Dear Valued Clients and Friends,

I enjoyed a wonderful dinner with my long-time friend, John Mauldin, last week, and something we discussed is going to be the subject of today’s Dividend Cafe.

John is one of the most well-known newsletter writers in our industry, and I have been reading him every single week – no exceptions – for 23 years. Around ten years ago, after a shared CNBC appearance, he and I became friends and quickly connected the dots that John actually knew my late father and even published some of his writings back in the early 1980s. A small world, indeed. Well, since then, John and I developed a friendship of our own, I am a regular speaker and panelist at his annual Strategic Investment Conference, and we are known to do dinners together that can last for four hours, with all aspects of the economy, the market, the Fed, and the American political system on the table for discussion.

At this dinner event last week, John brought something up that inspired me for this week’s Dividend Cafe. You will not be surprised to hear that it is going to involve the Fed, inflation, and all the adjacent topics that so energetically fill the pages of Dividend Cafe quite often.

So jump on into the Dividend Cafe …

|

Subscribe on |

First, a repeat of my position

I have shared it over and over and over again for the last nine months, with growing intensity in more recent months, but my view goes something like this: Inflation, as measured by something like the Consumer Price Index (CPI), has been dropping like a rock for the last nine months, reaching +9.1% in June 2022, and going down each month (measured year-over-year, each month) ever since, hitting +5% in the most reading from March 2023. This is headline inflation – all items – and includes food and energy. My belief is that this disinflation is actually very, very understated by the fact that included in the calculation is the input of +8.2% “shelter” price growth. I will explain how they get there below. But bottom line – I think the shelter component is way, way, way outdated, and the CPI methodology is causing the CPI to print a number far higher than real movement in the price level.

In fact, I believe the actual CPI number right now is somewhere between 2.2% and 2.8% if CPI were doing a real-time measurement of shelter. But before we get to the complexity of this measurement and the discussion John Mauldin and I had last week, a further fly sits in the ointment.

A Core Truth

Core inflation, which seeks to exclude the up and down volatility of particularly energy, never got as high as Headline inflation but still went much higher in 2022. It hit +6.6% in the fall of 2022 and only recently came down to 5.5%. The existence of an inflation measurement that excludes things like food and energy is controversial, as some allege that it is intended to make things look better or worse than they really are in measuring the price level.

But hold on – did you catch that? The accusation is that it can make things look “better or worse” ?? Which one is it? How can it be both? Indeed, the whole rationale for a CORE and a HEADLINE reading is that it can do both – add to the inflationary data, or subtract from it. It is the very reality of this enhanced volatility that caused economists to advocate for two readings – one with food and energy and one without. And as we have seen in spades the last year, some months’ headline is looking a lot worse than Core because of gas prices. Those are the months the right starts screaming at Joe Biden because of energy policies, and those are the months that the Biden administration starts calling it “Putin’s inflation” and releasing oil from the Strategic Petroleum Reserves. But then, when oil swings the other way, those are the months the right starts using a different inflation metric (eggs, anyone?), and the Biden administration starts saying there is now “zero percent inflation.”

It’s all kind of exhausting – a permanent best-ball optionality that both sides of the political aisle use, as far as I am concerned, disingenuously.

The enhanced volatility of energy price inflation is only one reason a distinction between “core” and “headline” can be useful. It would take an odd stubbornness not to recognize that much of what impacts the price level, at large, is different than what impacts oil prices. Geopolitical dynamics, OPEC activity, weather, war, and all sorts of extrinsic causation can drive up and down movements in oil prices – necessitating a separate analysis from the broad price level. Movie theater tickets, health insurance premiums, and the cost of a rack of lamb at your favorite restaurant are all less likely to have their cost influenced by Saudi Arabia or Libya than oil prices are.

2022’s nuances

There were times in 2022 when it was convenient to use Core depending on your agenda, and there were times the same agenda would have made it convenient to use Headline. What are these agendas I could be referring to? Do I have an agenda? Inquiring minds want to know!

One agenda that is heartbreaking for me to discuss but seems beyond a plausible point of deniability is that many on the political right wanted to use inflation as a political hammer against the Democrats and did not want to let nuance, facts, details, and complexity get in the way of political advantage. Now, I say this as a person who considers himself a member of the political right (at least as long as the right will still allow “movement conservatives” like me in their orbit). And I also say it as a realist – I am well aware that everyone uses whatever is happening in the news for their side or against the other side when the appropriate narrative crafting and spin will allow for it. Politics is just like that. I get it. But, I also know as a fact that many, many, many people on the political right knew that excessive government spending did not suddenly and miraculously become inflationary just because a candidate they do not like was in power. Blowout reckless spending happened in the first decade of the 2000s under a Republican, continued for eight years under a Democrat, then continued again for four years under a Republican – and there was no movement higher in inflation – and no one said boo! If anything, the lack of inflation was a source of embarrassment for those who tried to play that card in the aftermath of quantitative easing and the financial crisis. It didn’t happen, and people let it go. The national debt exploded under President Trump. Crickets. Joe Biden comes in, inflation goes up, and voila – government spending created inflation.

I think you know how I feel about this – I hate hate hate excessive government spending, and believe this indebtedness is a millstone around the neck of economic growth. I don’t like it when a Democrat does it. I don’t like it when a Republican does it. And I think it is detrimental to economic progress. But no, I do not believe excessive government debt is inherently inflationary, for the simple reasons I have written about ad nauseum that:

(a) Japan proves otherwise (1990-current)

(b) The U.S. proves otherwise (2001-2021)

(c) The UK and EU prove otherwise (2001-2021)

(d) Excessive indebtedness collapses velocity, which is multiplied against the money supply in impacting the price level, putting downward pressure on growth

So while I felt that the third government COVID stimulus bill passed in April 2021 was reckless, foolish, partisan, unnecessary, and sure to create unintended consequences (not the least of which was damaging the supply of labor, which WAS inflationary!), I did not and do not believe that such silly government spending becomes inherently and sustainably inflationary, any more than I thought the trillions of dollars spent in the same capacity by the Trump administration was. Now, was there a sugar high that came from a $2,000 government check? Sure. But MV=PT (money supply X velocity = the price level X the total supply/transactions), and the increase in M can only impact P as long as V is not dropping or T is not rising. And I have written far too much about why T was the real challenge in 2021 and 2022 – we had a supply shortage caused by the lockdowns and exacerbated by the re-openings that surged demand without corresponding supply increases.

You’ve heard all of that before.

But I don’t want to only pick on those on the right who tried to politicize the 2022 inflation. There was rank politicization from the left as well, sometimes to the ideologically absurd. “Profiteering” by companies was the accusation from the Sanders/Warren wing of the Democratic Party as if the laws of supply and demand and general principles of competition all go away in certain calendar quarters when it is convenient to do so. You’ll forgive me if I find that ridiculous. And as I said above, the labor shortages of 2021 were a massive factor in the inflation surge, and much of those shortages were a result of that fateful bill passed in April 2021. There is a pox on all houses here.

But through the nuances of 2021 and all the politicization and all the things I have said so far to upset everyone around me, left and right, there existed price inflation in 2021 and 2022 that has come way, way down, and yet still shows +8.2% in the shelter component. And this is where my talk with John Mauldin comes in.

Shelter in place for one more paragraph

“Shelter” is 34.4% of the Headline Consumer Price Index. If Shelter is up +8.2% and weighted at 34.4%, it is ADDING 2.8% to the inflation rate because of math. But it is over 40% of the CORE CPI!

How do they measure “Shelter”?

24% of the 34% is called “Owner’s Equivalent Rent,” – and it asks people what they think their home would rent for. 7.5% of the 34% is “Rent of Primary Residence,” and it asks what people are paying in rent now. If someone signed a lease in January 2022, their answer in October 2022 is still the same as in January. If someone signs a new lease in October 2022, their answer is different. The nature of one-year leases means there is a constant lag in this data.

Prices are not up +8.2% for one renting a new apartment today versus one year ago. Most metrics show something between -2% and +2%. Year-over-year inflation at this point in real shelter costs could very well be negative (deflation), and it could be +2%. So if you say +2% instead of +8.2%, you get an inflation rate of about 2.8% right now. If you say 0% you get 2.2%. You follow my math. The shelter component is outdated because of the lag effect in measurement and is distorting the data.

Now, it isn’t like this is a secret. The Fed knows this (I can’t say for sure they care, but they do know). Other analysts know it. It is what it is. But because inflation data is said to be the primary driver of what Jerome Powell and the Powell-led Fed do next, I have made the point over and over again that real inflation data is not a great argument for further monetary tightening.

And this brings me to my conversation with John Mauldin.

Was sauce for the goose, not for the gander?

John agrees with me on the basic construction above – that shelter inflation is overstated by the present methodology, and therefore overall inflation is lower than is presently reflected. I won’t speak for him on anything else I have said, but the conversation was not about the present lag (i.e., a reality of lower prices in shelter showing a higher figure), but rather, the same exact dynamic doing the exact opposite in 2020 and 2021.

His challenge to me: “Wouldn’t that mean the ‘shelter’ number was UNDER-starting the price impact in 2020 and 2021, as the same lag effect was creating a LOWER price growth than was actually happening on the street?”

My answer:

“Yes, yes, yes, yes, yes, yes !!!!!!!!!!!!”

The reason for the question?

“David, wouldn’t that mean the Fed was staying too loose then, not factoring in the data of what was happening to housing and rents then, just as you allege they are going too tight now, not factoring in the clear softening in prices now?”

My answer:

“Yes, yes, yes, yes, yes, yes !!!!!!!!!!!!”

Boom-Bust Danger

The zero-bound policies of the Fed were not okay in 2021 (all the way to spring 2022, by the way), and I said that over and over and over again. The reasons include but are not limited to that they were under-counting higher prices in things like real estate and rents then. John’s point is EXACTLY correct – that their excessively easy policies then were not justified by the real price data, just as their over-tight policies (in my mind) are not justified by the real price data now.

I will say that this is the most intellectually honest argument against Fed interventionism – not that it creates booms, and not that it creates busts, but that it creates BOOMS AND BUSTS.

The Fed’s tightening in 2022 and 2023 came about because of their looseness out of COVID, which was way too loose for way too long. The housing data is only one proof of this, but it is a legitimate one and one in which I am in total agreement with my friend, John Mauldin. When all is said and done, the Japanification thesis I believe in partially comes out of the reality that the central bank has been left with no good options but to BOOM and BUST, all the while dealing with political realities that make this inconvenient for brief periods of time.

Conclusion

I don’t have an agenda in criticizing inflation, deflation, Japanification, shelter data lags, or anything else I criticize, other than my earnest desire for an economic playing field that is free of distortions and biased towards growth and prosperity (all towards the aim of true human flourishing). And yes, that agenda sometimes means pointing out the errors going up and the errors going down.

Chart of the Week

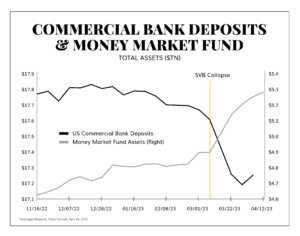

Bank deposits were dropping before Silicon Valley fell and have continued to drop ever since at a faster pace as the higher yield of money market accounts draws depositor cash out of the banking system.

Quote of the Week

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

~ Blaise Pascal

* * *

I hope you will have a truly splendid weekend, and reach out with any questions. Special thanks to John for inspiring this week’s topic, and I look forward to our next meal. I am sure it may generate another Dividend Cafe inspiration! =)

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet