Dear Valued Clients and Friends,

The right thing to do with Dividend Cafe the weekend USC football season is beginning is just replay last year’s edition over and over again, one of my favorite Dividend Cafes of all time … But alas, I have never rehashed old material for a Dividend Cafe since this weekly writing began in September of 2008 and I won’t start now. Fresh and new every week is the commitment, so fresh and new you shall receive (no matter how much Fight On it sometimes entails).

You may have heard that there are other things happening in the world besides USC’s imminent kickoff to their season. As I type Fed Chair, Jerome Powell, is preparing to speak at Jackson Hole, Wyoming. In the last 15 months or so he has raised the federal funds target rate over 5%, something nearly 100% of economists would have predicted would break the back of the economy a year ago. Here we are a year later, and not only is the economy not broken, but markets are not all that distraught, either. They aren’t great. And economic growth is tepid. But nothing has broken. Yet.

But we are not exactly out of the woods, either. And in fact, one could argue that the damage done from the Fed’s tightening has surfaced (or is about to surface) in less obvious ways. And that is the subject of this week’s Dividend Cafe. Maybe the Fed wants to create 7% unemployment (because, you know, more people unemployed brings down prices). Maybe a lot of economists predict that will happen (and were predicting it 18 months ago). But whether economic recession should happen (it shouldn’t) or will happen (TBD), there are certainly other looming problems that warrant discussion. And for that discussion, you will want to jump in to this week’s Dividend Cafe!

|

Subscribe on |

Dead Whale Spotting

So I have never been fishing in my life. I certainly have never been a part of any underwater explosion. I do not understand this analogy or know if this is even a thing. And yet when I read it, I certainly get what Louie is going for … What am I talking about? My friend and a man I believe to be a profoundly insightful macroeconomist, Louis Gave of Gavekal Research, has on multiple occasions talked about interest rate increases as if they are like “dead whale spotting” (his words, not mine). Dynamite sticks go into the ocean, and the explosion quickly kills a ton of little tiny fish that immediately come to the surface. But it takes weeks for those on the surface to see the whales and large underwater creatures surface. They only show up in their weakened state later. Louie’s point is that rising interest rates took their “little fish” to the graveyard last year (bitcoin, ARKK, work-from-home stocks, various shiny objects), but that other “whales” were also likely killed underwater, and we are just waiting for them to come to the surface.

So I cannot attest to the marine biology accuracy of Louie’s analogy, but I intuitively understand the broader point – this kind of violent monetary tightening had a short-term impact with smaller consequences, and it is worth asking what, over time, larger consequences may be.

First, the fishies

So in the above analogy there is a recognition that suddenly rising rates does create some visible damage right away – not necessarily subject to longer monetary lags. I would argue that is what 2022 was mostly about in financial markets. Though none of these things proved to be “whales,” there was collateral damage from (a) rising rates, and (b) the speed at which those rates rose. This was, in my mind, the re-pricing of poorly priced risk assets – what I deemed throughout last year as “shiny objects.” Unprofitable tech companies, highly priced venture capital investments, SPAC’s, solar stocks, electric vehicle fun, the popular fad stocks of 2020 (work from home, plant-based, etc.). In most cases, the reckoning for these areas was absolutely inevitable (over-valuation or bubble euphoria getting his comeuppance is always, always, always inevitable). The zero-rate environment that preceded the Fed’s tightening enabled, extended, facilitated, and expanded the shininess of these shiny objects. The Fed’s sudden reversal of easy monetary policy hastened their demise, but these things were going to revert to the mean one way or the other, as the law of gravity remains a physical law that can only be messed around with for so long.

In fairness, crypto belongs in the list of 2022 fishies from Fed policy, too, but I realize there were plenty of other things that helped end the “NFT” insanity and various crypto exchange scams and so forth. In other words, the Fed re-pricing risk exposed crypto as correlated with risk/tech/Nasdaq/etc. – not as contrary play against those traditional investments – but crypto’s problems last year were so much more than mere Fed rate pricing that I hesitate to treat it like just another fish. Also, the sheer dollars lost (well over a trillion dollars) was not exactly plant-based meat territory, if you know what I mean. At one point many wondered if the Bitcoin losses could be that “whale” event, until markets realized how non-systemic the losses were, with losses quite isolated to the risk-taking speculators, and not contagious across the economy or financial system.

The first false alarm of a whale

If crypto’s implosion was not the first false alarm of this Fed tightening period, the regional bank collapses of March were. I think it was an entirely reasonable expectation to believe that the failure of Silicon Valley Bank and Signature Bank would lead to more damage in the financial system. Indeed, First Republic’s failure just weeks later was a heavy-duty loss. And while it was not in the exact same vein or under the same causation as the regional failures, the Credit Suisse collapse into the loving arms of UBS was a big, big deal. But the isolations of each event prevented each from becoming a whale – the FDIC backstop out of Silicon Valley Bank, the JP Morgan acquisition of First Republic, and the Swiss-orchestrated deal for Credit Suisse to UBS – all resulted in a false alarm, with subsequent dominoes never falling.

The next shoe to drop?

A pretty consensus view is that commercial real estate is the whale to surface of 2022-23’s Fed tightening, and that may be its biggest vulnerability – its consensus status. We simply do not have events that reach code red status when everyone, every single human being you can find anywhere, is already talking about it, and has been for well over a year now. Does that mean it isn’t real? Yes and no.

Commercial real estate does not exist as a monolithic asset class. What drives the well-being of hotel properties is different than what drives the well-being of data centers. Self-storage is unique from multi-family. Office is not industrial and industrial is not retail.

So maybe you’re thinking that certain commercial real estate classes are doomed, yet others are really healthy? Is hospitality (hotels) doomed – after all the two biggest hotels in all of San Francisco just gave their keys back to the bank – two of the biggest hotel failures, ever. But since average revenue per room and occupancy levels are, by and large across the country, at record levels, many hotel investors (including yours truly) have found this to be one of the greatest times to be invested in hospitality.

“Yeah, but office – everyone knows office is doomed – no one is going back to the office!” Well, as company after company after company after company after company changes their mind on poorly-devised remote work aspirations, something else has happened. Rather than take my word for it, go to midtown Manhattan, where everyone said people were not coming back to work, and go to a newer, nicer building landlord and say you want to be a tenant. When you get the rate quote tell me office is doomed. “But low-quality office is doomed, even if better product is not.” Ummmm, okay. So in what world is saying, “the good stuff is good, and the bad stuff is bad” a profound statement about the asset class?

The challenge in commercial real estate is for developers who cannot obtain financing or for those with term financing costs that face a rate reset. Credit markets are almost frozen for much of the new construction in CRE. Private credit solutions work for stabilized assets but not development. How long can the market hang in there without new development?

This whale looms, in that its challenges now are reasonably isolated, but risk coming up to the surface to the visible attention of everyone. I’d throw this out as a front-and-center option if the Fed stays in this posture – broken credit markets for new CRE development.

Globalization gone wrong

I wrote last week about the predicaments China faces. The Fed is having a huge impact there, and it is not because our interest rate policy broke their over-valued property market. Their over-extended economy is asking for monetary stimulus, but their currency has dropped -15% already. They cannot use monetary policy to their benefit without further depreciating the Yuan. The Fed can do their dirty work for them by cutting U.S. rates, giving the Yuan an edge to the dollar, and not forcing China to tighten with one hand while the other loosens. But as long as the Fed is this tight, China is limited in what it can do. The domino effect of what is happening in China is an absolute candidate for whale status out of this Fed era.

Other candidates

Louie Gave also proposed things like U.S. Treasuries and Alternative Energy as candidates for whale status out of this era, but I think there are two reasons to look at both of those spaces differently. U.S Treasuries are not widely owned with borrowed money, and they are principal-protected at maturity regardless of their price fluctuations along the way. Price impairment can absolutely hurt those holding them on a mark-to-market basis (see: Silicon Valley Bank), but I would say that fits into the regional bank category, not a systemic problem due to Treasuries themselves.

Additionally, Treasuries are rallying because of the lack of a recession, not because of economic meltdown. The challenges in Treasury pricing are purposeful and self-induced and tautologically solved by a reversal of the policies causing them. Reverse high rates tomorrow; there are still dead fish (and likely whales) in the water, but reverse high rates tomorrow, and treasuries are, well, all better.

Now, alternative energy is an interesting deal. The global index is down nearly -50% from its 2020 peak, but I see this as a shiny object comeuppance, not a whale. And half of that price correction began before the Fed tightening began. I just don’t see it as a whale.

Never forget

The lesson of history is clear – predicting black swans is a fool’s errand. Surprises come (even exogenous shocks) for all sorts of reasons in all sorts of ways. And what could happen out of this Fed period is not predictable.

And the people learning that in the most painful way so far have been the perma-bears.

Ironic, huh?

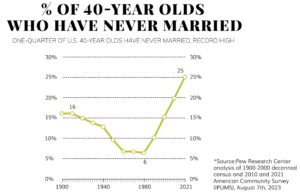

Chart of the Week

Whether it is cultural, demographic, or economic – from consumption to housing to employment – it seems highly unlikely that this is not somehow relevant to all we discuss week in and week out at the Dividend Cafe.

Quote of the Week

“If you are distressed by anything external, the pain is not due to the thing itself, but to your estimate of it; and this you have the power to revoke at any moment.”

~ Marcus Aurelius

* * *

I mention this at the end of today’s podcast and video but for you readers, please note I will be out of the office next Monday through Thursday. I will be bringing you the Dividend Cafe next Friday same normal time and channel, but I will be out of the country with my wife for a few days, and so Brian Szytel will be bringing you DC Today. Until I am back online on the plane Thursday I will not have access to email as for the first time in my adult life (and 22 years of marriage) I am going to be without work and electronic communication. This does mean any emails sent over these 72 hours I actually will not get at all (I get over a thousand a day so we have no choice but to just delete en masse all that come in then, as I just can’t sort through three to four thousand emails on Thursday afternoon. So thank you for your understanding, and I will see you all next week.

Fight on!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet