Dear Valued Clients and Friends –

Lots of good info today, so I will get right into it…

Dividend Cafe this week largely looked at the idea of stability breeding instability, and where this idea we refer to as a “Minsky Moment” (named for the great 20th century economist, Hyman Minsky) may or may not fit into the current market valuation saga. The written version is here (my favorite), the video is here, and the podcast is here.

One other thing I want to point out… two white papers posted at the PRINCIPLES page of our website! One on how we think about dividend growth investing, and one on how we think about investing in Alternatives. Our hope is that both papers provide a useful summary of the why and how of the moment in these two vital components of our investment philosophy.

Off we go…

|

Subscribe on |

Market Action

- The market opened down a hundred points but after ninety minutes of trading was back to even, and just gradually moved higher throughout the remainder of the day.

- The Dow closed up +189 points (+0.49%), with the S&P 500 up +0.77% and the Nasdaq up +0.95%.

*CNBC, DJIA, June 17, 2024

- Market breadth is not good. A month ago just 8% of companies were at 3-month lows. It has more than doubled to 17%, and yet, the S&P has continued to make new highs. A broad-based market result would see less companies at lows as the total market does better. We are getting the opposite of that, a reflection of the narrowness of market leadership.

- I loved this from Ben Carlson today, who himself took it from tennis great Roger Federer’s commencement speech at Dartmouth last week. Federer won 80% of the tennis matches he played over his career but only 54% of the points played. The comparison to the market is stunning – 79% of years, the market is up, but only 52.4% of days. And 100% of seven-year periods are up, up from just 98% of six-year periods, etc. The amount of money lost over years because of people believing they can “guess right” the days and weeks, is insane.

- The ten-year bond yield closed today at 4.28%, up seven basis points on the day.

- Top-performing sector for the day: Consumer Discretionary (+1.43%)

- Bottom-performing sector for the day: Utilities (-1.14%)

- Am I surprised that France has seen their 10-year go from 2.45% to 3.16% over the last six months, and Italy and Germany have each seen +50bps added to their 10-year, and markets have not flinched? Yes. But not as surprised that France’s debt-to-GDP has doubled over the last thirty years, and people still think bond yields are supposed to go higher from such things. A debt-to-GDP that has skyrocketed and a cost of debt that has cratered – it’s the Japanese, American, and European way.

Public Policy

- The current U.S. corporate tax rate is 21%. President Biden has said he wants to raise it to 28% while many House Republicans envision a 15% rate, and President Trump wants a 20% rate. Note: the 21% rate is NOT part of what theoretically sunsets late next year. Any change in the rate (up or down) would require a new act of Congress.

- Another note – believe what you wish about what the corporate tax rate should be, but understand how fundamentally dishonest it is to say U.S. corporate tax revenue as a share of the economy is extremely low compared to other countries. We tax people with LLC’s and S-corps and the like on their personal tax return. A massive amount of “business income” in the U.S. doesn’t go through tax returns at all.

- How many U.S. companies have inverted since the 2017 tax changes (i.e., moved legal domicile to another country for tax benefit)? Zero. 0%.

Housing & Mortgage

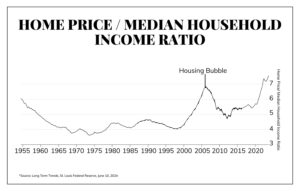

- I am not sure if a chart could sum up the affordability issue with residential housing better than this:

- 38% of mortgages in 2019 had a rate below 4%, whereas 63% do now (based on the massive amount of people who re-financed or bought in 2020-early 2022). Even that 63% is down from 75% when Fed tightening began in Q2 of 2022. Only 12% of mortgages are above 6% right now, showing how few have taken on a mortgage since Fed tightening began.

- The national office vacancy in 2011, a couple of years after the financial crisis, was 18%. It stayed right around there, dipping as low as 16% at one point but averaging over 17% all the way until COVID. Vacancies currently sit at 20%, so basically 2% higher than where they were for the last ~15 years. The level of vacancies in Class A is below the historical average; the level of vacancies in Class B is above the historical average; and many cities have very different results than other large cities. The “no one is ever going to the office again” camp is going to be proven as right as the “no one is ever going to fly again” camp was.

- Speaking of the “no one is ever going to ____ again” camp, the national vacancy rate for Retail was 11% headed into 2011 and is 10% now. It has essentially stayed at 10%, never really higher or lower for a decade now. This wasn’t the best call I have seen some make.

- The idea that Fannie and Freddie would get into the second mortgage world – that is, provide taxpayer backing to cash-out re-finances and such – is just beyond my comprehension for its recklessness and stupidity.

Federal Reserve

- We are at a 92% chance of no rate move in July, but that will soon be 100%. The 61% chance of a cut in September is, I think, a mistake. The 76% chance of a cut by November and 93% chance of a cut by December are, I think, more right.

Oil and Energy

- WTI Crude closed at $80.62, up +2.77% on the day, but up +10% from where it was less than two weeks ago.

- It was a rare week where midstream was down a tad last week, even as equities and oil prices were higher. But non-correlation is non-correlation.

Against Doomsdayism

- I have been working through Maarten Boudry’s Seven Laws of Pessimism. Today is #4 – The Law of Conservation of Outrage: No matter how much progress the world is achieving, the total amount of outrage remains constant. We get conditioned to certain things and yet become numb to progress and maintain a constant level of outrage and that which is bad (even if it is declining). Sometimes, it is fundraising-driven (causes always need something getting worse to raise money for), but much of it is human nature. A certain level of discontentment is baked in the cake, and we will move goalposts if we have to for that to stay true.

Ask TBG

| “What are the implications short and long term of Saudi declining to renew the petro-dollar agreement? How do you explain why this happened?” ~ Justin H. |

| I definitely have a lot to say about how it happened, but no, I don’t think the specifics of the non-renewal are that impactful when they have been so known for so long. The real issue will be in practical terms how it shakes out in the years to come and I still believe (as markets do) that the vast majority of oil transactions will be denominated in dollars. |

Have a great night, and get ready for an action-packed week!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.