Dear Valued Clients and Friends,

It is the end of 2023, and we are entering the Christmas weekend. I am off to a land far away with my family and am looking forward to spending the holidays in the snow. The calendar year for markets still has a week to go (with the exception of Christmas Day on Monday), and by this time next week, we will have brought 2023 to a close. I will avoid saying anything else due to the never-ending superstition that we money managers live with regarding our ability to make things worse by daring to say something prematurely. Let’s put it this way … I went to the Duke game at Madison Square Garden with my son on Wednesday night, and Duke (my college basketball love since 1990) was up by 11 points with eight seconds to go. My 13-year-old son was celebrating the win, and I scolded him – “It’s not over, son!” You know – that famous 11-point play – what can I say? Better safe than sorry.

Anyways, it was appropriate as we approach the end of the year to reaffirm some of the truly evergreen realities of dividend growth investing. Not only am I committed to dedicating one Dividend Cafe per quarter to this subject (minimally), but I also believe this final 2023 edition ought to address some really important realities in the present state of markets, and our investing philosophy brought to life. It is incomprehensibly fun for me to write on this subject. This subject is embedded in my being. My conversion to the world of dividend growth changed my life many, many years ago. It has changed the lives of our clients (at varying degrees of awareness). It was not merely a professional or tactical change but a deeply ideological one. Ideas have consequences (thank you, Richard Weaver). The belief system behind dividend growth investing is an idea that has had tremendous consequences.

So jump on into the Dividend Cafe, and let’s examine the lay of the land, where dividend growth fits in, and how this applies to our thinking not merely about 2022 and 2023 but for many years (and decades ahead).

|

Subscribe on |

A market celebration

Did you know that the S&P 500 has DOUBLED since President Trump was first inaugurated as President in January 2017? Now, in fairness, it has been seven years, and as those who know the rule of 72 know, a 10% return for seven years is a double. Math is math. But still, the idea that we were at 2,350 or so as recently as President Trump became President and then now at are at 4,700 in the S&P 500 (with, you know, his Presidency, COVID, President Biden’s Presidency, and about 200 new albums from Taylor Swift all in between) is surreal.

It is easy to look at the +28% return of 2019, +16% of 2020, +27% of 2021, and +22% or so of this year (TBD) and assume we are in a raging bull market. And indeed, we are. I prefer to look at history as a bull market since, well, you have to be either a raging idiot or a pathological hater of truth to not see the CENTURIES of market growth we are talking about as anything other than a long-term bull market. But I can respect that not all investors have a 200-year timeline, or 100-year, or 75-year, or 50-year, and we like talking about market cycles in shorter time horizons (some like talking about them in 24-hour market cycles; they are called “bad investors”). If we want to look at “this market” as the one that began with the post-financial crisis market bottom (March 2009) then the S&P 500 is up 13.9% for fifteen years with only two negative years along the way. Yes, that is a bull market.

But there is another mathematical reality that is worth noting. One mathematical truth (the market is up +13.9% for the last 15 years) does not change a second mathematical truth (the market is down for the last two years). Now, that second one is only barely true after the last six weeks or so. A monstrous rip to the upside since late October has created an S&P within striking distance of its all-time high, which came, wait for it, exactly two years ago. Yes, during Christmas week of 2021, the S&P was at 4,800. Here we are today at 4,700.

A market celebration with a lot of opportunities for cherry-picking start and end dates. Two things are true. There have been some really good years in markets as of late, including this year we are about to finish (TBD). And, for an index investor who placed a lot of money in the S&P two years ago and is just now looking at their portfolio, they are down. It’s hard for those people to call it a bull market. Hopefully, you get my point.

But 2024??

Maybe the market goes up another 15-25% next year? If so, it would take an earnings multiple of about 23x (nearly 50% more than its 16x historical average), and it would take the 11% year-over-year earnings growth being projected to get to $252/share from the current $221 level. Again, maybe earnings grow 11%, AND the very high 21x P/E ratio we have now goes to 23x or 24x. So, at that point, the 2019, 2020, 2021, 2023, and 2024 numbers would all leave the 2022 number in their dust, and the geometric mean return would be so robust it would feel like a bull market again, even for someone who entered in late 2021, right?

There is a problem with that, though, besides the fact that I’d be really, really, really uncomfortable betting on both 11% earnings growth and a 23x earnings multiple. It is what comes next. Reversion to the mean is a nasty beast. The. Market. Will. Not. Stay. At. 23x. It can’t. It won’t. And a market that goes from 23x to 16-17x (or lower) goes down a lot. And I mean, a lot. It gives up 2-3 years of return when it does so. And it happens every, single, time, in, history that a market has gotten to 23x earnings.

Once, it went to 29.5x earnings. Then, it went down -50% over a nearly three-year period. That was early in my career. I haven’t forgotten it. How about the Nasdaq? Well, it was trading at like 40 million times earnings in 1999 (okay, that may be an exaggeration, but only because it was actually more since barely ANYTHING in the Nasdaq made a dollar of earnings back then; good times! If a negative P/E had an infinity, it would be called Nasdaq 1999). It went down -80% and took 16 years to return to its 1999 level. I haven’t forgotten it.

So here is my point: It is most certainly NOT that we face an imminent S&P 500 crash. My point is that IF the next year or two goes like 2023 or 2021, THEN we face a market re-pricing that will be bone-chilling. I actually would be very surprised if that happened. And so what happens if 2024 is up +5%, or let’s even say down -5%, or something more “boring” like that?

It means people will have a four-year return in the market of, well, not that much. And that, my friends, is what is called a “flattish, range-bound” market. Big up, big down, some boring, and next thing you know, it is 2025 or 2028 or whatever, and the market has not moved much at all.

Those who spend money

You may be thinking that over the long haul the index does fine, and you would be right. You may be thinking that for someone with a 20-year or 30-year timeline, a decade of flat market action doesn’t necessarily matter a lot, and you may be right. I don’t want flat returns over that long of a period of time, and I prefer to find a way to monetize the market environment I am describing (more on this coming below), but I wouldn’t disagree that it doesn’t have to be fatal for a young accumulator. But there is one financial profile for whom it very well could be fatal.

Those crazy cats (i.e., half of all investors) that, you know, withdraw from their portfolio. Those who need income. Those for whom this nest egg investment pool is their source of sustenance.

It is not true that a portfolio that AVERAGES 8% per year over ten years achieves 8% per year when one is withdrawing from the portfolio. EVEN NETTED FOR THE IMPACT OF WITHDRAWAL, withdrawers achieve 8% with good recovery periods in markets, but less dollars are present because they have been withdrawn. The portfolio’s 8% average does not stave off the permanent erosion of capital if the portfolio is “averaging” 8% when withdrawals happen during prolonged period of market downturn. This is the reason dividends were put on planet Earth (well, that, and to validate the very essence of a profit-seeking company in need of rewarding its risk-taking investors).

Dividends provide the cash that a withdrawer can live off of when markets are down. They avoid the need to eat at the principal base and limit the mathematical efficacy of a recovery. They hold the share count together of a portfolio (corpus) of diversified public equities.

And if you care about such things, they do so at a lower marginal income tax rate than the alternatives, and they do so with an annual raise as the portfolio experiences dividend growth.

But wait, there’s more

What if you are not withdrawing from the portfolio, benefitting from the stability of cash flow and increasing cash that enhances lifestyle even in periods of market downturn? What if you are just an accumulator of capital seeking to optimize returns as you grow your capital base?

Here is the thing – you PRAY for market volatility, choppiness, up one year, down the next (which really, by the way, is up on quarter, down the next two, up the next two, etc. – the volatility of year by year volatility is, in real life, quarter by quarter volatility). This means the compounding of your capital is receiving a never-ending discount on more of your own shares, adding to your capital base regularly, and by definition, often at lower prices, as companies muddle through these market environments.

Accumulators benefit (better opportunistic compounding). Withdrawers benefit (growing income unimpeded by market volatility).

And all with an underlying portfolio with significantly better companies, more stability, and more insulation from the insanity of the day. I mean, does it get better than this?

Macro

Jack Nicholson said in one of the greatest movies ever made, “we live in a world that has walls, and those walls have to be guarded by men with guns.” I would say when it comes to investing that “we live in a world that has uncertainty, and that uncertainty has to be mitigated by companies with growing cash flows” (catchy, huh? Are you surprised that career as a screenwriter didn’t take off?).

I will write for the rest of my career about Japanification, about fiscal insanity, about monetary policy hubris, and about geopolitical risk. Some of these are the permanent conditions in which we live, and some are cyclical, but they color what we do and what we expect as investors. Dividend growth is not immune from it, but it is anti-fragile. It benefits from the interest rate instability, it benefits from market volatility, and it benefits from the higher quality and defensive nature of the mature, seasoned businesses that constitute it.

Conclusion

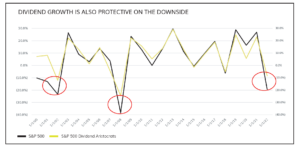

Some very well-managed dividend growth portfolios were up 6-7% in 2022 when the S&P 500 was down nearly -20%. In years of real market blowout strength they may or may not be up as much as the market. But when you can sustain a withdrawal rate, avoid the worst violence of downturns, and, most of all, avoid dependence on the uncertainty of expanding P/E ratios for your financial objectives, you have done something very few investors can claim. It was worth devoting my career to.

Chart of the Week

When defense matters most:

*All data provided by FactSet and Standard & Poor’s

Quote of the Week

“Acknowledging what you don’t know is the dawning of wisdom.”

~ Charlie Munger

* * *

Merry Christmas to you and yours. What a special holiday it is, the birth of all that changed history forever. As we celebrate this glorious holiday, just know that I consider it a gift to do what I do for a living, and I consider it a gift to do it for the people I do it for. The greatest dividends I have ever received are the people in my life, and for that, there is no tax, no carry, and no downside – just the glory of doing what God put me on earth to do. To that end, I work.

The next Dividend Cafe will be our very special annual “Year Behind, Year Ahead” white paper – coming MONDAY JANUARY 8 !!!!

See you in 2024.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet