Dear Valued Clients and Friends –

Lots on the new Treasury Secretary (nominee) today!

Dividend Cafe looked at the way that index investing can impact non-index investors and why our approach leads to a “don’t care” response. It covered everything else, from market momentum to credit markets to commercial real estate to why Gen Z and housing may matter politically. The written version is here (my favorite), the video is here, and the podcast is here.

I was on Fox Business’ Big Money Show discussing President-elect Trump’s latest cabinet picks.

Off we go…

|

Subscribe on |

Market Action

- The market opened up and stayed up throughout the day, though it was much more concentrated in the Dow than the S&P and Nasdaq.

- The Dow closed up +440 points (+1%), with the S&P 500 up +0.30% and the Nasdaq up +0.27%

*CNBC, DJIA, Nov. 25, 2024

- 51.4% of U.S. households think stock prices are headed higher, according to the recent Conference Board Survey (the highest in history). Is this bearish or bullish? I would argue yes. There is always the chance it is short-term bullish as a self-fulfilling prophecy plays out of momentum and enthusiasm in the short term, and there is always a chance (historically) it is bearish as sentiment and jubilation often don’t end well. It also is not a data point that I recommend building an investment philosophy from.

- The ten-year bond yield closed today at 4.27%, down -14 basis points on the day (biggest single-day bond rally in a long time)

- Top-performing sector for the day: Real Estate (+1.28%)

- Bottom-performing sector for the day: Energy (-2%)

Top News Stories

- The federal government has decided to cut back on the CHIPS ACT grant it gives Intel, but it is unsatisfied with its progress in getting plants open in Ohio. The only thing worse than corporate welfare is a cut in corporate welfare, I guess.

Public Policy

- So the biggest news of the weekend was in President-elect Trump’s naming of Scott Bessent for Treasury Secretary. Bessent is considered a solid, dependable pick with a strong familiarity with financial markets and a reliable ideological grounding in terms of first principles.

- While I want to give a larger commentary on the economic team, as of press time, he still has not named his National Economic Council Director. My sources tell me the two candidates for NEC are “the two Kevins” – that is, Kevin Warsh, former Fed governor and Morgan Stanley economist, and Kevin Hassett, former chair of the Council of Economic Advisors in President Trump’s first term. I would be thrilled with either candidate at NEC, but no one really knows if there are other possible candidates or not.

- Bessent has said he is bringing to Treasury a 3-3-3 rule:

- Cut the budget deficit to 3% of GDP by 2028

- Push real GDP growth to 3%

- Pump out 3 million extra barrels of oil each day

- As for my take on those three things, let’s just say that #1 is highly unlikely to happen unless #2 happens, but I certainly believe both are very important. If #2 can happen via de-regulation and other pro-growth initiatives, #1 becomes more likely, but only with true fiscal restraint. The third one is more challenging because I believe there is more at play here than just government regulation, first and foremost, oil industry capital discipline.

- Other announcements over the weekend included Brooke Rollins as Secretary of Agriculture (I am a very big fan of Brooke’s), and Rep. Lori Chavez-DeRemer for Labor Secretary (I am, ummmm, not a big fan here). She faces an odd situation where she will likely be confirmed in the Senate, but with more Democrat votes than Republican votes due to her opposition to Right to Work states, support of the PRO Act, advocacy to make more stringent the National Labor Relations Act, endorsement of teacher’s unions around the country, and support for California’s controversial AB5 initiative which severely limited ability to serve as an independent contractor.

- Current Fed governor, Michelle Bowman, is being discussed to replace Michael Barr as vice chair of Fed Supervision. Todd Zywicki, a law professor at George Mason, is the lead candidate to take over the Consumer Financial Protection Bureau.

Housing & Mortgage

- There is apparently little work to do for the Fed in terms of bringing down mortgage rates and “unfreezing” the housing market. Rates did fall from about 7% to 6.1% throughout September as financial markets absorbed the beginning of the rate-cutting cycle. Fast forward to today, and average 30-year rates are back to 6.8%, higher than the 6.7% in August (before rate cuts began).

- There is very little I want to see less than this, to be honest:

- Existing home sales increased by +3.4% in October, the largest gain in eight months.

Federal Reserve

- I am LOL’ing again about the odds of a rate cut dropping (December futures are now at 55% for a cut next month, down from 100%, then 80%, then 70%), but with the market rallying a thousand points last week. Time and time again, too many believe the Fed has an over-inflated role in what drives stock prices.

- I should point out that the odds of a cut by January only go to 66% (from 55% in December), But they are above 85% by March, and the most important thing to markets that discount today is what it believes about the future: We still have a greater than 65% chance of three rate cuts by this time next year.

Oil and Energy

- WTI Crude closed at $69.07, down -3% as talks of a cease-fire in Israel made the rounds.

- Midstream had its biggest week of the year last week, up over +5% on the week across midstream, with MLPs up +4.5%. It’s been quite a run to see midstream up well over +100% since late 2020 and +60% this year alone.

Against Doomsdayism

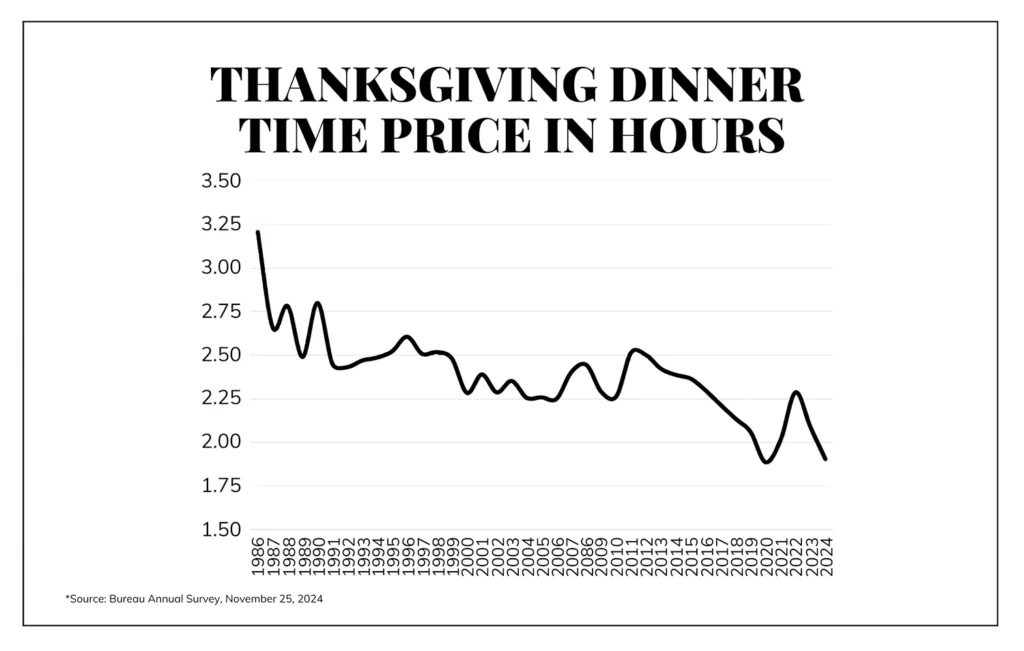

- A turkey is up 102% in price since 1986, but it used to cost a blue-collar worker 3.2 hours to earn the money to buy one, and now it is 1.9 hours, a decline of over 40%.

Ask TBG

| “In taxable accounts, do you not let tax consequences impact whether or not you keep for some clients but refuse to buy for others?” ~ Timothy L. |

| Only timing, but not the decision. If we believe something needs to be sold, we will not refrain from selling (perhaps delay until the next calendar year) due to tax. Our expression is that we want to be tax efficient but “never let the tax tail wag the investment dog.” |

On Deck

- We will have our standard daily recap tomorrow, a Thanksgiving Dividend Cafe on Wednesday, and that will be it this week (no WPHR for clients on Wednesday and no Friday anything)

It was probably the worst USC-UCLA game ever played Saturday night, and it started after my bedtime here in NYC, which only made things worse (what kind of animals routinely go to bed that late??). Now, I am not suggesting it was the worst game UCLA has ever played (can you even imagine trying to adjudicate that), but it was, as far as both team’s aggregate performance, a gross display of football. And yet, a win is a win. And shockingly, I got no texts at all from my many, many Bruin friends who seemed to know exactly what # to hit up a year ago. I have had a miserable football season, but not really with bad teams, just teams that have a hard time winning, which makes it worse. But this weekend, my Pacifica Triton basketball team beat public school giant Edison High to kick off our high school basketball season (our 300-person school beats 3,000-person public schools all the time, with God watching). Then USC beat UCLA on Saturday night (for me, Sunday morning). And then my Cowboys found a way to beat the Redskins Sunday. I haven’t had a lot of trifecta weekends in sports lately, but Thanksgiving came early in the Bahnsen apartment!

So, Happy Thanksgiving. Beat Notre Dame!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.