Dear Valued Clients and Friends,

I really do not know how today’s Dividend Cafe is going to be received. I obviously believe in every word of what I have typed or I wouldn’t have typed them, yet I have found two things to be the case in my efforts at thought leadership in matters of markets and economics:

(1) People sometimes do not like it when I veer off of a stock market focus, and

(2) People do not like hearing what they do not want to hear

The first one is more problematic when it comes to things like the bond market or public policy or monetary policy or alternative investing – the excitement of the stock market sometimes has to take a backseat to other matters that are absolutely integrally connected to it! In other words, one may be bored by a discussion of the 10-year bond yield relative to the thrill of what gyration their stock portfolio is presently in, but any meaningful analysis of stocks is impacted heavily by the 10-year bond yield. In other words, I am never that off subject, and in fact, when it comes to monetary policy, in particular, I think these macroeconomic considerations are the most important investor subject on the table, period, ever.

But the second one is what I am worried about today. In over 20 years of professionally stewarding client assets, I have never seen investors be as emotional about any “asset class” as they are about housing. And if all that meant was “people are nostalgic and protective about where they live” – that would be one thing. But that is not what I mean. Opinions about the residential real estate market are, shall we say, sometimes laced with emotion, sometimes perhaps delusion, and often with various presuppositions that are hard for me to make sense of at times.

Housing is back front and center in financial discussions, and all I want to do today in the Dividend Cafe is make sense of it, and give you some wisdom and insights that I believe will be useful in a holistic commentary of the day. So to that end, I work. We’ll still be friends if anything I say bothers you.

Let’s jump into the Dividend Cafe for a special Housing edition …

|

Subscribe on |

Ancient history as context

I have written a lot over the years about the lessons of the financial crisis of 2008, and reminiscing about the specific events of that era – a defining moment in my life and career – is counter-intuitively cathartic for me. But really, talking through the specific (and historical) events of fall 2008 lacks context if we don’t recall the events of 2002-2006 that made all of it possible.

Biographically, I have always believed the financial crisis was the “fork in the road” of my career as an investment professional. The way in which we stewarded client capital, managed people through the emotions and temptations of that era, and the communication habits formed (out of necessity) all ushered in paradigmatic changes in our business. I don’t think anyone cares that much about our own business growth, but let’s just say that during the financial crisis, I saw advisors hiding under their desks basically all day, every day, and our approach was a tad more proactive. And that worked out well for us, not only in properly serving our clients but in taking the clients away from those advisors who were hiding under their desks. So thank you for your cowardice (they know who they are).

But there is a biographical component to how the years leading up to the financial crisis impacted me and my family, as well. We lived in Newport Beach, California. I had owned two condos in Newport Beach as a single mean, the second of which was the one I lived in when I met my now wife, Joleen. I bought it for $242,500 in 1999. I bought my first condo for $165,000 in 1997 and sold it in 1999 for $204,000. I used that equity to buy this new condo, one with a panoramic ocean view. It was in a wonderful location, a half-mile from my Lido Village office, and I loved it.

But prices kept going higher, even after the dotcom crash of 2000, and I was getting married, had sold my prior business for a few bucks, and was accepted into the training program at Paine Webber for a 75% pay cut from what I had been making for about five years. I decided to sell that ocean view condo for $356,000 in 2001, and go rent for a bit as I went about building a new practice at Paine Webber.

I was now married to my soulmate. I worked 18 hours from 4 am until 8 pm every day building out my business. I had a great firm, was in the career of my dreams, and all seemed wonderful. But this little thing happened through all of the work and home success and happiness …

The housing market went bonkers.

2002-2005

If a 24% gain in two years on condo #1 wasn’t bonkers, or a 47% gain in two years on condo #2 wasn’t bonkers, then certainly what was about to happen to Orange County real estate was, well, bonkers. And when the condo I sold for $356,000 sold for $750,000 a couple of years later, I began to think I had lost my mind.

Now, one could say, “this was Newport Beach, ocean view real estate – what did you think was going to happen?” – but truth be told, the price growth in much less desirable areas than Newport Beach was far more perplexing. And the income levels of people suddenly buying $1 million homes in places like Irvine and Costa Mesa flabbergasted me (that is to say, their income did not seem up to the challenge of their purchase price).

Well, we know how all of this was playing out. Interest rates were low, and going lower, and going lower still, and home equity extraction became a new form of a paycheck. Re-finances and cash-out re-financings became the crypto hot thing of that day. It was all perfect – housing could not go down, it came with an ATM card, and the bars were filled with people bragging about their genius.

Meanwhile, poor old me was building a really growing business, income was great, life was great, and yet, that moment of market prices normalizing seemed increasingly elusive. I fought the regret for years of having sold the condo, though now I do look back on all of it and smile. I wasn’t smiling at the time.

Wrong until you’re right

One of the most important and oft-missed elements of the stories surrounding those who “predicted” the housing crash of 2008 – and by this, I do not count newsletter writers – only those who had money in it such as Michael Burry of The Big Short fame and other hedge funders like John Paulson – is how maligned they were in 2005 and 2006. They were not merely “early” on a call and then vindicated in 2007/2008 – they had to pay gazillions of dollars for being “early.” Their credit default swap trades required collateral and stay good with the house they were constantly having to feed new capital into the trade to stay level on their side of the swap. It was a complex and expensive way to express a point of view, and whole books have been written and movies made about their multi-billion dollar profits when bets against housing paid off, they were deeply underwater in their levered bets for quite some time before 2007.

I ended up buying a house in 2005 when our firstborn son, Mitchell, was born and bought the house in Newport Heights we would end up calling home for quite some time in 2007. But there were many conversations in 2003-05 about the madness of the moment. It did no good to be early. In the moment, people’s beliefs about the future are entirely driven by what they see in the present. It is hard for that to not be the case. I learned a lot about the world and human nature in this period, and candidly, I learned a lot about cognitive dissonance.

Enough about me, let’s talk about you

By the time housing prices fell in 2007 and 2008, I honestly couldn’t care less what the value of my home was worth. I could afford it, I had equity in it, and I was entirely focused on my own business and serving our clients who were being pummeled by the financial crisis. It was hard to care about the value of your home when you didn’t know if Morgan Stanley was going to stay in business or not. But there was another reason why home price dynamics didn’t matter to me personally – I was living in this home, attending church in the neighborhood of the home, putting my kids in schools proximate to the home, etc. because my house was actually a home. Our family lived there (we brought two of our three kids home from the hospital to this home). It was never a baseball card for me, and that mentality of viewing the house as a place to – wait for it, live, and raise our family – came naturally to us.

And through that entire experience – the selling of my condo, the years of real estate going crazy when I was not a homeowner, and the buying of new homes later in the decade – all caused me to learn a lot, to reflect a lot, and most importantly, to study certain things that would become very important in the formation of my financial philosophy on real estate.

I ended up writing a book on the causes of the housing/financial crisis, and I remain proud of that book to this day. I meant what I said earlier – the entire financial crisis-era was a personal, biographical, professional, and ideological watershed moment in my life.

And I believe there are some principles about Housing to share now that may be worth your while.

Enough with the deja vu

One of the most frustrating parts of believing housing prices are due to correct is the tendency for people to associate that belief with a forecast for a repeat 2008. Let me be as clear as can be about something:

Whatever happens in the housing market in 2023 and beyond, it will look nothing like 2008.

The most important reason for that is that 2008 was not, existentially, a housing crisis – it was a credit crisis. As it always is, the leverage in the financial system was the real problem, not merely the impairment of underlying values.

Banks are over-capitalized. The financial system is categorically different (in both good and bad ways). And the basic quality of underwriting is categorically different than the 2002-2006 era of no underwriting whatsoever.

Are there people out there who are at risk in their own situation? Of course. But is that risk systemic as it was in the 2006-2010 period? Not even close. The financial system, the capitalization, the underlying equity, the transparency of where the debt lies, etc. are well known.

So get 2008 out of your minds when you think about the current housing market.

So how should one be thinking about housing right now?

The number one first thing that I believe needs to be said here harkens back to my thinking in 2007 about the house I lived in from then until 2015 … if your purpose in owning your primary residence is to live in your home, to make memories in your home, to raise kids in your home, and if you can comfortably afford the cost of the home, then. who. cares. about. the. supposed. value. of. the. home. ??????

It matters what Zillow says or your neighbor says or what comps show or whatever else if you are planning to sell. It matters if you need the money. It matters if there is some legitimate economic practicality involved. But as a pure cosmetic to what you like to tell yourself, it matters not a whit.

And since so much of this is really about what people want to tell themselves, just do what everyone is going to do anyways … lie to yourself. If your house drops in value, just say it didn’t. Voila. Problem solved. Because saying it is worth more than X is just as practically significant as X dropping in value is when you are not selling – and that is, not significant at all.

I don’t understand the need to connect psychological significance to the value of an illiquid asset, and I do not think economic actors should be concerned about the value of something they own for the purpose of living in. Home values for a primary residence that is affordable and has protective equity are, for all practical purposes, irrelevant.

So that’s all there is to it?

No, there’s more.

I will argue that a correction in housing prices is a very, very, very good thing.

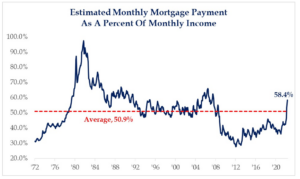

My friends, this is a completely unsustainable thing here:

*Strategas Research, Daily Macro Brief, May 26, 2022

The challenges with housing right now are because it is too expensive. That this seems like a good thing is related to the confusion people have with how asset-rich they feel to how income-poor someone else may really be. One feeling like they have a more expensive asset on their balance sheet is immaterial; one actually spending a higher percentage of monthly cash flow on housing than they can afford is a highly material thing.

A correction in housing prices is no more a bad thing than the increase has been a good thing – it all stems from illogical and incoherent thinking.

What is going to happen

Interest rates going higher are not “going to happen” – they have happened (see the Chart of the Week below).

Inventory is going to come higher (and has finally begun to do so). It won’t skyrocket higher, and may not get to the point of being a “buyer’s market” any time soon. Limited inventory and new construction that is below demand levels still keep the seller in charge to some degree.

But prices calibrate around basic laws of affordability, and that is what is going to happen. Will that mean a 10% correction or a 20% correction or something less or something more? I do not know. But that is the general range I would expect.

Is it local?

Of course, it is. Phoenix is, on one hand, far more desirable now to many people than certain other areas (demand will stay high), but on the other hand, it has seen massive home price appreciation (affordability may need to adjust). The supply and demand fundamentals that dictate housing are not national, and they more or less never are. I understand 2008 feels like an exception. But truth be told, that was not nearly as national as people think either (home prices dropped 50% in the Inland Empire of California, 70% in Reno, Nevada, and 6% in Dallas, Texas – how “national” is that??).

What I would NOT do with the “regional” argument is say, “ergo, my property is not going to adjust.” I would, again, recommend not caring, but the cognitive biases that cause one to believe their home is immune is generally ill-advised.

What to do

High amounts of equity in owned real estate change everything. They change it for the individual and family, and high equity changes everything systemically. The encouragement of low equity home purchases is the mother of all evil here. Buy when you can afford to put real equity down. Don’t buy in 2022 if you feel the need to be a bargain shopper. These prices are not bargains.

If you want to get settled and can afford it, buy now. If you don’t care about the prices fluctuating in an asset you have no intention of selling, buy now. If you feel the need to enter a place that is not quite so crazed, wait longer. Things are going to settle in a calmer and more rational place.

Conclusion

The cultural and social factors that I consider the root cause of the 2008 crisis are what they are. I cannot change these moral preconditions myself, but I do have strong opinions about them. But in the financial and economic realm, I would be prepared for a lot of people – and I mean, a lot – to start bemoaning the tragedy, fear, and apocalyptic idea of softening housing prices. Pay them no heed. They are ignoramuses at best and charlatans at worst.

Our economy does not need a bubble in housing prices any more than it needed a bubble in “hot tech” stocks. It needs rational pricing that is undistorted by the cost of capital and reflects healthy supply and demand realities. We need more housing stock. We need more household formation. And we need less handwringing over the value of our homes.

We need what is coming.

Chart of the Week

The COVID rate dip has come and gone. Congrats to all who re-financed in that period, especially those who extended their rates for the period of time they plan to be in their homes.

*Strategas Research, Daily Macro Brief, May 27, 2022

Quote of the Week

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.”

~ Warren Buffet

* * *

Okay, if you are still talking to me, I hope you have a wonderful Memorial Day weekend my friends! Summer is here. Please reach out any time, and for this weekend, enjoy the weather, your family, your pets, and your home. It is, after all, why you live in it.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet