Dear Valued Clients and Friends,

I wrote the majority of this week’s Dividend Cafe before the news had broken that President Trump and First Lady Melania had tested positive for COVID. We wish them a speedy recovery, of course, but don’t have much to say about “market implications” of such, other than the obvious – more uncertainty, more volatility. I will hold off on political and market implications for a few days, for obvious reasons.

There are lessons from the COVID era that will stick with us forever. Most of them, mind you, if not all, were not new lessons – they were reminders – reaffirmations of timeless lessons and principles. I am not sure the way we were reminded of some of these lessons felt familiar. Markets do not often drop 36% in 31 days. But these general principles all held true, in spades.

In this week’s very important Dividend Cafe, I am going to write about some of those lessons (not all of them), and transition that into an opportunity to MAGNIFY what we believe at The Bahnsen Group, what we are doing now, and how we are using the COVID moment to optimize client portfolios for the years to come, all by just MAGNIFYING what we have always believed.

This Operation Magnify that we have been developing for months is both a proactive and reactive process. We want to take new realities to their logical conclusions and apply them into an investor’s portfolio, and we want to create an entirely consistent process and infrastructure by which we assess and administer this on behalf of our clients.

If you are not a client of ours, it really doesn’t matter. The moment you are living in is a moment of paradigmatic change for investors. Viruses and the risk of viruses have always existed. “Tail risk” events that shock and awe markets have certainly always existed (and always will). But there are fundamental realities that have changed – many of which were well under way pre-COVID, I assure you – and the discussion in Dividend Cafe today is useful even for those not under our care.

Re-visiting assumptions can be a healthy thing even when nothing has changed. I promise you that I will be washing my hands more post-COVID than I did pre-COVID, and that will last. I promise you that an appreciation for general health (particularly as we understand the primacy of obesity as a co-morbidity in really lethal COVID cases) is something that will last. But the good habit of hand-washing existed before COVID and the bad habit of an excess BMI existed before COVID, too. What COVID has done for many is just re-magnify some timeless necessary realities and practices.

The same is true of your approach to investing, and that is where we are going in today’s Dividend Cafe.

Let’s start with a basic summary of some key realities we learned or re-learned in the COVID moment of March:

(1) Equity market investors live with the perpetual reality of violent downswings, as bad fundamental news can create downward pressure, and downward pressure can technically build, the results of which create more bad fundamentals, the results of that resulting in even worse technicals. This “pile on” effect is as old as equity investing itself, and cannot be replaced.

(2) Correlations skyrocket across asset classes when severe distress hits markets. “When you have to sell, you sell what you can, not what you want to.” So even non-correlated money-good assets like municipals, corporate bonds, and mortgages can break down when selling pressure escalates.

(3) Timing a bottom and re-entering into a recovery is the best way you will ever discover to miss about 40-50% of the recovery, and that is if you are lucky. The most significant part of a market recovery takes place at the very, very beginning, and that beginning is often way, way sooner than the economic recovery begins. Market timing around these realities is folly.

(4) Every significant down-draft feels like it is the fatal one. None of them are, but all of them feel like it at the time.

(5) A highly leveraged financial system exacerbates all of the things I discuss in #1-4.

These are by no means the only five things we re-learned during the COVID mayhem of March. But I am taking those five realities and building from there …

Getting more particular out of COVID

Each of the above principles and realities are timeless. They have always been true and always will be true. Some of what is driving Operation Magnify is particular to this moment in time, though. What happened out of the COVID moment that is especially noteworthy and actionable. I will offer up five things:

(1) The Federal Reserve ran back to a Zero Interest Rate Policy in a heartbeat. They had spent a couple years (2017-18) getting off the zero bound of the post-financial crisis era, and in one second they ran right back to zero interest rates. But this time, they also drove long-dated bond yields down – with a ten-year at 0.6% and a thirty-year barely above 1%. After the financial crisis, even as the fed funds rate sat at 0%, the ten-year was still well above 3% and the thirty-year above 4%. This flat and 0-1% range across the yield curve requires a different understanding of bonds and of how all risk assets are priced.

(2) “Credit” and “Boring Bonds” have nothing in common other than both offering a maturity date. Consider the following when we look at, say, high yield bonds or bank loans or structured credit, versus Treasury Bonds:

Credit – high income

Treasuries – no income

Credit – high volatility

Treasuries – no volatility

Credit – correlates to equities in distress

Treasuries – reverse correlates to equities in distress

That most bond investors have these two sub-asset classes in the same bucket or silo of their portfolios is foolish, misleading, confusing, and distortive.

(3) Alternatives did their job, which is to say, they offered a different set of risks and rewards than were offered in traditional stock and bond markets. Some alternatives performed remarkably well, some performed well, and some outliers disappointed. But if their job was to alter correlations, they did so. More importantly, the Alternative space is more important now with high equity valuations and low bond yields and few choices for portfolio diversifiers.

(4) Dividend Growth really, really did its job. This is hard for some to swallow, because dividend stocks went down like all stocks did, and in fact, a couple energy stocks and shopping center REIT’s really went down. But the goal of the dividend growth world is two-fold during periods of severe market distress, always and forever:

- To offer continually growing dividends to use for reinvestment at lower prices for accumulators

- To offer continually growing and steady, reliable income for withdrawers

Both things happened, and in the case of the latter – the truly vulnerable investors – retirees and withdrawers … Well, they saw 70 dividend cuts in the S&P 500 and a ~4% reduction in distribution/income year-over-year from the index, and a huge reduction in yields in the bond market. But with dividend growth, price volatility did nothing to their income, which grew in the face of economic distress and income reductions all around them.

Dividend growth’s theses, properly understood, were magnified in the COVID moment, period.

(5) Illiquidity was rewarded. Investors can’t sell what they can’t sell, and when many assets were punished for no other reason than the fact that they could be sold (see above reminders), those assets that could not be sold benefitted from maintaining pricing that was connected to fundamentals, not the mark of the last panicked sale.

What does Operation Magnify mean here?

So when we take the lessons we were reminded of from the COVID moment, and the particular takeaways from COVID, we wish to apply these combined things by Magnifying our timeless principles with a particular application to the moment. We saw the following as very important questions to ask and key takeaways.

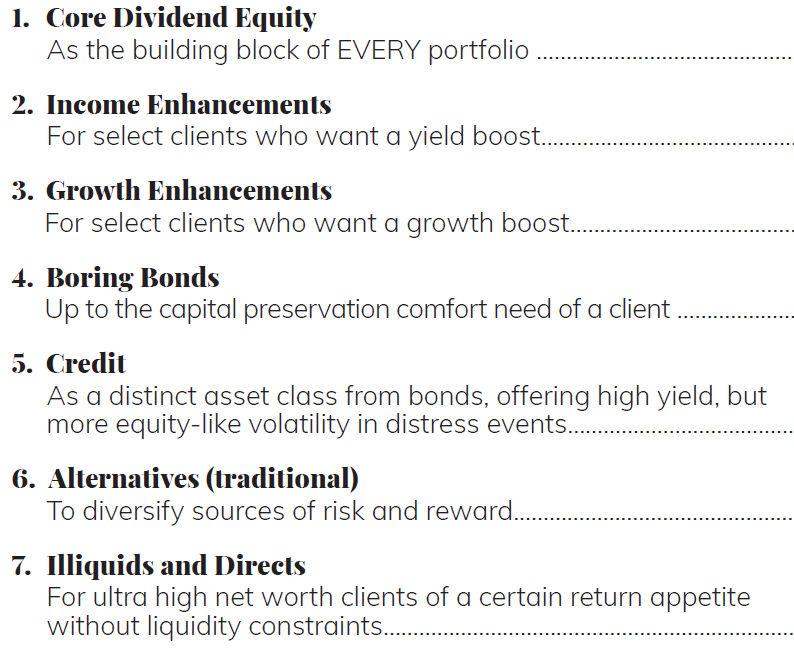

First, our SEVEN BUILDING BLOCKS IN EACH PORTFOLIO are now separated and categorized as the following:

We would start by asking (or re-asking), what is the amount of “capital preservation” you want in your portfolio, knowing it will not include even moderate income or risk mitigation any longer (i.e. “Boring Bonds”)? For some, that allocation will not change. For a few, it may even go higher. For many, it will go lower. But acknowledging that two of the three benefits of “Boring Bonds” are off the table for the time being means re-thinking that allocation. Once that is set to the right comfort level, with an appreciation and calculation for what its impact is to lifetime income and return, then we can move on to the remainder of the allocation.

The income need, the total return aspiration, and the tolerance for volatility have to determine the allocation for Core Dividend Equity – the key building block of the portfolio.

Once that healthy allocation is set, we can ask if there is a need for an enhancement to income (those needing high cash flow only). We can also look to credit, recognizing it as a diversifier and income-enhancer in most times, but as a risk enhancer in times of real distress.

For others, we can ask if the risk profile calls for an enhancement to growth (those who can stomach the volatility and want that octane in their portfolio). We won’t do this thoughtlessly, as many advisors and investors do. We are looking to bottom-up, company-driven, truly price-disconnected opportunities in Emerging Markets, in Small Cap equity, and in true Innovation and Disruption – not stale, over-priced names driven by popularity and familiarity.

And finally, we look to increase exposure to alternatives, subject to liquidity needs, cash flow needs, and total risk tolerance. We primarily see an increase in alternatives coming from a decrease in bonds, as we don’t believe most investors need a decrease in their equity allocation. But on a case by case basis, the time has come to Magnify the benefits of alternatives, and recognize the “no good option” policy has produced. One can take the lower returns the zero rate environment has created, or they can take the higher portfolio volatility replacing those bonds with stocks will represent, or they can take the different risks that increased alternatives will present, without elevating equity beta, and without succumbing to the zero rate reality in Boring Bonds.

There is so much more to say here, but Operation Magnify requires a re-visiting of one’s risk appetite, a gut check on volatility comfort, and most importantly, a true process and deliberation with your advisor to re-consider and optimally allocate across the seven building blocks of a thoughtful and elegant portfolio.

*********

A few other odds and ends …

Coloring it in even more

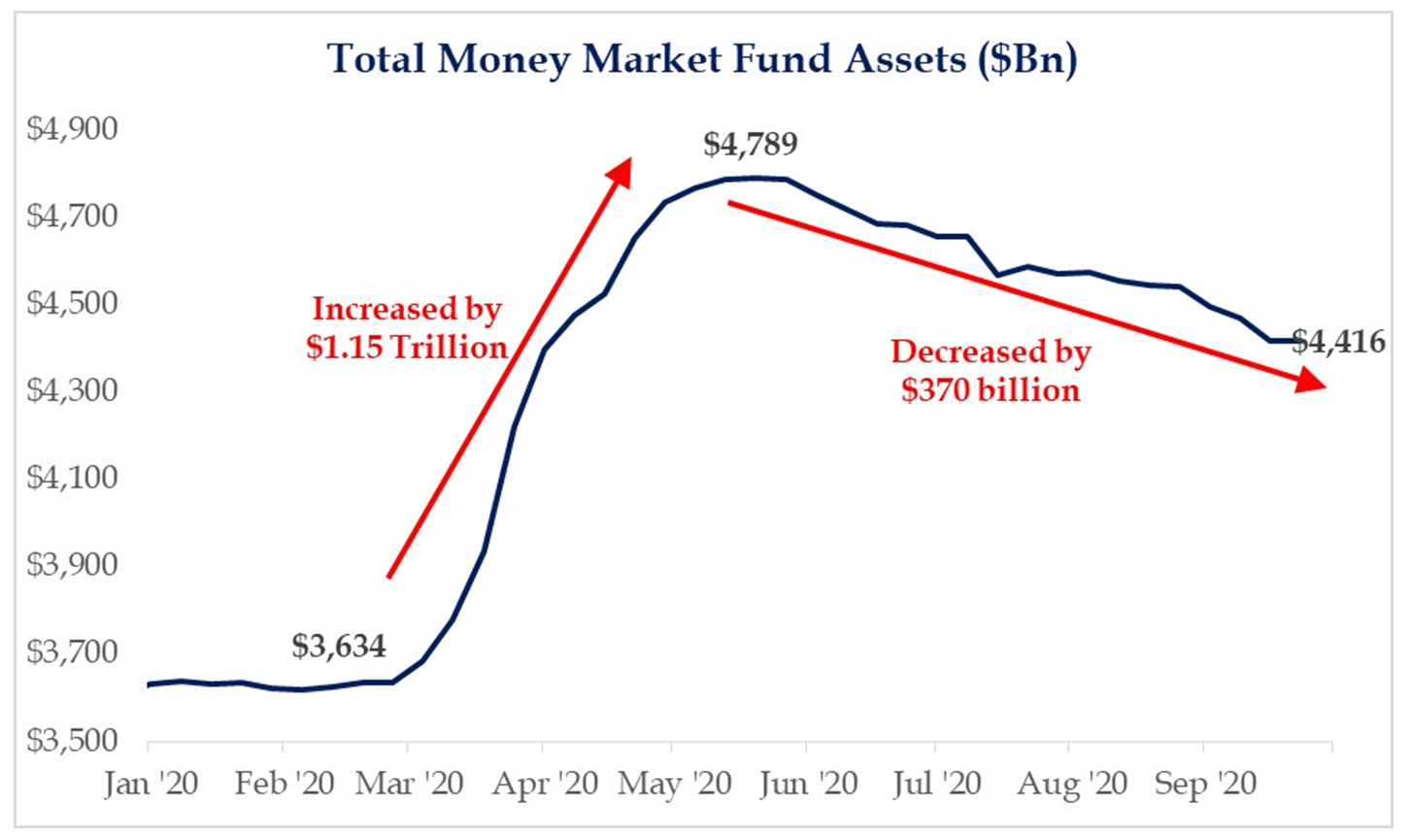

I thought this chart provided even more color than what I included last week about the high levels of cash still on the sideline during COVID. When we talk about money market levels that were near $5 trillion, it really doesn’t tell us anything, because we had $3.6 trillion (or so) for quite some time before COVID. Standard fare. But the jump an additional $1.15 trillion was anything but standard, and the $370 billion since re-deployed out of cash (stocks and bonds) happened quicker than one would expect in normal circumstances. Yet the “excess” cash remains ~$800 billion, so the story is not done.

*Strategas Research, Daily Macro Brief, Sept. 29, 2020

Energy Complex Value

If the factors that keep energy companies from receiving rational valuations are sentiment and various ESG/social constrictions, there is, of course, one solution that would take all that pressure out and allow unbridled value realization – a private equity take-out.

Economic Update

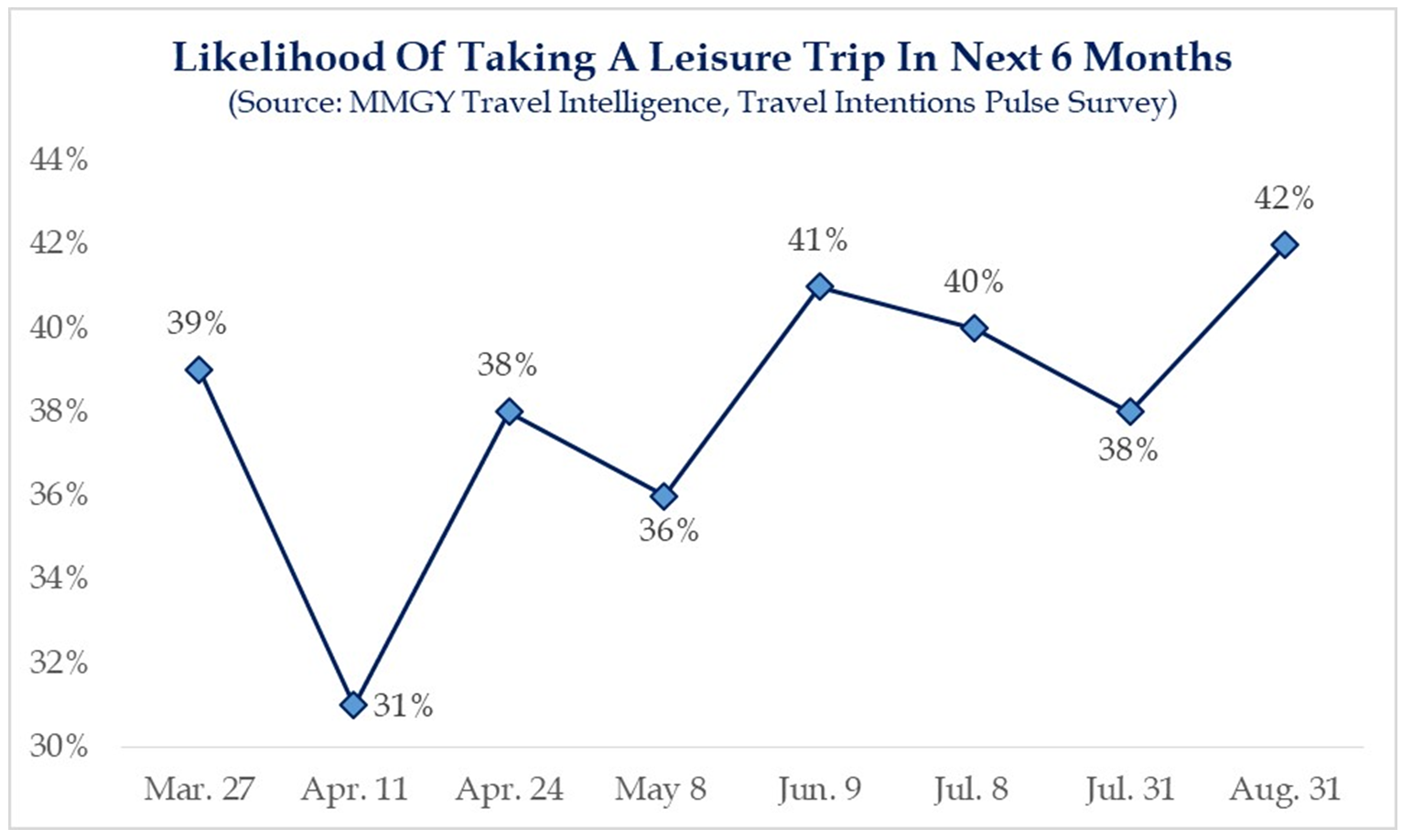

Reliable travel surveys are beginning to show significant pent-up demand for vacation travel. I would expect this number to increase even more as more travel restrictions are lifted.

*Strategas Research, Daily Macro Brief, Sept. 28, 2020

Air travel remains down 60-70% and yet business travel has still been very anemic, so that looms as a catalyst to a significant move higher.

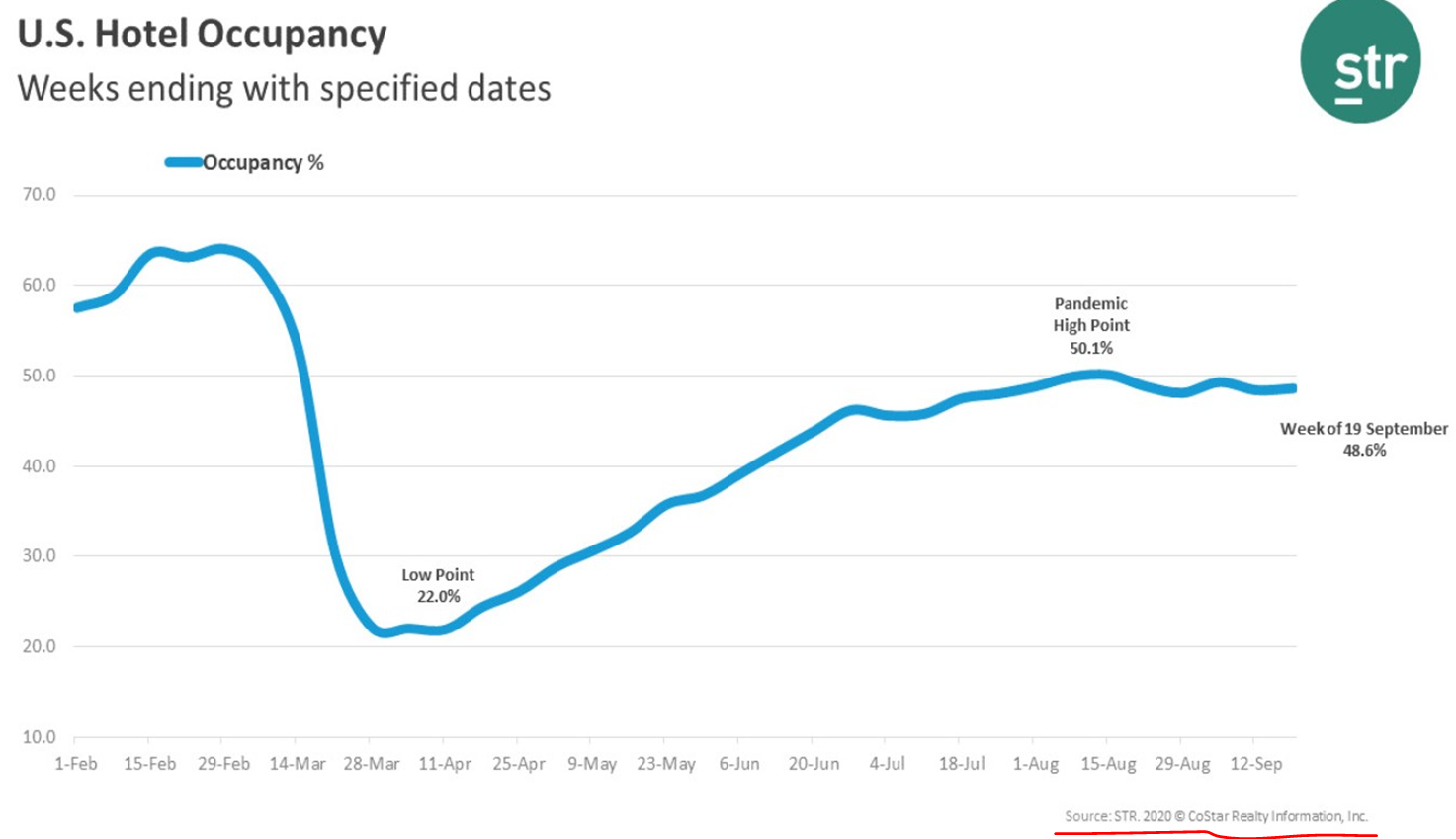

Hotel levels have picked up much more than I would have expected, and one can easily see improved sentiment, loosened restriction, more progress in therapeutic and vaccine, all working together to close this gap even more.

Politics & Money: Beltway Bulls and Bears

- Going into the debate Tuesday night, the betting odds had Biden at 54.8% and President Trump at 42.8%. Now, the odds are 59.8% and 40.6%, back to a ~20% spread.

Chart of the Week

People can fixate on ZIRP all they want (zero interest rate policy), but the “other” central bank story of 2020 and beyond is and will be what they have done with their balance sheets, and their support to liquidity in capital markets. This Y/Y increase is stupefying not just for its magnitude, but for its composition.

*Strategas Research, Daily Macro Brief, Oct. 2, 2020

Quote of the Week

“Well, you know, for me, the action is the juice.”

~ Michael Cheritto

* * *

Some of you may have seen this video yesterday in The DC Today, but I am a nostalgic person, and that includes the good and bad. I think there are some investment truisms in here I am proud of. And I might add, having been out of live TV studios since March 13, it is quite interesting to see the plethora of settings on display here! Multiple offices, houses, backdrops, and more. =)

Wishing you all a peaceful weekend filled with serenity and contentment. Reach out to us, any time.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet