Dear Valued Clients and Friends,

It has been a fascinating week in the markets, with oil tanking, but the energy sector way up; with the markets up and down every day; with some bond sectors rallying, and others selling off. Some degree of non-correlation between asset classes seems to be sneaking back into play, and non-correlation is the hallmark of normalcy. Now, we have a long, long way to go … but there were interesting green shoots this week in each category of economic life we like to cover.

But the various developments in the markets this week are not the full heart of Dividend Cafe this week. The heart of this weekly commentary is how to think about portfolio balance right now, what diversification really means, and what government stimulus and Fed interventions do and do not mean for your portfolio.

So shut down your Zoom, turn off your Netflix, and do your third walk of the dog for the day later. And jump on in to the Dividend Cafe …

Unemployment and re-opening

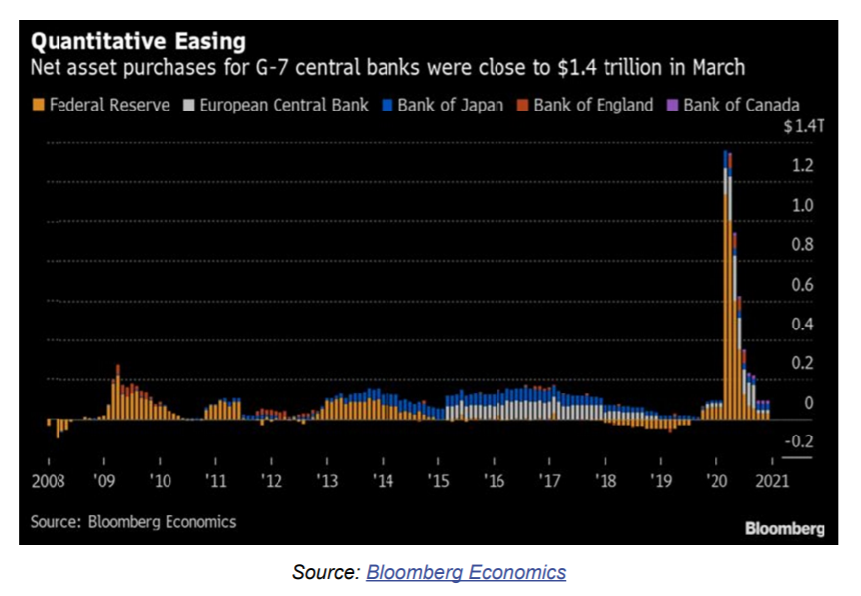

The unemployment claims have piled on – and they are both a human and economic disaster. An unprecedented level of fiscal and monetary stimulus has piled on to try and offset it all (see further down in this commentary). The weekly jobless claims do not cover those ineligible to receive benefits, or who for various reasons may not have filed for benefits. The unemployed in the country since the shutdown began are not less than the weekly claims indicate, but they certainly total something more …

There is not a person I know who wants the country to re-open so stocks can go higher. The reason for wanting the country to be re-opened is so that people can go back to work, receive earned pay, and be productive in their day to day lives. I say a lot that “to that end, we work” at The Bahnsen Group (describing various ends and objectives in the mission of our business). But day to day usefulness and productivity is the end to which our whole society works. We can’t wait.

And that has nothing to do with the stock market or asset prices.

Long-term diversified?

A 50/50 Stock/Bond investor has never had a rolling 10-year period where annual returns were negative, ever. This includes the Great Depression. And even rolling 5-year averages have been positive 96% of the time, with the only exception being in the Depression, and a one month period in early 2009 where the trailing return was -0.02% (for a minute). Perhaps these historical perspectives and reinforcements do not help in the midst of market collapses, but this is a stunning reinforcement of the benefits of asset allocation, portfolio diversification, and re-balancing. (H/T Ben Carlson)

The pause so many must feel

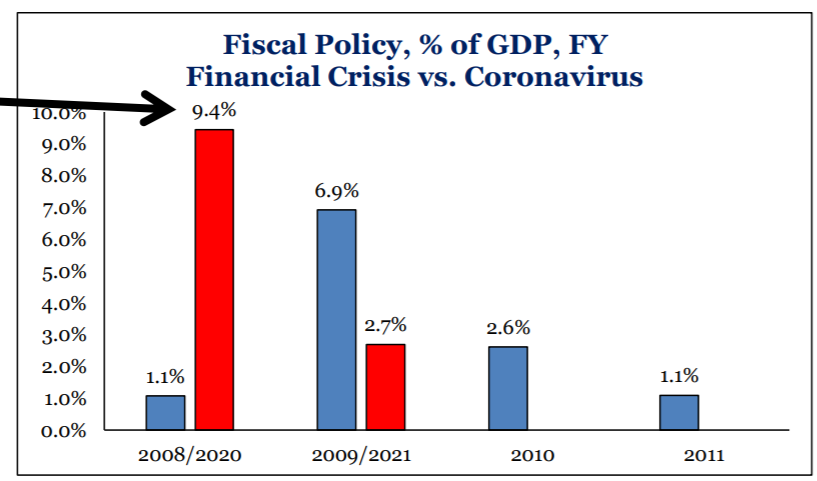

All of the bad news in the economy is real. And much of the fiscal stimulus efforts in the CARES ACT are underwhelming in their efficacy. But the sheer magnitude of the percentage of GDP being thrown at the problem through fiscal stimulus alone, not even counting the monetary bazooka of the Fed, is simply surreal, and surely unprecedented. One can be pessimistic about how this will play out, or they can be optimistic, but they cannot be either from any sort of experience – because this is new territory entirely.

* Strategas Research, Policy Outlook, April 23, p. 3

Dollar-Cost Averaging: Redux

We have two views right now that have to be juxtaposed together to form a coherent application in client portfolios. One is that fixed income returns out into the future (outside of higher risk Structured Credit) will be much less than historical levels while equities are at very attractive levels relative to where things will be on the other side of all this COVID distress. But the other is that, along the way, recessionary conditions and volatility in the economic recovery will likely create volatility in equities.

There are a few ways one might choose to add money from either new cash or re-balanced out of bonds into equities right now:

- All at once – usually the most profitable; always the most uncomfortable

- Tactically – at various points of market distress, adding at those “dip” levels when they occur

- Periodically – eliminating risk of timing error and human intervention by just allowing for a disciplined, systematic deployment over a given period of time (for example: in eight even increments the first of each month for eight months, etc.)

We have generally been tactical in cash deployment, but we believe the potential for a range-bound market around economic headline volatility for the months ahead calls for a more periodic approach.

Voters, Energy Sector, and Saudi

As I continue to study the present state of the oil and gas sector, I am increasingly convinced that the refining sector (downstream) has a lot more to do with where we go from here than the producers (upstream). The thought initially became important to me last week when I considered the level of diesel demand relative to other gas needs in our present economy. But one of my major hedge fund resources convinced me this week that storage capacity is weighing on markets more, and that policy tools are readily available to address it once the right people understand the real lay of the land.

One thing that I wish I had better understood about the initial OPEC+ deal signed Easter weekend is how much in incentivized OPEC countries to flood the market before the end of April. Like the drunk who has one last bender before going to rehab, the deal gave countries carte blanche to really turn the spickets on heading into the May production quotas. And that flooding of oil supply was not vindictive; it enables Saudi to simply export from excess inventories in the production cut months of May and June! So in other words, while new production may come down, exporting from over-supplied inventories need not.

When the demand-side of this saga inevitably improves, the supply-side is going to require greater attention to Saudi. The United States has significantly more leverage with Saudi/Aramco than is being understood, and I believe that if the economic landscape for oil and the larger policy dynamics do not meaningfully move in the favor of our oil and gas industry in the next two months, we will see any number of policy levers pulled (tariffs, sanctions, national security, etc.).

Race to the Bottom

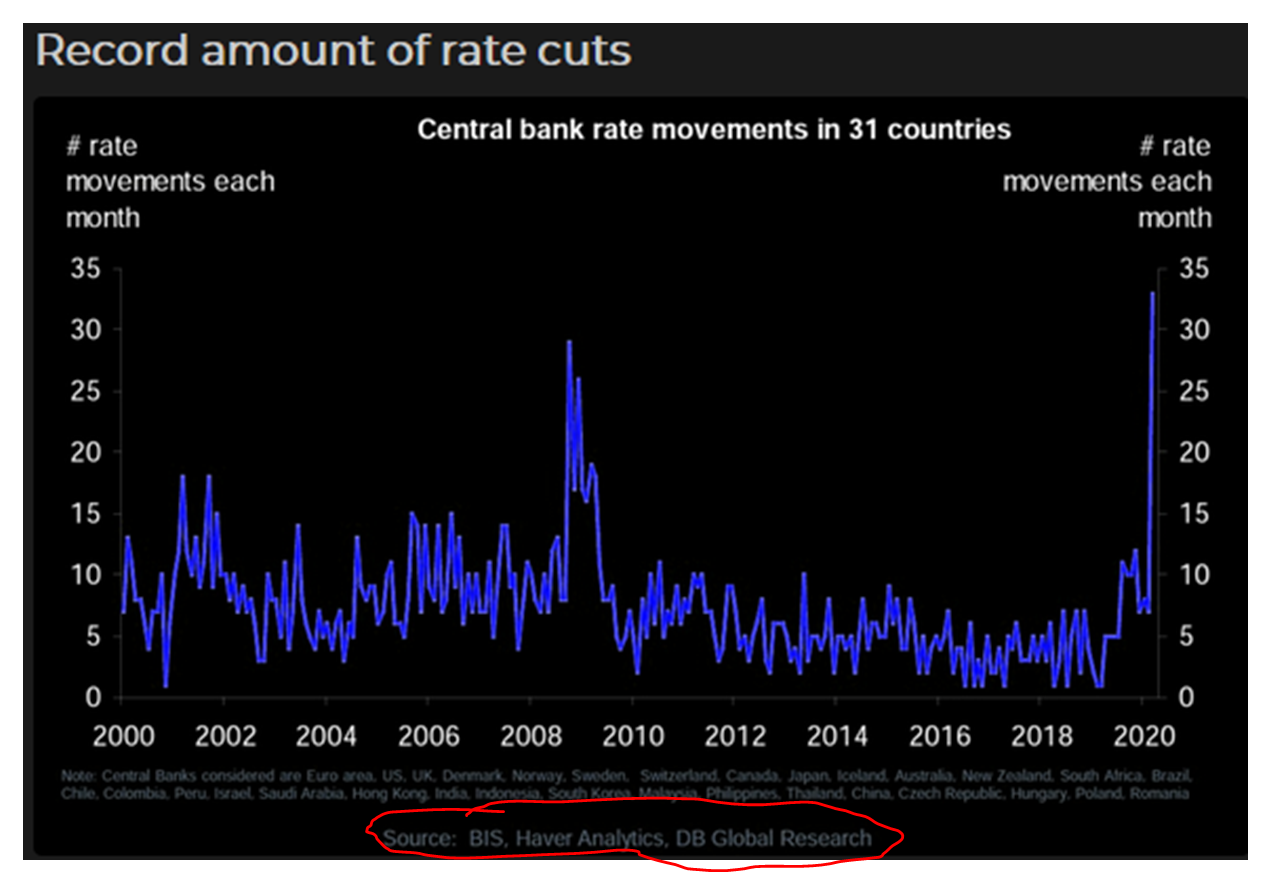

If I had a nickel for every time someone has asked me how the U.S. dollar stays so strong with our Fed being so reckless accommodative, I would have a lot of nickels. But the premise in the question always falls on the same misconception – that currency strength is measured by absolute standards, as opposed to relative ones. Let’s say you believe (with pretty good reason), that all else being equal, our Fed cutting rates to 0%, intending to keep it there for a long, long time, and providing quantitative easing as far as the eyes can see, that it should put downward pressure on the relative attractiveness of our currency. Well, what would you do, then, about the rest of the world? See below. “if everyone is doing it …”

The highway patrol cannot ticket everyone going over the speed limit at once.

Levered Loans or Double Trouble

One of the things at the heart of the Fed’s meetings next week will be the Fed’s approach to collateralized loan obligations that house various floating rate senior bank notes. With or without Fed support, the very high spreads in the very low default asset class indicate (from the historical record) a very opportune time to enter the asset class. But fundamentals are volatile right now, not to mention technicals, and there is no assurance the space has seen its lows. In whatever format an investor takes exposure to the wide spreads in levered loans, one thing is clear: Underwriting matters.

Structured Credit Explained

Please don’t roll your eyes just yet. I fully expect you will end up with eyes glazed over – I just want it to be from the end of the paragraph, not the title itself.

The term “structured credit” can be used to describe assets that have taken a debt instrument, and securitized it for investors. A borrower owes his or her bank money for a home mortgage. When a large volume of those mortgages are bundled together into one pool, and that single pool is sold to investors with various terms and conditions, it has “securitized” the asset (the liability of the borrower is the assets of the creditor), and it has “structured” it into a vehicle that has rules and expectations (secured by contract law). We have understood this concept with mortgages for decades, but the same principle is at play with commercial mortgages, and with other forms of debt (car loans, credit card loans, student loans, etc.).

What the “structure” entails is that the owner of this asset (the “pool” of mortgages, for example) is paid first from cash flows, and has risk last. Should there be a default, there are credit protections, lines of defense, and payment priorities that protect senior people in these credit structures (versus junior people, or equity people, etc.).

The dislocations in various aspects of structured credit were financial crisis level in the month of March. Many have since been repaired (where rather direct Fed intervention was forthcoming). Some have begun repair, but remain wide in their spreads to treasuries. And some remain fully broken, as fear about liquidity and fundamentals and limited optics to the future handcuffs the marketplace.

Defaults do not tell the whole story, because even in the event of defaults, there are recoveries. But nevertheless, the defaults themselves in all sorts of economic cycles speak to the seniority of the debt holders in these structures.

We feel that there are dislocations in the MBS and ABS space that represent opportunity in the right situation. And we are pursuing accordingly.

Fret or Fed

The Fed meets for two days next week, and several revelations are expected Wednesday around the implementations of their new policies and facilities. The Fed’s current exclusion of single-asset non-agency CMBS and AAA-CLO’s from the TALF program is a hot topic. Not surprisingly, the Commercial Real Estate Finance Council is arguing aggressively for inclusion in the new TALF. But so are key members of Congress (see letter), and their argument for private label CMBS and CLO inclusion in TALF 2.0 is gaining steam. I do not have any way to gauge the temperature of the Fed governors whose opinions actually matter, but the scope of Fed support around its current facilities is not fully defined, and represents a mostly-unwatched potential catalyst for capital markets and risk assets.

Politics & Money: Beltway Bulls and Bears

- The political action is all around things POTUS says at his daily pressers these days, so it was nice of Senator McConnell to suggest in a radio interview that “states would have to declare bankruptcy” as opposed to getting support from the Federal government. Speaker Pelosi claimed it would be a line in the sand for the next round of stimulus. I am going to go out on a limb and predict that Round 4 will take a long time, that there will be support to states in it (the level and the mechanism are up for debate), and that both sides will claim victory when it is done.

Chart of the Week

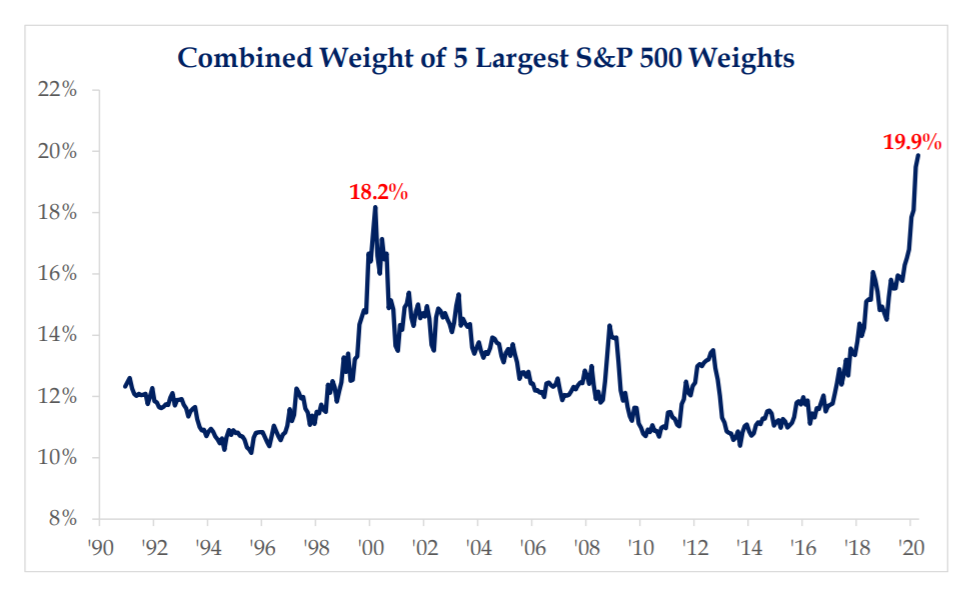

Index investors would be wise to understand that five of the five hundred companies they own are 20% of their portfolio now, allowing those five companies to really pull their index up, or down, depending on how those five are embraced by investors. The “self-reinforcing” mechanism of it is what bothers me – where certain stocks continue going up because of technical flows. The susceptibility to an equally self-reinforcing mechanism the other direction has been a significant reality in the past (see: March 2020).

* Strategas Research, Investment Strategy Report, April 24, 2020

Quote of the Week

“Countries have no friends. Just interests to defend.”

~ Lord Palmerston

* * *

I wish you and yours a wonderful weekend, and hopefully some light at the end of the tunnel of whatever sheltering and quarantining you are dealing with at this time. Please reach out to The Bahnsen Group any time, with any questions you have. To that end, we really do work – from 26 remote locations right now.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet