Dear Valued Clients and Friends,

While we have no idea what the month of April may hold, we do not mind turning the page on the month of March, one of the most challenging months for markets, and for our country, ever. This special edition of Dividend Cafe offers a lot of perspective on where things stand in the markets right now, some very serious opportunities, and some real and lasting risks. The month of March will be in the history books, no doubt, but this Dividend Cafe is not yet focused on looking back – but rather, looking in the present moment, and looking ahead. There is a lot here to inform and edify you.

Let’s jump on in, to the Dividend Cafe.

A good market? Yes, No, and Yes.

Does it feel to you like the last five days were the second best five-days in market history? I didn’t think so.

But they were. Only the last five days of November 2008 were better (and I can assure you those five days didn’t feel so hot either).

Historically, the one-month and three-month returns AFTER five day periods like this are all over the map (50/50 positive/negative). But four months later it is positive 80% of the time, and 250 days later positive 100% of the time.

Think about that: After the ten best 5-day periods in market history, the market is up 250 days later 100% of the time.

This theme is not going away:

- Short-term market timing will rip someone’s face off

- Markets will experience much volatility over the next 30 and likely 60-90 days

- As we look further out, the historical record provides more clarity for calmer and more benign market returns

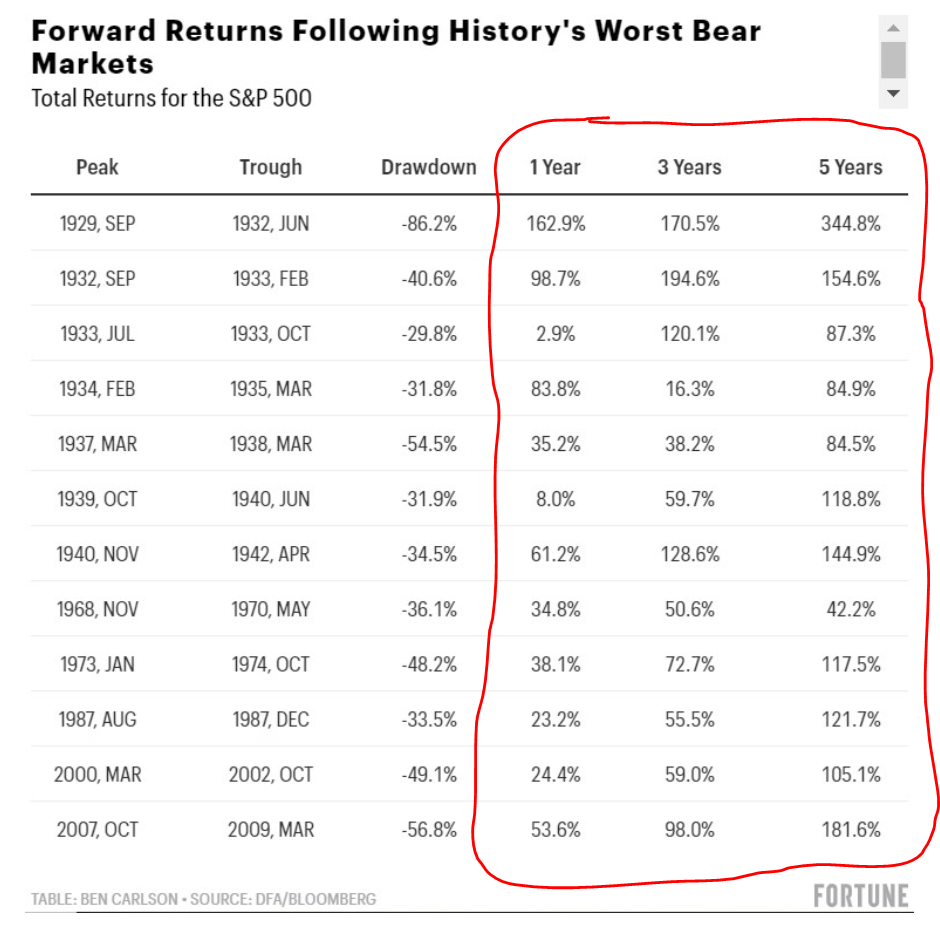

Now to really look out (1, 3, 5 years)

Offered with no additional commentary:

Bond market realities – last few weeks

The ten-year treasury yield went from 1.6% in mid-February to 0.57% on March 9 (and it was actually much lower intra-day March 9). Since then, it has gone up or down a full .5% each of the last three weeks. The moves have been rapid in either direction (just like equities), and obviously provide a sense of how dislocated the overall bond market has been (when even the safest and most stable asset on the planet has seen such wild volatility).

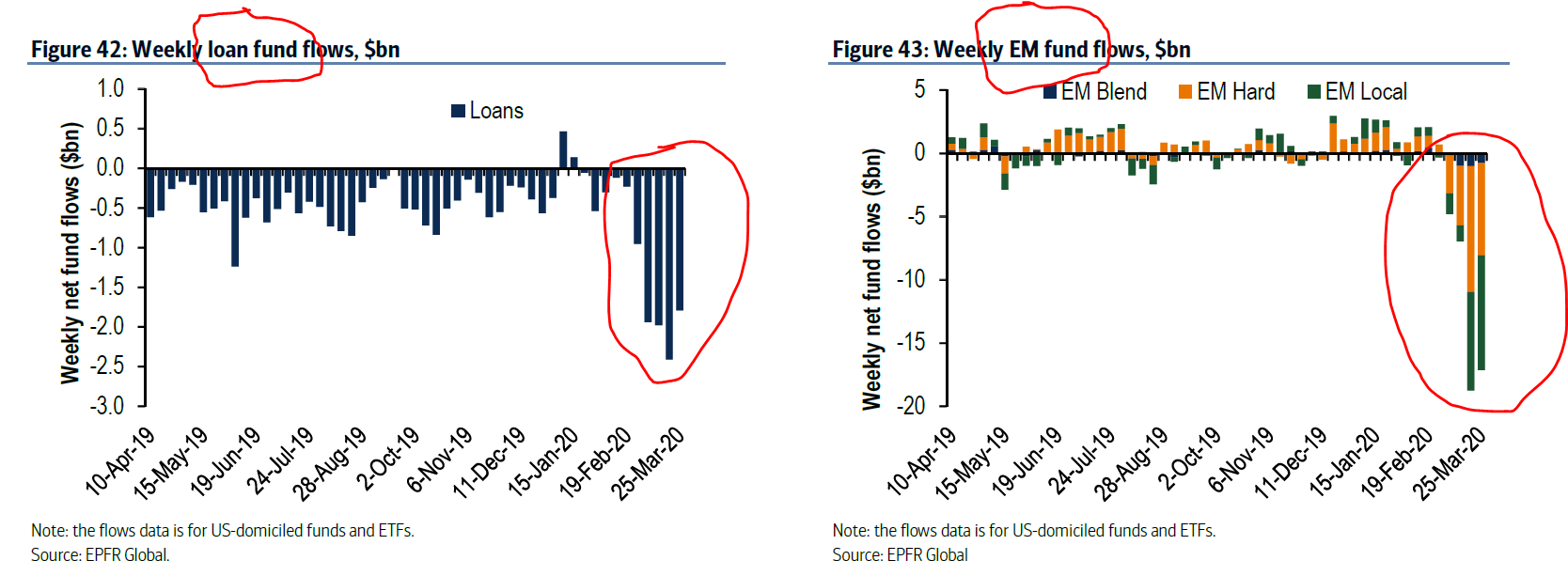

The worst weekly outflow from corporate bond funds in history had been $7 billion prior to the week of March 16. That week, the outflows were over $35 billion. In one week, investors redeemed $35 billion of high-quality corporate bonds … The forced selling pandemic was real, nasty, and brutal. Six of the ten worst one-day sell-offs in history (negative performance of Investment Grade bonds) happened in the last two weeks. And nine out of ten of the worst five-day sell-offs in history happened in the last two weeks.

As mentioned last Friday, the exact same dynamic spread into emerging markets bonds, as the sovereign debt of countries began trading 350 basis points wider than Treasuries in that distressed March 16 week.

Bond market realities – next few years?

Now, there does come a time where one (like us) may want to evaluate the bond market in a more real, intelligent, substantive, and fundamental sense. Severe market dislocations do not allow for such. Whenever things become more stabilized in markets, we will be stuck with the following realities:

(1) Essentially low – very low – interest rates are likely going nowhere. The Fed’s zero-bound rate policy for the fed funds rate and their heavy quantitative easing (QE) programs will put downward pressure on rates for some time.

(2) So the tension points where duration-sensitive assets have benefited from low yields, but credit-sensitive assets from suffered from intense capital markets dislocation will likely change, where low rates end up co-existing with healthier credit conditions.

In other words, the shift from duration to credit is coming back, and opportunistic bond buyers will be wise to consider this sooner than later.

So load up on credit?

Not so fast! One has to determine if they want an “opportunistic” bend to their bond portfolio, or a “parking lot” objective (i.e. just holding assets safe and sound with minimal expectation of return). The tactical realities of the fixed income asset class are irrelevant when not applied to particular investor objectives. We believe each client situation has to be evaluated one by one. There will be cases where opportunistic income and returns in the months ahead are the primary objectives, leading to incremental additions in credit, securitized, high yield, preferreds, and more. And there will be cases where a more defensive and liquid posture is warranted. This is a significant part of our job in the days, weeks, and months ahead.

How to know when things are normalizing (in markets)

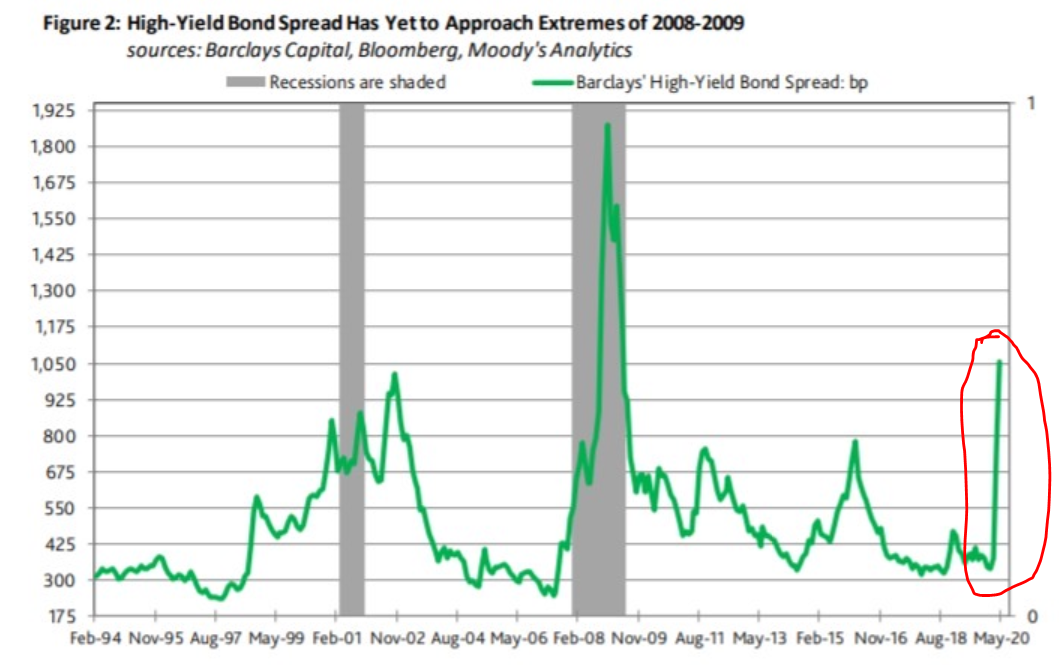

There is no indicator that will be more holistic and comprehensive in indicating improved risk appetite in financial markets than seeing spreads in the high yield bond market tighten. As the chart here shows, spreads have blown out, and while they have tightened in Investment Grade corporate bonds, municipal bonds, and agency mortgages (all three of which still have plenty to go), it is the High Yield space where spreads are widest relative to averages, and where one will get the greatest indication of improving financial conditions.

This always begs the question: Do tighter credit spreads (when they happen) cause improved financial conditions, or reflect improved financial conditions?

The answer, is YES.

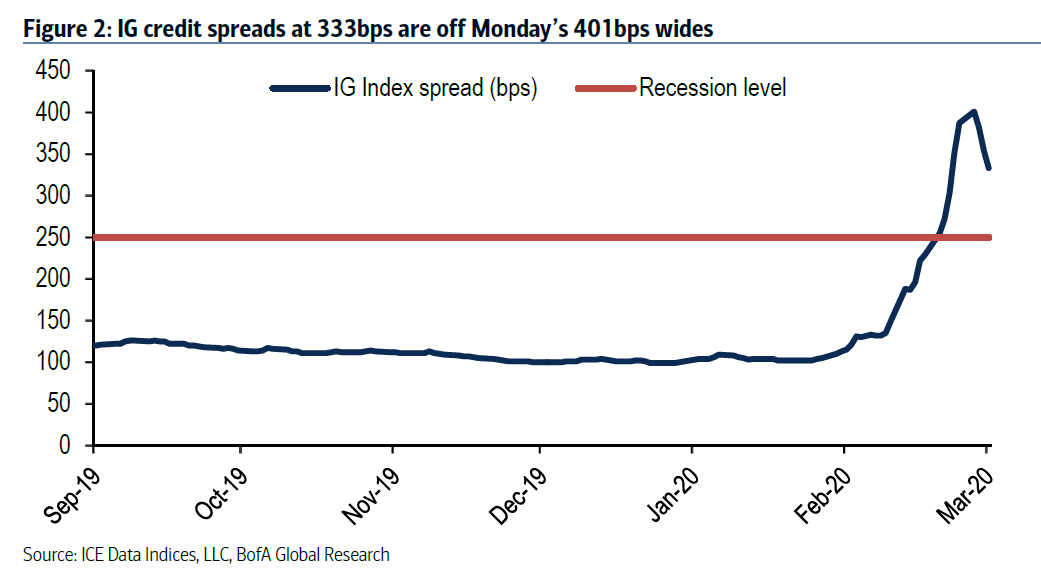

And IG not totally better!

As the Fed came into the Investment Grade corporate bond markets, spreads definitely tightened and prices firmed up (thank God!), but spreads are hardly back to a normalized level (though we suspect they are headed there when the Fed really becomes active). If one believes in “buy what the Fed is buying (or will buy)” – and we do – there is still value in investment grade (IG) bonds!

More broken credit

The syndicated bank loan space and emerging debt space saw unprecedented outflows in March – self-fulfilling prophecies that decimated those sectors during the peak sell-off. Flows are not about to come rushing back in (yet), but the outflows slowing will allow for normalization. And the most opportunistic of credit investors will lead the repair (and receipt of reward).

Avoiding confirmation bias

The truth is – it is impossible to avoid. All one can do who manages investments for a living is read everything reputable that they can, and be aware of the presuppositional nature of mankind. I am very aware of it. And I read, and respect, so much differing material that I try to mitigate the tendencies make us mere mortals subject to confirmation bias.

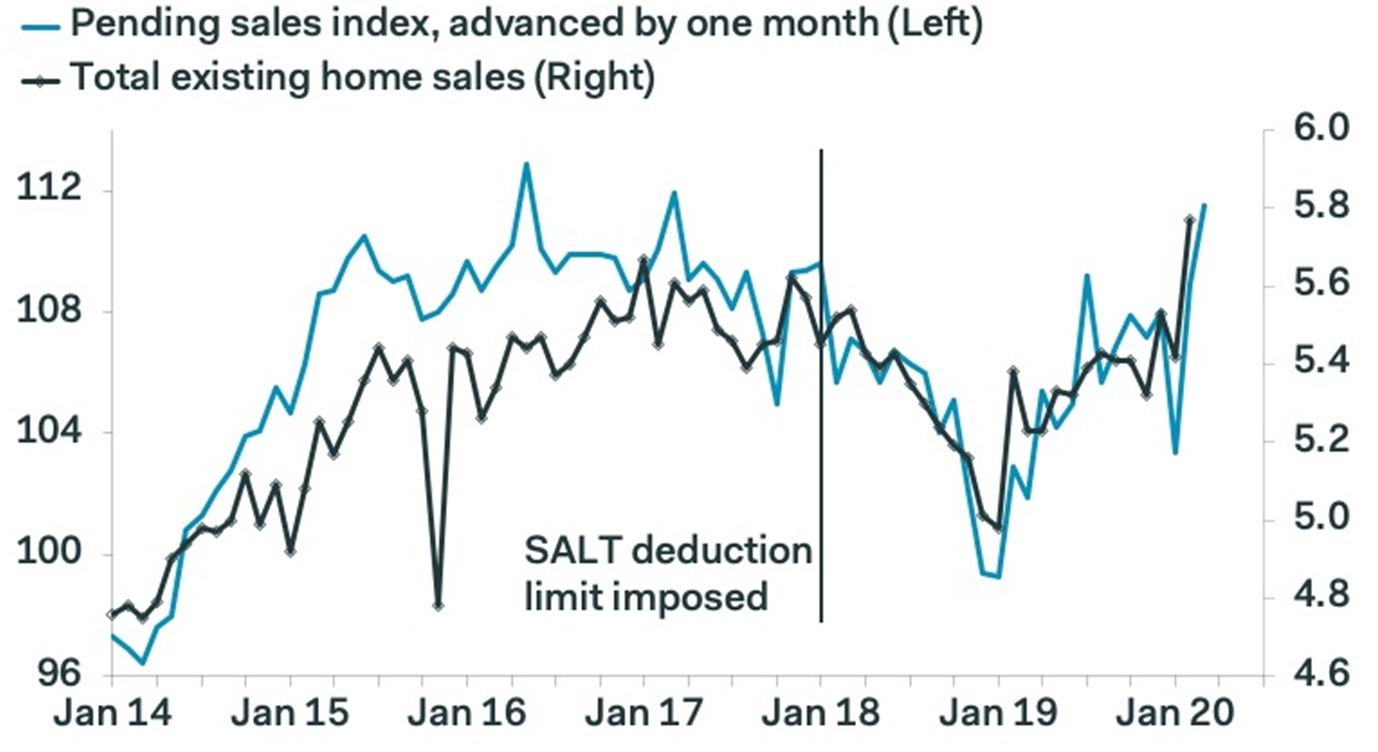

Home sales – spring becomes summer?

The report on February home sales was simply stunning yesterday – that home sales in February (pre-COVID breakout) had risen +2.4% (when a drop of 1.8% had been consensus estimate). Most certainly, some of those pending sales cancelled in March, and obviously, all activity has more or less come to a standstill for the Spring. But should a lot of “lost second quarter” transactions become third-quarter transactions (which would be our view), it will be robust summer indeed.

Note: Volume of home sales activity matters; dollar level means nothing to us, and in fact, rising dollar levels could be an intense negative. For those who disagree, see: 2005-2009.

* Pantheon Macroeconomics, U.S. Pending Home Sales, March 30, 2020

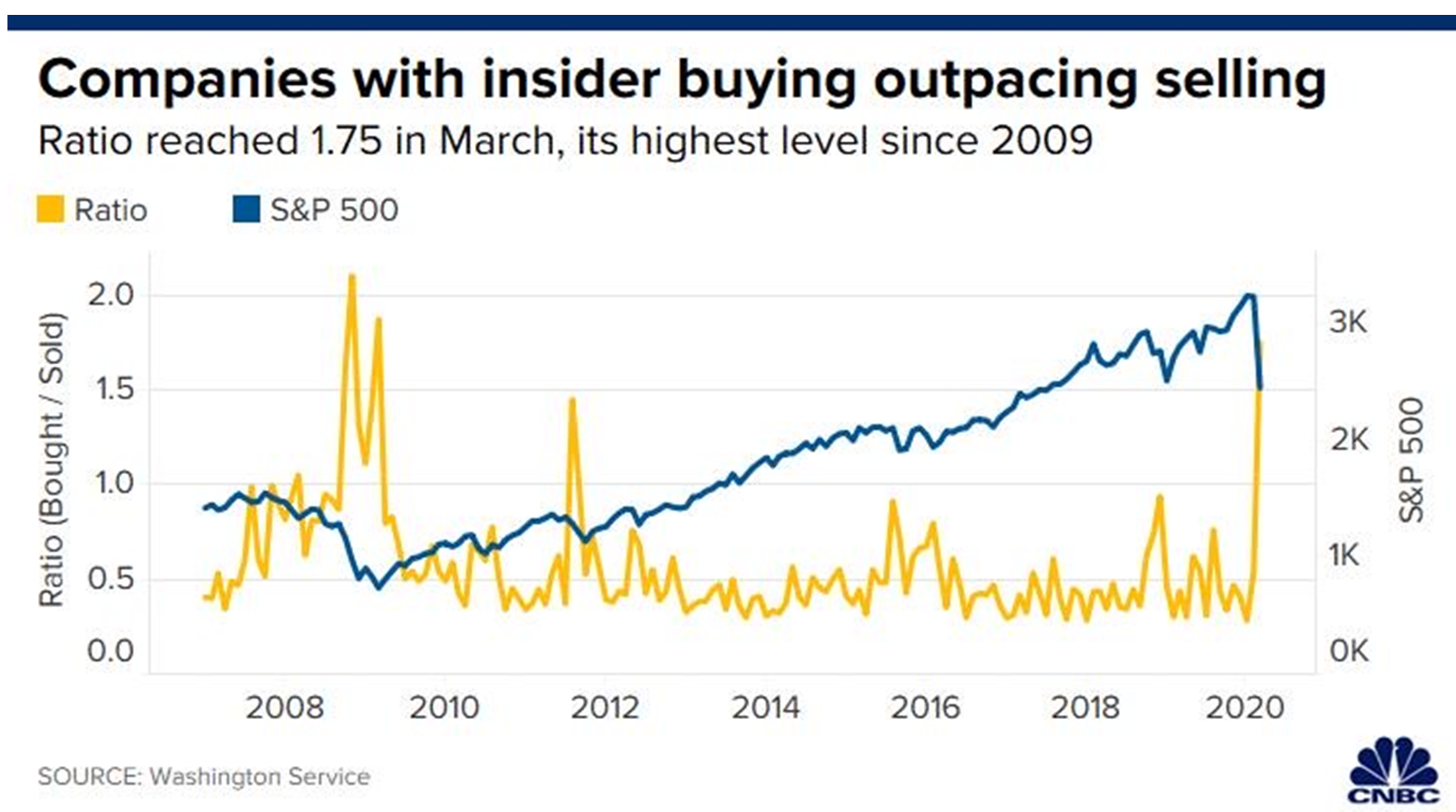

Chart of the Week

The month of March has seen the highest level of insiders buying stock since March of 2009. I am very skeptical of using one isolated data point to firmly draw a conclusion or formulate an investment thesis. That said, I do believe the discernment process involves using multiple data points to steer clear of confirmation bias and find wisdom in actionable conclusions.

The $1.2 billion of insider-buying (not counting the last few days of this month) represents 5x the normal average of $235 million.

Quote of the Week

“Bull markets and Bear markets can obscure mathematical laws; they cannot repeal them.”

~ Warren Buffett

* * *

I have no idea what April will bring. I do have an optimistic framework around the direction of the health data, but I recognize there are ample uncertainties in both that and the economic vulnerabilities we currently face. I believe the next two weeks will be very noteworthy in the way this saga is remembered, both economically (efficacy and speed of stimulus, Fed audacity in credit interventions, and timeline/magnitude of slowdown), and also medically (curve bend, therapeutic, true clarity around mortality rate, recovery acceleration, and more).

But regardless of what happens in all those fronts the next two weeks, we have two months and two quarters where we will still be dealing with this, as a country, as an economy, and as investors. But for two years and two decades, we will still be guiding our clients to their actual long-term goals to the very best of our ability. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet