Dear Valued Clients and Friends,

The subject of bank stability has really been a big conversation topic since the failure of Silicon Valley Bank and Signature Bank back in mid-March. People have wondered who was to blame, what went wrong, what could have been different, and what else is still going to happen that we may not know about.

I have written in these pages already about Sunday afternoon dramas and the market instabilities that generally create such events. Notice how I worded that, for it was intentional. Sunday afternoon dramas do not create market instabilities; market instabilities create Sunday afternoon dramas. And as we navigate through a change in the present financial cycle, a little perspective is warranted on what has been driving financial cycles. In fact, if we do this well we may just understand not only how this fits into Sunday afternoon dramas and the broad reality of market disruption risk; we may also understand a lot more about the federal reserve, interest rates, and basic financial behavior.

So let’s jump into the Dividend Cafe …

|

Subscribe on |

There’s No Free Lunch

It would be nice if we could have various catalysts that promote higher asset prices without any backlash. We can’t. This is not because of something bad the Fed is doing on the back end. The Fed is unable to escape basic laws of economics just as all of us are unable to. If the Fed could use low-interest rates to create great economic results, with no risk on the other side, with no second half to the story, I imagine they would. Interventions in the natural order of things come at a cost. Sometimes that cost is worth it.

When people have surgery on their knee, it hurts (after the anesthesia wears off). It also leaves may add long-term vulnerability around the cartilage, arthritis, and more. But it doesn’t mean it wasn’t worth it. This is what people never seem to understand about trade-offs (the economic reality encapsulated in the phrase, There’s No Free Lunch). Pointing out that there is a trade-off does not objectively state if the trade-off is worthwhile – it just merely points out that “lunch isn’t free.” We get something we want (a fixed ligament) but we give up something else we may want (as someone who had reconstructive knee surgery 23 years ago, the costs have many to list out here, but I digress). I could use 1,000 examples, but I am sort of stuck with the knee surgery one now. I think the basic point I am making is intuitive to most intelligent human beings (which is almost all of you!), so I won’t belabor the point:

A wise person counts the cost, thinks through the trade-off, then makes decisions as to whether or not the give-and-take of a particular decision or transaction is worthwhile.

Monetary Free Lunch

So back to the Fed and interest rates. The most common “trade-off” to the good times of excessively low-interest rates is that the period creates excessive risk-taking and what we in the biz call “mal-investment” (“mal” means bad for all of you who did not take high school Latin like us cool kids did). Excessively low rates incentivize people to take on more debt, to put on more leverage, and to view bad deals as good deals. It may become clear quickly that some of the deals were bad, or it may take mean reversion to reveal the naked emperor (i.e. rates reverting to more natural levels). But it always happens eventually.

And this is what we mean by boom/bust cycles exacerbated by the Fed – the good times sewing the seed of their own destruction by attracting bad investments. The allure brings in speculation and risk, and at some point, those risk-taking speculators find out that 2% cap rates are not great deals or digital tokens of a dog are more like beanie babies than bars of gold.

Bad investments looking good is one common symptom of a boom cycle that moves to a bust cycle, but it is not the only one. Debt levels that seem serviceable at one rate become less serviceable at another rate (because of, wait for it, math). Valuations that seem okay at one rate become less attractive at another level (as risk assets are always priced against something, always). And one of the most under-appreciated risks of excessively low rates that then go higher is bank covenants. Borrowers agree to certain terms and ratios (say, earnings-to-debt service costs), and as rates go higher, they may still be making their payments, but their ratio has worsened to a point where they breach covenance, allowing the bank to call the loan.

It is a multi-variant risk when booms form as the catalysts to the inevitable bust go beyond the manias of things like dotcom, Vegas condos, bitcoin, and various other shiny objects. Those mania implosions are really, really bad, and they are classic “busts” that arise from “booms” – again, with Fed fingerprints all over the scene of the crime.

But. They. Are. Not. The. Only. Way. Stuff. Gets. Bad.

Loose Money Sinks Economies

The illustrious economist, Dr. Lacy Hunt, lists five ways that excessively easy money does damage to financial stability:

(1) Money supply grows too fast for too long (when velocity is stable, this is inflationary!)

(2) Credit becomes too available for too long, leading to too much debt being taken (one person’s credit is another’s debt)

(3) Interest rates are too low for too long, which mis-prices risk and distorts price discovery

(4) Subpar borrowers get access to money they shouldn’t get money for and use it for deals they shouldn’t be doing

(5) Markets take “forward guidance” as gospel – essentially believing that what is, will continue to be, and believe the Fed when they project certain things about the future and then do an economic calculation and decision-making around that guidance.

2022 really dealt with #’s 1-3, but 2023 has been the year of points #4-5 coming back to haunt us.

When GPS fails, you get Silicon Valley Bank

Look, I am as critical of the banking regulators as anyone, and I certainly find the idea of taking $100 billion of long-dated bonds onto the balance sheet without hedges to be odd. BUT, has anyone considered that at the end of 2021, the Fed was absolutely crystal clear as can be that they were keeping rates low, and even into 2022, when they did raise rates, it would be a slow and measured pace? This wasn’t just hinted at – it was policy guidance. Who could disagree that the Fed was “guiding” banks to go long duration, or at least not fear 525 basis points of increase in less than one calendar year?

The easy money policies of 2009-2021 created actions. They served as guidance. They set expectations. They distorted behaviors. And they did not just do this for crypto bros – they did so for bank managers and treasurers, too. Would you lend out to a commercial real estate borrower at 2.5% if it would capture huge deposits that you thought you’d get to pay 0% on for some time to come?

The Fed unequivocally incentivized decisions on both lending and deposit gathering, and many banks are now paying the price.

I am not vindicating some of the bank decisions that were made. I believe banks need to be well-capitalized, know their customers, know their deposit stability, and manage the capital as if it were their own. And many banks made many bad decisions. But there was a boom-era mentality that fed forward guidance, and the bust-era reality is now here.

Write this down

The simplest dictum you will ever need to understand interest rates and their impact on economic behavior is this great Austrian syllogism:

(1) Interest rates that are unnaturally high slow economic growth as resources are diverted from productive activity to interest payments.

(2) Interest rates that are unnaturally low create rampant speculation.

(3) The natural rate is that which neither slows nor accelerates economic activity, and is found in the growth rate of nominal GDP.

(4) Central banks favor unnatural looseness, not unnatural tightness.

(5) And this leads to financial instability.

Here we are.

What’s the Fed to do?

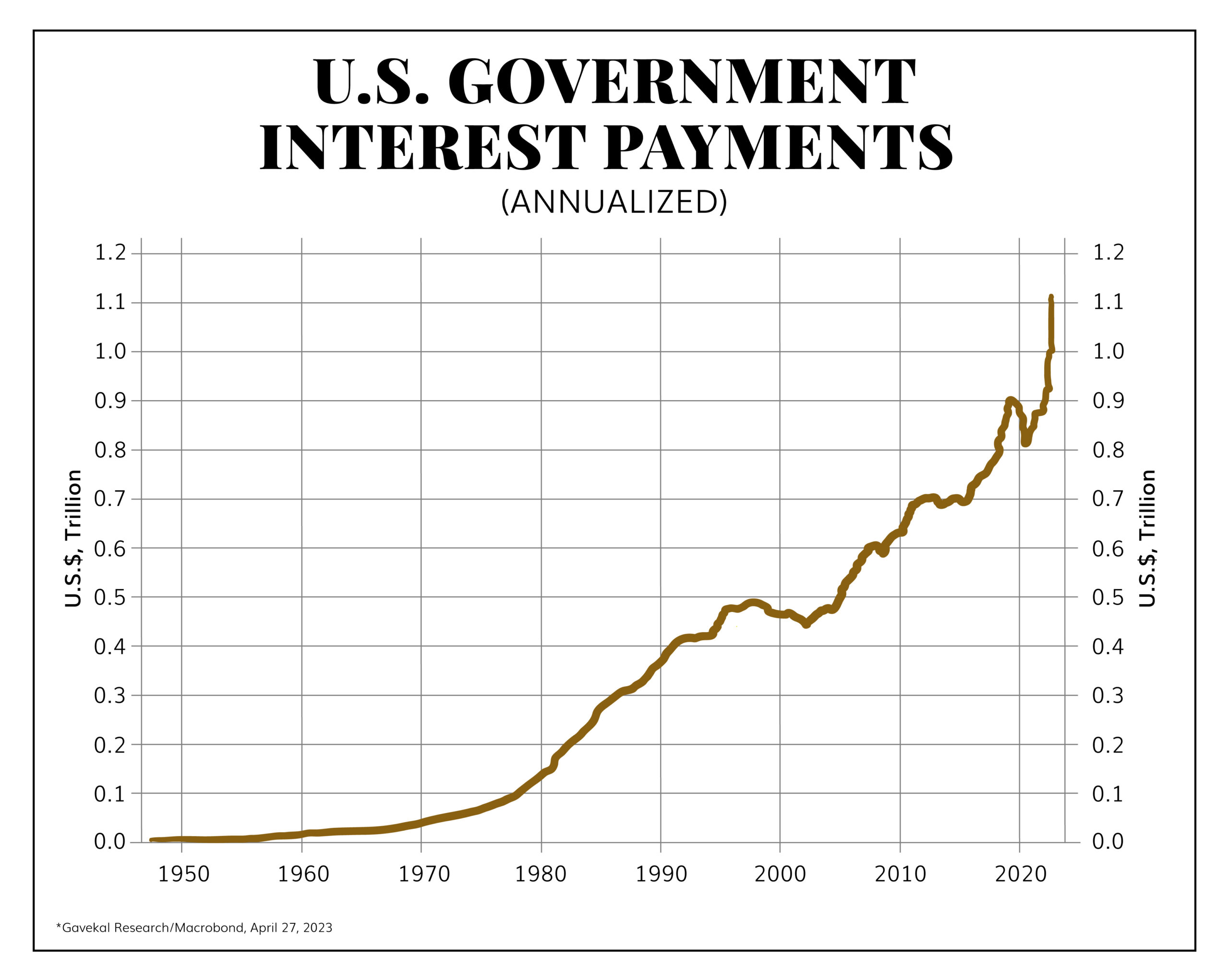

There is $6.5 trillion of government debt maturing this year and $3.2 trillion maturing next year. That is essentially $10 trillion of government debt that was likely costing around 1%, which, when rolled over, would be costing 4-5%. This adds ~ $400 billion to annual outlays.

Only, it doesn’t do that if it doesn’t happen. Huh? What I mean, that is the math (1% being replaced with 5% at $10 trillion does equal an extra $400 billion). But that presupposes it happens in the next 6-18 months, and that sort of begs the question.

Will the Fed let the interest payment outlays go up by that amount? Will the Treasury roll over 1-2 year debt with more 1-2 year debt when 10-year debt is even cheaper?

Humans Act

The rate depositors want for their cash has caused them to pull hundreds of billions of dollars from the banking system. Humans act (respond to incentives).

The rates borrowers are paying have caused them to borrow less or not at all. Humans act.

The amount the fed funds rate was paying banks from 2020-early 2022 caused them to lend at a certain rate and payout at a certain rate on deposited funds. Humans act (banks are run by humans).

And the full intersection of borrowers, lenders, depositors, bankers, customers, investors, developers, and every other actor in the complex financial system we have is filled with humans, acting.

And they act in a world of boom-bust madness because we refuse to learn from history, and refuse to stabilize our monetary policies around the natural laws of the universe.

Lunch not only isn’t free. It can sometimes bankrupt you.

Chart of the Week

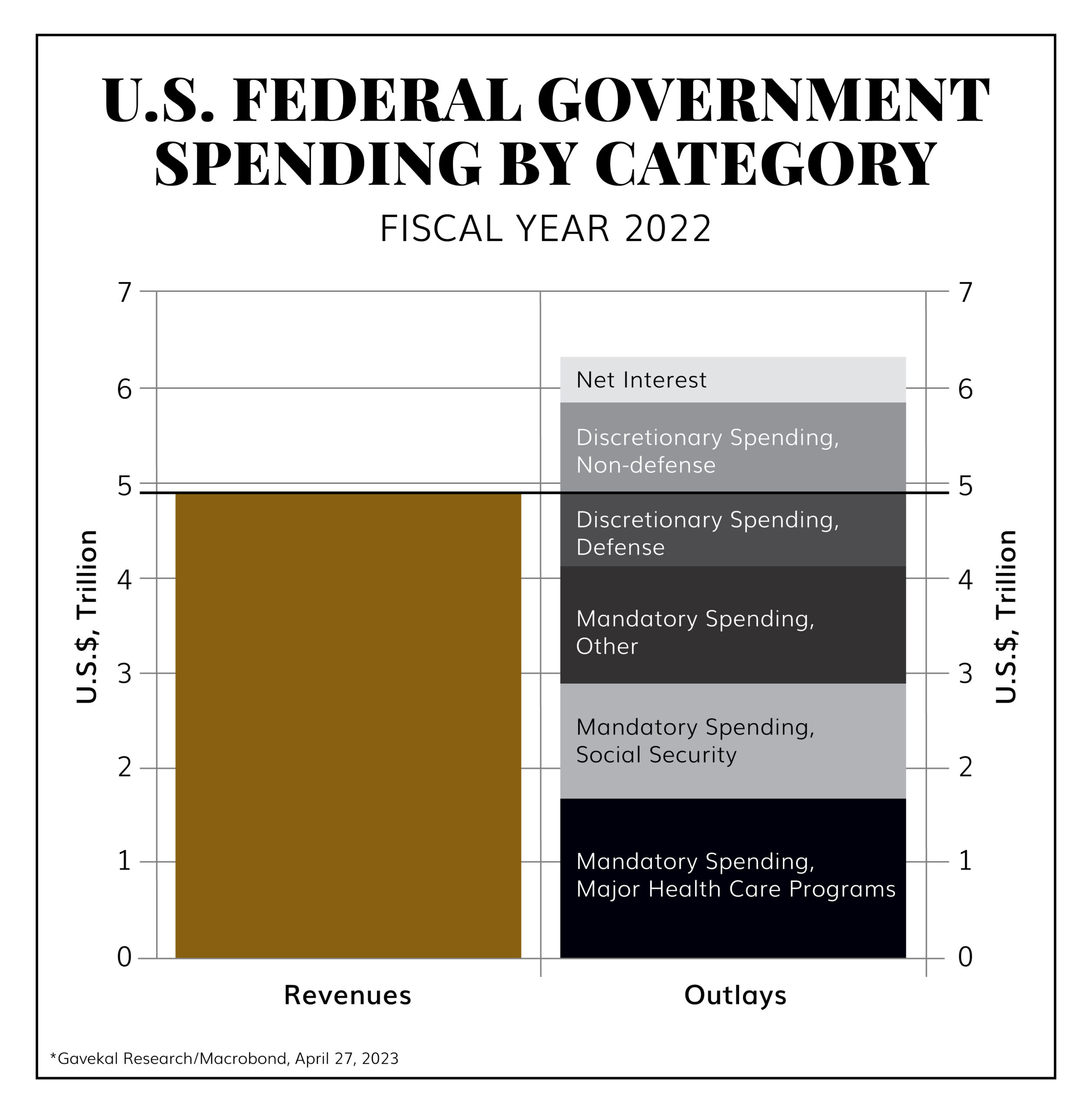

Here is your annual deficit.

Quote of the Week

“To be ignorant of what occurred before you were born is to remain always a child.”

~ Cicero

* * *

May your weekend be delightful, and may your decisions be driven by good information. And when you eat lunch, may you remember that it wasn’t free.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet