Dear Valued Clients and Friends,

I love these “question and answer” editions of the Dividend Cafe. I should say that 100% of the questions that appear are always completely real, from actual readers, reflecting different things on your mind across a variety of topics related to markets and the economy. Today, we get to talk about what it means for markets to “price things in,” about gold, about government debt, about dividend growth, and so much more. It is digestible, succinct, easy, comprehensible, and it is about as much fun as one can have in weekend reading.

Let’s jump into the Dividend Cafe …

|

Subscribe on |

Pricing in the unknowable

“You frequently use the phrase, “that’s priced in,” or, “the market has already priced that in.” How do you know if and/or when the market has already accounted for an event, especially when that event is only a possibility?”

~Jesse

This is a very, very good question. And the answer is that we never know the exact level of “pricing in” that has already happened – we only know that markets always are, by definition, trying to do so. The less an event is known or understood the less it can be “fully” priced in, but the possibility of an event and certain risk and reality around it means that markets, by definition, are trying. Totally unknown, unforeseeable events cannot be priced in, by definition. The most practical way to think about market discounting is in a theoretical sense that should never leave one’s analysis, without attempting to calculate specificity and precision. The major utility of this knowledge is that markets are trying to price in what they can in terms of belief and possibility, because like gravity, it is a law of nature.

Is it debt if I owe it to myself?

Very helpful article on government debt and its impact. You excluded inter-government debt from the ratio of debt to GDP. I assume that is because it does not compete with private issued debt and therefore not relevant to your point. Could you please explain the overall impact of that inter-governmental debt. Is it harmful and if so, how and why? If it’s not harmful, why not do much more of it?

~ Dave B.

In a sense, this whole subject is prone to certain accounting semantics. I believe the most accurate way to think of debt-to-GDP is in terms of public debt – money the government has to raise that it owes to outsiders. But total debt-to-GDP and public debt-to-GDP are not metrics we have to choose between – we can look at both. In dollar amounts and in ratios, we can (and do) know and understand both. And when comparing to other countries, it is important to do so on an apples-to-apples basis (I sometimes see commentators compare our total debt-to-GDP to another country’s public debt-to-GDP and wonder if it is purposeful deception going on or just unintentional ignorance; it is usually the latter). Inter-governmental debt

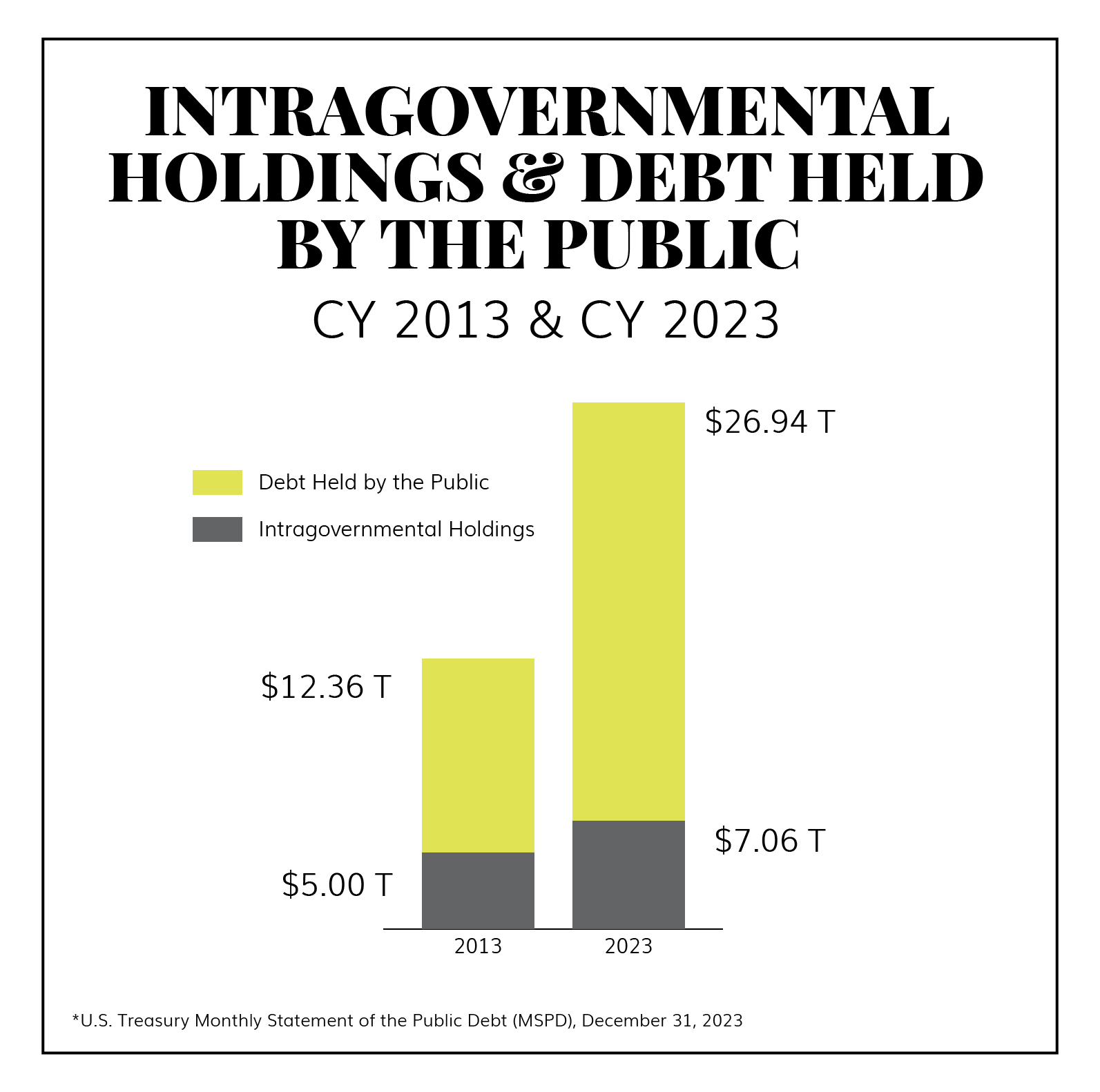

A big part of the reason why public debt matters more in economic analysis is because that is where the growth of the debt is. Over ten years we have a 108%+ growth in the size of public debt but just a 40% increase in inter-governmental debt.

But fundamentally, the issue with internal debt is that there is more flexibility in how it is paid back. To not pay it back, though, of course, leaves whatever it was used for unfunded. So, no matter what, even if it is in a separate category of creditor rules and realities, it is EITHER money that has to be paid back or it speaks to some government program that will not be funded. So you have to pick your poison.

Stop the losses!

“Do stop losses factor in to your portfolio management, or are they less relevant in the context of dividend growth investing?”

~ Paul

So, for those who don’t know, a “stop loss” is a type of order a trader may use to say, “if a stock is at a certain price but drops down to a given lower price, sell me out at that lower price to avoid the stock going even lower.” And the answer to this question is an emphatic and really important “No!” But allow me to explain.

Stop losses. Do. Not. Work. Stocks OPEN UP well below their “stop loss limit” price all the time and then get sold well below the dollar level used. They also notoriously get stopped out right at the point of the silly limit price, and then magically rally above that level from there. They are an open invitation to traders to take you for a ride. They do not eliminate the “excess” downside below your stop price because they routinely gap down after hours. And most of all, they violate the point of dividend growth reinvestment, which is not to get stopped out of declining stocks but to buy more of them.

Should we buy gold??

“My husband keeps saying we should buy gold. I disagree. Have you written about this elsewhere? I prefer dividends from good companies.”

~ Fran

Well, far be it for me to get in between you and your husband, but yes, I tend to take your side on this one. This has nothing to do with my outlook on what the gold price will be in six months, or a year, or three years, etc. I do not have such an outlook at all. By “no outlook,” I mean I do not predict it will be lower, flat, or higher – I predict that no one has the foggiest idea. Asset prices are priced off of an internal rate of return (future cash flows discounted into the present). Gold has no internal rate of return, so all I can do is speculate.

Now, gold bugs will say, “but it is for an inflation hedge!” and then they are giving me a little more to go off of in interacting with the argument. For one thing, it simply isn’t. As I have pointed out in the Dividend Cafe and elsewhere a dozen times or more over the years, over a 40+ year period gold is down by about 20% against inflation – DOWN, by TWENTY PERCENT!, over a full 40-year period!!

The fundamental argument is that gold can be a hedge against monetary policy insanity. And as you know, I believe there has been plenty of monetary policy insanity over the last decade. And what do we have to show for it, over a TWELVE YEAR period of zero interest rates, quantitative easing, negative rates, and all the monetary experimentation of this post-crisis era? Nothing. A completely and totally flat period since 2012’s peak.

I haven’t written a specific paper on it, but one of our partners is working on one now. At the end of the day, we avoid gold because we believe growing cash flows are a proven superior hedge to inflation and because we don’t feel we can price gold as either under or overpriced. It can go up and very well might, but we have learned from history – with no ambiguity about this – that it can go decades at a time, confounding and disappointing its biggest fans.

One flows from the other

“Since dividends are paid out on a share basis and not on a value basis, rebalancing the portfolio may have a disproportionate effect on dividend income. Is the target weighting used by TBG based on value only, or will you consider the weighting of the dividends as well?”

~ Kris

I think there is a misunderstanding in the question I should help clean up. A share basis and a value basis become the same thing within a portfolio management process. We may own 100 shares of XYZ, but the reason it is 100 shares is that it equals a certain percentage of the portfolio that we control and target. If 100 shares were not equal to the percentage we wanted, we would be buying or selling more as the math required. The share count becomes incidental to the % (weighting) we are after, and of course, that becomes a dollar amount when all is said and done. Rebalancing to a desired weighting is immaterial to the dividend income in that some shares of certain stocks that are above our targets are being sold, but others below their target are being bought. The dividends are not weighted any different than the positions – they are a direct by-product of the weightings. What I THINK you are really asking is whether or not a particular yield/dividend on a particular stock is factored into that stock’s weighting, and then consequently across the whole portfolio in total. And there, the answer is absolutely yes.

Demography is Destiny

“Do you think China’s upside-down demographic position will have an even greater impact on its economic situation this year and can that be quantified?”

Dan

No, demography is a multi-decade phenomenon, not a single-year one. That their demographic trend is negative is indisputable but that is not a 2024 story, nor quantifiable in a single year.

Actionable political dysfunction

“I agree with you wholeheartedly in your analysis of the lack of interest by either political party in cutting spending or dealing with the tough financial problems when they are in power. That said, how should that knowledge guide our equity and bond investments going forward?”

~ Jeff

It should guide an expectation of greater excess indebtedness and greater fiscal and monetary instability out of that, leading to downward pressure on growth that encourages a greater allocation to high-quality dividend growth versus speculative hopes for pure multiple expansion. And it should lead to a long-term expectation of lower, not higher, bond yields.

A Japanification question that makes my very point!

“The example of Apple’s debt presents the opportunity to connect some dots I’ve been struggling with regarding the Japanification thesis. If over-indebtedness as a nation is bad because of the law of diminishing returns and if diverting resources to pay debt that could be used more productively elsewhere, then how does that impact Apple? If what can increase economic growth is a capex cycle that increases productivity, then wouldn’t that investment in new factories and automation come from Apple’s (or Pepsi’s, or Boeing’s, or Ford’s) cash flow and private and/or public debt that the company issues? How does the government’s debt impact the capex cycle and the investment decisions of private companies that drive economic growth?”

~ Dusty

Greater investment in productive assets from the likes of big American companies is exactly what could alter our downward productivity and growth trajectory. But the entire point of the Japanification thesis is that, algebraically, the more of our national income being used to service debt, the less of it is being used for productive purposes. This is a tautology. Furthermore, savings drives investment and investment drives capex. The more debt, the less savings. Ergo, less productivity. Now, would it be worse without great companies doing great productive investment? Yes, I would say that is pretty safe to say. But it doesn’t negate the underlying thesis – it emphatically reinforces it!

Dividend Growers and the Market: Chart of the Week

“How do dividend growers normally do against the whole S&P 500 and why shouldn’t someone just buy a passive dividend growth index?”

~ I.C.

There really are two different issues here. One is passive dividend growth investing vs. passive index investing, and one is passive dividend growth investing vs. active dividend growth investing. On that latter question, let’s just say we are very, very happy to put our active dividend growth track record up against passive strategies any time, both in theory and in practice. The huge differential in 2022, when the market was bad, and then another huge differential in 2023, when the market was good, both in favor of active dividend growth management, tell a significant story. In all kinds of weather, we believe active management is key to the philosophy of dividend growth and that passive exposure to “aristocrats” ensures a lower yield and a lack of attention to changing circumstances within portfolio companies.

But as for the general concept of dividend growth vs. the market itself, I have shared other data points and charts over the years about how overwhelming the data becomes with a longer track record of empirical observation. In a normalized decade, the quantity of years where dividend growth does better becomes quite clear, and the compounded impact to total return becomes overwhelming. The reason I offer this chart here is to make the point that there are years (1999, etc.) where the overall S&P 500 does a lot better than the so-called “dividend aristocrats.” But the quantity of years is titled the other way, often for long stretches of time, and I should add, especially in markets that are not straight-line pure bull market euphoria.

Quote of the Week

“Every investment price, every market valuation, is just a number from today multiplied by a story from tomorrow.”

~ Morgan Housel

* * *

I am headed back to 20 degrees New York City from 60 degrees Newport Beach, but I am not complaining. I, tragically, am not watching the Cowboys in the playoffs this weekend, but I will be doing lots of wonderful things that make live worth living. I hope you will be doing the same.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet