Dear Valued Clients and Friends,

The week went essentially much as I expected in the markets – the health data continues to point towards marked improvement, but not quite yet a full re-opening; markets did not continue the violent rally of last week, but had some modest volatility both up and down; and the economic data from March was awful, with all eyes and ears focused on where we go from here.

The market is up again on the week, but that comes with some decent-sized up and down days along the way (down 300, up 600, down 300, flat, up 700).

I am very excited about this week’s Dividend Cafe, and hope you will see why when you read it.

- Is life about to change forever and ever?

- Is a “new normal” coming, and what does it mean?

- Will the next 12 months be a bear market or a bull market (from here)?

- What really happened in March at the points of maximum market distress?

- Long-term ramifications of this COVID-19 experience

- And so much more

So jump on in to the Dividend Cafe. I promise it will be a refreshing commentary on markets and the economy for investors who deserve better than the sensationalistic or self-serving garbage often posing as commentary.

Another new normal?

If there is anything I am confident of as we assess what economic recovery will look like in the months and quarters ahead, it is that the behavior of Americans in the public square will be 10x more related to their own perceptions and comfort levels than it will the edict of the day. A lot of people will jump right back into their normal activities (consider me one of those people). And perhaps there are some people that ten years from now will still be walking around in a mask and not going within six feet of other people (let’s just say I find the predictions of a society filled with such to be somewhat lacking in sociological awareness). But in between those two options are the vast majority of people who will make their own judgments, and over time, adjust behavior accordingly. And anyone who sells businesses short on their ability to adjust to these realities, even as those realities incrementally nudge, adjust, and find a trajectory, needs to study the history of entrepreneurial flexibility. Free enterprise is a wonderful thing. So is human freedom and choice. Pulverizing demand erosion has taken place, and different parts of the economy will respond differently. It is not an instantly fixable situation. But to doubt that adjustment will be a healthy part of the “new normal” is to fundamentally miss so much of what is embedded in a free enterprise system. I remember all the warnings of “the new normal” coming out of the 2008 crisis. I remember after the first year of “the new normal” and then the second year and then the third year (I can go on and on) saying to clients, “well, if this is a new normal, I’ll have more of this.” They meant it to be a negative statement, and in fact what they were essentially arguing (about obvious and embedded changes out of the financial crisis) were not entirely wrong; it was just that “the new normal” wasn’t a negative at all for investors. The economy changed; and the ability for market actors and companies to adjust was put on display.

Perma-pessimism will end the way it always does – with pessimists finding something else to be pessimistic about, and optimists talking about their portfolio returns at cocktail parties (no matter how close they are standing next to the people they are talking to). Time and patience matter. But so does an understanding of history, and an understanding of market forces.

Friday, on Maria Bartiromo’s Wall Street

Bull or Bear: It. Is. Not. That. Simple.

The pain and severity of the present economic malaise is not up for debate. The fact that this level of economic distress will not last is also not up for debate. What is not so much “up for debate” as it is “totally unknown” is when some form of economic recovery can begin, what the speed and magnitude of that recovery will look like, and what I would add to the mix, what the attribution of recovery will look like (i.e. how recovery will manifest itself differently in some sectors vs. others).

Around the reality of those uncertainties, some facts and circumstances exist that deserve objective consideration. If one is looking to be positive in their assessment of post-COVID circumstances for markets, the following are not bad arguments to use:

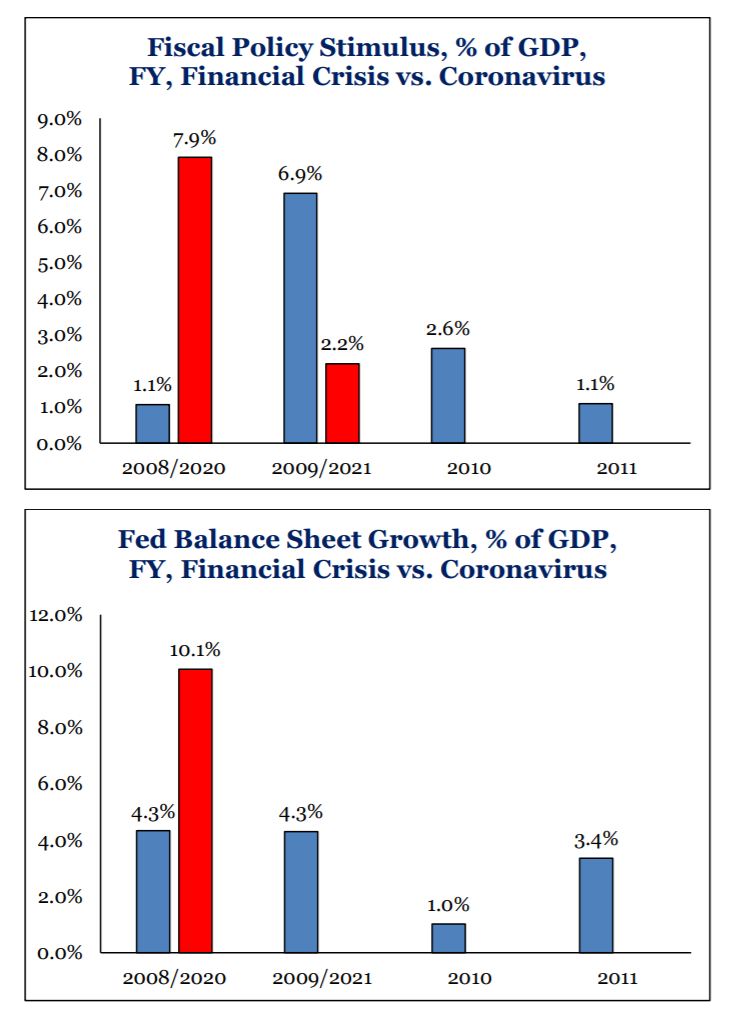

(1) Don’t fight the Fed. Unprecedented levels of monetary stimulus supporting all avenues of financial markets, and putting a huge boost to the risk premium while compressing risk-free returns.

(2) The fiscal stimulus is absolutely unprecedented, and much of it might even prove to be effective.

- * Strategas Research, Policy Outlook, April 17, 2020

(3) What is the alternative for asset allocators? U.S. public equities become the best option when non-U.S. equities look worse and fixed income fails to offer needed returns.

(4) History has been very kind to those who invested in America’s comeback from past crises (the Great Recession, 9/11, Dotcom, 1987 crash, etc.). Profits may need time to come back, but profit margins are at the essence of what corporate America efficiently does.

Now, there are very legitimate off-setting arguments for those taking a more negative approach to the next 3-12 months in markets:

(1) The damage done to the economy, especially small businesses, may have much of the financial damage plugged with fiscal and monetary stimulus, but the psychological damage may take much longer to repair.

(2) The levels the market sold off from in February and March were already elevated valuations.

(3) Consumer uncertainty may be more damaged than analysts can possibly input into pro forma expectations

(4) Could there be a second wave of the virus?

So which way to go?

You will note that the most compelling “bear” concerns are evergreen – that is, they always exist, at all times (this is less true for some than others). Unknowns around aggregate demand, concerns around valuation, and certainly fear of a new, bad thing, are all a part of the risk premia of markets. The key to manage through these uncertain times is the use of the most effective tools capital allocators have ever had:

(1) Asset allocation – weighting of different asset classes (stocks, bonds, alternatives, cash)

(2) Re-balancing – disciplined, non-emotional way to trim gainers and add to losers and maintain fidelity to a risk/reward trade-off

(3) Behavioral modification – selling in peak fear and buying in peak euphoria do generational damage; long-term investors must maintain a long-term focus to avoid getting pushed and pulled in the wrong direction

Understanding March for what it was

The history books will be 100% accurate to report the month of March as the month where a health pandemic fear took over the world economy, where policymakers shut down the economy to try and stave off a growing health concern, and where stock markets declined violently and rapidly. The news, the policies, the macroeconomics, the joblessness, the uncertainty, the health, the human toll – all of these things are just unavoidably relevant and primary.

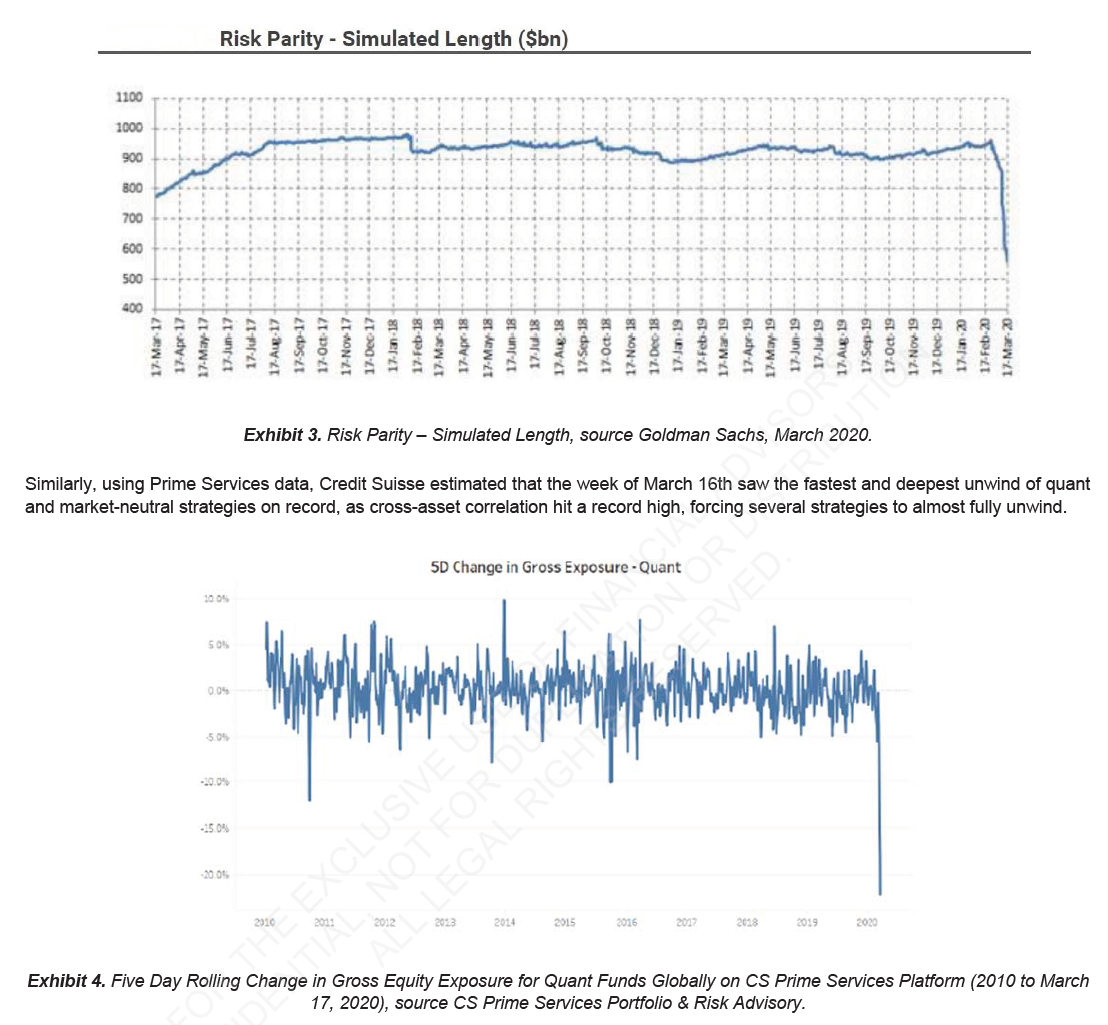

But if you ever want to really understand what happened across financial markets at those peak levels of volatility in mid-March, you simply have to understand this:

Over $400 billion of forced selling took place in risk parity deleveraging alone. And over 20% of net long exposure came off quant strategies in just days. Hundreds of billions of dollars of forced selling in days, not months. This is not merely the “algorithmic trading” of computers the press loves to ignorantly talk about. These were highly levered, multi-billion dollar strategies that saw unprecedented levels of forced selling, taking a fundamental distress event of significance (COVID-19, economic shutdown), and turning it from a market standpoint into a 10-standard deviation event of hyper volatility.

There will be much more said about this in the months ahead. I just don’t imagine it will be regulators or media talking about it.

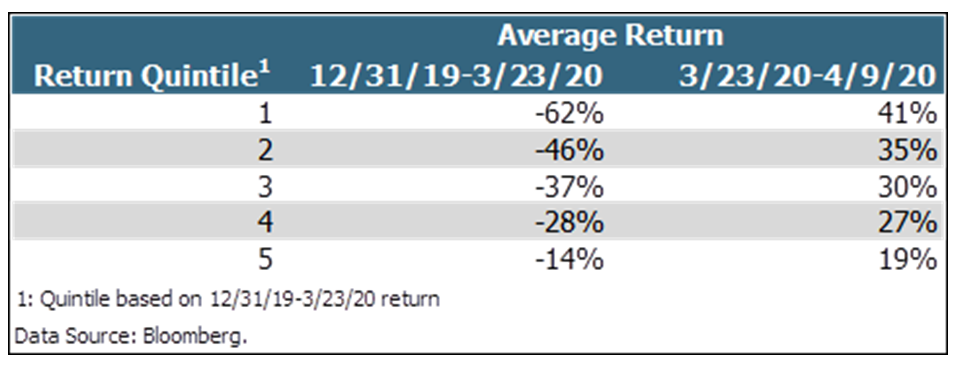

Sounds like active management to me

Last month in the middle of the market mayhem, the S&P/Dow Jones indices decided to not effect their standard quarterly re-balances across their equity indexes. Those re-balances would have obviously added to the low-performing positions of March and taken from the higher-performing positions. Since that time, the worst performing stocks from March are up 41% while the best performing stocks are up 19%. In other words, the broad stock indices would be up a lot more if the standard re-balances had been allowed to go through.

Now, decisions in investing to do something or not do something will always result (with hindsight) with a good result or a bad result. This could easily have gone the other way, too. But my point would be this: Apparently passive investing is pretty profoundly active at times.

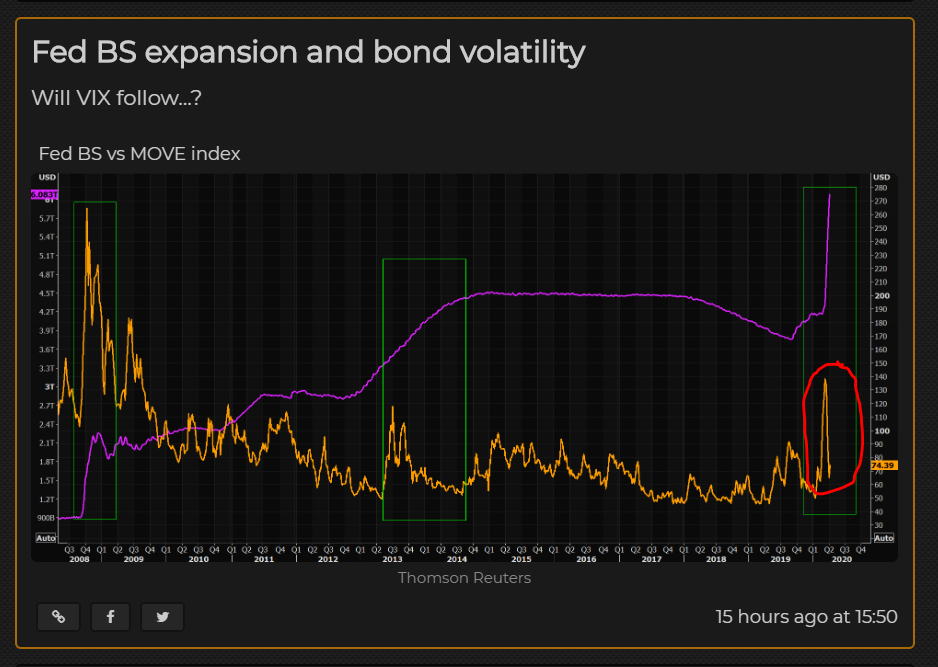

Correlation here is definitely causation

The most significant event in the last couple of weeks in capital markets was the Fed’s intervention in a variety of bond and financial markets. The collapse of volatility in the bond universe is clearly connected to these Fed interventions, and has facilitated much improved normalcy and efficiency.

There is a historical precedent here

This chart will need to stay in front of you in the months ahead. There is a dry powder it speaks to that eventually pursues a Return on Capital.

* Bank of America, MarketEar.com, April 11, 2020

Long-term considerations

We have been inundated since the COVID scare really took over national life with two major considerations, both very short term in their scope:

(1) How long will the health pandemic last here in the U.S., and

(2) When the economy does re-open, how bad will it be, and how long will it stay bad

Both are fair and in fact significant considerations. We have been getting more and more information over the last couple of weeks about the trajectory of the health side itself, though as for question #2, it seems quite difficult to handicap how economic restoration can play out when the economy remains shut down. In other words, we can get to the end of answering #2 at some point after we get to the beginning of answering it, but we aren’t even there yet.

I do believe, though, that there may be some longer-term considerations that warrant discussion as it pertains to financial, economic, and investment aspects of this COVID affair – things that transcend the two questions I have posited above. Some of them may carry concerns, and others may actually [dare I say it] give rise to optimism. But here goes …

(1) A higher savings rate into the future. Now, this is heresy to Keynesians, and perhaps even your own non-Keynesian instincts are saying, “wouldn’t more savings mean less spending, and that hurt the economy?” But that is one of the greatest misnomers of all economic understanding, ever. As a basic economic identity, savings equals investment, period (one cannot invest into productive activity or productive goods if they have not first saved the money to do so). But even the argument that “excessive savings” compresses aggregate demand misses the real point of this society, at this point in history. We do not have a systemic problem of excess savings in America; we generally have a society under-prepared for financial emergencies. An increase in capital cushion provides more systemic protection for individuals and families, but it also provides capital formation which in turn drives more production of goods and productive activities. More savings equals less leverage, and less leverage means a more stable financial system.

(2) Supply chain diversification. I am not offering a nationalist screed here against global economic participation, but I do believe that there is a greater national awareness now of the risks embedded in having key parts of the national interest connected to other nation-state actors who may not share American values. The trade war did not force American manufacturers to re-think supply chain considerations because the trade war was a tax on American consumers, and was predicated on the wrong considerations (zero sum economic fallacy). But a national interest in seeing pharmaceutical and certain technology production be re-onshored is likely to be a significant theme in the post-COVID years ahead. How much of that is driven by national sentiment vs. policy mandates remains to be seen, but my bet is it will be a combination of both.

(3) The European Disunion. We have lived through a couple decades of the consequences of the failure that was the Euro currency, and several nation’s debt crises almost hastened its demise, if it were not for aggressive intervention by Draghi and the ECB within the last decade. But the seeming lack of continental cohesion as different countries were left to deal with the COVID crisis, combined with the limited options economically for some countries to deal with the impact, leaves the future state of the Euro currency further in doubt to me. One or two significant member countries may very well see this event as the catalyst to a full separation, realizing the benefits of taking one’s own monetary interests in-house, just as fiscal interests remain divided now.

(4) Illiquid investments. I believe there will be a greater interest in the future to investments not subject to the realities of forced selling and the obnoxiousness of daily mark-to-market pricing. Where one is less subject to the visibility of price pressures is one thing (I have argued before the psychology there is a real substantive benefit), but here I make a bigger point: Less liquidity means less ability for panic selling to drive down prices. Certain investment categories were not meant to exist in a structure of daily liquidity, where negative feedback loops become predominant.

Politics & Money: Beltway Bulls and Bears

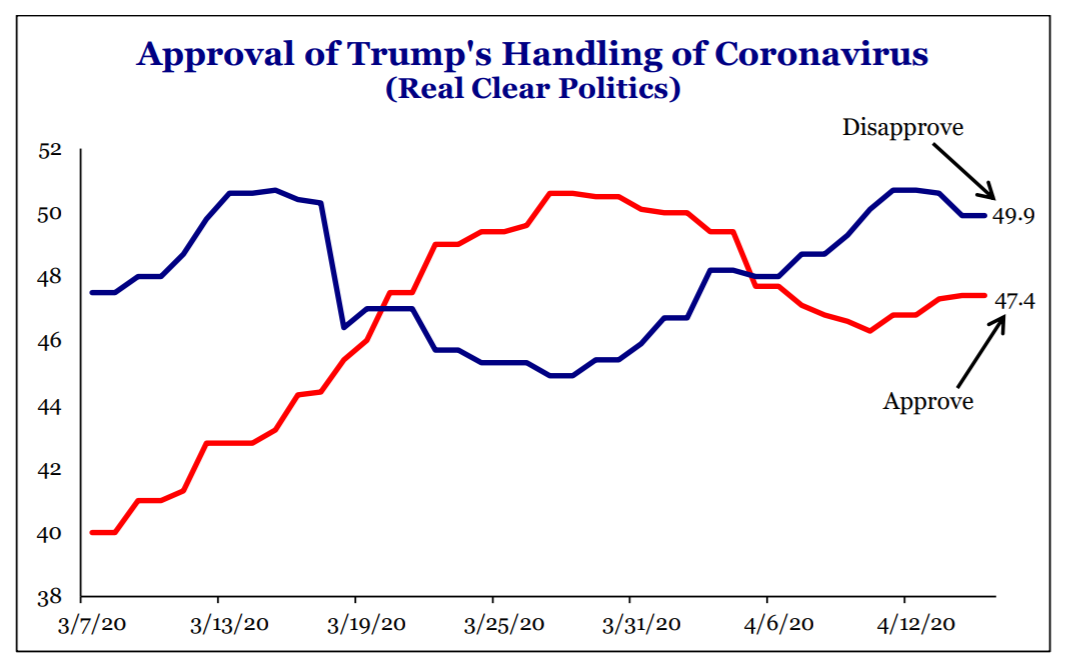

- The following chart reflects the rolling average of POTUS approval rating across a multitude of polls. There are a number of ways to interpret it, and I suspect many are prone to interpret it in a way that aligns with their own views or biases. My take is that it is volatile and almost assured of moving around much more as things unfold. I also believe the daily press briefings often turning into a fight with the press corps is not creating a lot of national endearment or base expansion. That said, the approval ratings were much higher in late March when health uncertainty and market distress were much more severe, a perhaps counter-intuitive reality that reinforces my theory that this may be more expressive of dissatisfaction with the tweets and style of press briefings than particular policies or actions.

* RealClearPolitics poll average, Strategas Research, Policy Outlook, p. 6, April 16, 2020

- I am putting the update on the Cares Act PPP extension in the Politics section because it most certainly is a political animal. Sen. Schumer has indicated there was progress in his talks with Secretary Mnuchin, but I continue to hear that there is little movement between Republican and Democrat leadership. The NFIB, meanwhile, is requesting that the payroll requirement (75% of funds) be lowered to 50% of funds (to still obtain loan forgiveness).

Chart of the Week

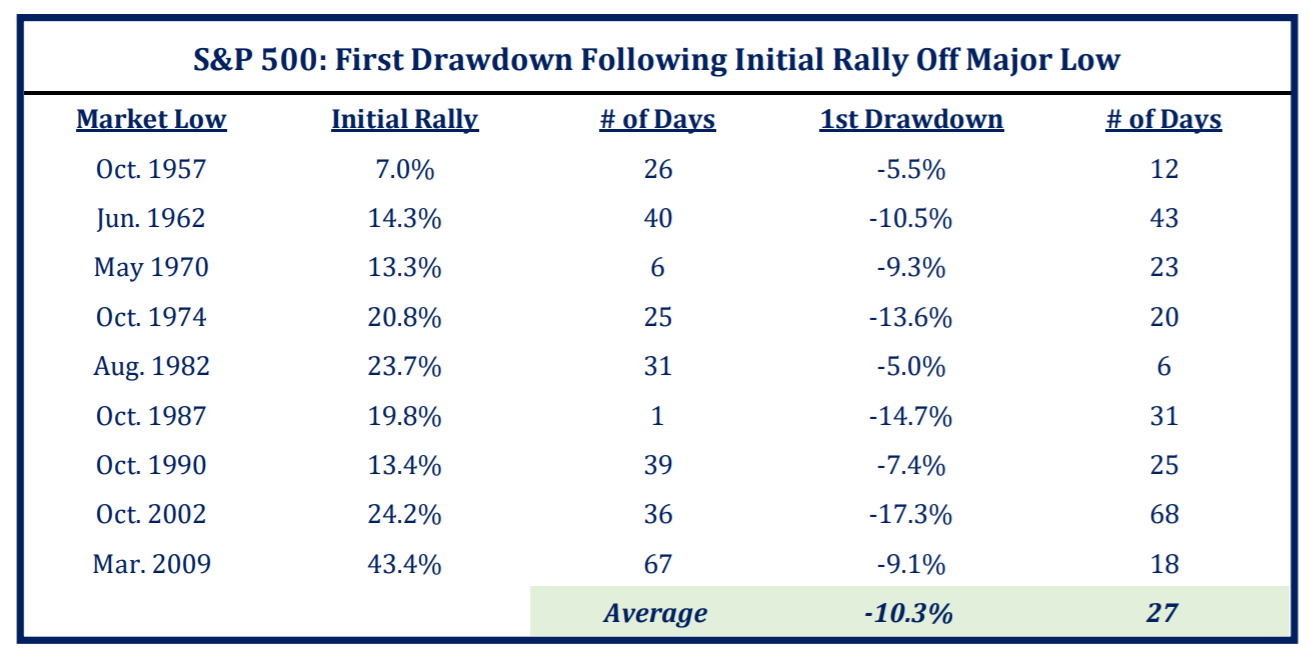

A little history on past market lows, past market rallies, and past interruptions to all of the above. Now, if we wanted to really make a point, we would then add the market rally that followed the draw-down that followed the rally that followed the low … But I am hoping you get the point.

* Strategas Research, April 16, 2020, p. 1

Quote of the Week

“Investors should purchase stocks like they purchase groceries, not like they purchase perfume.”

~ Benjamin Graham

* * *

Thursday’s appearance on Varney/Fox Business

Check out www.COVIDANDMARKETS.com every day for a daily update on COVID-19 health data, public policy discussions, and investor ramifications.

And finally, please note our National Video Call on Monday at 11:00am pacific!

With all that, enjoy your weekends, reach out with any questions, and please, be safe, be well, and be free. To those ends, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet