Dear Valued Clients and Friends,

There is a Friday Dividend Cafe coming – I do not know when – where the basic tone will be celebratory, and the underlying emotion will be relief. Some lift in equities, some normalization in credit, and some feeling that the worst is all behind us – that Dividend Cafe is coming. Will it be next week or months down the line? I do not know. But I look forward to writing it, and I imagine many of you look forward to reading it.

This week is not that week, and I believe this week’s Dividend Cafe does as much to make sense of everything going on and where we are headed than anything I have written so far. I also do believe the national call we hosted on Tuesday remains current in explaining our outlook.

In the meantime, the country as a whole, not just investors, remain in a period of uncertainty and challenge. And out of this uncertainty and challenge, I believe will come much better days. Let’s jump into the Dividend Cafe.

The most bottom line possible

As I tried to lay out in our national conference call possible, I am breaking down the present market distress into two categories …

(1) The present technical market breakdown as forced sellers flood the system across all asset classes and where sellers outweigh buyers heavily. This results in broken prices, unfilled transactions, inadequate liquidity, and downward pressure on prices that do not match reality, even the hyper-distressed reality of the present crisis. I do not know when this phase will end, but it has been the primary story of the last week.

(2) Then, beyond that, of course, is the fundamental economic havoc presently unwinding around our societal efforts to contain the coronavirus threat. These issues have large uncertainties around them that both create further risk and further hope for recovery.

Before we can really assess how #2 will shake out, we have to look at three intervening catalysts:

Catalyst #1 – Monetary Policy

The monetary policy response has been aggressive – with every known liquidity provision being enacted, substantial quantitative easing being implemented, and rates, of course, brought to zero. We would note outside our own Federal Reserve, that the European Central Bank (ECB) announced a 750 billion Euro program Wednesday night.

The two pieces that I believe are still out there, which are not remotely priced into markets, and may very well never happen, but could:

(a) Allowing companies to go to a tier-one bank directly, post collateral (equity/debt) for a loan, and have that bank go directly to the Fed to borrow cash for that loan (posting its own collateral). No change in the law required. This is the Fed indirectly lending to businesses through the legal conduit of the banks and their collateral. What the Fed is doing is removing credit risk and market risk from the lending the banks will do to help via funds in this special facility. It will not count as regulatory capital, incentivizing banks to do this abundantly.

(b) Some relief in Dodd-Frank and widening of the 13.3 emergency act provisions that may allow the Fed to step in and buy municipal bonds (which may not require Congress at all, as the Fed can buy “government debt”) as well as high-rated corporate bonds (certainly would require some Congressional allowance). This may be a pipe dream, but would be a massive support to the country’s highly indebted financial system.

Catalyst #2 – Fiscal stimulus

The first ($8.3 billion) bill was passed weeks ago (mostly for vaccine research and health care discretionary needs).

The second bill was signed into law Wednesday night and provides big increases in sick and family leave, expands unemployment assistance and adds significant resources for testing. It is more emergency measures than “stimulus,” per se.

The “bazooka bill” is the challenge. On one hand, there is a lot being discussed and proposed that would likely be very beneficial towards calming markets, but it is just very hard to believe lawmakers get it done quickly, and without drama and upheaval along the way. There will be changes, modifications, conditions, and horse-trading, but here is the best sketch I have been able to together so far.

- $500 billion in direct payments to taxpayers and tax cuts (the mechanisms here are varied, and unclear as to what political support there will be for different options).

- POTUS has said he wants to send $1,000 to adults and $500 to kids, so $3,000 for family of four. They want to get this out within three weeks of the stimulus passing.

- $300 billion in small business assistance

- Loan forgiveness for companies that keep employees on their payroll (companies apply to commercial bank; the govt funds the loan)

- $150 billion for loans to non-airline companies

- $50-100 billion in airline industry relief (loan guarantees)

- POTUS has said he will support banning public companies who take relief money from doing stock buybacks, which seems like an obvious concession to assist the possibility of passage

- A delay in federal tax payments due for 2019 from April 15 to July 15 (this is already done, as Treasury did not need the approval of Congress; some details still unclear at press time)

- Speaker Pelosi’s urging of the Fed to do something to help cities and states does make me wonder if the table is being set for the Fed to be able to buy municipal bonds.

Our belief is that a stimulus bill of significant size and scope is coming, but there is a risk of “political diceyness” along the way. Could there be some stunning agreement over the weekend? Yes, but I am very skeptical. I see this going into next week which exacerbates volatility along the way.

One Senator Warren has said she would require any companies receiving aid to keep their payroll rolls together, to avoid stock buybacks (POTUS said okay), to not pay dividends while receiving aid, etc. She also has said she wants a $15/hour minimum wage requirement within a year of the emergency declaration ending, and that the CEO’s face criminal charges if they don’t certify certain things, etc. I am not as confident those last things will play out.

The number of variables behind all of this are part of why there is so much uncertainty and volatility. I believe a bazooka stimulus is coming, I believe no one will be perfectly happy with it, and I believe it is unlikely to be done as quickly as the market wants it to be done.

Catalyst #3 – The Health Picture

The report Thursday morning that Wednesday represented the first day of no new positive cases in the Wuhan province (or surrounding areas) was highly encouraging. Signs of stabilization of new cases in Italy were also encouraging, though there is ample work to do still. But no potential catalyst exists for a worsening of market conditions or improvement of market conditions than where the health picture in the U.S. goes in the weeks to come. That cases will continue increasing is a given; but how this quasi-shutdown “flattens that curve” in the days ahead will be a massive factor in, well, everything. And the uncertainty of it puts a very low ceiling on markets for the time being. This data is crucial in the week or two to come, and it is one of the biggest reasons that a sustainably strong market rally will have a hard time coming (strong, possible; sustainable, more questionable) until we see this health picture play out as we all hope it will.

The acceleration of pursuit for FDA approvals and several particular treatments is good news, and we pray for positive evidence of impact in short order on two fronts (Chloroquine, and Remidivisir).

All of you have access to the same health reports and data about all of the cases, cures, demographics, etc. I hesitate to share because I do not want to give the impression that I am making the claim that this is all way overwrought. I think a lot of the response is based on where the data could go, not where it is. The markets want to see the data bend in positive ways (reflecting containment and recovery) in the weeks ahead.

The investibility of government support

Something I want to note about the companies possibly receiving government support through this (Boeing, airlines, cruise ships, hospitality, etc.) – it is possible in some cases government support helps the company and its operations/employees, yet strangles the equity. Of course, it may work out in some cases that equity values benefit depending on how the support is done (I am very skeptical). But when one looks to the companies that received direct government support in 2008 (Fannie/Freddie, Wall Street banks, GE, etc.), in no cases did the equity of those companies return strong as a market leader once recovery came.

Just as important as the stock market

It is imperative that investors understand what is just as important of a development this week as the sell-off in the stock market, and that is the temporarily broken dislocations in the bond market. The avalanche of selling across financial markets has led to far more sellers than buyers in all asset classes, and wide spreads between “bid” and “ask” … Many corporate and municipal bonds have challenged liquidity, and other more esoteric credit instruments (syndicated loans, preferreds, etc.) lost all forms of normalcy whatsoever.

However, and this is crucial. This a technical mis-pricing and not a reflection of a change in fair or fundamental value. It is irrelevant to one not selling money-good bonds, and it is unlikely to last long. This has happened in every “washout” period in financial markets I have ever studied, and is part of the “everything correlates to 1.0 in extreme conditions” reality of a levered financial system. I would be paying no attention to the marked prices of bond portfolios or credit instruments at this time, and I sure would not be selling into it.

Discussing the dislocations in the bond market on CNBC

The other connected but separate issue

Many have asked about the oil crisis playing out in world energy markets as the demand-side hit of this coronavirus pandemic was met the supply-side crisis of Russia and Saudi unable to agree on logical production cuts. We do not know where this will go or how it will get there, but the basic options really are as follows:

(1) It gets resolved in short order by Saudi and Russia (they blink, or decide they are content with the havoc they have unleashed)

(2) It gets resolved in short to intermediate order by U.S. policymakers (a tariff is imposed on imported oil; a truce is mediated by U.S. officials with OPEC and Russia)

(3) Strong hands take assets off of weak hands – companies with balance sheets and particularly private equity dry powder – assume the liabilities of the weaker financial actors in this saga, with the weak player’s equity dying off but the opportunity moving to strength for the acquirer

(4) The debt of the weak players’ defaults and the banks and bondholders holding it take deep losses, though nothing systemic

We see our exposure through higher quality “big oil” integrated companies and now higher quality pipeline companies set to benefit (over time) through any of these scenarios, though option 4 (the least likely) does the most systemic damage. We see no assurance of a quick and sudden recovery, but do believe that one is going to come whereby the high quality players are in a much better position than they are presently priced. No one can live with $20 oil – not West Texas, but not Russia or Saudi either. The grind hurts, but it is unclear what other option there is.

Clarity of mind

We can’t know when the health pandemic will end. We can’t know when the economic distress from all of this will be known and quantified. And we can’t know when the turn will come, and how significant the improvement in conditions down the line will be. So that rationalizes equity market uncertainty.

But we do know that the kitchen sink has been thrown at the fiscal and monetary side of this, with more throwing to done. And yet even in that environment, high rated municipal bonds have sold off. This must be understood for the liquidity and technical dislocation that it is. Capital markets are in disarray, and the shakeout of the forces causing it needs to run its course.

A New FDA

The urgency with which the FDA is reportedly working to get new treatments properly tested and approved is very encouraging, as I allude to above. 48 new drugs were approved by the FDA in 2019 total – 48. There is a pipeline of over 16,000 pending. A new process is needed not just in crisis, but in regular times.

Economic check

It is impossible for a stock fundamentalist like me to do an assessment of what Q2’s economic pain means to stocks and what the hopeful recovery in economic conditions in Q3 or Q4 means. There is so much uncertainty and unknowns around the time this all will last that we can only wait to do a rational and intelligent assessment of earnings revisions, etc. We know they will end up reflecting better valuations than we presently see, and worse valuations than we saw two months ago.

We also don’t know where anticipated economic holes get filled in the federal stimulus package. All ability to really assess and forecast these things in an application to investment markets right now is essentially futile.

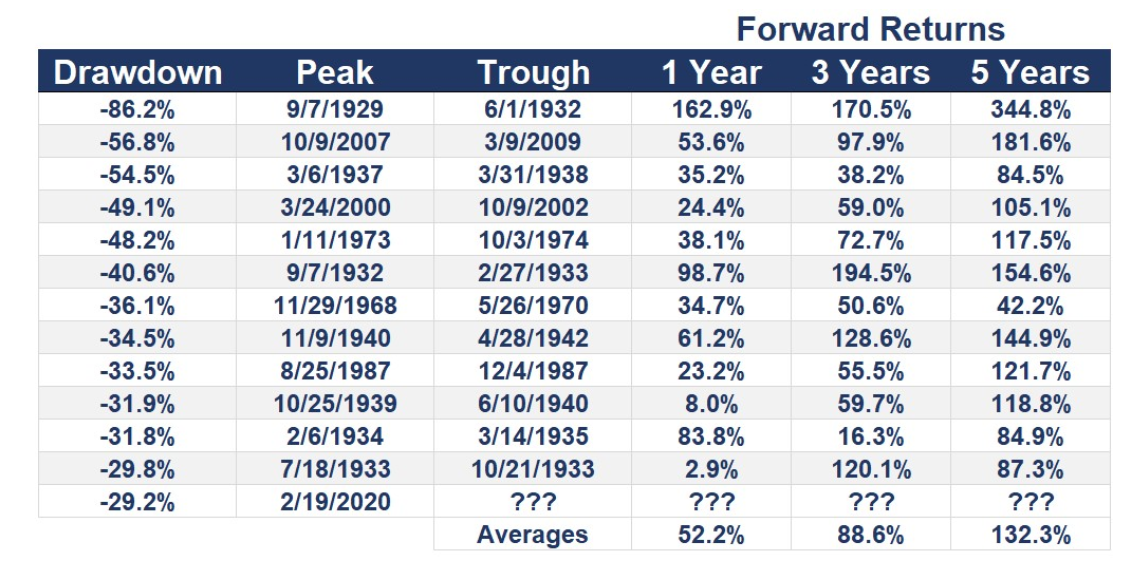

The rally to come does not help now, but please know this while we languish in this bear market

Just for historical context …

* Returns from Bottom of Bear Markets, A Wealth of Common Sense, Ben Carlson, March 18, 2020

Violent volatility

In 2019 there was not a single day in the market with a move of over 3% (up or down). In the last nine days, we have had it happen six times. (h/t Ben Carlson.

We do not guess market bottoms

It is unwise to speculate on how low the market can go before the necessary conditions for recovery surface. The fundamental and technical expectations have been outlined above. I will offer the following list of conditions that generally in past crises like this have foreshadowed that the end of the hyper-distress was near:

(1) Extreme negative sentiment (say, for example, a hedge funder using the expression “end of the world”)

(2) Massive oversold conditions (volume, price, bid-ask spread)

(3) Less stocks making new lows

(4) Yield curve steepening

(5) Credit spreads improving – this is so, so key!

From health, to oil, to liquidity

The market wish list in the days and weeks ahead:

- A flattening of the curve in the COVID-19 cases

- A resolution on policy front or market front to the oil collapse

- A normalization of capital markets where fixed income and other markets are seeing current dislocations

I hope I do not sound too optimistic when I say that I believe all three things are coming, even if not as quickly as we all want.

Politics & Money: Beltway Bulls and Bears

- There are all sorts of reasons this may fluctuate over the days, weeks, and certainly months ahead. But for the first time, the betting odds do now have the Democrats favored to win the Senate and the White House in November’s election.

- One “stimulus” option available to President Trump – suspend the massive tariffs being charged on Chinese imports paid by American companies and consumers ($370 billion of tariffs, annually). The problem? These tariffs are important to his political message regarding globalization. I don’t see this happening.

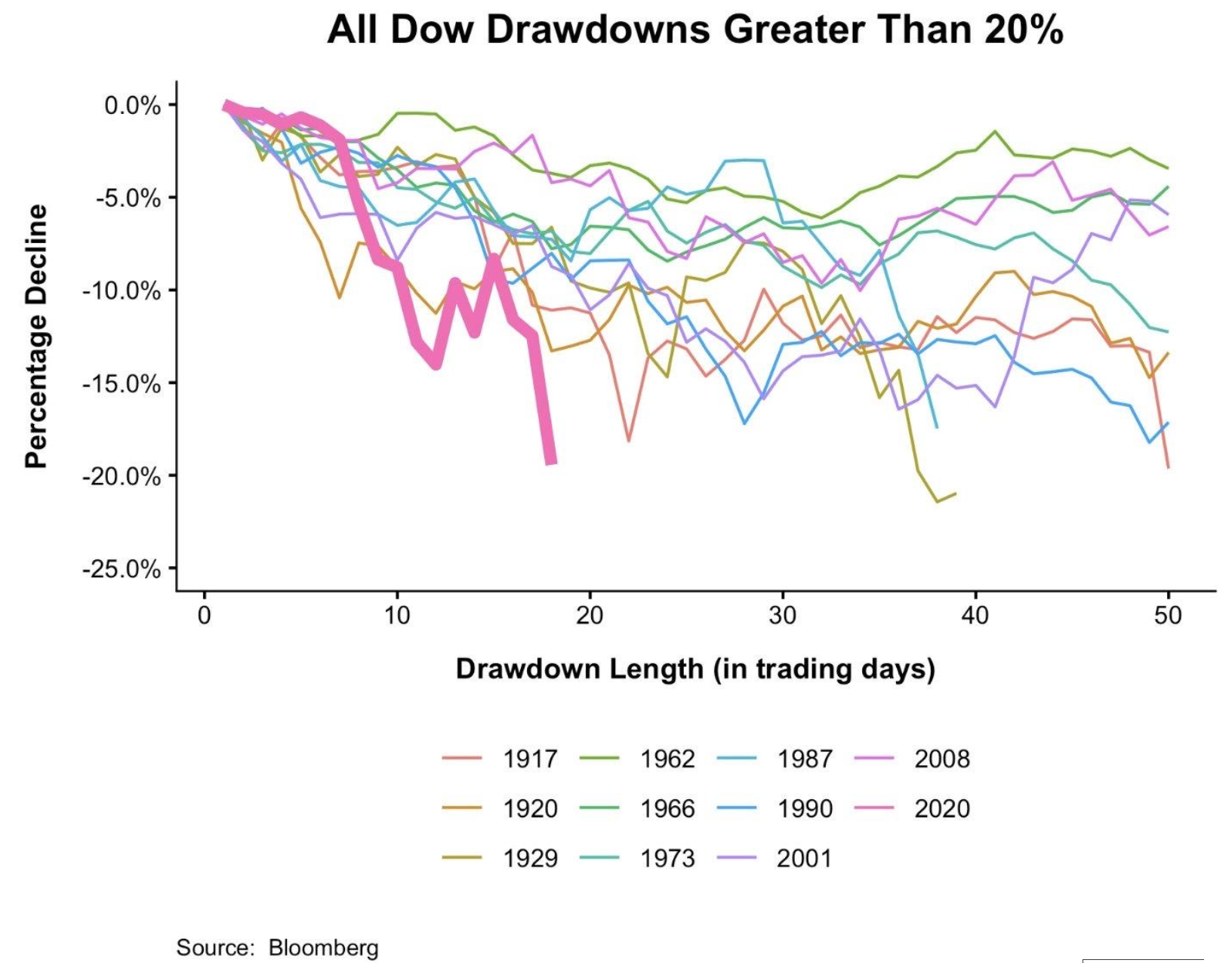

Chart of the Week

When one looks at the suddenness of this decline compared to past bear markets, this really is a sight to behold. The hope would be that the speed of the drop would hasten the recovery.

Quote of the Week

“Courage is resistance to fear, the mastery of fear, not the absence of fear.”

—Mark Twain

* * *

As I hit “submit” this Friday morning the market is down 100 points. Unfortunately, I can’t delay submitting until after the market closes because it won’t leave enough time for the powers that to get this out logistically with everyone working remotely and the various challenges right now in some of those inner-operations. Yet that said, whether the market goes higher today or lower today (I would bet it will be one or the other), we enter the weekend filled with vulnerabilities in the financial markets, questions about a fiscal stimulus package, and the realization that there is ample time until all this plays out.

I hope you also enter the weekend knowing that this will all play out. It will. And I look forward to that moment, no matter when it comes, with you.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet