Dear Valued Clients and Friends –

It was another sell-off day in markets as additional uncertainty swept through markets in the aftermath of President Trump’s threats to remove Chairman Powell from the Federal Reserve a year before his term legally ends. I’ll expand more on this below, along with the other key notes of interest in markets today.

Dividend Cafe on Friday looked at what we don’t know and what we do know in the midst of all the chaos around tariffs, a tax bill, and deals with other countries (particularly China). The written version is here (my favorite), the video is here, and the podcast is here.

I was on Charles Payne/Fox Business talking dividend stocks on Thursday, was on Brian Kilmeade/Fox Radio Friday morning, Big Money show for a long on-set stint Friday early afternoon (highlight reel here), and then on Kudlow’s show talking the Fed and more Friday end of day.

Off we go …

|

Subscribe on |

Market Action

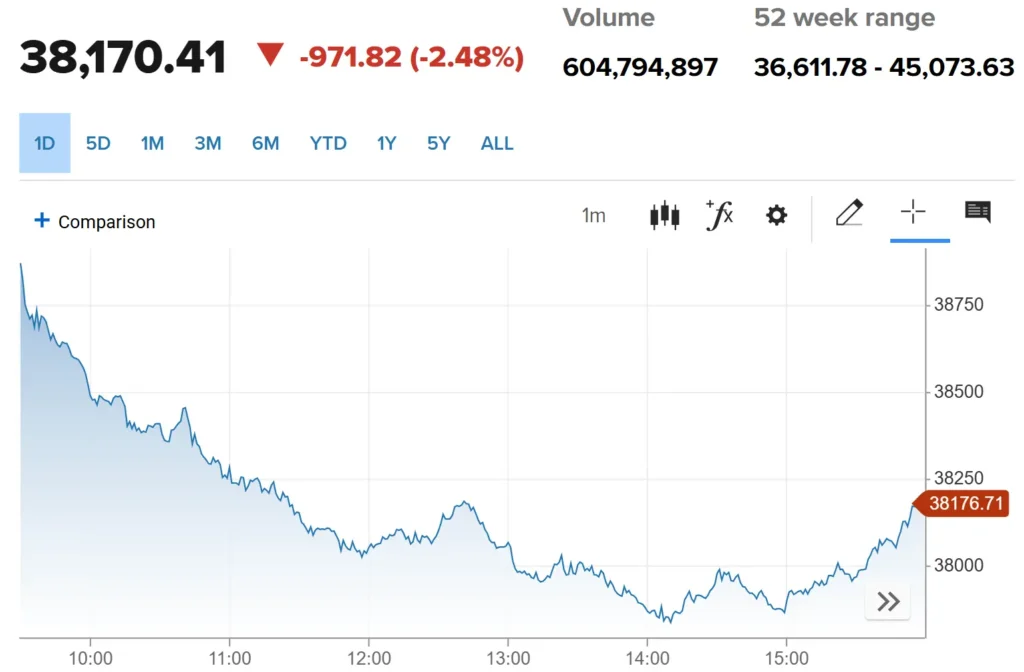

- Markets opened down today and just fell more throughout the day, at one point down 1,300 points.

- The Dow closed down -972 points (-2.48%) with the S&P 500 down -2.36% and the Nasdaq -2.55%.

*CNBC, DJIA, April 21, 2025

- There is perhaps no bigger issue for equity markets right now (besides the immediate outcome of this tariff issue and the immediate outcome of the tax bill) than the impact to earnings from what has transpired (or will be transpiring). The trade war may or may not be resolved, it may or may not worsen, and it may or may not have some zigs with other zags. But when equity investors look to market valuations to assess attractiveness of investment decisions (what is called the P/E ratio – the ratio of price divided by earnings) they must realize that the E in the P/E is no longer reliable. Earnings impact is unknown, and that does not mean it goes to a worst-case state; it does not mean we have a recession or a -10% drop in earnings as is typical of recessions; it simply means it is another uncertainty in this present uncertain moment, strongly recommending that investors maintain the humility that both upside and downside uncertainties require.

- Credit spreads had been below 300bps in January/February, and they widened to 350 throughout March (wider, but hardly considered “wide.”) In the aftermath of the April 2 tariff announcement they blew out briefly to near 500 when markets in their peak distress, and have been sitting between 400 and 450 for the last ten days or so. Further breakdown of credit (wider than 500) suggests very high odds of a pending recession.

- The ten-year bond yield closed today at 4.41%, up eight basis points on the day. The short end of the curve (six months through three years) all saw yields drop as the curve steepened quite a bit.

- Top-performing sector for the day: Consumer Staples (-1.34%) – this was the BEST performer today!

- Bottom-performing sector for the day: Consumer Discretionary (-2.86%) and Technology (-2.72%).

Top News Stories

- Pope Francis died at the age of 88. A new pope will be selected by a conclave of the College of Cardinals soon.

Public Policy

- One of my major themes for 2025 was the deficit coming in lower than expected, largely because revenue into this fiscal year would come in higher than expected. April tax revenues look like they are going to make me look prescient, as capital gain revenues (where there had not been income tax withheld, as there generally isn’t) is up 30% year-over-year.

- The word coming back from the recent trade delegation between the U.S. and Japan was that it was underwhelming. The administration is in a tough position because Japan’s tariffs on the U.S. were already lower than the U.S.’s tariffs on Japan. I can see how that would make getting a “good deal” and “reciprocity” might be tricky for U.S. negotiators.

Economic Front

- The economic news I suspect markets are most responding to (more than threats from the President to remove the Fed chair) relate to stories of collapsing freight and shipping. Hundreds of thousands of containers of cargo (if not over a million) are believed to be stalled, canceled, or otherwise uncertain. This by-product of the trade war was known and predictable, and becomes evident in the “real economy” very, very soon.

Housing & Mortgage

- The NAHB Builder Sentiment Index sits at a brutally low 40, way below the 50 breakeven level. Declining expectations more than offset present situation, and prospective buyers is half of the level needed for breakeven. The #1 issue being cited is tariffs in terms of uncertainty for the sector. Suppliers say they have seen a 6.3% increase in costs from tariffs so far, and 60% of those surveyed expect that to increase further.

- Housing starts fell 11.4% in March, the biggest drop in a year.

Federal Reserve

- There was a massive amount of talk over the weekend as President Trump made more noise about wanting Chairman Powell removed as Fed chair (he has a year left on his legally protected term). President Trump referred to Jerome Powell as “a major loser” in a social media post and seems to be asking the Fed to lower rates in between meetings, a bizarrely peculiar thing to do if the economy is not falling off a cliff.

Oil and Energy

- WTI Crude closed at $63.34, down -2% on the day.

- Despite the additional downside in the stock market last week (S&P 500 down -1.5% in the four-day shortened week), midstream energy jumped a massive +5% on the week. Oil prices modestly strengthened, bond yields came down, and the beginning of earnings season for the sector proved beneficial.

- Chinese imports of U.S. LNG (liquefied natural gas) appear to be ZERO right now.

Glossary

- “Tariff” – a tax on imported goods paid by the importer, which serves as a subsidy to domestic production and a tax on domestic consumption

Ask TBG

| “I really appreciate your commentary and investment philosophy. I tend to side with free markets and the comparative advantage theory. However, I came across an example recently that made me wonder how it fits. The example is that Taiwan did not start out with a comparative advantage in producing semiconductors but have created one through effort and creativity as well as government and private incentives. If you accept that as true, what is the role of governments in promoting comparative advantages or should they just let the chips fall where they may, disregarding national security concerns?” ~ Bryan P. |

| You bring up two different subjects here and inadvertently lump them together as if they were one and the same. The issue of how comparative advantages are built is one thing, and the issue of national security concerns is another. I think both are important. There is no part of the setup or concern underlying your question that should lead one to “disregard national security concerns.” This is the frustration a free trader and national security hawk (all at once) like me feels in the current moment – none of the present policies have anything to do with national security, or are doing anything to deal with our critical infrastructure dependency on global supply chains. I would rather be laser-focused on that, and less concerned with t-shirts in Vietnam, chocolate in Switzerland, coffee in Brazil, and component parts in China, which, you will forgive me, are not national security concerns. So that part of your question feels forced to me, and is separate from the other issue of what fundamentally creates comparative advantages.

There are a lot of ways a comparative advantage can be built. The primary job of an economic actor is to find comparative advantages, not necessarily to care how they came to be – when we select our favorite restaurant, we are generally focused on the best food and service, and not studying the resume of the head chef. But all that to say, from agricultural abundance, to climate, to access to natural resources, to educational focuses, to cultural or vocational focus, and yes, to government intervention, a country develops comparative advantages in a lot of ways. I believe the best thing a free society can do to develop advantages is remove impediments to growth, cultivate risk-taking, enforce the rule of law, encourage entrepreneurship, and allow robust capital markets to evolve. Those things work for countries that want to be superpowers, and offer an opportunity society with dynamic mobility to their citizens. If, on the other hand, one country’s idea of comparative advantage is to favor one sector and subsidize it, well, they may create an advantage in one space – but they do so at great loss and opportunity cost in the rest of their economy. |

On Deck

- We get much deeper into earnings season this week and very deep into it next week.

Looking forward to seeing our new Dallas office tomorrow and meeting with 70 clients and guests tomorrow night. I have a feeling I know what the dinner time conversation will be about. I will be ready.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.