Dear Valued Clients and Friends,

I did a Dividend Cafe about housing exactly six months ago, focusing then on the dual economic and cultural reality of what was going on in the housing market. I think another six months gone by is a pretty good amount of time to now re-address this vital subject in American life. Housing is, for some, a crucial part of their economic story. Even for those smart enough not to think of their house as a “retirement asset,” it is still a crucial economic consideration. Almost everyone I have ever met needs a place to live, and the ones I met who did not had very odd theories on the JFK assassination. Very few people own an asset with as much leverage attached to it as their home (assuming one puts 20% down they are 4-to-1 levered on the purchase; imagine buying $1 million of stock and only paying $200,000 for it). Housing costs (monthly) from rent or mortgage to property taxes and maintenance and insurance are the highest percentage of the monthly outflow of nearly every single family in America (even many who do not have a mortgage).

Beyond the economic reality of housing, from the silly (it is an “investment”) to the practical (it costs money to live somewhere), there is a deeply personal reality to housing, including for yours truly. People make memories in houses, they associate periods of their lives with where they live, and they form families and social connectivity around houses. And even with all the suburban model has done in a postmodern culture to undermine community, many people’s “houses” are also part of their “neighborhoods” – a Tocquevillian concept we’d be wise to re-affirm. This subject matters.

So today in the Dividend Cafe, I want to “check-in” on the subject. I hope you will find it valuable, but I don’t believe it is super profound. The “numerical” realities are not very controversial right now, other than for those whose commitment to delusion is beyond my help. But some of the “why” behind the “what” is important, and I think we address all of that this week and more. So jump on into the Dividend Cafe.

|

Subscribe on |

A house is a home

I can do this part really quickly out of respect for those who have been reading me or listening to me for a long time. I realize this may be new perspective for newer readers, so I’ll cover it but get it out of the way. In a nutshell, I do not believe a primary residence is, or ever has been, an investment. Most people who tell you their cocktail party bragging stories about buying a home for $300,000 that is now worth $1.7 million or whatever the math (fake or real) is have never done the math. They have not factored in 20+ years of insurance, mortgage interest, maintenance, taxes, and so forth, and whether those numbers are included in the cost or not, the “compound annual growth rate” over these periods of time is, well, really low. Because math. A small number that goes to a big number feels like a lot of profit. A small number that actually has a gazillion add-ons to it is a bigger number. And then, where there is profit over a long period of time, the “compound” effect (which can be attained by anyone with an HP12C calculator) is just not a big number.

And then there is the real problem in calling a home you live in an “investment.” You. Have. To. Sell. It. Now, I remain open to the idea that someone out there might sell a $1.7 million home and go move into a $1 million home – I just haven’t met the person who wants to sell high and then buy low in the same zip code (because it can’t be done). Can you sell in Newport Beach, CA, and buy in Little Rock, Arkansas? Yes. I’ll keep you posted.

And once you have to sell the place you live to realize the investment, you have done two things: (1) Realized a modest gain over time, which is actually underwhelming when you do the math, and (2) Gone homeless. And once you solve for #2, you are, well, back where you started – owning a now more expensive property than you originally paid for.

If this strikes anyone as being anti-housing, you couldn’t be reading me more wrongly. I have a multitude of homes, all of which are used for a very specific pro-housing purpose: To live in, eat in, sleep in, and enjoy my family in. I couldn’t care less about their price in a secondary market now unless I needed to sell them quickly, and as much as humanly possible, no one should ever find themselves needing to sell a house quickly.

I love homes in the sense that I love living. I do not view houses as trading cards.

A great way to start

One wonderful habit to have to go along with this view of housing is to have equity. The need to sell was massive in 2008 because when things hit the fan, there was no equity. Simply put, people had to sell and would take a loss to do so, and some people had losses and so, therefore decided to sell (or walk away). It was a classic negative feedback loop. The upside-down position incentivized selling, and the selling was problematic because of the upside-down position.

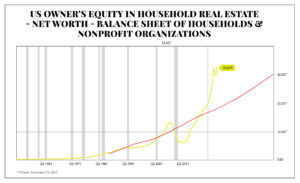

But a very impactful thing has happened since the housing crisis of 2008. People have equity in their homes, making them less desperate, less panicked, and less stupid.

And what this means is that with rates higher, or with questions about the economy, or with various ambiguities about the state of housing, there is more sobriety than panic (and I am always a big fan of sobriety).

Two things explain the move higher in equity since 2013 or so, when equity levels re-reached pre-crisis highs – (1) People couldn’t extract that equity like a piggybank anymore, and (2) Prices went higher. It is, again, math. If the asset and liability both go higher together, there is no gain in equity. If the liability goes up and the asset doesn’t, there is a loss of equity. And if the asset goes up while the liability doesn’t, there is a gain in equity. Math.

I have no idea what happens to the asset price gains of 2020-2022 that took us so far outside the trendline, but I do know that the ability for asset prices to go up without the absurdity of mass equity extraction – new liability (cash-out re-fi, HELOC, etc.) are why we are in such a better macro position this time around.

Affordability

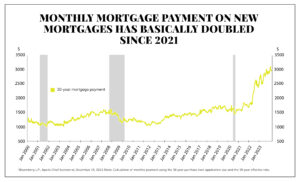

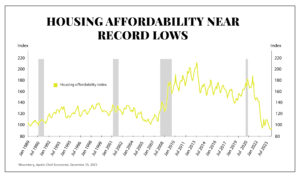

The challenge today is not collapsing prices leading to panic selling in the midst of evaporating (or negative) equity. The challenge is affordability. Prices, or more specifically, the monthly payment, are too high.

The vast majority of Americans buy a monthly payment. Granted, this year 29% of all new single-family residences were bought for all-cash, but that speaks to the very point I am making. The high cost of monthly payment created by a sticker price of the home and a high borrowing cost with high interest rates keeps people from being able to buy. The high equity many have in their homes keeps them from needing to sell. The fact that the average homeowner is paying 3.7% on the mortgage they have on their home while they would need to pay 7% if they bought a new home also keeps them from selling. So, in the end, prices don’t budge, affordability stays constrained, and you end up with this:

Supply is all that matters

What then changes prices and resolves this imbalance in the market is supply. The demand is pretty well set, and the leverage of sellers exists around the current economic reality (high equity, favorable current borrowing rate, etc.). What changes the dynamic is options. More options of where to buy. More inventory. More capital stock of housing. In other words, more supply.

There are no shortage of experts who can opine on why supply is so limited better than I, but I do believe the following factors have to be understood as to why the impasse has not been broken:

(1) Capital markets are constrained. Post-crisis, banks lent less and almost not at all to builders. Banks have not served as risk-takers with builders in the way they did in the 1980s for a long time. Regulatory changes to banks limited capital formation here, and the overall mentality and risk tolerance changed when it came to building new homes. Private equity has played a role in new home construction, and even then, it seems to get people more mad than grateful.

(2) This is perhaps the most important factor in limiting new supply – “NIMBYism” – the “not in my backyard” opposition that is prevalent across much of America in opposing new construction, high density, and general growth of housing stock. Unsurprisingly, places not opposed to new construction are thriving. Places with embedded NIMBYism in the culture are struggling from a lack of supply. It’s pretty simple.

(3) The hurdles of red tape are monstrous. The various burdens to get approvals, to overcome environmental impact requirements, to navigate through zoning and other impediments to new construction limit the pool of builders that can even serve as risk-takers in such a context. Not many can afford to wait years and years with no incoming cash flow before knowing if a project will get approved. #2 and #3 in this list add to that reality.

(4) Finally, there are many policy decisions that may be well-intentioned but create fewer options and, ultimately, higher costs. I could go on and on here but don’t want to politicize this, and don’t think getting in the weeds is necessary. Many cities, counties, and states have added a regulatory atmosphere that has made new housing construction very difficult, very expensive, and very unlikely at the scale and speed necessary to clear the market.

Where we find ourselves

Less nimbyism and less red tape caused some areas to attract more construction than others. Perhaps some of those southeast or sun belt markets are now a tad overbuilt (and in some cases, perhaps not, as job and population attraction have been robust). High interest rates have made the “build to rent” world totally impossible economically. Insurance costs have skyrocketed. Existing homes continue to struggle with “no volume” as buyers and sellers have reason not to budge on price.

Fortunately, purchasing a new home is not the most important investment decision one will ever make because it is primarily not an investing decision at all; it is a lifestyle and personal decision.

And, like with all personal decisions, patience, discipline, careful contemplation, and time are all your friends.

Quote of the Week

“The secret to a happy life is simple. Don’t have a lot of resentment. Don’t spend more than your income. Stay cheerful in spite of your troubles. Deal only with reliable people. And do what you’re supposed to do.”

~ Charlie Munger

* * *

Next week will be the final Dividend Cafe of 2023, as I will be gone the final week of the year in a land far, far away with my family. It is hard to believe we are nearing the end of the year. I promise to save the best for last in the Dividend Cafe.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet