Dear Valued Clients and Friends –

We are heavy in the Economic Front today, but there is plenty to fill your cup in all of the normal topics.

Dividend Cafe on Friday looked at fifty years in markets and the economy, juxtaposed with the first fifty years of my life. I have never received as much feedback on a Dividend Cafe as I have this one, so thank you. The written version is here (my favorite), the video is here, and the podcast is here.

One thing I should quickly say – it would be a very good idea to subscribe to The Bahnsen Group’s YouTube channel. From 30-60 second reels we frequently post, to new media clips to the various Dividend Cafe weeklies; the video channel is a free, organized, updated hub of our content and perspective. Subscribe and feel better about yourself when you see me actually in front of a camera!

Off we go …

|

Subscribe on |

Market Action

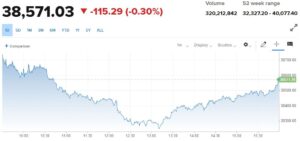

- The market opened up +50 points, dropped almost -500 points intraday, and rebounded throughout the second half of the day.

- The Dow closed down -115 points (-0.30%), with the S&P 500 up +0.11% and the Nasdaq up +0.56%.

*CNBC, DJIA, June 3, 2024

- The Dow’s +575 point day on Friday to end the month of May was its biggest daily increase thus far in 2024. I would love to tell you that it was the market’s response to a benign PCE inflation report (see Economic Front below), but the Nasdaq was basically down a tad, and the Dow’s doubling of the S&P’s return on Friday just seems to indicate to me there was month-end rebalancing or technical factors. Bonds rallying as the long bond yield fell 5 basis points does indicate PCE data was some part of the rally.

- It is tough to say where the defensive sectors are in all of this market action. On one hand, 2023’s worst-performing sector, Utilities, has seen a very strong move relative to the market. But on the other hand, Consumer Staples and Health Care have not. This divergence is confusing.

- The ten-year bond yield closed today at 4.39%, down -12 basis points on the day. With a rally this massive in bonds, the fact that stocks did not participate may be, paradoxically, a good thing (if the high correlation between the two is starting to normalize)

- Top-performing sector for the day: Technology (+0.98%) and Health Care (+0.74%)

- Bottom-performing sector for the day: Energy (-2.60%)

- Watching the market volatility of the last couple months, and seeing headlines contradict each other literally days apart (“Markets rally as rate fears subside,” followed by “markets sell off as rate worries grow” – blah blah blah) – has brought back some fun memories of this consistent incoherence from our financial media.

Top News Stories

- Claudia Sheinbaum has become the first female President of Mexico, winning in a landslide

- Reports are that Skydance has prevailed as the buyer for Paramount Global

Economic Front

- How is the consumer doing? Readers and clients know my macroeconomic consistent view: The U.S. consumer is always consuming until they run out of credit. The idea of a consumer “pulling back” is one of the funniest questions or vernaculars I hear in financial media. It is a myth, period. That said, the consumer certainly pivots activity, makes deals, alters patterns and behaviors, and is generally pretty relentless in their pursuit of value. I was not aware until reading a Josh Brown article this weekend that:

- Teenagers are filming burrito-makers at Chipotle for TikTok to ensure they don’t chince them on portions

- Jennifer Lopez has canceled seven dates on her concert tour, and many other shows apparently are not selling well, at all

- Cruise operators have intensified discounts and programs

We also know that our very own McDonald’s has brought back the $5 value meal. At the end of the day, I tend to agree with the same conclusion Josh had in his article which I think is indisputable in what we know of the data and reality of the American consumer … Some level of discrimination and discernment is coming back. This is not the same thing as contraction – it is alteration and selection – and it is a perfectly positive reality in the flow of an economy. Two words to help guide your understanding of economics: Humans Act.

- Take it as the imperfect indicator it is, but one would think it at least reflects interesting relative data (that is, how one city is doing compared to another). But Las Vegas leads the nation in being at 97% of cell phone activity during weekday working hours compared to 2019 (and for those who have not been to Las Vegas since then, new concert and sports venues have simply resulted in an entirely new place; it is not the same city). Minneapolis is the worst in the nation (of 56 cities analyzed) at only 44%. Seattle is near Minneapolis as the second worst at 47%. I will let readers speculate as to why that may be. San Francisco has gotten up to 57%, still well below other major cities but better than the 30% range it had been in for a long time.

- Personal Consumption Expenditures (PCE) for April was up +0.3% (headline) and +0.2% (core). The Fed’s favorite inflation measurement shows year-over-year inflation at +2.7% currently. Food prices were down -0.2% on the month.

- Personal Income rose +0.3% in April, in line with expectations and basically a tad above expenditures. Real consumption (adjusted for inflation) is up +2.6% from a year ago.

- ISM Manufacturing came in at 48.7 for May, below expectations, and in contraction mode. New Orders fell -3.7% on the month.

Housing & Mortgage

- As mentioned on Thursday, home sales fell -7.7% in the month of April, almost back to the lowest level on record (which was in 2001).

- One of the dumbest things ever uttered is someone pointing out that they paid 12% or 15% for a mortgage in 1979, and therefore 7% today is somehow cheap or standard. Of course, 7% is not brutally expensive relative to much of borrowing history, even though the 2-4% mortgage regime of most of 2001-2022 is the new baseline for most people. But that is just not the point, at all. Those borrowing at higher rates a generation ago were doing it to buy a home that was dramatically cheaper in cost – and I don’t just mean absolute cost, but adjusted for income! The challenge today is NOT the interest rate on the mortgage; it is that the interest rate is being applied to a house that now costs $800,000 and used to cost $150,000. The monthly payment used to be 20% of income and now is 50% of income. It is about the sticker price of the home, period.

Federal Reserve

- I am surprised that September futures odds show a 55% chance of a rate cut in three months. I suppose some may be hedging if the unemployment number gets up to 4% by then, but I stand by my belief that if they had started cutting in March or May or June it would be one thing, but a first rate cut in September that close to the election just isn’t very likely (optics, etc.). The Fed funds futures market pricing of 70% odds by the November meeting and 86% by December seems much more logical to me.

Oil and Energy

- WTI Crude closed at $74.01, down a tad over -4%

- As expected, OPEC+ extended their production cuts into 2025. The aggregate targets across their cartel call for 39.7 million barrels per day in 2025. Approximately two million barrels per day are being reduced from production currently.

- Oil prices didn’t move higher on the OPEC+ news for a very simple reason: Everyone already knew

- Saudi Aramco (the largest oil company in the world by both oil production and market capitalization) is doing a secondary stock sale to raise $12 billion.

- But that secondary pales (“shales”?) in comparison to the $200 billion of M&A activity here in the United States (Exxon’s purchase of Pioneer, Conoco’s purchase of Marathon, Chevron’s purchase of Hess, etc.). We had 65 publicly traded oil companies five years ago and have 40 forty now. Consolidation continues.

Against Doomsdayism

- Second law of pessimism (as we continue through the Seven Laws of Pessimism as laid out by Maarten Boudry in Quilette) … The Law of Velocity of Bad News: Nothing travels faster than bad news. It is true. Mass communication, in particular, has facilitated very quick transmission of information. Earthquakes or tsunamis in one part of the world hundreds of years ago weren’t even known about in other parts of the world, other than maybe rumors months later. Bad news can impact millions of people in real-time, with visual aid (which is emotionally potent), when for millennia it may not have been known at all, let alone with such emotional flair. This speed of bad news and depth of impact is highly distortive and leaves a stronger impression that builds on itself.

Ask TBG

| “There is a clip making its way around the internet that seems to show the leading administration economic advisor not sure how government borrowing or money creation works. Do you believe Modern Monetary Theory is a legitimate school of thought and is that what we face as a country – unlimited money printing in the years ahead by policymakers who believe it will do no damage?” ~ Tim S. |

| What Jared Bernstein says in that clip that has gone quite viral is obviously incoherent, and whether or not he was just caught on camera in a bad moment/bad day, or if he truly is that dense, I can’t say. I have been on air with him before and met him on a couple occasions and it is hard to believe that he has such a poor understanding of things as we see in that clip, but he certainly comes from a different world than I do ideologically.

Modern Monetary Theory (MMT) is not a movement catching on mainstream, but rather is one promoted by just a very small number of truly fringe left-wing economists. The more mainstream but still very left-wing group of economists that make up the consensus views in American academia and policy (Paul Krugman and Larry Summers and Brad DeLong and Thomas Piketty) all uniformly reject MMT. The problem is that many refer to MMT as their bogeyman for critiquing ANY policy involving government spending or loose monetary policy. MMT deserves to be lampooned, and many of the policies people critique deserve to be lampooned, but that doesn’t mean that QE and budget deficits are, in and of themselves, MMT. In other words, the old fallacy of composition is often at play – “MMT is bad monetary policy. QE is bad monetary policy. Therefore QE is MMT.” It’s unhelpful. In a nutshell, no serious person believes there are no trade-offs to the government using money creation as a policy tool. It lacks a limiting principle. And it is based on presuppositions that are fundamentally false (namely, that laws of math and economics apply to households but not governments). |

On Deck

- The May jobs report will come out this Friday, the 7th

- Tomorrow the Job Openings data comes (JOLTS)

Have a wonderful night, and reach out with any questions!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.