Dear Valued Clients and Friends,

The utter insanity of today’s financial markets continued in Sunday evening futures action, Monday morning futures action, and throughout the day Monday. The largest Federal Reserve announcement yet came, and plenty needs to be said about the so-called “fiscal stimulus bazooka.”

Today’s special Dividend Cafe provides as much explanation of these crazy times as we can muster, and offers yet more practical guidance on surviving the bear market we are presently enduring. Please read, and please share as you see fit.

Monday action

So down 900 in futures, to up 500 in futures, to up 400 points in after-market trading, to down almost a thousand, to all over negative territory for hours, finally ending down 580 points.

And why is this all a little hard to take seriously? Because technicals are driving everything as all fundamental buyers were sidelined waiting for the people we elected to lead us to offer clarity on the stimulus bill. Markets are virtually suspended pending better clarity on this stimulus bill, some version of which we continue to believe is coming.

Will the market “pop” on the news? Who knows. On one hand, the market has to know something is coming. On the other hand, the “news” may come just as the “forced selling technicals” (what is really driving short term market action) reach ultimate exhaustion.

I refuse to offer a short term prognosis on what the market will do today, tonight, tomorrow, or even the rest of the week. My general feeling that selling pressure is about to run its course is not actionable in any way. I merely believe that a lot of things are shaping up to re-direct the trajectory of conversation and sentiment.

Fed Bazooka

The Federal Reserve announced $700 billion of Quantitative Easing last Sunday, and from that announcement or subsequent ones last week, added money market fund support, commercial paper market support, and significant repo transactions – all to support the nation’s financial system.

But none of it compares to what was announced this morning:

- First and foremost, “no limit” to Treasury and Mortgage-Backed buying. The mortgage-backed securities will surely receive higher priority now, and they have added commercial-mortgages to this basket. This is an all-out war to provide needed liquidity to the financial system and assure adequate credit in the system

- A $300 billion program for new credit to employers, consumers, and small businesses

- Support to corporate bond market (more on this below) through a primary credit facility (for new bond issuance) and a secondary credit facility (for buying up of currently trading corporate bonds)

- A TALF (Term Asset-Backed Securities Loan Facility) to support flow of credit to consumers. Assets will be issued back by SBA loans, auto loans, student loans, and credit card loans, providing liquidity and support for credit to small businesses and consumers.

- Municipal support expanded to include a wider range of municipal securities (still only six months or lower maturity, though)

- A “Main Street Lending Program” is coming to support small and medium sized businesses

The benefits to the nation’s financial system here will not be immediately felt as it will take days for this liquidity and relief to soak its way through bond, credit, and money markets. The “second order” benefits to other asset classes less directly impacted but very much impacted via derivative effects is substantial.

WHERE is the stimulus bill?

The Democrats have blocked the mostly-agreed-to fiscal stimulus bill that Secretary Mnuchin had negotiated late last week and into the weekend. The key issues Democrats are holding out on?

New emission standards for automobiles. Tax credits for solar companies. These are some of the things holding up the bill.

Senate Minority Leader, Chuck Schumer, is in contact with Secretary Mnuchin, and there are ample reasons to believe they will get through so much of this utter silliness. But my writing on Friday that clownish jockeying in final days would add to market volatility around this passage has proven prescient.

Sen. Sherrod Brown of Ohio, a Democrat who I believe is a more serious man than many in Senate leadership, is reportedly in frequent talks with Secretary Mnuchin. House members certainly do not want to return to DC. The market pressure is best catalyst towards them getting a deal done.

WHAT is the stimulus bill?

Essentially, there will be a few categories in the final resolution.

(1) Small business damage control – assistance designed to keep payrolls protected

(2) Direct support to taxpayers – tax refunds, payments, straight to households

(3) Corporate liquidity – a variety of mechanisms in tandem with the balance sheet of the Federal Reserve (most important to markets, possibly). The liquidity facility for Fed purchase of corporate, municipal, and asset-backed securities gives trillions of dollars of firepower when this $425 proposed facility is levered by the equity of the United States government. Collateralized loans for targeted industries (airlines, travel, etc.) – no stock buybacks while loan is in effect. Some details here still being fought over.

(4) Health Care support – additional funding for a variety of medical aspects, treatment, supplies, local needs, hospitals, etc.

Why do I Care about Corporate Bonds?

First, because all assets are highly, highly correlated right now. There are virtually no zigs/zags in the system because of the massive leverage in the financial system, where in a market crash, all correlations go to one. Of course, the fundamental correlations are nowhere near “one” – so this is a reflection of broken market technicals and mechanics – forced sellers and multi-asset investors selling what they can sell, because they have to sell.

Part of the big Fed announcement is that they will be buying investment grade corporate bonds. This creates incredible liquidity in a marketplace that has irrationally dried up in recent days, Money-good bonds with no buyers and bid-ask spreads that widened out irrationally. The Fed can now buy corporate bonds with at least a BBB-/Baa3 credit rating or higher (that is the lowest of the non-junk ratings) provided the maturity is five years or less. This added support or liquidity trickles into the longer dated bonds, too.

Energy market

There is $3 billion of purchases from the strategic petroleum reserves in the bill, but the Democrats want this out. This would possibly add support to the energy sector and particularly the weakest areas in the high yield bond market.

Other nooks and crannies

We also understand the bill will allow companies to carry back losses FIVE years, adding to refundable moneys available from the government.

Net interest expense will go from being deductible at 30% of EBITDA to 50% of EBITDA.

2020 Payroll Tax payment can be delayed until 2021 or 2022 – potentially $300 billion of short term liquidity for businesses.

Eight weeks of cash flow support for small businesses – $350 billion – through fully guaranteed federal loans (with banks as conduits). Can only be used for rent, payroll, and utilities.

And this is big – no RMD’s (required retirement distributions for 2020) – a big tax savings for many investors who do not want to withdraw!

All of these things are in flux, and I am doing my best to give you information as my sources and research get it to me.

Health Update

The positive testing cases in the U.S. are, of course, continuing to skyrocket, largely a by-product of the woefully low testing in the first few weeks of this outbreak. The unreported fact is how many testing positive are either (a) Already better, or (b) Well on their way to being already better. That is the data point we are watching carefully – how many recoveries are coming on the backs of the new diagnoses. There is ample reason to believe that recovery data is going to skyrocket in the weeks to come, largely because of the lateness in testing getting done (and results posting), and the high cure rate of the disease for those under 80 and without pre-existing conditions.

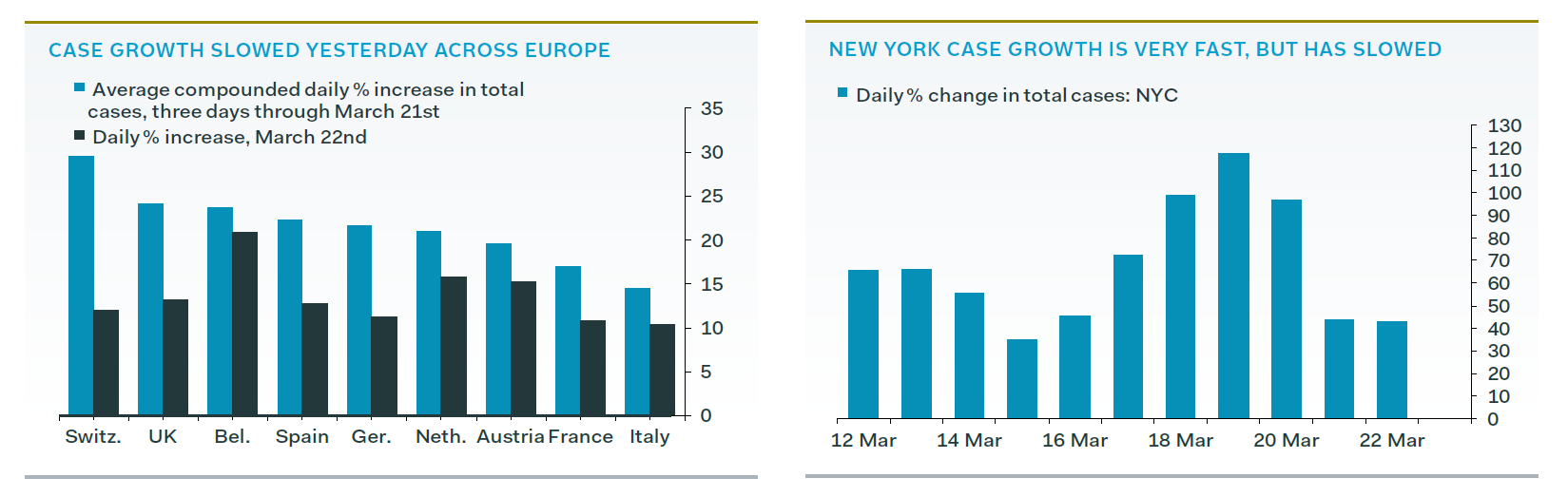

In the meantime, while it is only a couple days of data, the case growth has substantially slowed throughout Europe in recent days. Italy’s lockdown has been in effect the longest, so you would expect it there; but the numbers are down (percentage daily increase) in Switzerland, UK, Spain, Germany, France, Holland, and more. And even in New York City, where the fastest case growth rate is taking place, that pace has slowed substantially the last two days.

* Pantheon Macroeconomics, Daily COVID-19 Update, March 23, 2020

Time is still needed to see positive data from the U.S. lock down efforts. And of course, the other outlier remains the treatment options rapidly working their way through testing and approval processes.

Will spreads tighten?

They have to – it is the number one most important thing in capital markets right now. Spreads of municipal bonds, corporate bonds, mortgage bonds, high yield bonds, securitized bonds, preferreds, and the entire credit and debt capital structure are way too frozen, way too inefficient, and way too expensive. Spreads tightening will create the positive feedback loop/virtuous cycle we most need right now – they will signify improvement, and they will reinforce improvement.

Are people panicking?

Some investors are and some will continue to, but the dynamics I refer to in the market as “technical dislocations” are not so much about panicked investors as “forced sellers” and other algorithmic, momentum, computerized, risk parity, or other forms of non-traditional market presences that heavily distort reality in short term windows.

Hundreds of billions of dollars of “volatility targeting” and other systematic trades have been taking place (in some cases, per week). The point is not that they create a direction which otherwise would not be there – it is that they create amplification, especially in short term periods. If you would like more information on this topic, do not hesitate to reach out.

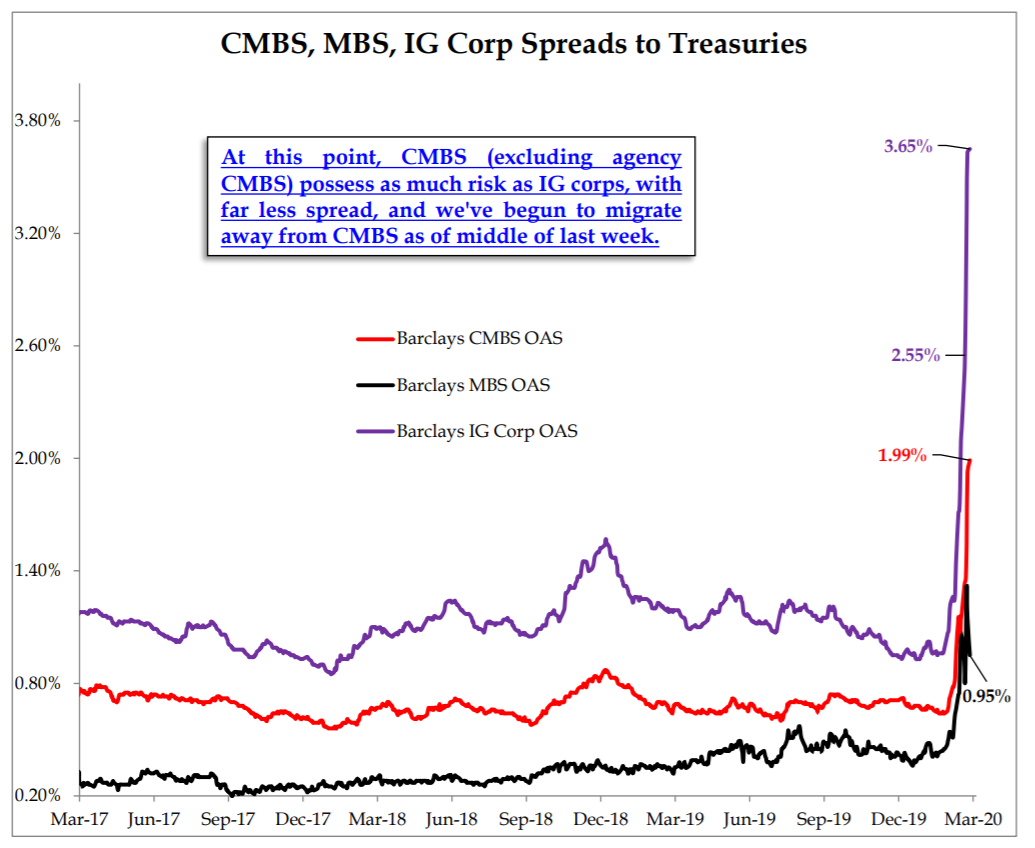

Chart of the Week

A visual look at how spreads have blown out in recent days in the investment grade corporate bond space, the residential mortgage bond space, and the commercial mortgage market …

* Strategas Research, March 23, 2020

Quote of the Week

“Investment performance doesn’t determine real-life returns. Investor behavior does.”

~ Nick Murray

* * *

Please reach out as needed. We have so much more time to go through this painful stretch. I continue to pray daily for health and recovery for all sick. And all of us at TBG are here for you, up and down, every day.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet