Dear Valued Clients and Friends,

I am doing three things in the Dividend Cafe today that I pretty much never do. For one thing, I am blatantly ripping someone off (you’ll see; it’s not as bad as it sounds). Secondly, I am getting pretty biographical (though I guess I do that every once in a while; last week being the most recent example). And then finally, I am really focusing on one pretty specific and even granular investment topic. Now that, I do every now and then – but not like this. You’ll see.

So jump on into the Dividend Cafe to see me rip off someone else’s work, talk about a very personal and biographical aspect of my life, and apply it all to a really specific investment lesson and principle – one that should not be missed.

|

Subscribe on |

First, the rip-off

I have been reading Hinds Howard’s MLPGuy Weekly Bulletin for about eleven years, every single week without exception. It was once a free commentary and at some point became a very moderately priced subscription bulletin at Substack. Hinds is the Portfolio Manager of an infrastructure strategy at CBRE Clarion, a Gen Xer like myself (the underrated generation), and a truly enjoyable writer. He also lives, eats, sleeps, and breathes the midstream energy sector. I became a midstream investor under the tutelage of my investing mentor, Lowell Miller, fifteen years ago. I became a dedicated student of the sector shortly thereafter and have read so many thousands of pages on the subject over the years you really would not believe it if I told you. The weekly bulletin from Hinds is a delightful and valuable read.

Well, a little over a month ago he was writing about the midstream energy sector and he told the tale of challenges he has had with his eyesight over the years. He used that challenge as an analogy to the midstream sector in a way that made me think, and now, I am taking that inspiration to tell my own story.

Was Blind but Now I See

Some of you may know that shortly after my father passed away when I was a very young adult right out of high school I was diagnosed with a corneal disease called keratoconus. I had certainly had it before dad passed but we didn’t really know, and it wasn’t something that was interfering severely with the health of my eyes or my vision. I had worn glasses or contact lenses since I was ten years old but I always just assumed I was a regular nearsighted kid. In my late teen years and early 20s, this corneal condition began accelerating rapidly.

Well, keratoconus is not a super rare condition by any means (think of it like a small blister on the cornea that alters the shape of the cornea, and obviously distorts the vision, perhaps severely). But in my case, I was very young to have it, and it deteriorated so rapidly that my doctors determined I would need to have corneal transplants to save my eyes. I was able to use a gas-permeable contact lens to functionally see in my right eye, but my left eye was so severe, and the vision so brutally bad (10x legally blind) that I just learned to live with really unpleasant eye conditions. In 1997 they finally got a donor for my left eye (that’s a story in and of itself), and the transplant happened. I now had a transplanted cornea in my left eye, and even though it hurt like hell every time a suture got loose in the eye, it went well, the cornea was drastically improved, and then in 1999, a transplant happened for the right eye.

It wasn’t smooth sailing from there. I still had nearsightedness, the light sensitivity with the transplanted corneas was severe, but there was no rejection, and as much as can be done from transplants, the keratoconus was removed. I wore glasses and could see okay (not like most people, but so much better than I had for years, that I felt content). But then in 2012, the keratoconus began to re-surface. My Newport Beach eye doctor sent me to a world-renowned specialist in Beverly Hills, and four different surgeries later (two per eye), we at least thought the general corneal stability was vastly improved. My left eye was really, really improved in terms of vision, and the right eye was okay but not great. Light sensitivity was worse than ever, but I could see. And I thought the corneas were now healthy to live a normal life with my eyes even if corrected vision was sub-optimal.

Over the years the eyes would change a lot. Astigmatism would fly higher in one eye and the nearsightedness would worsen a lot in the other. Then vice versa. It was really weird. If you have known me over the last decade or watched me in investment videos or speaking engagements or media appearances, you may have noticed a lot of different glasses over the years. Well, despite my reputation as a true fashion-forward icon (LOL), the constantly changing glasses have not been cosmetically-driven. I have gone up and down with varying degrees of vision functionality, but the key phrase is “up and down.” The very prescription of my needed correction is as volatile as the Nasdaq in 2022 (see what I did there). Significant dryness has been a struggle (I use fifty drops per day), light sensitivity can be brutal, and I have severe blurriness at night time (I don’t drive at night, ever). In more recent years the delta between the right eye and the left eye has blown out to a level that is hard to comprehend (they are just vastly different corrections, which takes really severe adjustment, and for many – not me thank God – it creates brutal headaches). And the correction needed for distance has become massively different from the correction needed to stare at a computer screen, tablet, book, or research paper.

Again, not the end of the world. But not fun. You just sort of get used to the challenges, and I can honestly say I have never, ever succumbed to a spirit of complaining or self-pity about it. It is what it is, as they say.

I have had basically no vision out of my right eye for nearly a year, and really none for six months. My Newport Beach eye doctor referred me to a specialist in Manhattan, where she recently diagnosed such severe scarring in the middle of the right eye cornea that the mystery was solved as far as why vision had deteriorated so much. To me, it was just another development in what has now been a 30-year challenge of ups and downs in my vision BUT, she began a process of using a new contact lens technology on the right eye only (I haven’t worn a contact lens my entire adult life), and then after getting the highly complicated fit right and allowing my eye to adjust to it, mixed it with a brand new correction in glasses over the contact lens, that has brought my right eye from 20-200 vision to 20-30 vision. My left eye is doing great. My right eye now with the contact is seeing the best it has my entire adult life. I have separate reader glasses that allow me to stare at my screens and pages and actually see. And after so much waiting, so much mystery, so much disappointment – I can see.

I am so, so happy. I will have to have a further surgery/procedure to deal with the scarring in my right eye, but the keratoconus is at bay, the corneas are healthy, and after years and years of struggling with the vision, I can see. And that’s enough for me.

What is the point here?

I am sorry to make you bear through all of that, but this is the part I stole from Hinds. I will quote Hinds directly to be as thorough as can be in attribution:

“Then this week, as almost an afterthought, I tried a new doctor who I heard was on the cutting edge in terms of contacts. I walked in with no expectations, and I walked out with a new lease on life. He prescribed me contacts, and he gave me samples to walk out of the office with. The joy of removing my sweater without having to remove my glasses when I returned to the house was incredible. I couldn’t stop smiling.

The midstream sector similarly was given up on. The market stopped thinking about MLPs. But they started working a while back and seems like the stocks will continue to work as long as the dynamics of capital discipline, prudent payout ratios, and of course a strong commodity price backdrop remain intact too.”

The deterioration done to the midstream energy sector in 2015-16 was absolutely brutal. And then sluggish recovery after the violence of the initial energy collapse was even more disheartening. Then, after all of the challenges from 2014 to 2020, the world decides to shut down for a global pandemic and to say that many considered it the final nail in the coffin is, to put it mildly.

It was a long period that had many starts and stops. Much like the challenges with my eyes over the years, the path of the midstream energy sector has not been a straight line up or a straight line down. It has been a series of false hopes, recoveries, unforeseeable complexities, and various effects from external circumstances outside of its own control.

And then one day, it just gets better.

A brief history lesson

The fracking revolution in the United States enabled levels of oil and gas production capacity in our own country no one ever thought possible. U.S. production going from 4-5 million barrels per day to 10-12 million barrels per day changed the world. Natural gas production skyrocketed. The U.S. now had leverage with profound geopolitical implications and an economic growth catalyst that was vital for our nation reeling from the Great Financial Crisis.

But that oil and gas had to be transported and stored. Greater production didn’t mean it would magically get to refineries. And newfound technologies and innovations with natural gas liquids also carried profound environmental and economic opportunities. Simply put, the upstream and downstream components of the energy world needed more midstream capacity to survive. We transported a lot of liquid fuels by truck and by rail (we still do), but it is expensive, dangerous, clunky, unreliable, environmentally dubious, and in all ways, sub-optimal. But pipelines, well they solved for so many of those challenges and gave us a new lease on life. These pipeline companies received fees from the producers to transport oil and gas, and they paid handsome and growing dividends to shareholders like us. What could go wrong?

Then, in late 2014, OPEC decided they had had enough of the U.S. competing on their turf. They brazenly (and mistakenly) thought they could destroy the U.S. shale industry by flooding the world with oil. The logic was pretty simple – OPEC could profitably drill at much lower prices than the U.S. fracking industry could, so if higher supply brought prices down it would hurt them, but not as much as it would hurt us. They were willing to bruise their own heel if they could crush our head. And U.S. energy assets collapsed.

In concert with this 2014-2016 period of high global oil supply designed to kill U.S. shale, a new movement was taking hold designed to really do in the U.S. fossil fuel industry – the ESG movement. Environmentalists either disinterested in or unconvinced of the environmental superiority of U.S. natural gas as a means of electricity production (amongst other things) declared war on the U.S. energy sector. Funds were cut off from pension funds. Grandstanding Congressmen and women yelled at banking executives for funding U.S. shale. Permits were denied for new projects. And intensity was elevated to code red in cultural opposition to U.S. shale.

Good times.

U.S. energy sector rubbed its own eyes, too

It was not just OPEC, Congress, green energy folks, ESG, and so forth hurting the U.S. energy sector. They had overspent, overborrowed, and failed to build capital cushions needed to deal with cyclical challenges. When capital markets cut off midstream from raising new equity as a means of funding growth, they pretty much were unable to grow (debt as a means of funding growth was simply not possible with the already levered balance sheets).

And then COVID happened.

What some meant for evil, others meant for good

The reality of the COVID pandemic may have felt like a death knell to the energy sector in 2020, but somehow, someway, much like a new corneal diagnosis and novel approach of a specially-designed contact lens and glasses, it produced a completely new approach. It created a love affair with “capital discipline.” Midstream companies beefed-up capital, organized plans for distributions around sensible economic logic, sold unproductive assets, and reset expectations for investors. Companies that had been distributing cash to shareholders without the cash flow to service the distribution stopped doing so. Governance that had been lacking was improved (more shareholder-friendly dynamics between limited and general partners). The industry went through an existential moment.

They were blind, but now they could see.

Caveat

Look, not all midstream operators were equally reckless. Some were always more disciplined than others and that is still true now. But the improvement the industry has gone through has been rapid, amazing, beneficial to all stakeholders, and most importantly, has changed the sentiment of investing in the space entirely.

The eye exam

The indexed measurement of the midstream world is up 160% since its COVID collapse. But more importantly, it is up +25-30% year-to-date as broad equity markets are down -15 to 25%. The strategy we helped inspire for actively managed midstream exposure is up +51% since it went live 15 months ago, not including its cash distributions (rapidly growing as they are). The entire apparatus just simply changed.

The path ahead

As Hinds said above, capital discipline is still needed. Reasonable and responsible capital ratios must be maintained. The overall sentiment of the U.S. energy sector will matter. But I am confident in all three of those things, and believe by any rational measurement (yield spreads, earnings multiples, Free Cash Flow yields, etc.) the sector is still incredibly attractive.

Just as my eyes have never really had a predictable and sustained period of consistency, there will be bumps and bruises along the way. But a sector that just wasn’t working for a long time suddenly is working.

And this is a beautiful thing to see.

Chart(s) of the Week

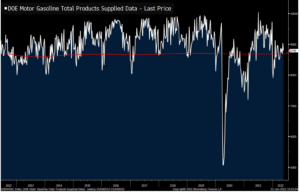

The demand side of gasoline (weekly consumption) going back ten years (DEAD FLAT):

*Bloomberg, June 2, 2022, Boock Report

The price of gasoline in the same period:

*Bloomberg, June 2, 2022, Boock Report

No one would dare claim with a straight face that fiscal or monetary policy pushed up the prices of oil and gas over the last two years; this is a massive supply-side failure (and in my mind, one with multiple fathers – from Biden administration policies to curtail production, to the ESG world’s demonization of that which feeds and warms and transports us).

If Energy inflation is so clearly and indisputably a supply-side phenomenon, how can we better understand other price inflation components? Food for thought.

Quote of the Week

“The more difficult the victory, the greater the happiness in winning.”

~ Pele

* * *

Enjoy your weekends, and thank you for suffering through this personal diatribe. I hope the message of it is understood. And I hope the great midstream operators we invest in will never forget the lessons that brought us here. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet