Dear Valued Clients and Friends,

As I am typing Friday late morning, late into the final market session of the week, the market is down on the week (modestly down at this point). That came with a big move up Monday, a modest move down Tuesday, a huge move down Wednesday, a decent move up Thursday, and so far on Friday, a down day.

Note the theme? Not a huge up or down week in markets, but huge volatility day by day by day.

Why did markets go up 500 points the day the worst jobless claims data in history came out? Why did markets not tank on the news of the worst unemployment data in ten years? Because markets do not go down on news, they already knew was coming. Period. I am confused by media and financial professionals who do not seem to understand this, but I take seriously my obligation to help you, readers of Dividend Cafe, understand this.

Because markets are “discounting mechanisms,” pricing in today what they believe about tomorrow, “good news” cannot make markets rally unless it was not already expected, and “bad news” cannot make markets drop unless it, too, was not expected.

And if you know someone who has not known that in the midst of this national shutdown, that jobs data was not atrociously bad, I really don’t know what to say. The key, my friends, is where we go from here, and that itself is riddled with uncertainty. So let’s unpack as much uncertainty as we can, and jump into a fruitful and useful Dividend Cafe.

Where success will [not] come from

There is a very simple path to avoiding major financial mistakes in the weeks and months to come: Ignoring those who say they have the formula for how low GDP growth will go, how high it will go, when it will go, what the jobs data will exactly be, when the curve will bend, when the national economy will re-open, how it will re-open, what consumption will be in Q2, what consumption will be in Q3, what shape the recovery will take, etc.

Everyone knows things are atrocious right now. Some believe the virus will be contained by late spring (I am in this camp), others do not. What is not known at this time is:

- How effective the first level of stimulus support will be (how timely)

- How broad the “virus containment” will be, when it does come (i.e. do we “mostly” re-open the American economy, or will there be quasi-continued distancing measures in select regions?)

- What pro forma cash flows across the complexity of American business will look like ex-post stimulus

Where I feel some modest optimism is that the oil/energy picture will improve from the depths of March sooner than had been feared. And that Federal Reserve interventions in financial markets will have their desired effect of adding liquidity and keeping credit flowing.

Both downside and upside uncertainties remain. Asset allocations must reflect the possibilities on both sides. I am convinced the asset allocations of our clients do.

Deciphering the Future from Flows

$284 billion came out of bonds over the last four weeks – and $658 billion went into cash the last four weeks – the most stunning metrics on record in those respective categories. $156 billion came out of Investment Grade corporates, $47 billion out of Emerging Market Bonds, and $23 billion out of High Yield.

That is the most amount of money to end up in cash (i.e. future deployment) in such a short period of time, ever. Coiled spring.

The Cost of Fear

I suppose it is mathematically and intuitively obvious that stocks bought at a lower price have a better future return than stocks bought at a higher price. Of course, it can’t be that obvious since a huge part of the investing public utters some variation of this infamous backward logic whenever markets go through extreme distress – “I will wait until equities are doing better to deploy money into stocks.” It is emotionally understandable; it is mathematically sad.

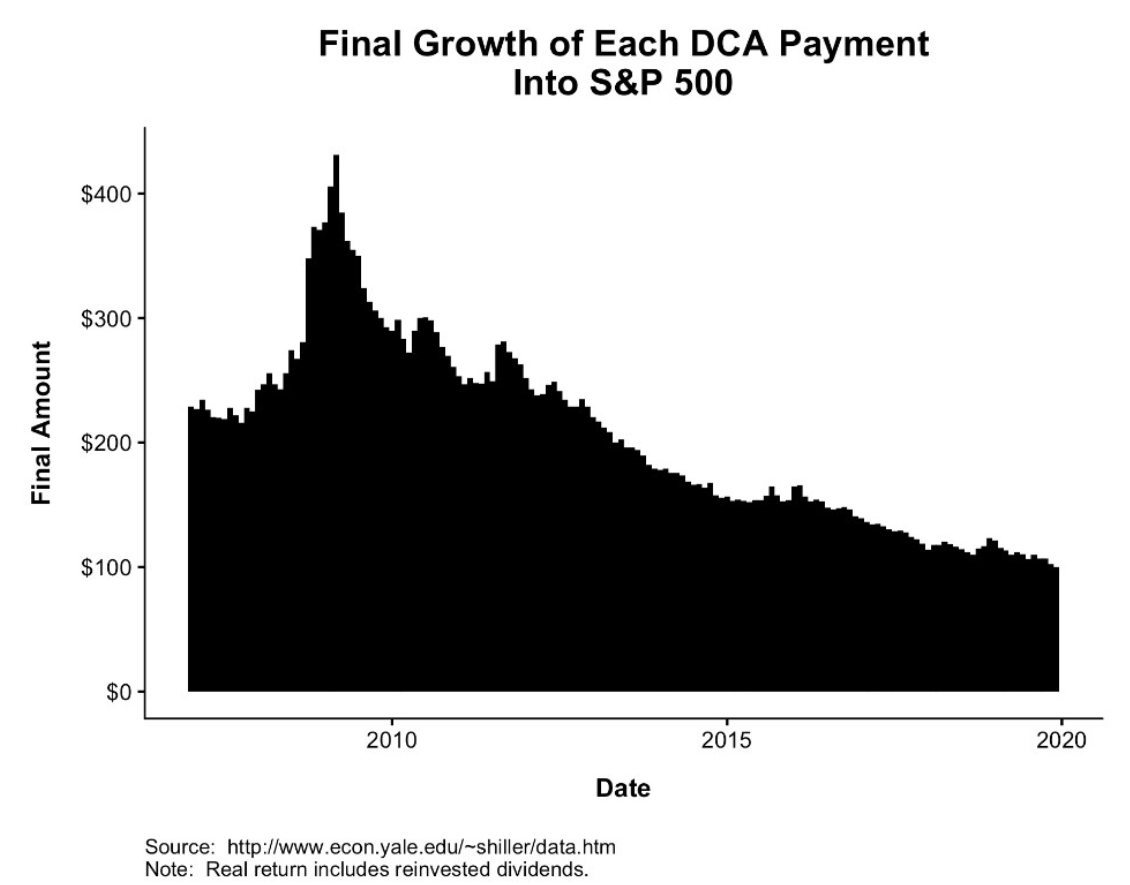

But I absolutely love this chart from Schiller/Yale showing the value of dollars “averaged in” over the last ten years. The most profitable silos of money in the future are inevitably the ones done when prices were lower, not higher. Again, this is a tautology – it is not rocket science. Or is it?

Europe

I am doing my best to stay laser-focused on the tensions and uncertainties of the moment, and not delve into longer-term implications that, while important and interesting and relevant, distract from shorter-term concerns. That said, a big issue on my back-burner for future consideration when we are looking backward on this pandemic is the state of the European Union. It strikes me that an entirely possible conclusion out of this coronavirus mess will be that the European countries are, in fact, “each on their own,” and that the downside of giving up one’s own currency, borders, and laws is not being compensated by an upside of continental solidarity.

We already see European countries re-asserting various trade and legal sovereign controls, and I remain unable to answer why certain European countries will not, in due time, re-assert control over their currency.

My understanding is that Italy is pushing for a “pan-European” government bond to help Italy’s fiscal condition. Germany bans such, and shows no signs of letting up. Will a Italy vs. Germany monetary divergence represent the beginning of the end of the European Union?

The heat of the moment

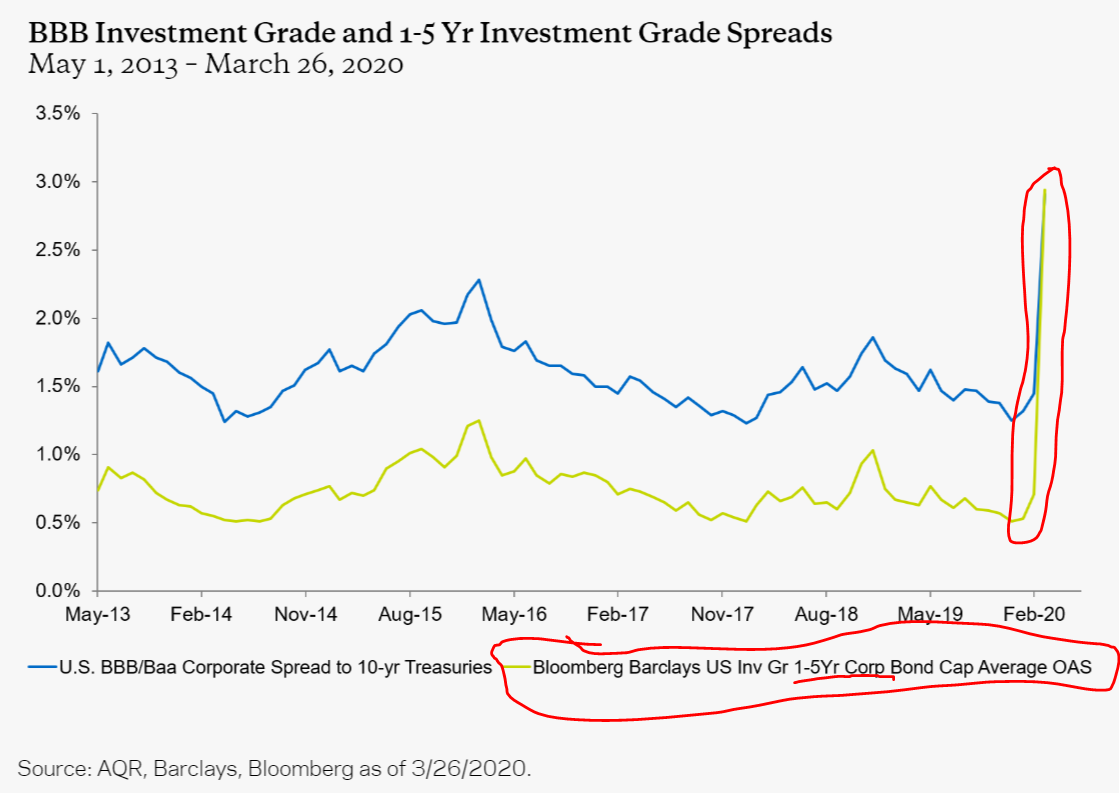

It really is worth noting the particular technicals in bond market dislocation of recent weeks as revealed in spreads of 1-5 year Investment Grade corporate bonds.

The specific widening of spreads in shorter maturities may seem counter-intuitive in many ways. Aren’t longer dated bonds riskier, as there is more time for things to go wrong later (vs. sooner? But this widening reflects the real problem facing all risk assets in this “run on assets” – liquidity. Investors did not rush to sell their ten or twenty year bonds; they rushed to sell one year bonds. This particular maturity spectrum (1-5 years) is where the most pain (from dislocation) has been felt, and it is the spectrum the Fed is honing on in with their pending corporate bond facilities.

Economics in practice

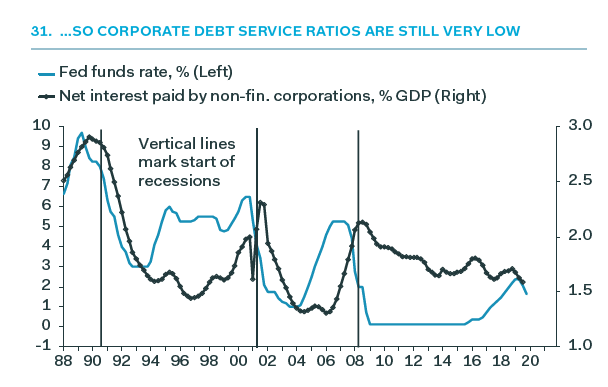

Corporate debt has gone from 125% of GDP to 175% since the financial crisis, yet one thing has held it all together, to where debt service ratios are much lower now, than they were then. Higher debt with a lower service ratio? How is it possible?

A reduced cost of capital, and a growing GDP.

* Pantheon Macroeconomics, April U.S. Chartbook, p. 10

One of these things is not like the other

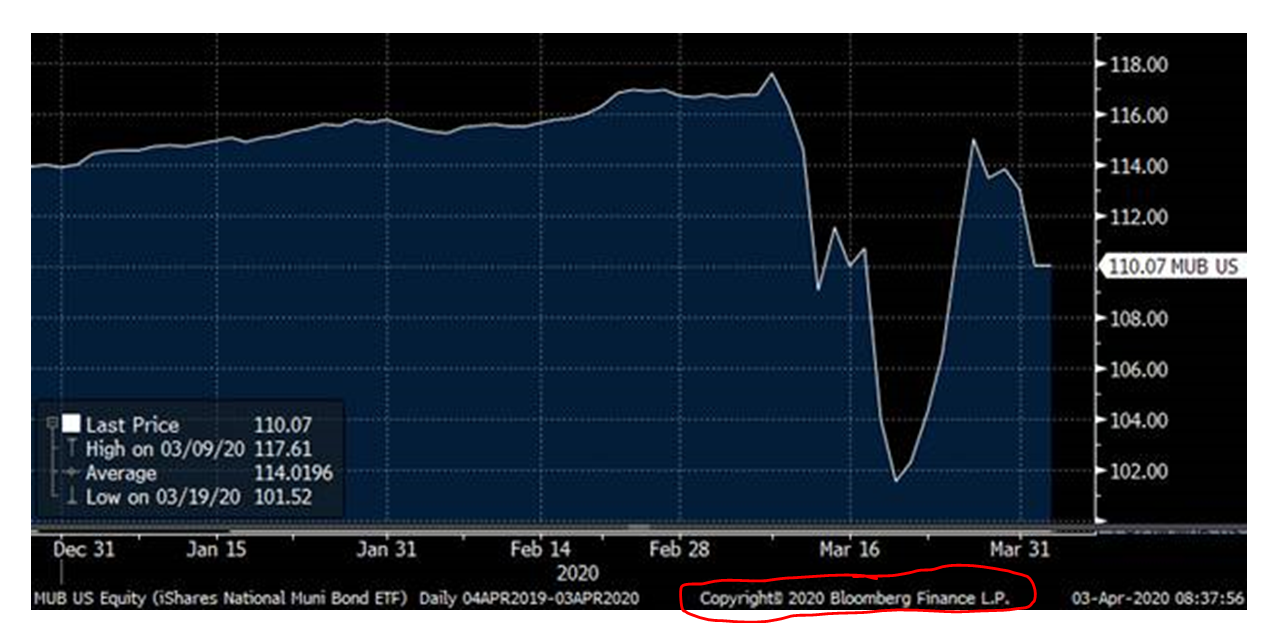

Why have municipal bonds seen more price volatility and dislocation than even corporate bonds? The answer is sort of the essence of the dynamic I have been describing: Liquidity has been driving this, not financing. Banks are able to lend. Companies are able to borrow. Government and Fed support will work its way through the system. Municipals represented a more narrow category of borrower (only high tax-paying individuals buy municipals, not endowments, pensions, IRA’s, foundations, etc.) – and the need for cash (liquidity) was exacerbated in that less efficient space.

The chart reflects three things about the national muni bond space:

(1) The severe dislocation that took place in the week of March 16 (i.e. national margin call).

(2) The recovery since the Fed has entered the fray.

(3) The room the muni world still has to go to achieve full normalization.

A quote to capture the moment

It isn’t the “Quote of the Week” section of Dividend Cafe, but it is a quote to help contextualize the moment we are in as far as central bank intentions to the economy and markets:

“When it comes to lending, we are not going to run out of ammunition. That doesn’t happen.” – Jerome Powell, Chairman of the Federal Reserve, March 26 (on the Today Show)

A toast to illiquidity

Leverage and illiquidity are two different things, measuring two different categories of things. Leverage can be a killer in times of distress (mortgage REIT’s where the most pain has been felt the last few weeks are 5-10x levered). But daily liquidity interacts with leverage to create a downward spiral (i.e. levered assets having to be sold as investors exercise rights of daily redemption, forcing more selling, pushing prices lower, while the leverage worsens the selling pressure, rinse and repeat).

A simple mantra (taught to me by the great Michael Milken) is that Business Risk should be inverse to Capital Risk. The benefit of illiquidity in investments that have capital risk (leverage) is that forced selling cannot create a self-fulfilling prophecy.

But of course, even without investors having the right to ill-advised liquidity on leveraged investments, the mere existence of excessive leverage is still a risk. Margin calls can force selling, and hedges can be blown out to raise cash, further risking-up a portfolio of assets at the time hedges are most needed.

What we want is the right technical framework for these types of investments to be own, and to possess superior fundamental tenets. Our criteria?

(1) Illiquidity trumps liquidity in rapidly cascading (down) markets

(2) Leverage must be smart and prudent, not excessive and reckless

(3) Underwriting matters

(4) Business risk and Capital risk matters

How bad was it?

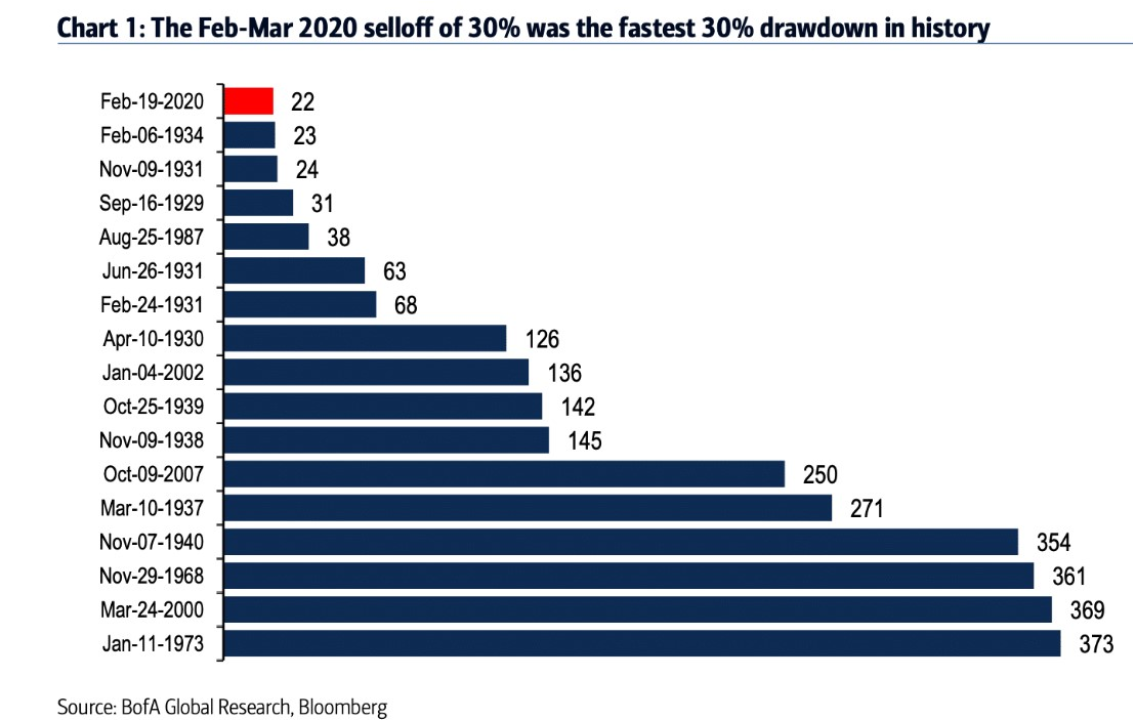

Besides how bad the March market crash was, let’s first look at how fast it was:

Then, let’s look at the magnitude of the daily drops that took place in March:

* A Wealth of Common Sense, March 31, 2020

Politics & Money: Beltway Bulls and Bears

- I don’t even want to do this section until the COVID issues are behind us, because I am so disgusted by [both sides] attempts to politicize all this. Basically, I don’t see this as a political issue, and a very large part of our society is incapable of seeing anything outside a political lens. I find that discouraging (to say the least).

- To the extent matters of beltway significance enter the fray for investors, I will certainly continue extensive coverage of such. I remain in contact with people in Treasury, NEC, the Fed, the Congress, and the overall beltway ecosystem, daily. It’s just that my intentions are around the effecting of policy and its effects to capital markets. My intent is not to cast blame, to defend, to accuse, or to comment on a President’s ratings (Dear Lord).

- So, with that said, a “phase 4” Congressional action will fall in this “Politics and Money” silo, and I think a phase four is coming (but not quickly). More to come.

Chart of the Week

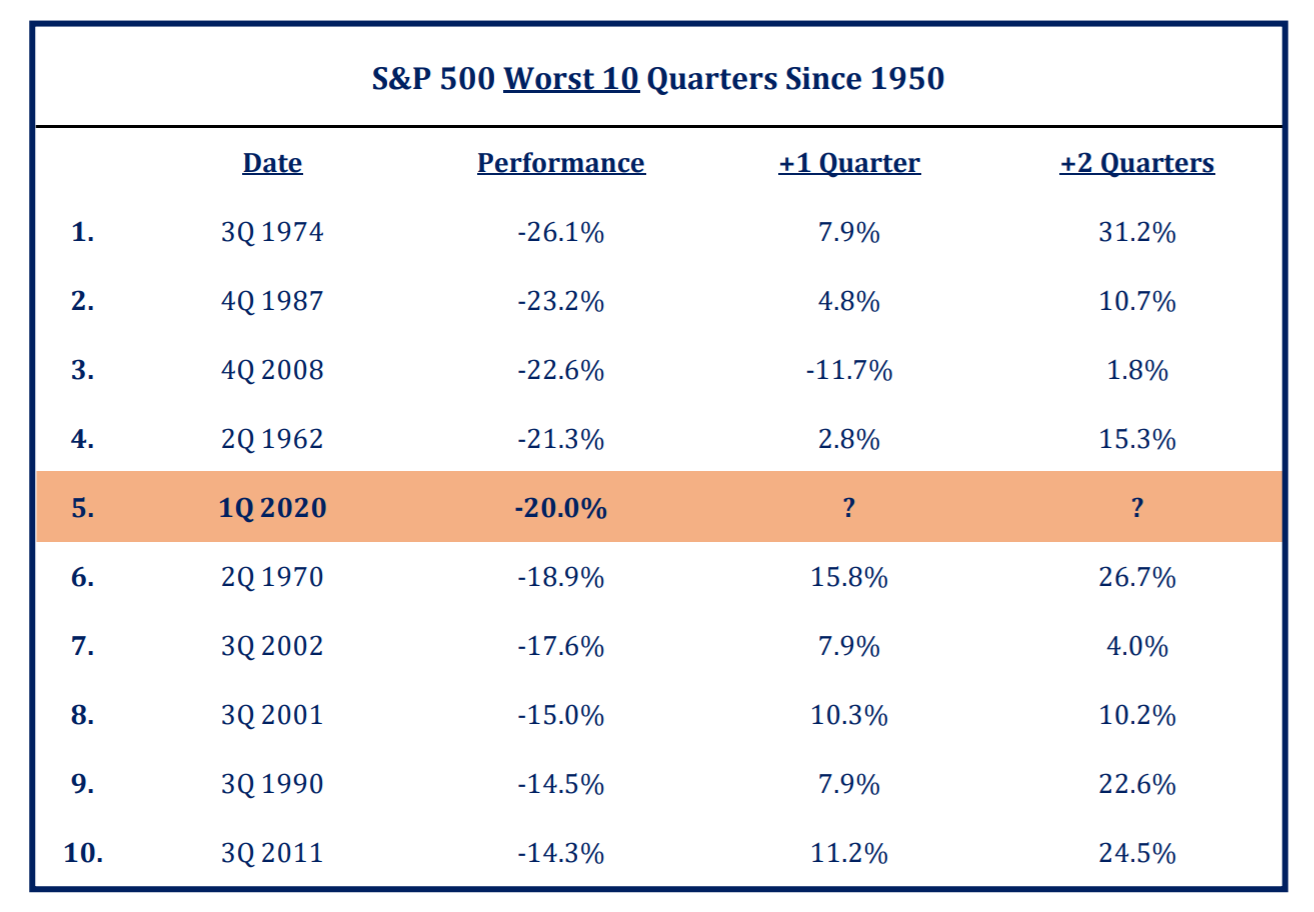

It may not feel right to say the first quarter of 2020 was only the “fifth worst quarter of all time” (it always feels like the first-worst when you are actually in it), but fifth-worst is still pretty darn bad. Note the performance in the following quarter, and the following two quarters, after the other “worst nine” quarters in market history.

* Strategas Research, Technical Strategy Daily Report, April 1, 2020

Quote of the Week

“There will always be bull markets, followed by bear markets, followed by bull markets.”

~ Sir John Templeton

* * *

I appeared on Varney/Fox Business as the market opened this morning to talk jobs, dividend sustainability, and economic reality.

I believe elevated volatility will be with us for the next couple of weeks, and I am prepared for that daily grind. I also believe subdued volatility is coming, and I look forward to that, too. In the meantime, every day we guide our clients to avoiding big mistakes, I know we are earning our keep. And every day we thoughtfully consider what ought to be done to optimize a client’s long-term objectives, I know we are living out our fiduciary duty.

So those ends we shall work. Reach out any time. We are here for you.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet