Dear Valued Clients and Friends –

I don’t really even know what to say about what today’s Dividend Cafe entails. I do not believe it is an exaggeration, at all, to say that there are four stories that each individually would represent one of the biggest news stories of the year, all playing out today. I have never had a more difficult time organizing a Monday Dividend Cafe, or even my own weekend and Monday reading and research, for that matter. Essentially, in no particular order, there was:

- A U.S.-China tariff pause that was far, far more de-escalatory than had been expected.

- A pharmaceutical price-fixing executive order.

- A Russia/Ukraine off-ramp that might, might, go in the history books.

- Major moves on the “big, beautiful” tax and reconciliation bill.

I will cover all four of these things in plenty of detail in today’s Dividend Cafe, along with all the other news that is fit to print. But really, just one of these stories would warrant its own special Dividend Cafe, so I am working hard to avoid having you drink through a firehose today.

Dividend Cafe went around the globe on Friday to look at the framework of the UK trade deal, the state of our discussions with China, the state of their economy, the best part of the new [potential] tax bill, our currency exchange with countries everywhere, why private equity is doing deals when no one else is, the reality of drill baby drill, and the arguments for and against stock market increase from here. So yes, it went a lot of places. The written version is here (my favorite), the video is here, and the podcast is here.

There is more than a lot to cover today, but all well worth the read, so off we go …

|

Subscribe on |

Market Action

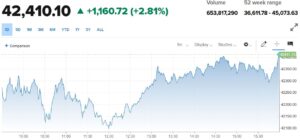

- The market opened up nearly 1,000 points today and stayed up around that level throughout the day, closing at the high of the day.

- The Dow closed up +1,161 points (+2.81%) with the S&P 500 up +3.26% and the Nasdaq up +4.35%.

*CNBC, DJIA, May 12, 2025

- Initially, futures opened last night up about +400 points when all markets heard was that the U.S. and China were reporting a deal in the works. In the middle of the night (U.S. time), futures shot up to +800 on word that the interim deal included a full capitulation on reciprocal tariffs (for 90 days). By 7 AM ET, that had moved to +1,000 points as markets continued to absorb the news (with the percentage move in the Nasdaq being almost +4%).

- The ten-year bond yield closed today at 4.47%, up ten basis points on the day.

- Top-performing sector for the day: Consumer Discretionary (+5.66%) – (some want more than two dolls, apparently)

- Bottom-performing sector for the day: Utilities (-0.68%) – the only negative sector

- The dollar rallied 1.5% today on the news of the China tariff changes.

Top News Stories

- The U.S. and China shockingly announced a suspension of the trade embargo they’ve been mired in for the last few weeks. The 125% reciprocal tariffs were cut to 10%, with plans to iron out a final deal over the next 90 days.

- Russian President, Vladimir Putin, and Ukrainian President, Volodymyr Zelenskyy, are set to meet in Turkey on Thursday for face-to-face peace talks. And President Trump has said he may join them! What could go wrong?

China Trade Deal

- What we know:

- The 125% reciprocal tariffs are off the table for ninety days, coming back down to 10%.

- On an annualized basis, this is $300 billion of tariff cost to the economy that now won’t happen.

- What we don’t know:

- Currency was either not discussed or has not been floated publicly in terms of where things are headed. I have no doubt some discussion of currency will be a part of any final, successful deal.

- What needs to be said:

- Maybe things fall apart in the next 90 days. Maybe they don’t. Maybe it gets better. Maybe it gets worse. BUT, if you were a U.S. importer or domestic manufacturer heavily reliant on Chinese imports for your production, and your costs were up 145%, shutting down your supply chain entirely, and now you had what might only be 90 days to order parts/goods/materials before seeing skyrocketing prices, what would you do? Expect an ordering bonanza in the next ninety days that defies human imagination.

Tax Deal

- The spending changes around Medicaid apparently do include work requirements and a greater process for monitoring eligibility, but with no change to how much funding the federal government provides states, it is hard to see how this will be sufficient (in total savings) to satisfy fiscal hawks.

- The latest report is that Speaker Johnson is now seeking $1.5 trillion of spending cuts and $4 trillion of tax cuts in the “big bill,” versus $2 trillion and $4.5 trillion, respectively.

- Several of the loudest Republican proponents of raising the SALT deduction cap wrote a blistering statement last week, rejecting wholesale the intentions of the Speaker to lift the cap to $30,000, saying they will not support the bill if the cap is “only” lifted to that level. I had sort of figured that the cap would end up being lifted just to $20,000 or $30,000 when all is said and done, but it is important to remember that the two or three moderate Republicans in the House in NY and CA who want to see this deduction cap lifted higher have a lot of leverage. Not only are their votes clearly needed mathematically to go anywhere with this “big bill,” but they get a FULL REPEAL of the SALT deduction cap (i.e., back to unlimited SALT deduction) if nothing happens at all! In other words, if there is no extension, their high-earning constituents in CA and NY get a tax cut that is much larger than if a tax cut and extension are passed! So, how the SALT deduction gets handled in all of this is truly beyond me. Just a couple of hours before press time, it was announced that the first draft legislation sets the SALT deduction cap at $30,000, and disqualifies anyone over $200,000 from access to the deduction ($400,000 for couples)

- Much of the “pay-fors” in the bill come from rolling back tax breaks for electric cars and clean-energy production.

- The talk about a higher tax rate on the highest wage-earners in the pending bill has received lots of circulation. First, it was circulated “from unnamed sources” that the White House was asking the House and Senate to let the tax rate go from 37% to 39.6% for the highest bracket of wage-earners as part of the new budget reconciliation/tax bill. Many blasted the idea, a few populists loved it, and it was made clear to me by everyone I talked to that it was not even being considered (and no fingerprints for the idea came back to President Trump, whatsoever). But last week, the idea was floated that a new bracket would be created for those above $2.5 million in income at a 39.6% rate. This also found its way to Bloomberg and CNBC, with no named sources. President Trump ending up tweeting that Republicans “probably should not do it.” (citing political risk). So there you go.

- The bill does include a higher tax on stock buybacks, as well as a tax on endowments under certain conditions and caps.

- And while the bill includes some “no tax on tips” language and eliminates taxes on overtime wages, they expire in 2028. This House draft also includes auto loan deductibility (for American-made cars)

- The House bill does not exempt taxation on social security income, but does include a $4,000 addition for seniors to the standard deduction.

- The bill raises the estate tax exclusion to $15 million (so $30 million for married couples) and increases the 20% deduction for closely-held businesses to 23%.

Pharma Price Order

- The executive order announced that the White House will apply a “most favored nation” policy on the drug industry. In typical Trump 2.0 fashion, the announcement came via social media without the benefit of details, just announcing that “going forward, America will only pay whatever the best price another nation pays” for pharmaceuticals. How this would be administered, whether it applied to Medicare and Medicaid (or other?), was unclear. How this order will hold up in the courts is also unclear, as past attempts to do a truncated version of this were struck down by the courts (largely on procedural grounds). Today, the additional clarity provided was that the focus is on reimbursements from Medicare and Medicaid. Ultimately, unless the order specifies how the order deals with final net pricing (list drugs for the U.S., less the impact of Medicare and Medicaid reductions), it is impossible to calculate the real impact.

- The order provides a 30-day deadline for companies to negotiate lower prices before governmental price fixing kicks in.

- The pharmaceutical sector rallied huge on the news, after being down -2% in the pre-market, presumably on the belief that

- Much of this will prove to be unenforceable.

- Some of the mechanisms seem to require Congressional approval, which is not likely to happen.

- A lot of this was already priced in.

We are working on additional research around this issue and will be making it available to clients upon completion.

Russia/Ukraine Peace Deal

- Okay, that headline may be a tad premature. But Ukrainian President Zelenskyy agreeing to meet Russian President Vladimir Putin in Turkey this Thursday for talks was a hugely unexpected development this weekend. Now, whether or not this meeting actually happens is another subject altogether, as is what can be expected to come of the talks given the wide gap between the two sides’ expectations.

Economic Front

- Retail inventories are currently at lower levels than they were pre-COVID, meaning a decline in shipments of new inventory is more likely to create empty shelves than even COVID did. The inventory/sales ratio has picked up from the immediate post-COVID low, but is still well below where it has been for most of the last thirty years. Where shipments go from here is a huge question, of course.

Federal Reserve

- China’s central bank announced a very modest 10bp cut in its 7-day reverse repo rate, once again reflecting the very cautious, prudent, and conservative approach to monetary policy the People’s Bank of China has taken for quite some time.

Oil and Energy

- WTI Crude closed at $62, up +1.5%, behind less fears of recessionary demand erosion.

- The big theme in midstream energy quarterly announcements last week was the dichotomy between companies whose natural gas business presents a connection to the power demand story and those who are far more exclusively tethered to upstream crude oil production. Natural Gas Liquids (and companies exposed to storing, gathering, processing, and transporting such) were the winners last week.

Ask TBG

| “What is your view on the Trump administration’s willingness to raise the tax rate on carried interest? Those in favor of raising it seem to view it as a loophole for wealthy GPs and hedge fund managers since they don’t typically invest in their own funds; so their share is viewed more like a bonus than a capital gain. My research is that this higher tax on carried interest would reduce GDP by 0.1-0.2% and raise revenue by just $3 billion per year. Given that the latest CBO deficit estimate for fiscal year 2025 is $1.9 trillion, this wouldn’t even qualify as a rounding error. Why jeopardize any growth for essentially no benefit?” ~ Mike M. |

Well, in fairness to the people on the right and the left who support getting rid of capital gain tax treatment on carried interest, while it is true that the revenue we are talking about is virtually nothing ($13 billion over ten years), it is certainly reasonable to evaluate tax policy for its fairness or unfairness, even apart from meaningful revenue generation. That said, a few things need to be clarified:

I think the issue just needs to be understood better. The argument for the so-called carried-interest loophole is that it creates alignment between managers and investors, and since those managers have to take a long-term investment approach to get the favorable tax treatment, it should be aligned with the same tax treatment as long-term investment. Those in favor of this also argue, with some merit, that the carried interest is only for the capital gain of an investment, which has its tax rates set by law. That the managers received their interest from sweat equity vs. capital contribution is immaterial (or so the argument goes). The arguments against the loophole are pretty straightforward, regardless of conjecture about impact on GDP growth and tax revenue: One is working, doing labor, and paying a reduced tax rate from what those dollars would be taxed if the rate were straight labor. It is generally presented as a pretty black and white issue when the reality (especially for more objectively honest non-partisan types) is that there is an argument to be made on both sides of this issue. To me, it would be a strikingly easier issue to adjudicate if we were not talking about whether or not a more favorable rate should exist for carried interest, but rather how to get the labor and investment tax to the same level. That kind of “flattish-ness” in the tax code would almost make this conversation obsolete, but sadly, it is not anywhere near ready for political prime time. I should note that, as the House bill’s first draft was released just before press time, no change in carried interest was part of the bill. |

I know this was a long one, but it was a long night and a long day, hence a long Dividend Cafe. We have a lot of wood to chop, my friends, in all of the categories of things I bring up today. The Dividend Cafe will be here to keep you posted on all this wood-chopping as we go!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.