Dear Valued Clients and Friends –

The first week of August started off surprisingly strong, with further moves higher in all market indices, and much “less bad” economic data than has been expected. “Less bad than expected” is a consistent theme right now, and it evokes two simultaneous reactions.

On a market level, “less bad than expected” is bullish – and it does speak to the very complicated and very rapid process by which markets discover, discount, and create prices. Prices are not causes, they are effects, and they are effected by trillions of simultaneous and rapid-fire realities and transactions and indications – all of which result in, prices. Markets are the best mechanism known to mankind for discovering prices, and they reflect a lot of complicated and sometimes confusing data, and our interpretation of such data. I am not just referring to stock prices, by the way. Credit spreads. House prices. Mortgage rates. The cost of a banana. Auto fuel. Prices are all influenced by a trillion things at once, and I, with Friedrich Hayek, consider price discovery the miracle of markets, and the sine qua non of modern economic life.

So yes, our economy is reflecting prices that often stem out of “less bad than expected” realities. Consumer prices. E-commerce shipping rates. Gasoline. Airline tickets. And yes, stock and bond prices. They all would be different if things were “really good,” or if things “even worse!” Instead, what price levels reflect is “less bad than expected.”

But here comes the second reaction to this current dynamic, after I am done appreciating the reality of price discovery … “Less bad than expected” is still really, really painful to a lot of people right now who did nothing wrong. That characterization of the American economy is not a softening of the human suffering the lock-downs and quasi-lockdowns have created in response to the COVID pandemic. There are people who live paycheck to paycheck largely cut off from economic life and activity, and it is creating both an economic debacle for them (even if the aggregate effect in society is “less bad than expected”) – and tremendous human suffering. People are meant to be outdoors. They are meant to be vertical. They are meant to be in community with one another. They are meant to interact. They are meant to be productive. And yes, they are meant to flourish (as long as the word has proper anthropological meaning). What “less bad than expected” means is a lot of people are in sub-optimal conditions for flourishing.

And no price discovery or economic truisms can change that. It breaks my heart. And I earnestly pray for the conditions necessary to resume economic life, and the will to do so, not for market pricing – but for the human person who is being cut off from opportunity for flourishing.

In this week’s Dividend Cafe we will:

- Summarize this week’s action in the market, with a summary of the better-than-expected July jobs report

- Look at the intense pursuit for a COVID vaccine and what that means for markets

- Add a little detail and caveat to the current market rally, and big tech’s role within it!

- Discuss what it will taken to energize midstream energy

- Correct the record on Q2 GDP growth

- Think through the growing tensions with China

- Simulate the stimulus

- Look under the hood of the current state of the economy (pretty extensively), covering manufacturing, auto sales, hotel traffic, restaurant traffic, and all the things …

- Politics & Money – the polls are tightening, and we look at a long-held theory about predicting the Presidential winner …

- Chart of the Week – our cup runneth over with optimism for dividend growth, thanks to present conditions, and past lessons

Market Redux

Coming into Friday the market was up almost a thousand points on the week (up 250 Monday, up 150 Tuesday, up 370 Wednesday, up 180 Thursday), with Friday’s action totally flat as of press time.

Futures this morning were down over 150 points three hours before the market open, but rallied back into positive territory when the July BLS jobs report came out just hours ago. A surprising 1.76 million jobs were created in July, much higher than the 1.48 million expected. The unemployment rate fell to 10.2% from 11.1%.

More on the Jobs Data in our Economic Summary section below …

Is a vaccine coming for markets?

The national focus on a vaccine has to do with an accelerated immunity to COVID-19 that many understandably want to see, and I have provided frequent updates on the vast progress being made on this front in our daily COVID & Markets missives. But truthfully, there is a need to assess the impact a vaccine may have on various investment markets as well.

One of the most obvious things that needs to be said is this: The market sure seems to be taking for granted that one is coming … There is too much good news coming from too many highly resourced companies with an abundance of government and think tank support, to not believe some vaccination help is on the way. Does it mean markets would not rally further if a sort of “finality” announcement was delivered? Not necessarily. But as far as the discounting mechanism of markets, it is not exactly going to be a surprise when this hopeful announcement does, in fact, come.

Now, anything that eliminates the need for social distancing in the public square is going to help the areas most battered and bruised by the COVID lockdowns (retail, travel, airlines, cruise ships, food and beverage, etc.). The overall market has proven resilient pre-vaccine, and overall economy may have pockets of strength and recovery, but the vaccine (especially if it comes sooner than later) will accelerate normalcy in the areas that are most struggling. I would see it as more of a redistributor of gains than a creator of new gains …

I would not expect the gains to be reserved for the “first approved treatment.” I imagine we will have, over time, half a dozen competitive vaccines approved, if not more (as it should be). Choice is a good thing in the marketplace, and medicine is part of this. The overall appetite for health care and biotech should come out of this with more constructive sentiment than it has had over the last several years.

Finally, I agree with analysts who see a vaccine steepening the yield curve (moving rates higher along the term structure with the Fed holding the short end level), and tightening credit spreads across risk assets, especially in CMBS and RMBS (commercial and residential mortgage bonds).

The big reality about big tech today

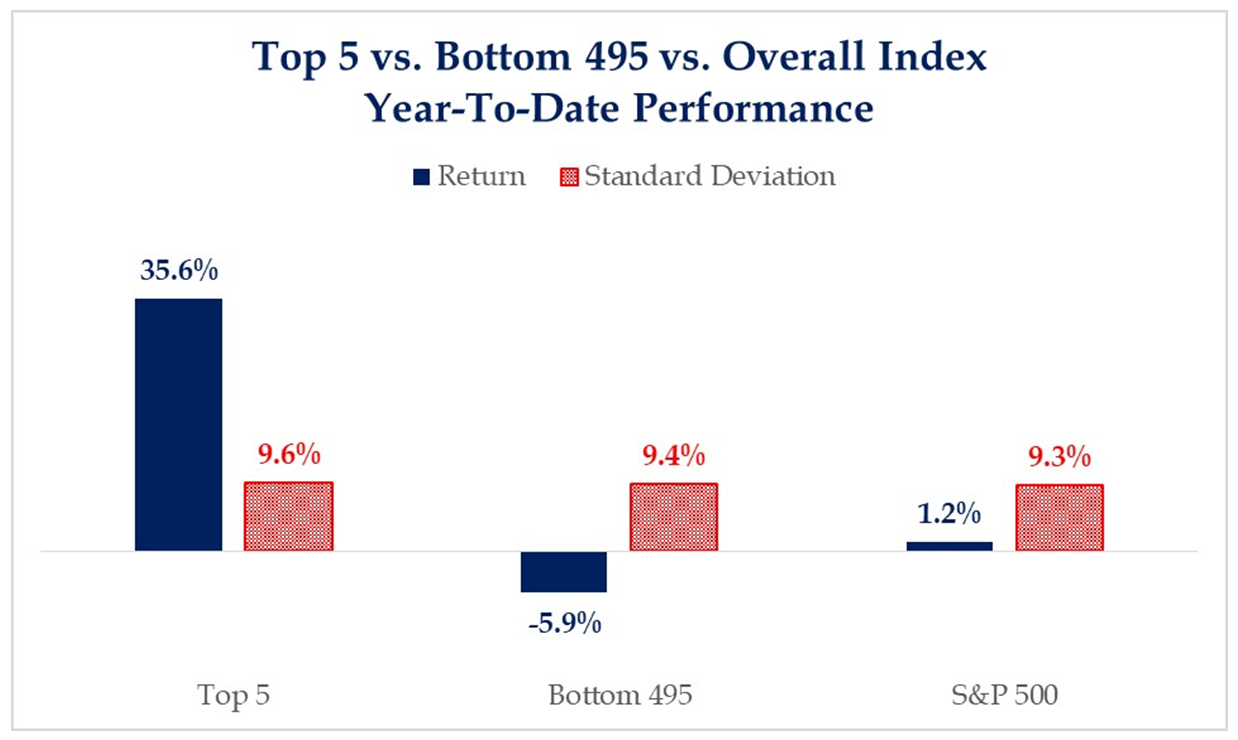

The S&P 500 is now slightly up on the year, though still down ~2% from its February highs. But calling it up on the year is a tad odd, when FIVE out of FIVE HUNDRED COMPANIES, are up 36%, with 495 companies actually down 6%. This is a dispersion that even puts the 1999 behavior to shame (back then, the S&P was up huge, not flat; but 44 of the 500 companies delivered all of the return). This year, it is five.

*Strategas Research, Daily Macro Brief, August 5, 2020

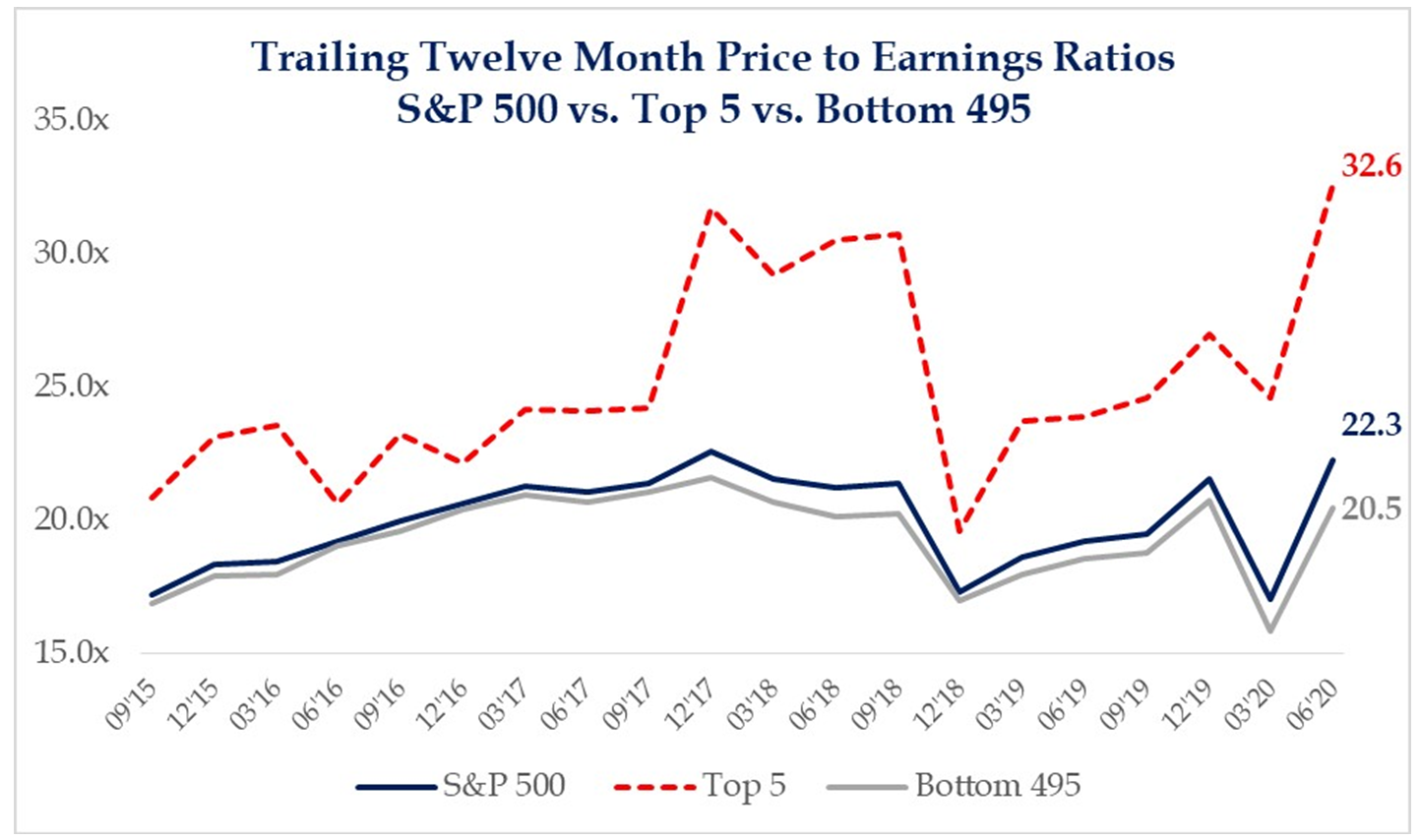

The hope that this price performance is simply a result of how much more profitable these five big tech companies are than everyone else is, unfortunately, not the reality of the data. The bulk of the market is essentially trading at the same multiple or a tad lower as it was starting the year, where these top five names have just seen a parabolic explosion in their own valuation (P/E ratio) …

*Strategas Research, Daily Macro Brief, August 7, 2020

The 1999 / 2000 comparisons are not totally lacking foundation or similarity.

The future of transporting oil and gas

The midstream energy sector, engaged in the storage and transportation of crude oil and natural gas, has suffered immensely from negative investor sentiment for some time, largely around associations with oil, concerns about financial sustainability, debt and leverage burdens, and those critics who oppose the entire fossil industry (even the safer transportation of the cleanest fossil fuel in natty gas).

Overcoming negative sentiment will take a number of things, one of which is free cash flow yields getting in line with distribution yields. The willingness and discipline (and necessity) of reducing capex in 2020 and 2021 will go a long way towards facilitating this alignment. Capital budgets must say disciplined even when market conditions recover. Those companies with leverage ratios below 4x should be viewed differently than those trading higher, and that discernment in the space will create a better investor outcome. Critics of fossil fuel still must content with the ~80% of energy needs fossils create, and the superior environmental outcome with natural gas versus coal. Storage and transportation needs are not going anywhere, and to the extent the regulatory environment becomes more burdensome for new (and needed) projects, it will paradoxically drive values higher for legacy assets (like the ones in play now from leading midstream companies). Counter-party exposures will get better as weaker E&P names consolidate (largely from bankruptcies or acquisitions). Even in the case of upstream delinquencies, contracts with midstream operators are still honored as that take-away is needed to generate revenues for the troubled producer. But the restructuring phase across our energy sector right now will lead to more counter-party stability for midstream companies on the other end.

There is no way to predict when investor sentiment will come back to this sector of the market. The question an opportunistic value and yield investor must ask is – should we be in a hurry for it to do so?

GDP did what?

I think you will find this video interesting where we start off by unpacking the Q2 GDP number in the U.S. economy in a way you may not have seen or heard elsewhere. We do dive into a plethora of other topics, too, if interested.

China tensions part 37

President Trump signed an order Thursday night banning U.S. residents from doing business with a couple particular Chinese companies, effective 45 days from now. The piece not getting as much attention is that Chinese companies listed on U.S. exchanges will lose their listings if they do not comply with U.S. audit requirements within a certain period of time. This could end up having profound implications for Chinese ADR’s and certain emerging markets ETF products, etc.

Stimulus tensions part 38

By now you must surely know that there has been no kumbaya moment at Capitol Hill to get a stimulus bill done, and despite assurances from both sides that they will get there, all indications are that the disagreement levels have not moved or altered at all.

President Trump is planning to sign executive orders over the weekend to:

(1) Keep the Unemployment Insurance benefits elevated (and he will use DOT discretion with unused CARES Act funds to do so)

(2) Keep the moratorium on evictions in place

(3) Defer the payroll tax

(4) Allow for ongoing deferrals of student loans

Now, the payroll tax portion of this will end up going to court, but my guess is that the rest of it will give the Republicans more leverage, and there is a chance this will force Pelosi demands down a bit. I expect a lot of action this weekend and into next week, but the chance that we get these “spot” orders and then no comprehensive bill is not zero percent … it really could play out that way.

Glass is half-full and half-empty

I read an outstanding report this week on the state of Office Real Estate (feel free to email if you’d like a copy), and was intrigued by their estimate that demand for space will decline by 10% in light of what they believe will be permanent work-from-home transitions (versus temporary ones), BUT that reduction will be offset by a need for increased space per employee as offices become more collaborative and more “spaced out.” The latter dynamic is unlikely to happen until we are well past the worst of the recession.

Economic Update for the Week

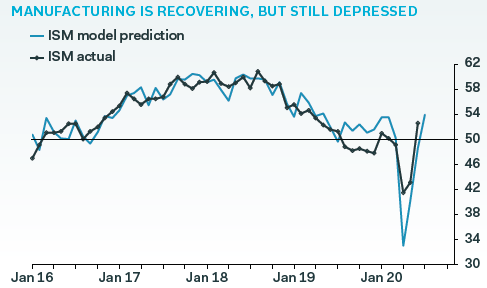

We’ll start with the areas that are my bigger focus, and that is the related aspects of business investment (capex, manufacturing, industrial production, etc.). As is the case in so many categories of the economy, there has been sizable improvement off of unfathomable levels from the lock-down, yet there remains a lot of work to be done. Credit markets working smoothly offers huge aid to the industrial cycle and ought to create a very different dynamic than we saw post-financial crisis. But that said, business spending that merely replaces stale equipment will not be robust enough; there will have to be enough confidence in forward conditions to see real futuristic investment for capex to go where it needs to go.

*Pantheon Macroeconomics, Weekly U.S. Economic Monitor, August 3, 2020

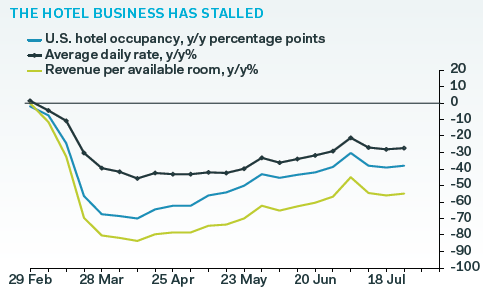

The hotel data is a telling sign of where things are in the consumer/leisure/retail/travel world (the most direct COVID-exposed part of the economy, where the bulk of the economic pain has been concentrated). What you basically see is the huge collapse at the point of shutdown, a big but not good enough rebound from the bottom to the early part of July, followed by a flat-lining since July across occupancy, rates, and revenue per room.

*Pantheon Macroeconomics, Weekly U.S. Economic Monitor, August 3, 2020

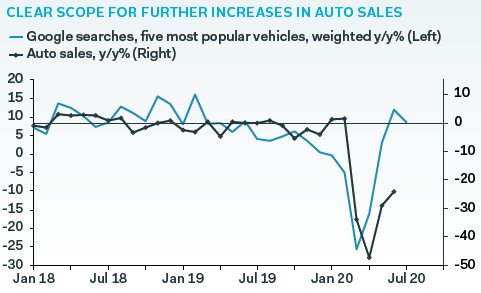

The auto sales number has improved and is still improving, if Google searches are any indicator. Auto sales benefit from low borrowing rates and potential new aversions to public transportation. Vehicles 16 years or older now account for > 25% of the vehicles on the road, a strong indication that a replacement cycle is coming (the average age of a car on the road is 11.9 years vs. a 9.6 year average, again reinforcing likely replacement cycle coming).

*Pantheon Macroeconomics, Weekly U.S. Economic Monitor, August 3, 2020

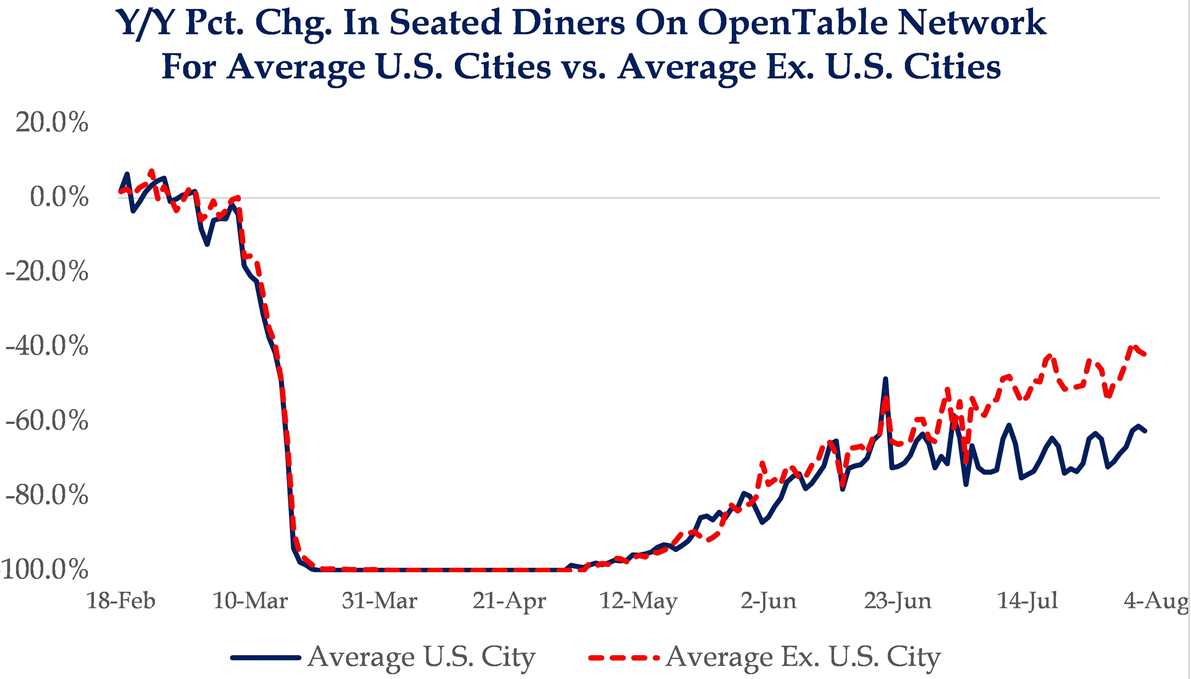

It is interesting to see that while restaurant activity is picking up everywhere, it has leveled off in the U.S. whereas it has continued to improve in Asian and European cities. More U.S. restaurant openings are needed in the weeks ahead.

*Strategas Research, Daily Macro Brief, August 5, 2020

And finally, obviously there has been a huge focus in the last couple of days around the jobs data, all of which was modestly positive relative to expectations (almost 1.8 million jobs added in July vs. 1.4 million expected, despite the COVID spikes of July). Initial jobless claims hit their low levels since COVID began Thursday (1.1 million), and continuing claims fell to 16 million (another sizable move down).

It is impossible to be too encouraged by any of it … yes, some numbers have improved and yes some numbers have stopped getting worse. But the jobs picture overall still looks extremely challenged for roughly 15-20 million Americans, approximately 10% of the work force. I am grateful to see the bulk of restored jobs be in the leisure/hospitality/retail space (where, of course, the bulk of the losses took place). But there is just so, so much work to do still, and a far less constrained re-opening is needed for this process to get momentum.

Politics & Money: Beltway Bulls and Bears

- We are now in “crunch time” for the election if one believes in one of the more famous metrics for predicting the winner: The so-called S&P 90-Day Test. The theory goes that how the market does in the final three months before the election, so goes the election result. Well, here’s the thing … It has worked out in 20 of the last 23 election cycles (87% of the time), that if the market was up the incumbent party/candidate won, and if the market was down the incumbent part/candidate lost. First of all, 13% of the time with only 23 representative samples is not insignificant. But secondly, the two times the market went up in the 90 days before the election, it was doing so in anticipation of the incumbent leaving (and new candidate coming in) – 1968, and 1980. So we get cause and effect mixed up with this stuff quite easily … Bottom line, there is plenty to digest around this election, but I don’t think 87% is predictive, particularly when clouded with cause and effect confusion.

- The Presidential Debate Commission denied the Trump campaign’s petition for a fourth (and earlier) debate, a request that came as a result of the increase in early voting that will now be happening.

- The polls definitely did tighten a tad this week, and we will see more in the next week or two if this is a start of a new trend or just statistical noise. But in national averages and certain battleground states, the Biden lead over Trump was narrowed a bit this week.

*RealClearPolitics.com, Election 2020, August 6, 2020

Chart of the Week

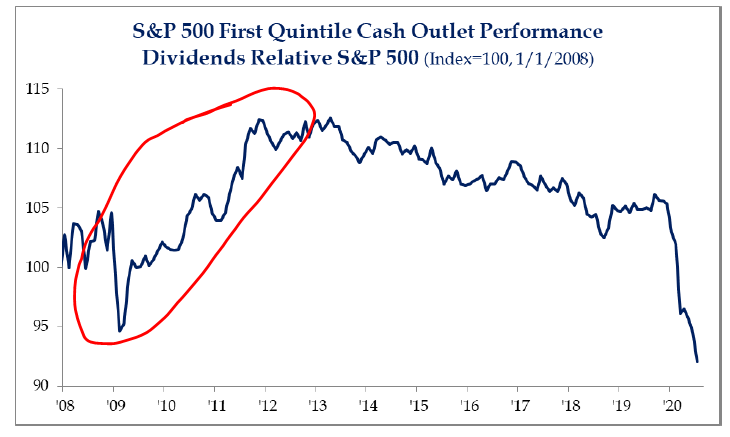

If I said to you right now, “the economy is in the trouble it is in – there are some companies paying down debt and other companies adding to debt” – which category would you rather own in this state of affairs? Most people would prefer the former; but it is the latter that has outperformed as of late.

If I said to you right now, “the economy is in the trouble it is in – there are some companies shining with free cash flow generation and others which more cyclical and volatile business models” – which category would you rather own in this state of affairs? Most people would prefer the former; but it is the latter that has outperformed as of late.

This encourages me a great deal. Markets are mean-reverting things – always and forever. How the fundamental strength of dividend growers did coming out of the last recession is of great significance when we think about the present state of affairs.

*Strategas Research, Investment Strategy Report, August 5, 2020, p. 5

Quote of the Week

“Retain faith that you will prevail in the end regardless of the difficulties, and at the same time confront the most brutal facts of your current reality, whatever they may be.”

~ Jim Collins

* * *

I hope you all have a wonderful weekend, and I encourage anyone interested to reach out to us with any questions, any time. Please join us for our bi-weekly national video call this Monday, at 11am PT/2pm ET.

May you and yours find flourishing in these challenging times. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com