Dear Valued Clients and Friends,

Everyone loves to talk about the stock market. When it is doing well, people assume everything is great (wrongly). When it is doing poorly, people assume everything is terrible (wrongly). Presidencies can rise or fall based on the Dow or the S&P 500. The stock market is at least familiar to most people, even if they don’t own stocks. It has cultural familiarity on top of investment democratization.

The same is not always true of the bond market, which is interesting since the bond market is so much larger and more important than the stock market. Interest rates, liquidity, mortgages, the currency of a country, and the monies that fund wars, governments, tunnels, schools, and bridges are all a by-product of the bond market.

But I get that bonds are boring. You usually pay around $100 and get back around $100, with the return coming from the coupon the bond paid to you along the way. Yes, you can buy (and sell) above or below $100, but “par” is the world of bonds, and stocks don’t have the ceiling of “par.”

However, the overall world of “borrowing” (debt to one party, credit to another) covers more than just bonds. The “credit” markets delve into the borrowings that exist to make possible homebuilding, homebuying, home re-financing, commercial real estate, small business loans, big business loans, and so much else. Securitizing the debt around car loans, credit card loans, and even aircraft and yacht loans is big business. Credit is not just a “boring” bond market – it is what makes the world turn into a highly robust and active economy. Capital is needed to fund capitalism, and that capital is, far more often than not, “credit” – not “equity” …

Today in the Dividend Cafe, we look at the current state of credit markets and what they teach us about the current state of affairs. Few things are more clear throughout economic history than this: weakening credit markets reflect economic weakness, then create economic weakness. It is a vicious cycle as old as the wheel.

And even the wheel probably had someone developing it on credit …

Jump on into the Dividend Cafe!

|

Subscribe on |

Credit as Chicken and Egg

The most important thing to remember in our economy is that credit serves as a cause and effect, a chicken and egg, a cause and an effect. Credit is used to do productive stuff, and when productive stuff is declining, credit is contracted. There are a few ways credit can go sideways or be spoken of in a negative context.

First, the cost of capital can go higher. A higher cost of borrowing money can mean less borrowing, less profitable projects, and more defaults.

Second, access to capital can become more limited. This is happening now in that there are fewer lenders available for certain commercial real estate projects, for example. But candidly, this is tiddlywinks compared to 2008 when credit just plain shut down. Good projects, bad projects; high rates, low rates; lots of conditions, no conditions; certain categories of lenders (banks, private, funds, etc.), all lenders … the story of 2008 was a story of broken credit markets in the extreme. “Tighter” credit means more onerous borrowing conditions; “frozen” credit means “good luck getting to borrow money.” Access to capital has tightened (less bank lending, more onerous commercial borrowing conditions), but it is not even remotely close to frozen.

Third, a wave of defaults can be a problem for credit. In other words, one may talk about troubled credit conditions not merely in the context of expensive new borrowing or tighter access to new borrowing, but they may mean people who already borrowed not paying back. That is also bad. And that generally happens because things are bad (less economic activity, less confidence, troubled projects, bad investments, extrinsic circumstances, etc.). And you can imagine, if you are a lender and a lot of people you lent money to are not paying you back, you become more stingy on who and how you lend money going forward. So #3 creates more of #1 and #2, as well.

Credit both reflects and creates conditions in the economy.

Ummm, back up a bit. What “freezes” credit?

The systemic conditions where credit markets get really bad – not just incrementally higher cost of capital or incrementally less access to capital – but truly broken credit systems – are almost always a crisis of confidence. In normal times, human actors being rational and self-interested generally can find a “clearing price” – a level at which a deal looks good to be a lender and, inversely, where it looks good to be a borrower. Those terms can sway one way (lender-friendly) or another way (borrower-friendly), but humans do not generally wake up believing free enterprise does not work. It does. And so some people want to benefit from it (as borrowers and lenders), and credit conditions just refer to the terms and prices that go therewith. Our credit markets are one giant and perpetual game of “Let’s make a deal!”

So when a real credit crisis comes, it is a systemic crisis of trust. In 2008 no one could trust counter-parties, and the complexity and inter-connectedness of financial markets made everyone drop their pencils to see who was solvent. Lenders laid off risk with swaps and derivatives but then didn’t know if their counter-parties in those transactions were good for the money, so that meant they may have more exposure than they thought, which meant that they themselves were potentially a bad counterpart to others, etc. In this kind of systemic spiral, a credit crisis erupts. Lending stops. Paybacks often stop. One company that can’t borrow means another company, depending on that company, then suffers, and so forth and so on.

The question before us

We are not dealing with a credit crisis right now, to say the least. Credit markets are not frozen. Life is fine. There are some pockets of tightening access to credit. There is a broadly more expensive cost of credit, no doubt. But credit is not frozen.

The question is entirely one of severity around how tight things are and how tight they get. That will determine the reality of this moment economically.

Bond Bulls Beat Bond Bears (so far)

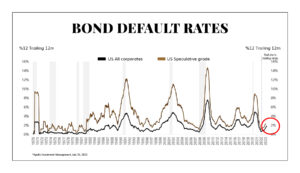

When you look at the listed bond market, actual debt instruments securitized as bonds, both in high credit quality and low credit quality sectors, you see two things at once: (1) Well, yeah, defaults have picked up a little; and (2) But not really. I mean, relative to real periods of credit distress, this doesn’t count as a rainstorm, let alone a hurricane.

Now, that can change. This chart is not done because tomorrow is a new day, the next quarter is a new quarter, etc. Defaults may worsen, but one has to ask why they haven’t yet when we are getting close to 18 months into a Fed tightening cycle, one that has seen the most rapid and violent rate hikes in a generation. The inconvenient truth for perma-bears is that, so far, companies were not impacted a lot by the tightening cycle because they had re-financed debt, extended maturities, and met borrowing needs in the ZIRP period of 2020-2021 (at least as far as bond market borrowers are concerned).

Loans not Bonds

But bonds are a very limited way of evaluating credit markets. If you are large enough to borrow in the bond market (heavy regulations, cost, underwriting, disclosures, presumed liquidity, etc.), you are a mature company at a certain stature in the economy (almost always publicly traded). But the levered loan market is a different story.

Loans are issued by banks to businesses significantly smaller than those borrowing in the bond market. The rates float – whereas bonds have fixed coupons – and “floating” when rates are rising means a higher cost of capital no matter what you borrowed initially. A bond borrower from 2020 got the money and didn’t see the cost go up until maturity; a loan borrower got the money and has seen the rate go up each time interest rates have gone up. Bank loans are the most senior debt instrument in the capital structure, but they are most vulnerable to weakening conditions because they float because the borrowers are more vulnerable and because they usually have conditions and covenants that could be breached even if they are still paying their payments.

In other words, if you borrow $200 million as ABC company in the bond market at 3%, you will pay $6 million per year in interest, and if your profits drop or your business weakens, it really doesn’t matter to bondholders as long as you continue to perform. The prices may rise or fall based on the perception of future ability to pay, but you can’t “call the bond” just because you see the business weakening. All that matters is that they pay. But if you borrow in the loan market, you may have promised in the loan agreement that your total debt payments will stay under X% of your earnings. If your earnings drop or debt payments increase (because of rising rates), even if you are still making the payment, you may have violated the loan agreement.

Think of it like a bank that can take your house if you lose your job, even if you kept making the payments. Fun thought, huh?

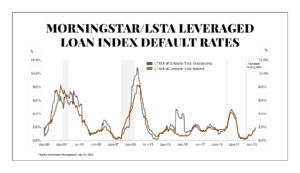

Well, here is the state of defaults for the levered loan market …

Again, it is, so far, a very benign default environment. It can change. It can worsen. But we already saw an explosion of borrowing costs over the last 15 months, and defaults have barely inched and are nowhere near a range considered problematic (yet).

Leveraged loans would not be a problem if their defaults were at the “average” level. That is a tautology. They would be, well, “average.” But, defaults in this environment are “below average.” They have risen (a tad) but remain “below average.”

Volume vs. Defaults

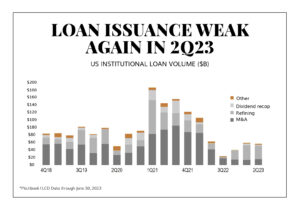

But the low level of defaults only speaks to one level of health in the loan market. Volumes speak to another – that is, not merely “How are loans issued in the past doing?” but “Are new loans happening that can help drive productive economic activity? On that front, things are less sanguine. New issuance is extremely low.

But, M&A is the main source of diminished loan volume (meaning, why few loans are happening), and we have ample reason to believe the slowdown in M&A is in the late innings.

Won’t new loans have to be issued at higher interest rates, you ask?

Well, consider this fascinating bit of information, and tell me if you think the Fed knows it or doesn’t know it: There are $27 billion of levered loans maturing in 2024 (not a lot); there are over $140 billion maturing in 2025 (this speaks to lower rated loan credits).

There are massive amounts of loans maturing in 2-3 years. But not 2-3 quarters. I know this. The market knows this. And I assure you, the Fed knows this.

I believe the Fed’s tightening cycle has enjoyed a free ride of low maturities in this period. The loan market agrees (up +6.9% YTD in a tightening cycle that is supposed to be facing a recession). Do you see my point?

Conclusion

I have more I want to say about credit, but I think we have bitten off enough for now, and I may do a follow-up on this subject in the weeks to come. I am time-constrained with today’s deadline, and I don’t want to go overly deep. I want you to understand the importance of credit in the economy, its role in creating economic growth, its role in reflecting economic conditions, and the current state of affairs (reasonably benign, with definite signs of a very moderate slowdown). The pockets where credit is tighter are, well, less healthy. And this is all known.

Chart of the Week

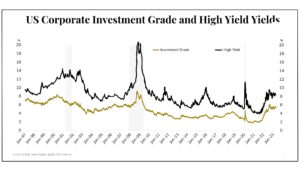

Corporate bond yields are low compared to pre-financial crisis norms and low compared to post-crisis periods of real distress. But they are high compared to the era of ZIRP (zero interest rates), and yet in a period of very few maturities.

Quote of the Week

“People are brainwashed to not realize that so many ‘noble’ pursuits (anything where one is paid with ‘honors’) are zero-sum. And wealth pursuits, outside of rent seeking, aren’t zero-sum.”

– Nassim Nicholas Taleb

* * *

I hope you have a wonderful weekend and find a way to stay cool. I am back in California, speaking at a conference in Napa tonight I will soon leave Newport Beach for, and be back in Newport for over a week tomorrow. Reach out with any questions, and thank you for sharing this Dividend Cafe far and wide.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet