Dear Valued Clients and Friends –

No, I am not going to actually devote this entire edition of the Dividend Cafe to Kamala, but you will find a lot more Politics & Money than normal this week, including a bit of unpacking around Joe Biden’s widely anticipated selection of Kamala Harris as his running mate, and what it means and doesn’t mean for markets, etc. As COVID headlines wind down, I expect the election to now hit its stride as the predominant driver of markets (or to put it more accurately, the better drive of market discussion) over the next few months.

Many long-time readers know of my passion for politics. I am grateful that my obsessiveness over politics has waned over the years, and I have barely had political television on my TV at all since the COVID era began. Like a lot of Americans, I have strong passions politically and ideologically, and yet am fatigued by the tribalism and dysfunction, and sometimes feel a little homeless in the current partisan divides. I idolized Ronald Reagan as a child (you wouldn’t believe me if I told you), and began reading National Review in first grade (and now forty years later serve on their board). Political enthusiasm runs deep, I assure you. But yes, there are times where the whole thing is just exhausting.

I won’t have the option of being exhausted or disengaged in the months to come as it pertains to markets. There are so many combinations of potential options out there which present different economic and market outcomes (or potential outcomes) that I need to be well-engaged, inquisitive, and prepared for what various outcomes may mean for our client portfolios.

As is the case in the present political cycle, there is a lot of hyperbole out there regarding some potential outcomes. I hear frequently how “candidate A will destroy the stock market forever and ever,” or “candidate B will end America as we know it.” Passions are high. I get it.

My own view is that the things I write about every week – including in today’s Dividend Cafe – will continue to be the far superior subjects when it comes to what is impacting markets. Interest rates. The Fed. Dollar liquidity. Economic recovery. I could go on and on. The election matters, and there are a lot of cultural underpinnings that I agree are intertwined with election passions. But my analysis and work in the months ahead will avoid excessive hyperbole and drama. I will respect the different feelings that different readers have on various candidates and issues, and won’t shy away from transparency around my own beliefs (playing it safe is not my style). And yet, my market analysis and conclusions around the politics of the moment won’t succumb to binary tribalism.

We owe our clients better than that. If the politicos and cable news stations can’t or won’t do it, we will at least try. Less heat, less noise, more substance. We’ll give it a shot.

And with all that said, here is a list of the topics we address in this week’s Dividend Cafe …

- Market Recap of the week that just was

- A little reality check on interest rates

- A report card for earnings season for Q2

- Anyone remember China?

- Commercial real estate lending

- Restaurants looking for some help – and possibly going to get it

- Is our monetary system working?

- Economic report card for the week (jobs, retail sales, consumer credit, and more)

- Politics and Money – a bit more of a look at Kamala Harris as the VP pick and what it means to markets and policy (and so, so, so much more)

- Chart of the Week

Off we go into the Dividend Cafe …

Market Redux

We enter Friday’s market session up nearly 500 points on the week, and as of press time the market is down just 25 points on Friday. Either way, short of a huge pick-up in selling on Friday, it appears to be another positive week across market indices.

Gold had its first negative week in a while, down about $125 per ounce on the week coming back below $2,000/ounce.

I discuss interest rates immediately below this (bond impact).

It was primarily a positive week with little pulling against market momentum, but one in which the push-pull over market leadership was certainly on display. On some days the big tech world and familiar market leaders did lead markets, but other days saw that pattern that has become more common and prevalent in recent weeks, where market laggards are outpacing the leaders of the COVID recovery, and where things like small cap, energy, financials, and transports gain ground on the Nasdaq world.

Feels weird to be encouraged?

The 10-year bond yield hit its highest level in months this week, indicating some optimism and normalcy, steepening the yield curve a bit, and aiding the net interest margin of banks and the like. What is the catch?

This “new high” was 70 basis points. 0.70%. That is “rates going up” these days.

Earnings Season Report Card

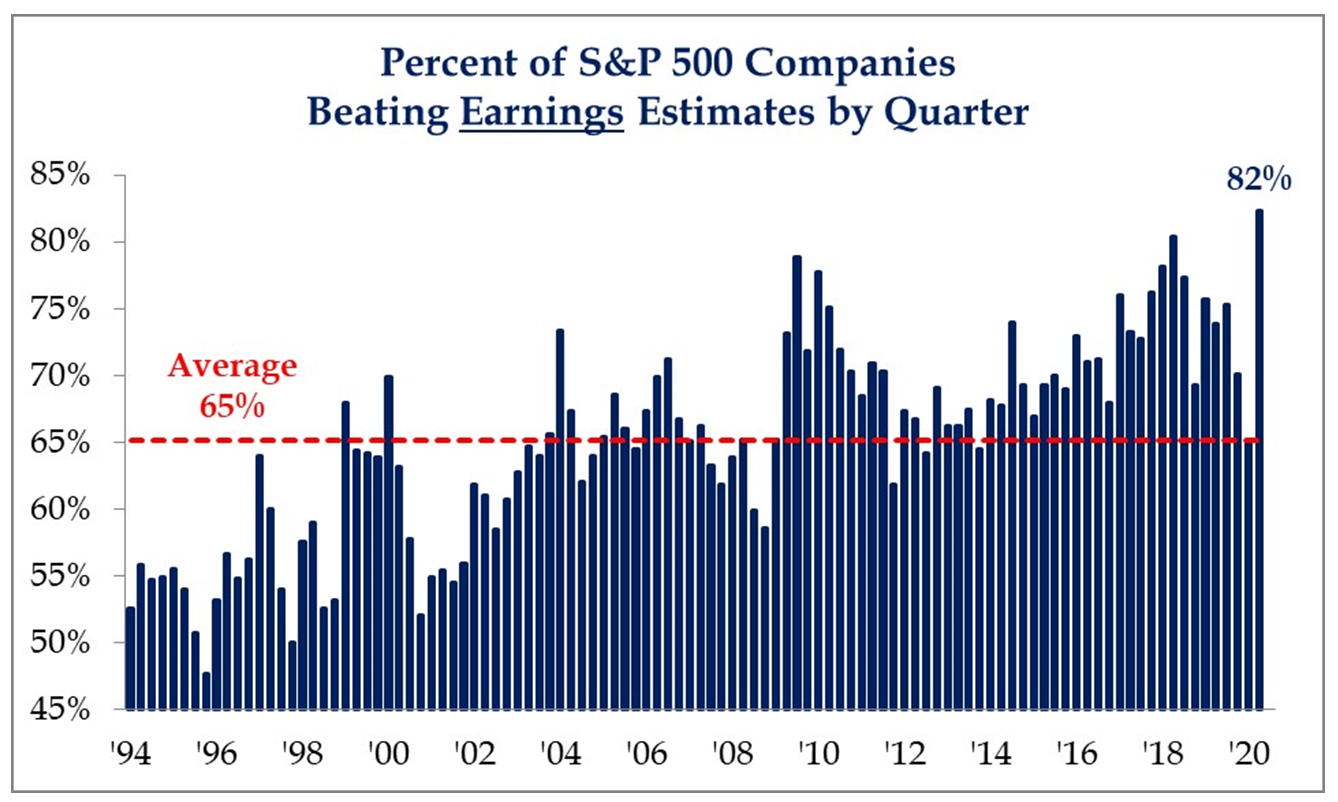

Who would have thought that a 32% year-over-year decline in earnings would be good news for the stock market? Well, anyone who had the estimates at a 43% decline, which was the blended analyst consensus entering earnings season … (the “less bad than expected” theme continues). Actually, the 82% of companies who beat analyst expectations is the highest percentage to do so ever (since such data was maintained beginning in 1994).

*Strategas Research, Daily Macro Brief, August 11, 2020

Now, frankly, as I have said repeatedly since March/April, I don’t believe analyst expectations for earnings impact to Q1, or Q2, were worth a hill of beans, and therefore it is hard to get excited or concerned where beating or failing to beat that hill of beans forecast has taken place. But do I believe a “less bad than expected” earnings season has facilitated this more positive backdrop to markets the last month or so? Sure. No question.

Anyone remember China?

I am old enough to remember when trade talks and disputes and threats and tariffs were enough to throw markets into disarray when things got dicey. We know the phase one trade deal was signed in January, and from the moment the markets got wind of such a compromise in the fall of 2019 to the time the details were announced in December to the signing in January, markets loved all of it. Now, we have the TikTok/WeChat spat, the national security moves in Hong Kong, the ongoing Huawei saga, and of course questions about U.S. manufacturing in China and what onshoring will take place in the years ahead.

Trade talks are taking place over the weekend and it will be very interesting to see if both sides believe they are on track, or want to stay on track, as it pertains to the purchase commitments and currency commitments made in the phase one trade deal.

An interesting question

Can you think of anything – anything – in the national conversation right now where the consensus (at least in rhetoric and expression) are as bipartisan and harmonized as “being anti-China” is? Sure, both parties may feel the other party is being disingenuous or sloppy in how they would handle it, but is either party planning to run as anything other than being anti-China, tough on China, etc.? In a day and age where we are as polarized and tribalized as we are, doesn’t this totally outside-the-norm agreement on an issue give you some sort of indication as to where this may be going?

Can I get a menu?

I don’t know if it will go anywhere or not, and my intuition is that it will stay in a stalemate longer, especially with a wider and broader stimulus deal clearly in a political stalemate, but there does appear to be bipartisan support that may be adequate to get a deal done for a $120 billion support bill for restaurants. Senate Minority Leader, Chuck Schumer, came out in support of the bill Friday, increasing the odds that this could pass as stand-alone legislation (there are 177 sponsors in the House).

This Restaurants Act creates a grant fund through the Treasury Department for restaurants to tap, and as I have written previously at COVID and Markets, is desirable by policymakers if it can (a) Slow future closings, thereby closing the gap on lost state and local tax revenue; and (b) Enable restaurants to pay their rent, which enables landlords to pay their mortgages, which enables banks to pay their investor pools, which slows down disruption in capital markets.

Midstream moment

While a judge did rule that the Dakota Access Pipeline in the Bakken had to close because of a lack of environmental report that plaintiffs were demanding (basically, a judge ruling that the U.S. Army erred in ruling that the project could proceed), an appelate court has now ruled that the pipeline can continue operating while the process plays out, essentially giving relief to an awful lot of jobs, and providing a more benign environment for the pipeline sector than some had feared a few weeks ago.

Commercial Real Estate Reality

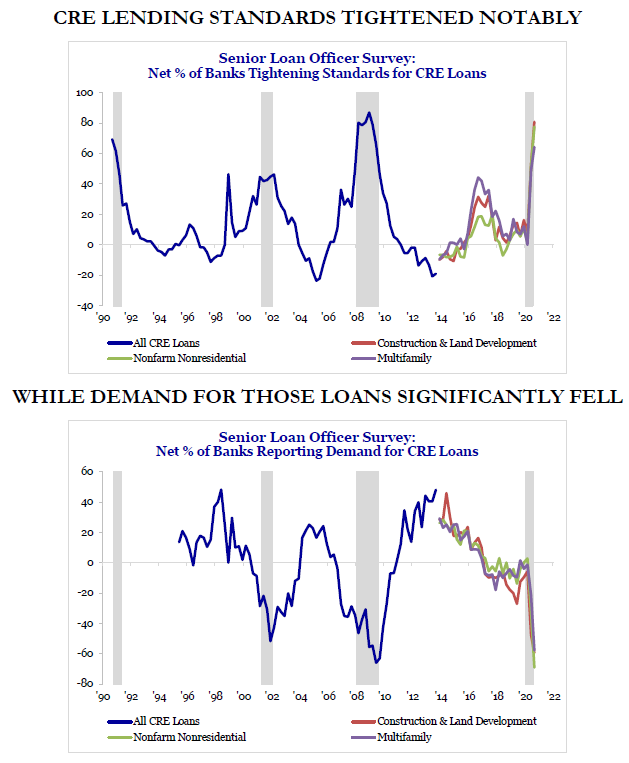

The health of the commercial real estate world can be evaluated by the willingness to lend to it. Understandably, lending has slowed since the COVID moment began. That trend will reverse at some point, and will be the leading indicator of pending normalization in the CRE world.

*Strategas Research, Charts of the Week, August 7, 2020, p. 5

Economic Recovery

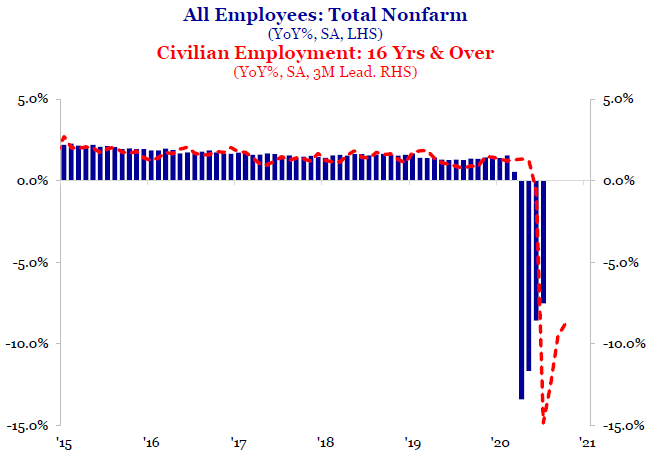

As a basic recap of the jobs data that we heavily covered last week, here you see two things rather clearly: (1) A huge drop in employment from the pandemic lock-downs; (2) The beginnings of a meaningful recovery that still has a lot of room to go.

*Strategas Research, Charts of the Week, August 7, 2020, p. 1

Retail sales for the month of July grew +1.2% (something around 2% had been expected.

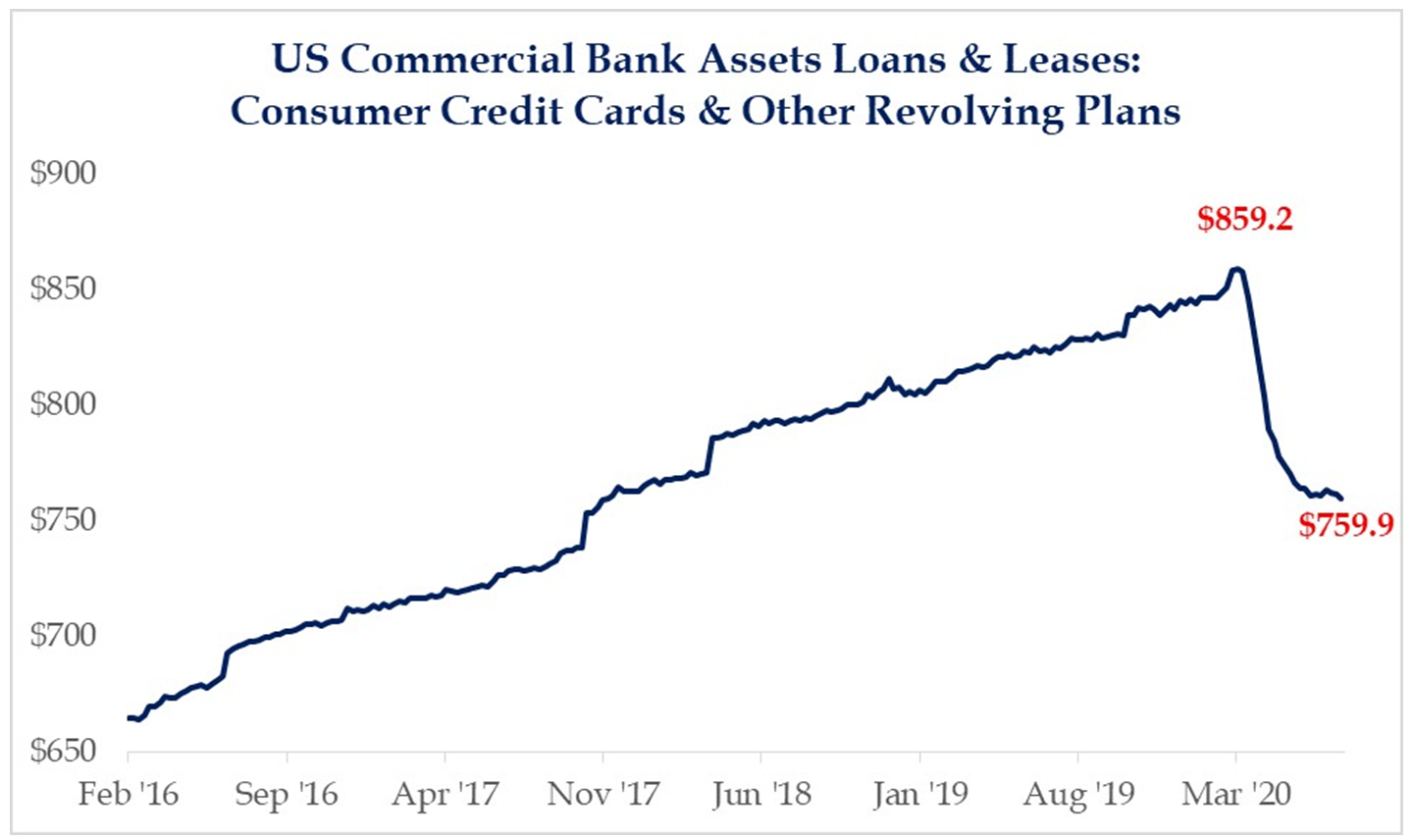

One of the surest fire ways to know when the economy is really picking up steam – sustainably and emphatically – will be when revolving credit picks back up. These reduced balances and revolving lines reflect a lack of demand, not a lack of access to credit, I assure you.

*Strategas Research, Daily Macro Brief, August 14, 2020

The Council of Economic Advisors is now estimating 80.6% of the layoffs from the COVID era to be temporary. I am happy to send the 79-page report on COVID economic conditions from the CEA to any who request it.

Politics & Money: Beltway Bulls and Bears

- As has now been well-publicized, Joe Biden this week selected former primary rival, Kamala Harris, senator in California and former state Attorney General, as his running mate for the 2020 Presidential race. I have always been in the camp that the VP selection makes very little difference in the trajectory of a race. One’s selection might – might – be able to do some harm, but it rarely makes a positive contribution. In this case, I think Democrats can assess for themselves if they like the Biden ticket now more or less with Senator Harris on it … From a market standpoint, she has very flexible views on most things economic, so therefore doesn’t come in with “shock and awe” leftist economic ideas like say, a Warren or Sanders, might. She probably could be convinced to support whatever was needed or desired, but she is not an Ideas type candidate, so I doubt markets will think much of it one way or the other. My view is that this race is much more about Donald Trump than anything else, even much more so than Joe Biden, and certainly more than Biden’s pick for VP.

- So with that said, where does the race about Donald Trump stand? Well, obviously polls still have Biden in the lead, though those polls have tightened to some degree from the wide leads of a couple weeks ago. While national polls might have contracted from something like an 11% lead for Biden to a 7% lead, the betting odds only went from 61%-37% to 59%-39% (roughly 2% move in what is a 20% gap). My own feeling is that the polls will likely tighten more, but that the polls will likely stay as Advantage Biden, with just their reflected margins changing a bit. Less than three months to go. Ultimately, I believe the outcome will come down to how well the pollsters have selected their targeted polling groups and turnout estimates, and how honest poll respondents are being with pollsters.

- Some have pointed out that Harris did support the Green New Deal in the Senate, and that is certainly true. She also supported both eliminating private health insurance (twice) in Democratic primary debates, and in not eliminating private health insurance in the Democrat primary season (also twice). My point is, she has established some ideological flexibility that may make it hard to be overly excited or overly worried about various positions held.

- I am of the position that Wall Street would have rather seen Elizabeth Warren end up as the VP choice than what may end up happening – that is, Elizabeth Warren as the Attorney General or Treasury Secretary choice. I doubt that is true in terms of how markets would have priced it – a Warren choice (which I understand was never seriously considered) would have instigated headline volatility in markets. But in reality, the things many investors may fear about Warren influence are certainly more actionable running the DOJ or DOT than they are as a VP.

- The Biden economic team thus far includes Janet Yellen, former Fed chair, and Jared Bernstein, a long time Keynesian advisor to the former vice president. The economic briefing Biden and Harris got from their advisors this week was primarily centered around how important it is that spending not let up – that low rates be used to drive spending despite current high deficits. In fairness, this is hardly a message either party can claim to be offended by.

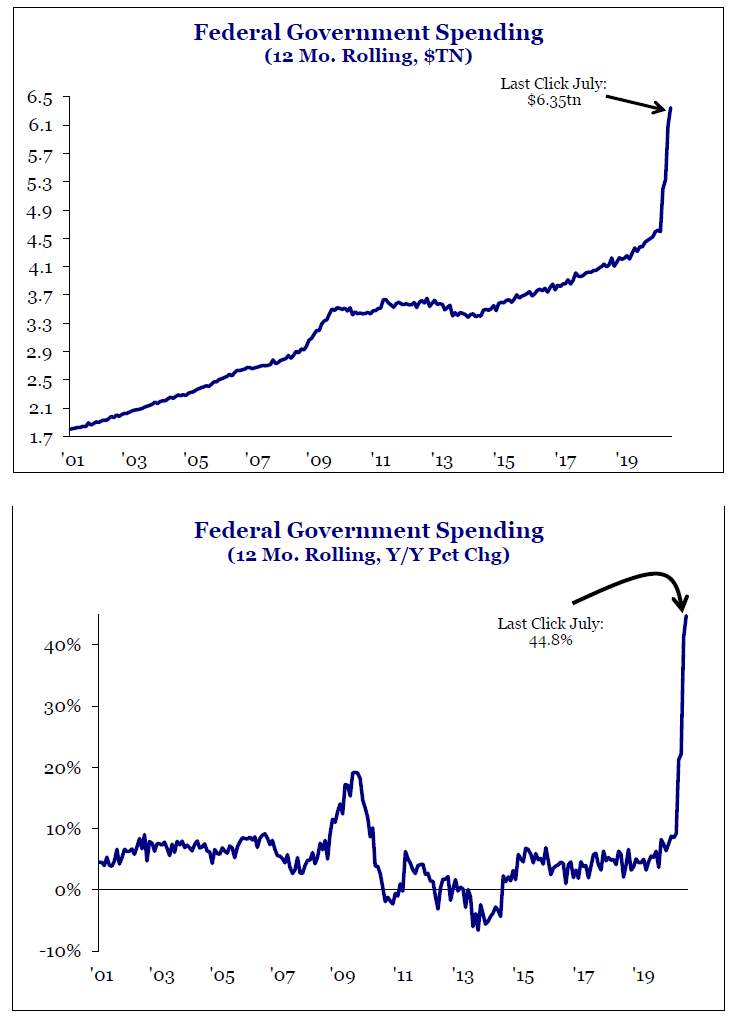

Chart of the Week

This is before a new stimulus bill. No further comments.

*Strategas Research, Policy Outlook, August 7, 2020, p. 7

Quote of the Week

“The great trade of our time will be long humanity, short government.”

~ John Mauldin

* * *

I hope you all are taking in what you can of this summer, and are ready to make the most of the last couple weeks of this truly odd 2020 summer season. While I know summer is technically ending in a couple weeks, it won’t feel like it is fall without USC football. I am praying the SEC goes forward with football, but obviously everything feels up in the air right now. And really spring didn’t feel like spring, summer didn’t feel like summer, but I sure hope fall can sort of feel like fall.

Q3 is now half way over, markets are acting good, the economy is improving slowly, and I remain unable to read if the national mood on normalcy is what I think it is. I don’t trust my instincts here. In the meantime, I am vigilantly engaged in having a market outlook appropriate for the election environment, and vigilantly engaged in delivering a planning, portfolio, and relationship experience for our clients that is second to none. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet