Dear Valued Clients and Friends,

As I type on Friday morning well before the market will open for the day, the Dow is up ~1,200 points on the week, basically right back to where it was the day before the Omicron news and market sell-off, and the futures are pointing upwards for today as well (of course, anything can happen on that front).

A week ago, I devoted the Dividend Cafe to discussing why I felt the Omicron story was a bad joke of a market mover, and we walked through a little COVID Market history. But I didn’t end on a sanguine note – I reminded you that there are vulnerabilities in the markets and that chief among them was the anti-fragilities created by excessive monetary interventions, and of course, basic valuation concerns where some euphoria may be overflowing.

Today we’ll leave Omicron in the rearview mirror where it belongs and where the media has conveniently left it just 10 days or so after dramatically different assertions. But we’ll dig deeper into a couple of things that warrant our understanding – an understanding that is not the same as concern or worry.

Come on into the Dividend Cafe …

Scariest four words ever

Yesterday on CNBC, I heard my pal, Joe Kernen, say to a very high-profile “new tech” growth manager named Cathie Wood, the following:

Maybe this time, it’s different. Maybe this time, the valuations just won’t ever contract again. With interest rates so low, maybe we are now in a new environment that doesn’t look to those kinds of things like valuations, and maybe valuations can stay sky high forever.

So yes, that got my attention, because there is one constant I have seen in my investing career that also matches the constant of history, that I am quite confident matches the constant of the future – Whenever people start talking about something being different from an actual law of nature and law of finance that lacks any exception in history, be afraid. Be very afraid.

Valuations, of course, always matter. And when valuations go into an extended period of excess (by a variety of measures), that can be a great thing for those trading into the surplus valuation. The fear does not come merely from the excess valuation (though it surely does enhance risk). The fear I speak of here comes from the complacency that comes from assuming it may all be different now. After all, if all bets are off if this time it’s different, why not allocate unwisely, excessively, imprudently, and irresponsibly? After all, this time, it’s different. What could go wrong?

But but but …

What really got my attention, though, was not just chitter-chatter that generally sounds very late-cycle to me (i.e., “maybe this time it’s different” – the classic rhetoric we hear from TV anchors, Uber drivers, and bartenders, right before something terrible happens) – but also the fascinating response from the formidable money manager.

In explaining the massive valuations that exist in a lot of the cool tech, new tech, work-from-home tech, whatever you want to call it, she wanted to plead for “how conservative” they have been in their projections, whereby they “assume these companies will come all the way down to FAANG-like valuations in five years.”

Conservative.

In five years.

FAANG-like valuations.

Her point was that even if you assume these companies are “only” at FAANG valuations in five years, their pro forma still indicates great returns based on what they believe the earnings growth may be. This was evidence of “hyper-conservative” assumptions.

Ay. Yi. Yi.

Define conservative

The current P/E ratios of the FAANG ingredients are 24x, 68x, 31x, 56x, and 29x, respectively. As a blended unit, it is 42x earnings.

So with a bunch of companies that are NOT the five largest tech type plays on the planet, with massive market share, unworldly margins, and brand recognition like the world has never seen, one can consider it CONSERVATIVE to think that IN FIVE YEARS those valuations will finally come DOWN to ONLY 42x earnings, whereby after five years, you will then be at a level where you would get all your money back on the investment in just a mere 42 years if you got ALL of the then-profits out each year.

Ay Yi Yi, Indeed.

Now …

Look, my comment here is not about FAANG. Those companies deserve a high valuation. Are their hottest growth years behind them? I certainly think so (in percentage terms). Are those P/E ratios too high? History says so. Are there political risks lingering? It sure seems like it. Do too many treat high-risk big tech stocks like they are a safe haven? Yes.

But I am the first to say that these companies are wildly profitable, with serious moats around their business models and unprecedented cash flow generation in world history. This is not about FAANG.

My shock at Cathie’s comment was about how we now think about risk. The idea that 42x earnings could be fair NOW because it will have grown into a 15-20x valuation in five years is maybe more reasonable (but still risky; a lot can change in five years, and maybe 20x earnings in five years is still too high). But to look at a large, vulnerable, questionable part of the market (non-FAANG tech) as if getting to that stratospheric valuation in five years is “conservative” is simply outrageous.

And yet, she can hardly be blamed for it.

The problem is us

This comment I caught may seem innocuous to some, but it speaks to the more significant societal problem I see now, which I believe is the real issue investors face – how to deal with what seems like too much complacency about risk. We speak nonchalantly about new shiny objects, and we forget the lessons of the past in five seconds. Historical lessons of risk cannot be allowed to get in the way of what matters, which seems to be that “people we know are making easy money.”

When it comes to crypto, new tech, and a variety of other things that have captured the imagination of a trading-obsessed easy money culture, I assure you FAANG is the LEAST of my concerns.

Growth/Value

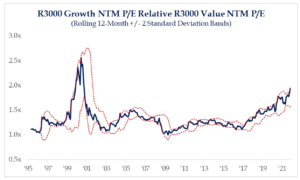

For much of the last 25 years, the premium in multiple for large-cap growth to large-cap value has been about 25-50%. So if the average multiple for value was 15x (as an example), the multiple for growth would be 19-22x (125-150% of the value multiple).

*Strategas Research, Daily Macro Brief, Dec. 10, 2021

One big exception to that relationship average was, well, the dot-com tech bubble. There we saw the ratio get up to 2.5x. It has now gotten well above its ~1.25x average up to 2x.

I should be clear

While I happen to believe large-cap growth is quite over-extended, the thoughts on excess valuation are already present in a certain sense when you consider:

(1) Small-cap growth is flat on the year despite small and large-cap value being up +28% on the year

(2) The average stock in the large-cap space has done 14% worse than the overall index, speaking to the reliance on “market cap” dependency to pull returns right now (a pretty traditional late-stage cycle)

(3) A basket of 30 or so very well known non-FAANG tech stocks and work-from-home stocks are down 30-70% in the last couple of months

(4) Bitcoin is down -27% over the last month, though it has had two big drops this year that were previously followed by two big spikes.

There is a lot of volatility around this stuff. My point is that I am not merely describing a prediction at this point but the reality in the present tense of many of these phenomena.

What has largely held its own thus far (some names more so than others) is FAANG. And with ten companies in the S&P 500 now being 31% of the market index, and just five companies being 24% of the index (all-time high, 30% more than even the year 2000 tech peak), it’s safe to say ALL index investors are in the same boat here.

Concluding Thoughts

I’ll put a bow on all this below the Chart of the Week and Quote of the Week, and we’ll wrap it up from there. Next week I need to do a deeper dive into the U.S. dollar and some more fun macroeconomic realities. Investor psychology is only tolerable in two-week stints.

Chart of the Week

I have long argued much of this valuation delta between the U.S. and the rest of the world post-crisis was justified, especially versus Europe. But the delta has gotten larger than ever, and as it pertains to the emerging markets portion of this, I have to say it suggests a re-thinking of approach to growth.

Quote of the Week

“The essence of investment management is the management of risks, not the management of returns.”

~ Benjamin Graham

* * *

I hope the last two Dividend Cafe commentaries give you the right perspective of how we are thinking about approaching markets. I thought of this analogy a few moments ago when I saw an “out of order” sign blocking entry to one of the elevators in my New York office elevator bank, and yet someone wearing a mask tried to get on it anyways and was frustrated that they couldn’t take it (it had whole walls inside of it removed) … Some people love the illusion of safety, yet are perfectly content taking real risk as long as they can tell themselves it isn’t risky.

We want to manage risk, not for the sake of client psychology or virtue-signaling or mere appeasement via talking points. We actually believe there are risks in the modern investing context akin to taking a broken elevator. And yet, we have no intention of trying to time our way around COVID headlines 21 months after this thing was newsworthy (i.e., wearing a mask by yourself in an elevator and thinking that does, well, anything). A society addicted to tokenism does not all of a sudden put its best foot forward in the investing side either.

We can’t do tokenism when it comes to risk and reward, and we can’t do utopianism either. The idea of perfectibility in investing is a myth, just as a society that can’t ever get a virus is. What we can do, though, is seek to mitigate risk intelligently, thoughtfully, and substantively. As much as I wish they would let me set mask policy and elevator policy, for now, I’ll stick to my lane and just be cautious about “shiny object” investing and take solace in the fundamental quality of underlying investments we study. We think this will play out quite nicely in the end.

To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet