Dear Valued Clients and Friends –

The Dow closed at a new all-time high today. We will go around the horn with just a smidge of updates in each of our normal categories!

Dividend Cafe looked at investor behavior, “time in the market,” inflation, and more. It was a potpourri of charts and information – but a shorter and sweeter one. The written version is here (my favorite), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

- The market opened up and moved around a bit throughout the day, with Energy and Consumer Staples helping to offset a tough showing from Technology and Consumer Discretionary

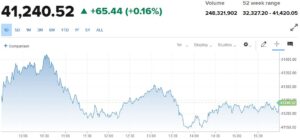

- The Dow closed up +65 points (+0.16%), with the S&P 500 down -0.32% and the Nasdaq down -0.85%

*CNBC, DJIA, Aug. 26, 2024

- The market’s 11-to-1 advance/decline breadth on Friday was the strongest in a given day since last November.

- Maybe one of the strangest things that has happened this month is the big market reversal, with Tech not really the standout leader and, in fact, some names notably weak (i.e., Microsoft, Amazon).

- Across the board, the Citi Panic/Euphoria Model continues to be in the very upper band of euphoria. But to give you an idea of how poor of a timing device this is, it has been there for basically six months.

- The ten-year bond yield closed today at 3.82%, up one basis point on the day.

- Top-performing sector for the day: Energy (+1.11%)

- Bottom-performing sector for the day: Technology (-1.12%)

- One of the big surprise sector rebounds in recent weeks: REITs, with real estate investment trusts responding very favorably to the big decline in interest rates.

- The dollar has stayed weak all month, not reversing or rallying as equities did.

Top News Stories

- Israel carried out preemptive strikes on Hezbollah in Lebanon on Saturday after plans were revealed for Hezbollah to launch 320 rockets and drones at Israel.

- Robert Kennedy dropped out of the Presidential race on Friday and endorsed Donald Trump’s candidacy.

- There may be an impasse on the scheduled debate between Donald Trump and Kamala Harris … The prior Biden-Trump debate rule (agreed to by both candidates) was that the microphone of the candidate not speaking would be muted to avoid interruptions and talking over the candidate whose turn it was to talk. Former President Trump resisted this in those negotiations but ended up agreeing to it. Now, candidate Harris is demanding that the mics be open for the entire time, and it is the Trump team demanding they stick to the other deal. Hmmmm … I wonder why both sides would dig in their heels over this?

Public Policy

- A federal judge last week did, indeed, throw out the entire FTC ban on non-compete agreements the Biden administration had sought. The FTC ban was initially suspended pending further review as multiple lawsuits sought to block it. Still, the judge has now ruled the Federal Trade Commission lacked the authority for such an “arbitrary and capricious” action.

Economic Front

- The labor data continues to offer all sorts of mixed messages. We covered the big revisions plenty last week, and we know that the last two monthly reports reflected a slight softening of the pick-up in the unemployment rate. On the other hand, layoffs are at record low levels, and it is just hard to predict a surge in unemployment (let alone a recessionary one) when, well, no one is getting fired.

- Durable Goods rose +9.9% in July, well above expectations. The only caveat is that the strong showing heavily depended on aircraft orders. Ex-transportation, the new orders were actually down in July and are only up +0.6% year-over-year.

Housing & Mortgage

- Existing home sales increased +1.3% in July and are -2.5% lower than they were a year ago. Meanwhile, new home sales were up +10.6% in July, and median prices for new homes are down -1.4% versus a year ago.

Federal Reserve

- When Chairman Powell said at Jackson Hole that “the time has come,” he cleared away any speculation (there hadn’t been any) that they would cut in September and not into the later months of the year. The odds remain 70% for a quarter-point and 30% for a half-point cut in September.

Oil and Energy

- WTI Crude closed at $77.07, up +3% on the day!

- Gasoline demand is running below pre-pandemic levels, which may mean there is economic softness reflected, or it may mean there are more people like me who walk everywhere they go. =) To be clear, gasoline demand this year is running above 2023 and 2022 levels but below 2021 and pre-pandemic levels.

- Exports of U.S. crude oil are at the highest level in American history on both a four-week average and a six-month average basis. U.S. LNG exports are up but well below last year’s levels before administration interventions to slow down new efforts here.

Ask TBG

| “What is your opinion on CEO’s getting a signing bonus? Also CEOs are now wanting to stay at home; for example, the new Starbucks CEO is receiving private jet travel to the corporate office. The Victoria’s Secret CEO wants to stay in New York and not the corporate office in Ohio. I believe the overall impact on company finances is small. Is the data limited at this time to see how these perks affect company performance?” ~ John C. |

| I would argue there are a couple different things at play here. I certainly have no problem with a CEO getting a signing bonus, per se, and it often is done to offset forfeited compensation or unvested equity they are leaving on the table at their prior firm. The remote work thing is another deal. Generally speaking, I believe CEOs need to be with their people and lead the culture in person. Many Fortune 500 companies have so many locations that the CEO may be on the road all the time, but I do believe the CEO being rooted to the home base of the company is ideal. Now, air travel Monday morning from a remote home to company HQ and back Thursday night (or some such arrangement) can be made to work in the right situation and with the right person, but the point is that a CEO who is a leader will value culture, and culture is not built in absentia or remotely. |

I will leave it there for today. Lots on the horizon this week and next. Reach out with any questions!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.