Dear Valued Clients and Friends,

So, if I know the readers of Dividend Cafe, I suspect half of you are thinking right now, “Can he please give us something this week not related to the election – enough is enough!” … and then half of you are thinking, “Oh boy, it’s time for part three of the election post-game coverage! I can’t wait for more Dividend Cafe analysis of the new administration.” How’d I do? Well, good news … you both win.

Yes, part one of the post-election analysis may have seemed like enough, and part two really, really seemed like enough. And yes, this week, we are going all over the place – not just to Mar-a-Lago or to the White House. But yes, there will be just enough additions to the policy, personnel, and markets categories to scratch some of your itches.

This Monday we will post the normal “Monday version” of Dividend Cafe, of course. There will be a “Thanksgiving edition” Dividend Cafe on WEDNESDAY, but your inbox will be off the hook on Friday (meaning, my keyboard will be off the hook on Thursday). As usual, everything will pick back up after Thanksgiving week on Monday, Dec. 2.

In the meantime, let’s jump into the Dividend Cafe, where a little passive index opportunity talk (different than you think), market momentum, bond spreads, generation Z, and yes, post-election chatter await you.

|

Subscribe on |

Impacted by what you do not own

I have spent the bulk of my time addressing passive (index) investing over the years, discussing the actual real-life events of concentration – the descriptive element (for good or for bad) that an investor in the S&P 500 now had a 33% exposure to seven companies, and a 67% exposure to 493 companies. The top seven were 10% of the market eight years ago. That is not, in and of itself, a bullish or bearish case – it is a mathematical one. About a month ago before the election took over Dividend Cafe I laid out my beliefs about what an investor ought to do (and not do) about this phenomenon (if they were not a client of ours, what an investor ought to do if they are a client is exactly what they would be doing, because, well, that is why they are our client).

I think the massive growth in passive index investing (from 25% to 50% of the fund/ETF market in ~10 years) should provoke more conversations about what it might mean for those who do not own the indexes themselves. The concentration issues highlighted above do not matter to me as a non-index owner. They do not matter to my clients, non-index owners. But are there elements of wider passive ownership that are relevant to the broad investment community, including those who are not passive index investors?

Well, let me beat myself to the punch. The answer is going to be yes, but there is a big caveat around it. I believe that the current phenomena of index ownership exacerbates volatility from what it would otherwise be. I also don’t care. I believe that the share of passive equity ownership we presently see impacts market liquidity. I also don’t care.

When demand is less responsive to price, spikes in price become exacerbated, as do dips in price. This is a tautology. Less elastic markets mean mispricing can last for a longer period of time. And most interestingly, less liquidity is available in markets when capital is not responding to mispricing at the speed or magnitude it otherwise would. On the margins, higher passive ownership and its inelastic structure and buying habits put upward pressure on volatility and downward pressure on liquidity.

A positive for a lot of people in index investing is that those doing the index investing are no longer doing dumb things; a negative for active managers is that there are fewer people doing dumb things to buy from (or sell to). “Excess returns” in investing are always zero-sum in the aggregate, and that is really a tautology.

But what do I mean by saying that none of this bothers me? Essentially, high demand for large-cap stocks and the indexes reinforcing that with equity ownership comes from something. What it comes from creates opportunity. Whether that thing is small-cap, mid-cap, value, or what have you, concentration risk is not a factor for those who do not have it, and it creates an opportunity for those buying other things that may be genuinely mispriced. The volatility conditions of the overall market should increase risk premium over time and can be ignored by well-behaved investors. And the liquidity conditions worsened by the advent of passive is simply another way of saying the same thing – that volatility is enhanced, with mispricings lasting longer than normal.

What’s not to love?

Speaking of that momentum?

$240 billion has flowed into equity ETFs in the last two months, with a particularly high portion of flows going into leveraged ETFs. As you will see in the paragraph below, credit spreads are very tight, the VIX is not elevated, and the S&P is 9% above its own 200-day moving average. Momentum is big with some indications it is ready to slow. Fundamentals have been well-discussed. The timing is impossible. The eventual reality is not.

Not always spread too thin

So right now, high-yield bonds are paying a yield that is 2.67% higher than similar maturity treasury bonds. We condense this sentence by saying, “High-yield spreads are 267 basis points.” Actually, for really cool kids, we say, “High yield is 267 wide.” But back to the point. The spreads in corporate credit are really, really tight – which is a way of saying that investors are not demanding a lot of payment for the risk they are taking with lower-quality corporate debt. Though this is not technically the tightest spreads ever, it is very close. And I should add, investment-grade corporate bond spreads (high quality) are only 81 basis points. Investors are adding less than 1% of yield to move from treasuries to corporate debt. This means that many find better risk-adjusted value in Treasuries than corporates and that perception of default risk is very, very low right now.

But wait … there’s more. CMBS spreads (commercial mortgage-backed securities) are nowhere near “all-time tight,” like corporate debt. In fact, they are abundantly wide. Spreads blew out during COVID, where people temporarily believed no one would ever shop or go to work again, and then narrowed dramatically in 2021 (partially because of economic normalization and partially because of the Fed support in the marketplace, not directly to CMBS, but indirectly in financial markets). But then, in 2023, spreads blew wide again as interest rates skyrocketed, and many perceived distress on the horizon. And indeed, for some product types and certain categories of CMBS, the default environment need to “amend and extend” loan provisions, etc., did bring distress in the sector. So now everything is normal, right?

Well, no, that is the thing. With high-yield bonds trading at a 267 spread to Treasuries, the lower-quality CMBS world is trading at a 640 spread. This is down 300bps from peak levels but still 200-300 wider than normal. Essentially, there is huge dispersion in the space – some types of CMBS are very different from others – and there is not the same liquidity in the CMBS market as there is corporate debt, either. There are, all at once, pockets of good opportunity here (manager talent matters, a lot), and there also is a reflection of broader risk. And with $800 billion of loans out there, mostly on the balance sheets of pension funds and insurance companies, I continue to believe I have my explanation as to why the Fed has to (ok, will) be cutting rates further,

Young people are getting smarter

I snicker about Gen Z a lot, mostly because it is what us Gen Xers do. I actually love Gen Z and hold most of my deeply embedded resentments in check for Gen Y, who I believe ruined the world (just kidding, seriously!). Where was I? Oh yes, Gen Z, those basically in their 20’s (or a bit younger). Well, Axios reached out to me this morning for a comment on their recent survey wherein GenZers said that it takes $600,000 of annual compensation to be “financially successful” (the average answer across all age groups was $270,000, so relatively speaking, Gen Z had a much higher bar for financial security than anyone else). I don’t know if my reply will get used in their story or not, so I will publish it here just in case.

It is entirely related to housing. Sure, groceries, student loan payments, and the cost of going out to restaurants and bars all matter – but “feeling successful” when you have to have a roommate to afford rent undermines all capacity for consumption. The idea of “feeling successful” when an introductory down payment on a home feels unattainable creates an irreconcilable tension. The cost of a first home has moved the salary level to far higher places where a young person can feel they have made it, and I think the delta between housing as the first place cause here and whatever is second place is massive!

Axios also asked why I thought a lot more Gen Z-aged people voted Republican in the recent election and are marginally more likely to identify with the right versus the left. I suspect some young people have moved right because the party in power when this financial tension has escalated has been the Democrats, and it is more of an anti-incumbency thing than anything else. However, an underrated factor that warrants mention is DEI. Young people felt a few years ago they were supposed to wink, nod, and play the game over the charade of ESG and DEI. Now, younger professionals want a meritocratic environment, and they resent the forces on the cultural left standing in the way. That is what I hear, anyway.

Economic appointment delay game

I stalled submitting this week’s edition to the content team as long as I could. I was really hoping some word on President-elect Trump’s appointments for key economic positions would come before press time. What we know by now is this: Howard Lutnick, chairman of the transition team, is no longer a candidate for Treasury Secretary, having been appointed Commerce Secretary; Linda McMahon, past chairwoman of the Small Business Administration (SBS) is no longer a candidate for Commerce Secretary, having been appointed Education Secretary; and the selection for Treasury Secretary, Director of the National Economic Council (NEC), Chair of the Council of Economic Advisors (CEO), and U.S. Trade Representative, are all up for grabs.

What was shared with the media this week was that President Trump had interviewed Marc Rowan, CEO of Apollo, Scott Bessent, believed to be the leading candidate, and Kevin Warsh, former Fed governor, and Morgan Stanley economist. Sen. Bill Hagerty of Tennessee is also in the mix. I believe each of these four selections (DOT, NEC, CEA, USTR) matters, and I believe there is reason for optimism on several of the picks. But you can go to all sorts of big news sites for wrong predictions about who is going to be picked; you don’t need to get those here. It feels to me like President Trump might, might, be looking for new names entirely, feeling unsatisfied with the current crop of candidates. The more time that goes by, the more likely that is.

Last but not least

I have been pretty transparent about both my optimism and skepticism about what Elon Musk and Vivek Ramaswamy will be able to do to “make government more efficient” with this new “Department of Government Efficiency” (which is not actually a department). But I will say this – I can think of little that will improve productivity more than asking people to go to work, and I can think of little that will cut costs more than asking people to go to work (as tens of thousands of employees quit the federal payroll if required to go to work. This week’s announcement that federal employees will be required to go back to work now that COVID has been gone for about four years seems like a step in the right direction, one that almost every company I could cite right now has already beaten the federal government to the punch on.

Chart of the Week

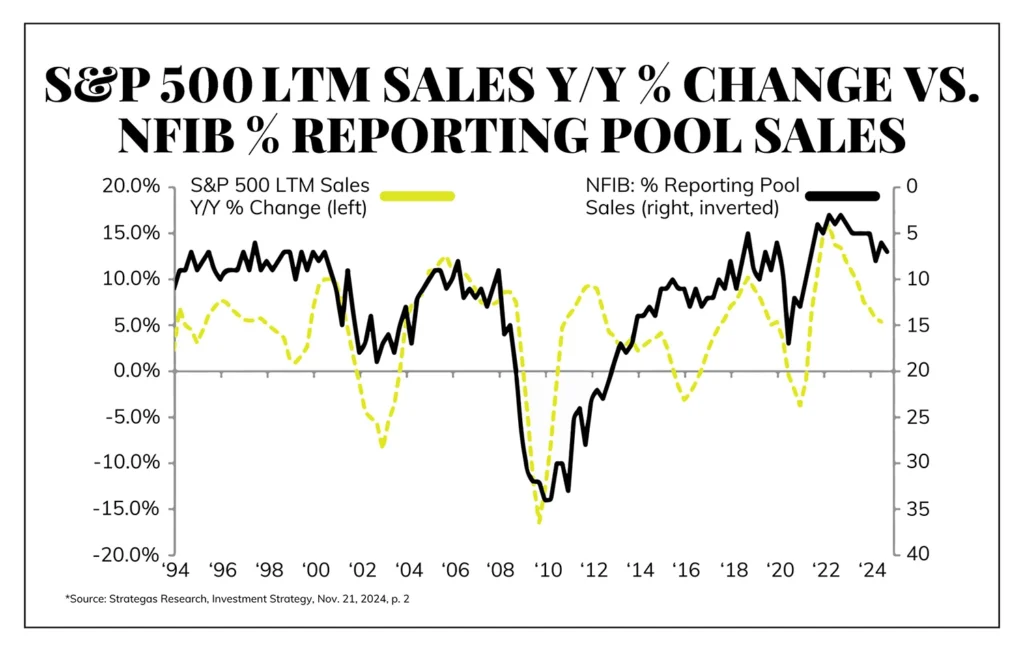

You may have heard that one of the key components of profits is, wait for it, revenues. Confidence in profit growth generally includes confidence in revenue growth because cost-cutting alone can’t sustainably create year-over-year profit growth. This chart is not anything to fret over, but it’s worth noting that the rate of growth of S&P 500 company sales has been slowing, and more and more small businesses are expressing concerns about top-line sales. It has not surfaced yet, but it’s on the radar for 2025, no doubt.

Quote of the Week

“A person is smart; people are dumb.”

~ Tommy Lee Jones

* * *

As I type on Friday morning, it is officially the coldest day of the year so far, in New York City, and I love it. Maybe we get a snowy Macy’s Thanksgiving Day Parade after all? I am very thankful for this weather (I love it) and very excited for next week. I’ll share more Thanksgiving reflections on Wednesday. In the meantime, have a wonderful weekend!

Fight on Trojans, beat the Bruins,

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet