a lot.

*A Wealth of Common Sense, June 11, 2021

So would we say that high inflation and high interest rates are good for stocks? Of course not. What we would say is that not all “high inflation” periods are created equal and that the absolute interest rate level, in and of itself, is inadequate information to assess stock market health.

At the end of the day, no matter how complicated this sounds, no matter how bad for simplistic political narratives it may be, and no matter how much nuance and inconvenience it creates, there are multiple factors that set the decade and multi-decade trends of stocks. Getting all of those factors right and then the application of all it right is not something I see people do.

Identifying the wrong things to do is easier. Being uninvested (cash assures a depleting purchasing power and inadequate growth over time), and market timing (the god-like assumption that one can do what cannot be done). Avoid those two things, and you have a very good chance of not screwing the rest of it up.

Live within your means. Not you. Us.

Dr. Lacy Hunt is not wrong when he boils it all down to this simple message: A society that does not live within its means creates future economic challenges.

What I want to do next week is spend a lot more time on the subject of debt. How does debt positively impact our economy and our portfolios, and how does debt negatively impact such? I am not an anti-debt zealot, yet I am a leverage-conscious obsessive. So that will be the next logical subject to cover in this subject, because it is at the very heart of why we believe so fervently in dividend growth, and it is at the very heart of what matters in the present economic debate.

Chart of the Week

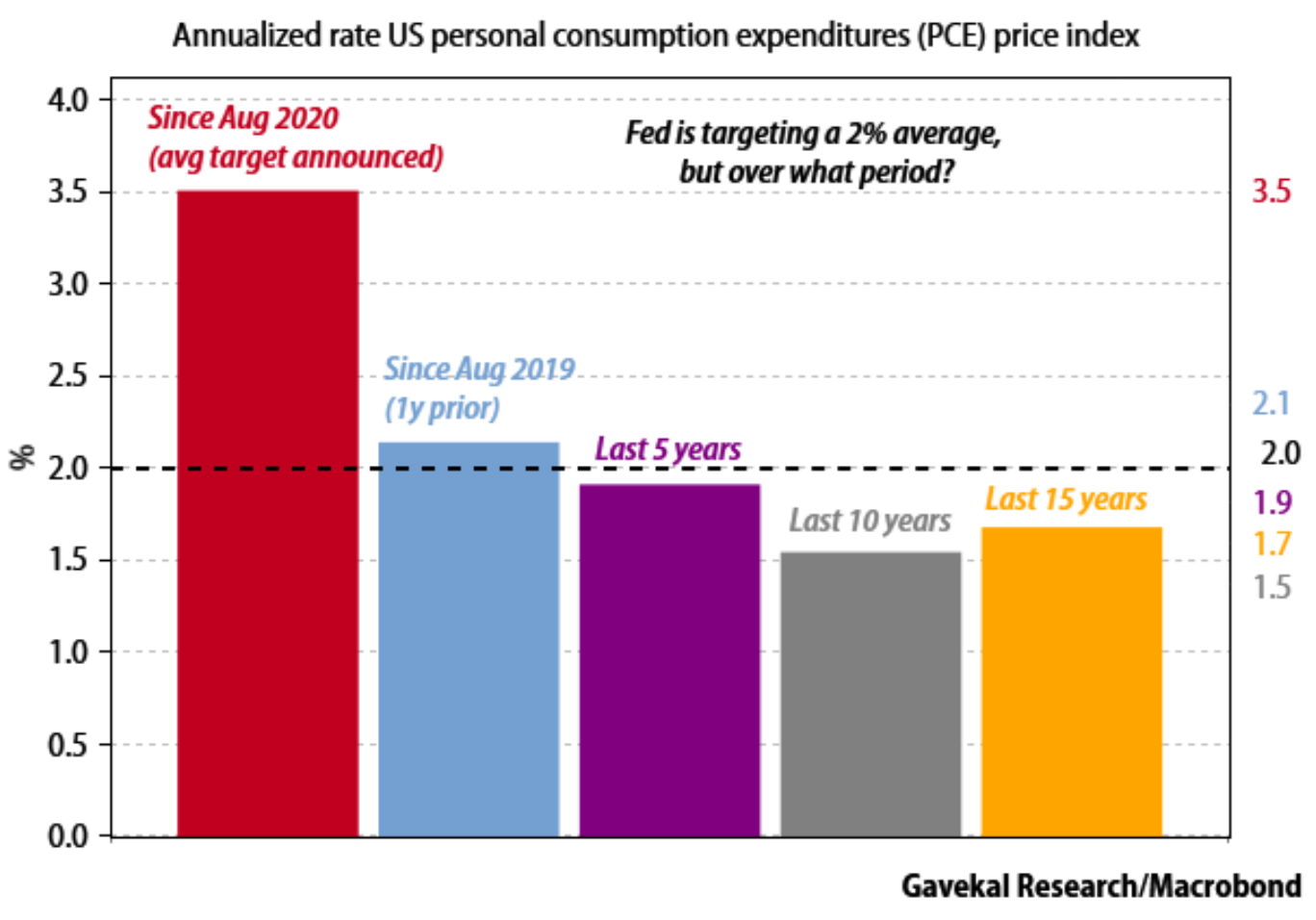

The window we use matters when looking at economic data.

Quote of the Week

“To be successful in business you have to realize that a great time to do something often is when nobody else thinks it’s a great time.”

~ Winthrop Smith Jr.

* * *

Wishing you all a wonderful weekend. School is done for all three of my kids. New York is rolling again. And herd immunity is with us. Enjoy your weekends and let’s see if the pent-up demand thesis continues into the summer. I am staying long that thesis, without a conflicted bone in my body.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet