Dear Valued Clients and Friends,

The stock market dropped this week, and it has given me a chance to write a Dividend Cafe about one of my favorite topics—the crucial importance of predicting the future, reading the tea leaves, and all that good stuff. I have strong opinions about people’s talent in such projections and the relevance of such projections to one’s long-term financial success. So today we are going to just have at it and talk about this week’s market volatility and what it means to you.

Some of you are going to be really, really disappointed (if I did my job right).

Jump on in, to the Dividend Cafe.

|

Subscribe on |

Has the rally reversed???

Let me start off by making a bigger point. On Monday, April 1 (that is, four days ago), I received a lengthy report from a very reputable research firm entitled, “Can this U.S. Equity Rally Continue?” On Tuesday, April 2 (that is, the next day), I was asked by Stuart Varney on Fox Business, “Is this selling the start of something bigger?” By Thursday, the media tone was exclusively focused on “what this sell-off means”, and my inbox of research Thursday and Friday has been, shall we say, unoriginal.

What a difference a few days makes? The Dow was up +6% in Q1, and the S&P was up +10%. And in the month of March alone, those two indices were up +2.2% and +3.2%, respectively. As I type this beautiful Friday morning the Dow was down 1,200 points this week (Friday’s action will either make that number higher or lower, because of math), which is equivalent to a down -3% week in the market.

So, while my first section in this week’s Dividend Cafe was going to be called “Can this rally continue?” in just four days, I am now leading with “Has the rally reversed?”—except my major “lead-off” point is that …

… this is all so stupid. Just incomprehensively stupid.

Narratives, themes, sentiments, and focus in the market do not change so dramatically in four days, barring a truly catalytic event. The bankruptcy of Lehman Brothers was a pretty good example… or talk of a global pandemic, or a terrorist attack. Yes, sure, certain events change facts very quickly. I could also re-word that prior sentence to say, “When facts change, then facts change,” but I would hope that such a commentary would cause everyone to unsubscribe because if they wanted market commentary that stupid, they would just read MarketWatch.com or The Business, Insider and call it a day (insult intended).

But we are not talking about catalytic events today. We are speculating as to whether or not standard fare market volatility means something is going on. Why are we doing this? Perhaps a little introspection is in order here. Why do people wonder if a market sell-off one day or one week means that things are about to get worse? I think we can unpack this and learn a bit about human nature, maybe about ourselves, and in the process, learn some healthy investor habits by learning to avoid some unhealthy investor habits (like our physical health, most good investment habits are about the behaviors we need to avoid versus the ones we need to pursue).

Let’s stipulate for the record that the noise out of a few days of sell-off is just noise. When a few days of being down -300 points turns into a -5,000 point drop there was nothing in the down -300 point days that told us a down -5,000 drop was coming. In fact, the opposite is generally true – far more often than otherwise, a few big down days precede a decent-sized market rally. This has been the case for the last 16 months but with a few exceptions along the way, it has also been the case most (not all) of the time for the last 16 years. Crazy, huh? I would bet real money that 80% of the time since March 2009, buying dips that play out over one week or so has, six months later, led to a really good outcome.

Of course, that doesn’t mean it has been true 100% of the time, and maybe in your investment timeline, six months is long-term because you plan to eat at Burger King every day for six months or because you plan to withdraw your whole portfolio in two months for a new boat. But as a general mathematical fact, dips have more often than not been an indication of a higher market, not a lower one, a few months out. And as a general investment fact, no one has the foggiest idea what is going to happen next week or next month, and they sure as &*^% don’t get any better idea of what will happen next week or next month based on what happened yesterday or last week.

You know what I know about market prices based on what happened yesterday? I know what happened – wait for it – yesterday. And you know what I do not know about market prices based on what happened yesterday? I do not know what will happen – wait for it – tomorrow. Now, lest you worry why you were wasting your time reading someone so stupid that they can’t even predict the future based on what happened last week, I want to put your mind at ease by telling you that everyone else is stupid, too, as long as by stupid we mean “someone who can’t predict the future.”

Now, we have other options. We may, limited by our stupidity about the future, instead opt for the far superior option of grift, deception, and disingenuity. We could say things like:

“Well, based on the fact that the market was down last week it is quite clear to me that we are being set up for a very attractive reversal and this is a great time to buy in advance of the pending rally this sell-off has created.”

Or, of course, we could go with:

“Well, based on the fact that the market was down last week it is quite clear to me that the market is setting itself up for another leg down, and our models show that we are likely to head down -11.5% before the market finds a bottom.”

I, personally, would rather wire all my money to the first person I saw on an infomercial, or just spend it all at the Mystical Psychic Garden on 53rd Street, where I have no doubt the proprietors would be flabbergasted to know the careers they bypassed by having more talent and integrity than many in the financial prognostication world.

What would be a good answer to the question as to what a week of market volatility means? I mean, I don’t want to give any ideas to the good people at Mystical Psychic Garden, but I would think that a few options exist. If one is in a big hurry, one could always try this:

“Hey, with the market’s big sell-off this week, what do you think it means for the weeks ahead?”

“I don’t know.”

But if they are not in a hurry, they could also try this:

“I suspect that it means either the market is preparing to go a bit lower, or a lot lower, or a bit higher, or a lot higher. But to be honest, from my study, in addition to those four options, it also could not move much at all. So really, I see it either going down, or up, or not down or not up.”

Now, I know what you are thinking: “Why is David being such an &^$ today?” But imagine how my family feels all the time? No, seriously, just imagine it. Anyways, back to the subject at hand. What if a thoughtful and kind person who traffics in honesty and trustworthiness for a living were to answer the question, “With the market’s big sell-off this week, what do you think it means for the weeks ahead?”

I would propose this as a thoughtful set of propositions from Team Trustworthiness:

- The market goes up and down 1% in a day or 3% in a week, A LOT. Never in history has any investor done well guessing what a day, week, or month will bring. Yet it brings something in all days, weeks, and months.

- When valuations get stretched above historical levels, markets are more “trigger happy” than normal, and therefore “noise” finds a way to more easily become a self-fulfilling prophecy.

- The things that made markets go up a week ago or a month ago didn’t go away. The things that made markets go down a day ago or a week ago also didn’t go away. When you wake up tomorrow and next week and next month it will be true that bond yields may be going up, or down; the Fed may be heading towards cutting rates, or not; the economy may be looking good, or not; the situation with Israel may be heating up, or cooling down; corporate profits may be beating or meeting expectations; or missing them. All of these things and the collective sentiment around them will create buying some days and selling others, and there has never been a day that this was not true. Nor will it ever be different.

- (Oh, I just said something really dumb, which maybe is not a surprise to you. But it is sort of weird to say that there will be buying some days and selling others, since, ummm, there is absolutely not buying any day if there is not also selling; and there is not selling any day if there is not also buying). I am kind of taking for granted that you know that.

- IF the way this particular sell-off plays out results in another -10% drop, there is nothing I would do differently and nothing you should do differently. If it does do so, I look forward to the increase in long-term portfolio value such a modest move down creates via dividend reinvestment in such a period.

- IF the way this particular sell-off plays out results in a rally off of this noise, there is nothing I would do differently and nothing you should do differently. I am confident in the portfolio we have created as it is and for the reasons we created it, and the various things that come in the months and quarters ahead with market volatility, interest rates, the Fed, the election, Israel, and the solar eclipse are all factored in. We have an investment philosophy focused on long-term value creation around the engine of corporate profits from well-run companies with a repeatable habit of sharing those profits with us. And that philosophy finds short term prognostication to be dishonest, unhealthy, and potentially destructive to one’s financial well-being.

Now, a fair response to this approach may be:

“David, I am with you. I get that you don’t know what the market will do next week or next month, and that noise around this Biden press conference or this Powell announcement is immaterial to our investment plan. But you surely have a longer-term outlook that shapes your portfolio management worldview?”

And indeed, I do. I believe our long-term structural economic growth has been impacted by excessive government indebtedness, and I believe that the medicine we give to treat these impacted growth dynamics distorts markets. I believe there are geopolitical uncertainties that have been with us as long as the Assyrians and Hittites and that geopolitical risks will be a part of the risk premium in markets until we reach the other side of glory in a new heavens and new earth. And I believe that investors living in this decade and the next will be wise to invest in what is knowable, not speculative, and to rely on history, cash flows, alignment with corporate management, quality companies, and the aspects of human nature and self-interest that have always prevailed in creating successful investor outcomes. I believed all this last week, I still believe it this week, and you have my word that I will still believe it in 500 weeks.

The good folks at Mystical Psychic Garden have self-interest, too. It just isn’t the self-interest I want our clients invested in.

Chart of the Week

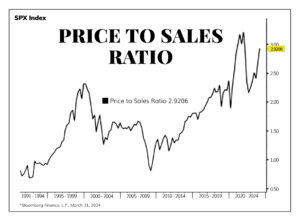

Maybe my constant use of the P/E ratio (price-to-earnings) to express frothiness in the S&P 500 is unhelpful, and maybe it “really is different this time” (hint: it never is). But this chart is, well, harder to argue with.

Quote of the Week

“Wisdom is the quality that keeps you from getting into situations where you need it.”

~ Doug Larson

* * *

Q2 is off with a bang, and I hope this week’s Dividend Cafe provided some useful color. I hope spring is underway where you are, that flowers are blooming, and that the sun is shining. Have a wonderful weekend, stay rooted to first things, and reach out if you have any questions at all about our first principles. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet