Dear Valued Clients and Friends,

I cannot tell you how much fun it is for me to spend three hours on a Friday morning reading research. Reading when it is dark outside is the single activity that brings me the most joy, and I love the inspiration it fostered for today’s Dividend Cafe.

Market action, Fed action, Price action, Valuation action – we have it all today, in the Dividend Cafe!

|

Subscribe on |

Easy come, easy go

The Dow Jones Industrial Average ended Q1 at 39,807, an all-time closing high. As I am typing Friday morning, April 12, just after the market open, it is at 38,250, so down about 1,600 points in nine trading days (-4%). This modest adjustment comes off of a March where the Dow went from 38,700 to 39,800 in ten trading days. It’s interesting to see it that way – a thousand points and then some in two weeks, first up, then down. And really we are just back to where we were in the ancient history of … three or four weeks ago.

The first ten days

What is driving that which is good? Some have suggested the “TINA” trade is back (“there is no alternative”), but that hardly seems true at a moment when bonds pay 4.5%, international stocks are doing significantly better, and various alternative strategies like private credit have been routinely delivering high single digit or even low double-digit returns. When “TINA” became a thing, bonds were paying close to 0%, and international stocks were sucking wind (like we will see against our athletes in the Olympics this summer!). In fact, “TALOA” is more true than “TINA” when it comes to those considering the U.S. stock market, at least in theory (hopefully I don’t have to spell it out, but “there are lots of alternatives” – these acronyms and shorthand in finance are far, far less annoying than reading my kids texts).

So if it is not “TINA,” what is it? I think those moments when frothy stocks and markets are getting frothier, still, there is a rational focus on corporate fundamentals, which have been quite strong. The impact of higher interest rates has been muted on big-cap U.S. companies who have had ample cash on their balance sheets and pre-funded borrowing needs in the glory days of COVID ZIRP (one man’s lockdown was another man’s bond issuance at 2.8% – good times!).

When bond yields drop investors feel validated that their high valuations will be sustained. That hope (and hope is the right word) attached to the fundamental strength of corporate balance sheets and cash generation has driven stock price appreciation.

The last ten days

What gives when the preceding section reverses, as it has since April began? Modest re-pricing around Fed expectations, bond yields, and the like are all at once noisy, and completely expected. I do not think those particular elements are ultimately material, but there is no question they exacerbate volatility. A ten-year at 4.5% instead of 4.2% is SUPPOSED to be, in a perfect world, a good thing indicating higher growth expectations. In a market that has hit froth mode, it becomes a catalyst for re-pricing that which is over-priced. Same as it ever was.

Geeking out on what matters

The cost of capital has picked up the last two years, and while a Return on Invested Capital across corporate America has stayed strong, that spread between the two has flattened and, in many cases, gone negative. Corporate profits have, thus far, been stable, and capital expenditures, while hardly robust, have not collapsed. Herein lies the answer to our mystery: Capital spending has hung in there despite the evaporation of the most important spread in corporate finance (the delta between return on invested capital and the cost of capital). Fundamental analysis of anything other than these basic moving parts is likely to miss the mark.

Inflation

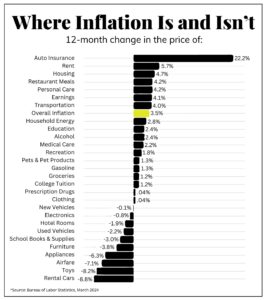

We provided this chart yesterday on the lay of the land after this week’s CPI and PPI reports (one being +0.1% more than expected and one being +0.1% less than expected).

But if one is looking for an upside surprise in headline inflation in the months ahead, oil prices are the most likely candidate. Though they have, thus far, stayed below $90 as they have moved from a mid-70s holding pattern to a mid-80s holding pattern, an extended stay into the 90s and near $100 would be the new conversation around headline prices. And it might even foster some intelligent dialogue about inflation instead of the cockamamie idiocy that passes for such now.

At the end of the day, even oil above $85 has not provoked OPEC+ to lift its production targets, still reeling in anger from the U.S. decision to flood the market with SPR releases in 2022 and its inability to make a dent in refilling such ever since. Now, U.S. oil production has surprised to the upside and that may very well help to contain prices in the months ahead. The debate on the supply side appears to be something I am unqualified to assess – whether the substantially reduced rig count we have seen over the last two years puts a low ceiling on production, or whether improved techniques in drilling and fracking lead to more efficient production with less rigs. Either way, oil prices moderating helped to dis-inflate headline prices (along with the massive disinflation of core goods), allowing data watchers to await the inevitable catch-up of shelter data to real life to bring the overall services inflation down. It would be fascinating if the latter plays out, just in time for oil prices to throw a monkey wrench in the aggregate data.

Speaking of which

Does one believe the 2024 outlook will be more like 2022 (tighter Fed than expected, valuation adjustments), or 2023 (anticipating an easier Fed, valuation expansion)? It’s a fair question, and all things being equal, higher oil prices, higher bond yields, and a more inflationary context (the last two weeks) is highly conducive to value-over-growth, the energy sector, and other such “2022 vibes.” Likewise, it is problematic for small-cap, high-valuation big tech, and other such “2023 vibes.”

But of course, markets do not often play around with our silly reductions. A simple binary of “Will 2024 be like 2022 or 2023?” ignores that 2024 is most likely to be like, well, 2024.

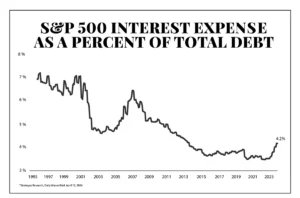

The cost of spending

One of the issues that comes up the most regarding the U.S. federal debt and the higher rate environment in which we find ourselves is the cost of servicing the debt. Interestingly, many use the high debt and rising rates to make the case that the cost of servicing the debt will overwhelm the budget, rather than make the case that because of fear of an overwhelmed budget, the Fed is going to put downward pressure on rates to facilitate the Treasury’s debt burden and ongoing spending. In other words, two people see the same thing but approach it from different angles – some see the consequence as flowing from the action (we will get a blowout of the budget because we will have higher rates), whereas others see the action itself being shaped by the anticipated consequence (we will get lower rates because the central bank wants to avoid that consequence).

My own take? Someone has to have a really, really low view of the Fed-Treasury accord and a very, very high view of “Fed independence” to believe that high interest costs will overwhelm the budget before the Fed resumes financial repression. I guess, in this case, it is yet another example of the pessimists actually being, unknowingly, WAY more trusting of government than I am.

Incidentally, the percent of total debt that interest expense represents is only recently off of HALF of its historical level.

Wage growth inequality

Since the tax cuts passed by Congress in 2017 and enacted into law in 2018 reduced corporate tax burden for companies, big and small alike, wages have grown (companies had more money to pay in wages). But a funny thing happened that is sort of indisputable in the data – the highest wage bracket had the least amount of wage growth (for the first few years there was no wage growth), and the lowest wage bracket had the highest rate of growth.

Could it be that lower corporate taxes are a lift to the lower-paid and not the rich?

China surprise

A major story in 2023 was the surprise of China to the downside. I am not referring primarily to their weak equity market behavior, which was a story all its own (and not a good one), but the surprising economic weakness even as they began re-opening their economy post-COVID. Expectations for 2024 were for continued weakness, with questions as to how they would lean into the Japan playbook of fiscal and monetary support to boost economic activity.

Well, modest fiscal boosts and very light monetary stimulus have done little, and China does not appear to be willing to embrace Japanification, yet. But what is helping China is everybody else. When you make your living selling things to others, it sure helps others in a buying mood. And China has seen strong exports (up +5% year-over-year in Q1) around strong order flow from the U.S. and Europe. Demand for orders remains high, and China may very well find that its contribution to global economic growth is dependent upon its global economic trading partners.

Contagious

Evidence of that Chinese export improvement (weak in March but strong in Q1) is found in firming commodity prices, particularly iron ore and copper. I would point out that it is not just China, but almost all countries that have seen improvement in their manufacturing data (including the U.S.) in recent weeks and months. This stronger manufacturing and commodity boom creates a virtuous cycle felt in emerging markets, who are huge customers of many of these manufactured products, and often huge producers of commodities. Yes, this is a 2022 vibe, to contradict what I said above about not expecting 2024 to look like a recent year. And indeed, plenty of surrounding factors are different … but there is a scenario where much of the economic backdrop bulls have hoped for plays out, but the valuations in the U.S. markets don’t allow U.S. risk assets to benefit as much, yet emerging markets assets do.

A summary: Strong manufacturing data anywhere (China, the U.S., etc.) is likely being [somewhat] caused by strong emerging markets demand. Strong commodity prices anywhere are likely being [somewhat] caused by emerging markets demand. And if you see such conditions, it is fair to assume that the environment for emerging markets risk assets may prove surprisingly strong.

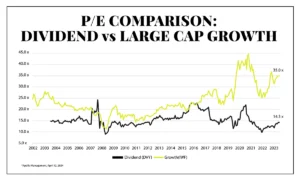

Chart of the Week

The P/E ratio of the whole S&P 500 is quite high, but the large-cap growth component is where the excess valuations are most pronounced. I thought it might be useful to show the way in which valuations have landed in big cap growth vs. a dividend-centric index. Is the market expensive? You know my answer. Are all markets equally expensive? I hope you know my answer there, too. Because they are not.

Quote of the Week

“Proverbs are short sayings drawn from long experience.”

~ Miguel de Cervantes

* * *

I am writing this week’s Dividend Cafe from beautiful Bend, Oregon, where The Bahnsen Group opened an office two years ago. It was a delight to see so many clients over the last two nights, and Joleen and I really enjoyed our time with John, Drew, Jill, and Nick (the private wealth advisors, operations director, and financial planning associate, respectively) who steward this office. I may have turned into a big city guy over the years but the mountain air and overall vibes in Bend were really special, and we are blessed to have our Pacific Northwest needs covered there!

I do hope you all will get some time to watch the Masters this weekend (okay, I guess I mean that I hope I get some time to do so). Spring is most definitely here. Enjoy the time for all it is …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet