Dear Valued Clients and Friends,

I am not sure it has gotten nearly the press it deserves, but the one economic story that has managed to get the financial press to talk about something besides the Fed’s rate plans and “will we or won’t we” talk regarding U.S. recession has been the state of China’s economy. Don’t get me wrong – it has hardly been barn-burning stuff, and press coverage has been limited to more substantive financial media (as opposed to the news that everyone watches, reads, and clicks). But there is increasing conversation about the state of China’s economy and what that means to the rest of the world.

If the coverage was merely, “China’s economy is not good,” it would be a pretty boring story. One of the reasons the story has a little interest to people is that after two years of hearing nothing but the “inflation” word when discussing places like the United States, the United Kingdom, and the European Union, the Chinese economic conversation is carrying with it the word “deflation” – and that seems to have people’s ears perked up (even those who have no idea what it really means).

In this week’s Dividend Cafe we are going to take a look at the state of affairs in China and offer a little forecast as to where they may be headed. More important than current conditions, as I see it, is what they plan to do about it all. I will propose in the Dividend Cafe that China’s response will be every bit as relevant to the United States (and the rest of the globe) as it will be to China.

So jump on into the Dividend Cafe, and let’s see if “Chinafication” is about to be a buzz word for the rest of the world.

|

Subscribe on |

Globe-ification

I have been obsessed with the lessons of early 1990’s Japan for many, many years now. I regret that I picked up this study in the aftermath of the U.S. financial crisis of 2008, as I would have benefitted from a more thorough understanding of Japanification prior to the U.S. entering its 2008 collapse.

I have written about the general subject so much that regular readers of Dividend Cafe likely need no setup. Others can easily pick up on the basic tenets here, or here, or here, or here.

Richard Koo’s work on “balance sheet recessions” has influenced me greatly, and yet my own conclusions in the light of the American financial crisis were that what countries facing balance sheet recessions do to remedy them actually make the problems worse. It is this worsening process via excessive fiscal stimulus (Koo’s remedy) and intervenionist monetary stimulus (American post-GFC remedy) that I have termed “Japanification.” It is the process by which more medicine creates a need for more medicine, still.

The historical facts, figures, causes, and specifics can change, and there are absolutely cultural, demographic, and economic particulars that vary from one country to another, but the basic concept out of a balance sheet recession into a period of treatment that results in downward pressure on growth is pretty darn universal.

When it comes to Japanification, “we’re all globalists now.”

State of affairs

Let’s start with the basics. China’s economy has grown like nothing the world has ever seen the last 25+ years behind a massive increase in trading prowess. As China has become a leading exporter to the world, it naturally has seen its need for imports grow substantially as well. Over the last year its growth of both exports and imports has gone negative, contracting on the year even as their economy has re-opened in 2023. Declining trade is a negative for any country, yet for a country whose economic growth is highly export-dependent it is exponentially worse.

China’s high growth of exports over the last 25 years has led to a lot of money coming into their country, which has led to a large demand for property construction (more money, more jobs, more wealth, more aspiration for better living conditions). You will be shocked to know that a substantial part of the boom for construction in China was financed with – wait for it – borrowed money. A large creation of credit to fund a large expansion in construction and real estate development fueled a lot of economic activity. And now with conditions waning, the credit fuel and property market in China has become hyper-vulnerable, leading to a domino effect of problems.

First, the practical. The unemployment rate for young workers (those in their early 20’s) is well above 20% as construction jobs have collapsed. Depositor confidence has collapsed. Plans for investment and consumption have collapsed. Sentiment is abysmal. Hiring plans have collapsed. New orders continue to decline. You get the idea.

Second, the financial. Downward pressure in the vital property sector of their economy not only creates less employment, but removes credit from the system, adds distress to the highly leveraged banking system, and puts pressure on Chinese authorities to “do something.”

Third, the obvious. Prices are dropping. And why does this matter besides a lower sticker price sitting on the balance sheet of a retired couple living in a home they have no intention of selling? Because there are a gazillion homes that have not been completed, and with prices dropping, construction companies are walking away from unfinished and unbuilt homes hand over fist.

Evergrande, the most indebted property developer in the world, declared bankruptcy Thursday evening. Country Garden, another large Chinese developer faces imminent default on their bonds. New homebuyers are retreating. The contagion effect is worsening.

And I will add – you cannot conclude that the psychological conditions leading to all of these economic headwinds are merely related to struggles in the property sector. The entire economy is coming off of a multi-year failure of policy in COVID lockdowns that have surely done unspeakable damage to the “animal spirits” of the economy.

What will they do?

One obvious solution China will turn to is a heavy increase in activity by the state-owned enterprises that do not have to play by the sane rules as everyone else. State-owned enterprises can still purchase land and can still finish projects since they have an unlimited balance sheet. Of course, this assures the death of their non-state owned property sector (one would think) since non-state owned competitors cannot compete. From banks to lenders to construction companies to land acquisition, a greater reliance on nationalized companies versus the private sector seems to guarantee the following:

(1) Economically irrational activity that would not take place via normal market forces

(2) Downward pressure on quality, satisfaction, results, and productivity when a greater portion of the economy is reverted to the government and removed from the incentive system of the private sector

(3) Further distort the problems that are requiring interference by eliminating price discovery, avoiding the healing effects of due liquidations and failures, and incentivizing bad decisions by forcing market actors to act within a system that has been distorted by state activity

But it appears to be a lot more than just a governmental takeover of the property sector on the table.

China’s policy response to this pickle is to assure households that everything is okay. Households get fearful that things are bad because growth is slowing. To assure households that they need not be afraid, state actors do things to encourage more debt. And more debt assures us that … growth will be slowing. Good times. And where have we seen this before?

The manipulation of economic activity to psychologically promote a behavior that goes against the mood and intuition of human beings has a very limited shelf life. It, first of all, usually gets people to do more of what they should not be doing if it gets them to do anything at all. But more than that, it generally fails to get them to do anything at all. A manipulated cost of capital when people feel afraid about the future does not get them to be confident in the future. It just gets them to do something else than they would otherwise be doing, all the while ignoring the underlying issue.

What we have here is a failure to stimulate?

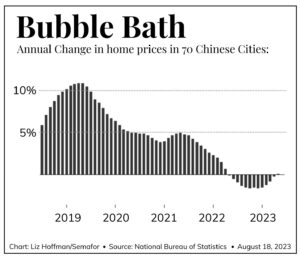

So now we face a situation in which China is either in a deflationary mess, or at the very least on the brink of one. Their year-over-year consumer prices are down -0.3% and their year-over-year producer prices are down -4.4%. COVID aside, the last time this happened was … early 2009 (the debt-deflation bomb of our era), The aforementioned construction jobs that have gone away do not reflect the only job losses – manufacturing and services are weakening as well. If the driver is a weakening property market (and let’s by very, very clear about this – all that ever means is the correction of a property market that was, itself, overheated; people refer to weakening in a property market without mentioning bubble-like conditions that preceded it for no other reason that many American investor’s inability to fathom that property bubbles exist – a dynamic some may call cognitive dissonance).

So essentially the sequence is: Property bubble materializes, property bubble deflates, with that bubble’s deflation comes weakening demand, and with weaker demand comes weaker growth, job creation, manufacturing, and wages. And with those weaker dynamics comes a weaker economy, which means weaker prices, which puts more downward pressure on that which was creating the economic weakening.

So, the logic goes, what is needed in this predicament is … “support” for the asset market whose deflation was starting the domino effect.

Yep. Under this logic, China must “support” the property market, which reflates the assets, which enables less debt default, which cuts off the pain in wages, manufacturing, and jobs, which enables prices to recover, which restores incentive for more production and activity, rinse and repeat.

And here’s the thing – as terrible of an idea as this is, it is highly likely to work, for a season. It seems likely to produce a beneficial response for a period. The worst case is that such a response will be unimpressive and short-lived – a sort of data blip.

But there is a more likely scenario where it really, really seems to work. I would argue that reflation of assets in the United States post-2009 worked very well. A resurgence of activity in the corporate sector out of a violent level of deflation in the household sector (and residential property market, in particular) did, indeed, create jobs, activity, and credit creation.

But it also came at a cost. A cost no one seems to want to talk about. A cost paid for in the form of a trade-off that the people on one particular side of were not given a vote. A generational downward move in growth is a very high price to pay for smoothing the effects of an asset bubble that bursts.

History rhymes

So yes, the knives are out now for China to stimulate. Cai Fang, a member of the monetary policy committee at the People’s Bank of China (PBOC) has asked for policymakers to “put money in people’s pocket” – to do whatever is necessary with policy tools to stimulate household consumption. His recommendation is 4 trillion yuan ($551 billion USD) paid straight to households. As economic conditions for households deteriorate, the pressure on policymakers to “do something” intensifies.

The PBOC is already looking at $50 billion of purchases of auto and consumer backed loans (something our own Fed cannot even do legally, well sort of, pretty much, not really, anyways).

But it is not just financial assets they are buying. They have been buying pork hand-over-fist, where supply overages have crushed prices

But in addition to standard Keynesian logic brought to China on the fiscal side, calls are great for monetary stimulus via rate reductions and credit creation. The logic is nothing new – “create demand by lowering the cost of borrowing, which gets people to borrow, do things, and sort of kind of skate over the thing that was previously contracting credit creation and basic activity.”

I’ve heard this before

When you attempt to stimulate demand for credit by lowering the cost of credit, you do a couple things. First, let’s make clear what you don’t do – you can’t manufacture demand for credit with the cost of it. The cost of capital becomes less and less relevant when demand for credit becomes more and more lacking. When asset prices fall below the amount of debt, lowering the cost of debt does not deal with the problem.

More stimulus and more borrowing cannot heal the real infirmity, which is excessive debt and mispriced valuations. Fiscal and monetary interventions can (and usually do) provide a little sugar high, but inevitably force conditions into more of the very problem that brought them into this mess to begin with – a lack of price discovery, mispriced assets, declining confidence in the future, and a misallocation of resources.

When the problem is too much debt, trying to get people to take on more debt does not work. Regardless of how low the cost of borrowing is, or how low the benefit of saving is (deposit rates), the issue driving decisions is not the cost of capital but the health of the balance sheet. The solution to debt is not more debt; it is less debt.

I mean, really.

Deflation is never a domestic issue

The Chinese Yuan has depreciated 15% to the dollar in the last year, which one think means its own PPI (producer price index) would have inflated by 15%. But instead, despite currency depreciation, its PPI has DEFLATED by 4% !! Now, I ask you, do you think China wants to see its currency weaken even further, because I don’t (remember how much we have talked about their desire to increase its competitiveness against the dollar for global trade purposes). Does Saudi want to sell China oil in a currency that is dropping? Do Asian and European trading partners want to transact with a currency that cost them money the second the transaction is complete? They do not. So China is highly likely to be buying Yuan (and I will add, selling dollars) which tightens its own monetary policy. This is called a vicious cycle.

Now what would the solution be? If the Fed did it for them, of course. The Fed loosening its own monetary policy would likely weaken the dollar and strengthen the Yuan without China having to sell dollars (or buy Yuan). And maybe that will happen (and maybe it will not). But my point is really a lot more simple than it sounds:

U.S. interventions in its own monetary policy have impacted China.

China interventions in their monetary policy impact the U.S. (and everyone else).

All in the name of avoiding the impact (read: vicious cycle) of price deflation, the act a country takes invites another action or response that then necessitates more action. Rinse and repeat.

What happens next?

I think the most likely scenario is that China unleashes massive fiscal support to “support” their economy, and that it is overwhelmingly deemed to be a success (for a time). Housing purchasing restrictions will be softened. Direct government subsidies will be implemented. And some stabilization of the deflationary threat will take place.

I should point out, not all “support” they will give their private sector is a bad idea. I may be opposed to the use of direct payments, cronyism, and subsidies, but I certainly think the removal or suspension of bad ideas is a good thing (call me crazy). Some of their purchase restrictions are absurd. Removing those will help.

But I do not believe a stabilization against deflation will mean a resurgence of economic growth, and in fact, I believe it will damage the cause of growth substantially over time.

What I do not know is how “Japanified” China will go with monetary policy. They have lowered rates twice so far this summer, but in their defense, not to the zero bound. The fiscal side of “Chinafication” will temporarily stave off deflation, I imagine, and maybe, just maybe, they will be content there. But I highly doubt it.

The cousins of fiscal and monetary stimulus love to spend time together. And the lesson of Japan, the states, and Europe, is the use of fiscal to soften the burst of an asset bubble leads to the use of monetary.

And next thing you know, you wake up with 1.5% GDP growth (if you are lucky).

In Dave-land …

What China ought to do is remove all impediments to private sector growth they currently have on the books. All restrictive policies that defy market principles should be set aside, tomorrow. Before any more fiscal support is given, more subsidies, more government purchase of pork, and more stimulating of an over-priced asset market, they should use policy tools to help by removing the policy tools that hurt.

3-6 months later it would be clear how much this has helped (at least directionally). From there perhaps they could turn other knobs. Of course, in Dave-land, China wouldn’t be a Communist country to begin with, but I am just trying to make the basic point – even in China’s own framework they have other options besides what I believe they are about to do.

But no, I think you will see aggressive fiscal stimulus in the months and years to come, and if I were a betting man, I would say aggressive monetary stimulus, too. The end result will be exporting deflation around the globe, and the assurance of sub-optimal growth for China versus the alternative. Lower growth for China could expedite U.S. incentive to de-couple supply chain activities, and it also could increase Chinese incentive to not allow that. That dynamic will be the larger factor impacting the American economy.

Some immediate impact from the initial push to re-shoring. Some immediate impact as China likely throws a fiscal stimulus sink at their problems. Continued geopolitical uncertainty that is not getting resolved any time soon. And our biggest economic competitor potentially taking a playbook from the biggest economic failure of the modern era.

Conclusion

Do not be surprised to see Chinese risk assets catch a bid in the months to come. Do not expect to see China take a more cooperative tone with the U.S. in various negotiations. And do not be surprised if in ten years the term “Chinafication” has surpassed “Japanification” in times mentioned in the Dividend Cafe.

Chart of the Week

The United States has a lesson for those who believe money supply can be increased and non-productive work subsidized as a way of healing a hangover …

Quote of the Week

“I am not young enough to know everything.”

—Oscar Wilde

* * *

I am in the Newport office every day next week. This whole topic may require some “P.S.” treatment so don’t expect this to be the end of it. But the basic theme remains: Markets benefit from short-term distortions, sometimes, the way a pinch of medicine or something to that effect produces relief from pain. Our interest as investors must be in how things are when the pain relief has worn off. In other words, we must be investors, not policymakers, where the agency problem is alive and well.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet