Dear Valued Clients and Friends –

Welcome to the new and improved Dividend Cafe. What you see today will be a weekly Dividend Cafe each and every Monday from yours truly, complete with a podcast and video. It has come for years now on Monday, once under the umbrella of “COVID & Markets” and after that under “The DC Today.” We are simply incubating it under Dividend Cafe, so there is just one list, one website, and one brand behind it all. You will note on the home page of Dividend Cafe that we are running a daily market recap that will include closing data every day along with key economic indicators. Additionally, we will be running an Ask TBG on that home page, where questions will be answered every day. Every Tuesday, Wednesday, and Thursday, that market recap with the podcast and an Ask TBG will be emailed to subscribers., And then Friday, the same weekly Dividend Cafe article we have always done (see next paragraph) will go, per usual. So check out the new Dividend Cafe, all its bells and whistles, and share feedback with us any time!

The Friday Dividend Cafe looked at the subject of contrarian investing, the state of the dollar, and a few thoughts on oil and politics, and the comedy of bitcoin as a “flight to safety” this last Friday. The written version is here (my favorite), the video is here, and the podcast is here.

Into the second quarter of 2024, it may be a good time to review our outlook entering 2024 and major themes as we continue through the year.

Off we go …

|

Subscribe on |

Market Action

- I am debating if any of you care how the futures market opens on a Sunday night. Its inclusion in this Monday bulletin has its genesis in the COVID collapse of March 2020, when the prior night’s futures were a huge story around what was going on in markets at the time (at one point, over 100% of the market’s downside in that period of drawdown from February of 2020 until it recovered its prior level in November of 2020 had come during OFF-market hours!!; in other words, markets strictly from 9:30 am until 4:00 pm were actually up, even as the market itself was at one point down over -30%). But I don’t get the impression anyone cares on Monday afternoon what futures had indicated the Sunday night prior. I will stop looking at Sunday market futures as soon as they bury me or as soon as the therapist I am not seeing and have never seen gets the September 2008 Fannie/Lehman/Morgan/Citi Sunday night memories out of my subconscious. But I may spare you the inclusion going forward.

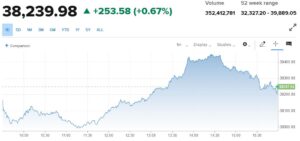

- Markets opened up +100 points this morning, quickly gave that back, and then rallied significantly for three hours before paring back some gains by the end of the day.

- The Dow closed up +253 points (+0.67%), with the S&P 500 up +0.87% and the Nasdaq up +1.11%.

*CNBC, DJIA, April 22, 2024

- I think the market’s non-existent response to the Israel/Iran conflict last week speaks volumes to a behavioral lesson around investing. If I say to you, “This Saturday, one of the most unprecedented attacks in history will be launched by one nation-state with my enemies in the region against another nation-state also with many enemies in the region?” what would you think markets would do over the days that followed? If I added that four nights later, the country attacked would launch its own retaliation, would you predict that the market would be up +211 points the next day? At the end of the day, people asking questions is not the problem. People having an intuition that these geopolitical vulnerabilities may add to volatility is not the problem. Only one thing is a problem in the light of history: Acting on these questions and intuitions.

- A few historical reminders in that vein (h/t Wealth of Common Sense 2017):

- The Dow was down -30% when World War I started BUT UP 87% from the beginning to the end of the total war

- The Dow was up huge the day after Hitler invaded Poland

- The Dow was up 60% during the Korean War

- The Dow was up 43% from the time U.S. troops went to Vietnam to the time the U.S. pulled out (so up, yes, but only 5% per year in that period)

- Once the troops were out of Vietnam, the market began a down-40 % drop

- In the 13 days of the Cuban Missile Crisis, the Dow was down -1.2%(and up +10% that year)

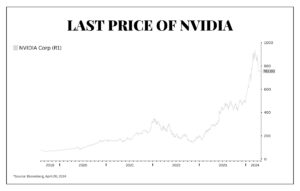

- The Dow was up +211 points on Friday, and yet the S&P was down almost -1%, and the Nasdaq was down over -2%, one of the strangest dispersions we have seen since 2022. At the heart of it? A -10% drop in one day in Mag7 darling, Nvidia.

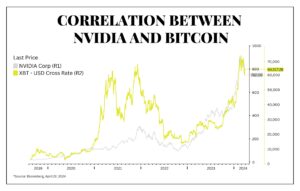

- One could say the correlation between Nvidia and Bitcoin is, well, interesting:

- Other Mag7 names, Microsoft, Google, Facebook, and Tesla are all on the earnings calendar in the days ahead.

- The ten-year bond yield closed today at 4.61%, flat on the day.

- Top-performing sector for the day: Technology (+1.28%) and Financials (+1.20%).

- Bottom-performing sector for the day: Materials (+0.10%) – all sectors up on the day.

- Energy is the top-performing sector in the market YTD and Real Estate is the worst-performing. Speculative tech is the worst-performing sub-sector.

- 87% of the companies in our country with revenue over $100 million are private companies, not public. We talk a lot about “small business” and “family business” being the backbone of the economy, and there is absolute truth to that. But those companies are 99% of the time much less than $100 million in sales … I bring this data point up to point out that even in scalable, substantial companies of size, it is most often outside public companies where certain opportunities lie, hence one of our reasons to look to private equity (where illiquidity is an option) to find value.

- Short position in the Yen is at the highest it has been in nearly twenty years. So, you know what that means is about to happen …

Top News Stories

- The biggest story of the weekend was the bill the House passed Saturday (see more under “Public Policy” below).

- A new NBC poll showed President Trump leading President Biden, 46% to 44%, in a two-man race, BUT Biden leading Trump 39% to 37% when third party candidates were included. In other words, at least this poll suggests that Robert Kennedy is taking away from Donald Trump more than he is Joe Biden.

Public Policy

- The House on Monday passed a $95 billion aid package for Ukraine, Israel, and Taiwan. The package adds sanctions on Iran and sets the table for the long-discussed ban on TikTok. $61 billion of the package represents aid for Ukraine. All the components of the bill passed on a reasonably bipartisan basis, with the faction in the House GOP lacking the necessary support to stop it.

- Some of those Republicans who opposed this bill and who were among those behind the ouster of Speaker Kevin McCarthy earlier this year are discussing a similar attempt with Speaker Johnson. So, we’ll see.

- Do I believe the Presidential election could end in a 269-269 tie? Yes, I do. Do I think that is likely to happen? Of course not. But could Biden win Wisconsin, Michigan, and Pennsylvania, with Trump winning Georgia, Nevada, and Arizona? And then if Trump wins the 2nd district in Nebraska (which awards electoral college votes by Congressional district), the map looks to be 269-269. Now, can all these states break this way? Sure. Is it likely? These days, I don’t rule anything out.

Housing & Mortgage

- 28% of U.S. homes with 3 bedrooms or more are owned by people aged 60 or over. Millennials with children own just 14% of 3-bedroom+ homes. Over 80% of baby boomers said in a recent Fannie Mae survey they have no intention of ever selling their current home.

Federal Reserve

- Where we stand now in the fed funds futures market: An implied 16% chance of a rate cut in June, an implied 43% chance of one in July, and a 65% chance of a cut by September.

Oil and Energy

- WTI Crude closed at $82.13, just down a tad on the day.

- Midstream Energy was up over +1% last week even as oil and the S&P 500 were each down -3%.

- Kinder Morgan kicking off earnings season with a bang didn’t hurt.

Against Doomsdayism

How crazy is this? One-third of the income ever created in human history was created in the last twenty years. How much has extreme poverty dropped globally over the last twenty years? By 130,000 people – EVERY. SINGLE, DAY. How many fewer children died in 2022 than 2002? 4.4 million.

Has everything been great over the last twenty years? Of course not. Are there significant issues in the culture, in the economy, in our national and global politics, that warrant concern? You bet. But is it intellectually and morally honest to focus on those negatives without an eye to the statistical facts in the preceding paragraph? It is not.

Ask TBG

| “I know that David Bahnsen was highly influenced by The Intelligent Investor by Benjamin Graham. David works hard to explain dividend investing in his writing and work. How would you compare and contrast or explain the difference between dividend investing and value investing, if there is one?” ~ Jason A. |

| Indeed, Graham’s The Intelligent Investor is a masterpiece and will always be canon for value investors. Dividend growth investing and Graham’s intrinsic value investing have a shared space on a Venn diagram but are not 100% the same thing, nor are they at odds with one another. Dividend growth as an investment objective uses capital return as evidence of the investment’s value, whereas Graham’s value approach speaks to an entry point of value as a means for entry. I believe Graham’s approach in the 21st century is a lot easier to use with private equity investing than it is with public markets, as it is just a lot harder to find companies trading at a discount to intrinsic value (in expected earnings or in price-to-book). We seek to use principles of not overpaying for companies (Graham 101) in tandem with companies that return profits to shareholders via dividends at an escalating rate. The two concepts marry well. |

On Deck

- The latest monthly report from the PCE (Personal Consumption Expenditures) comes out on Friday, the Fed’s preferred inflation data indicator.

- The Q1 GDP report (first release) also comes out this Friday, the 25th.

“If you are the smartest person in the room, you are in the wrong room.”

~ Confucius

I would be remiss if I did not thank the Digital Content team of The Bahnsen Group, Brian, Lukas, and especially Glen Hall, as well as the Design & Experience team (Mina and Joleen) for all it has taken to get the new Dividend Cafe across the finish line. Re-programming content plans and a delivery schedule across multiple mediums is harder than it looks, and Brian and I are grateful for everyone’s work and collaboration to get this done!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.